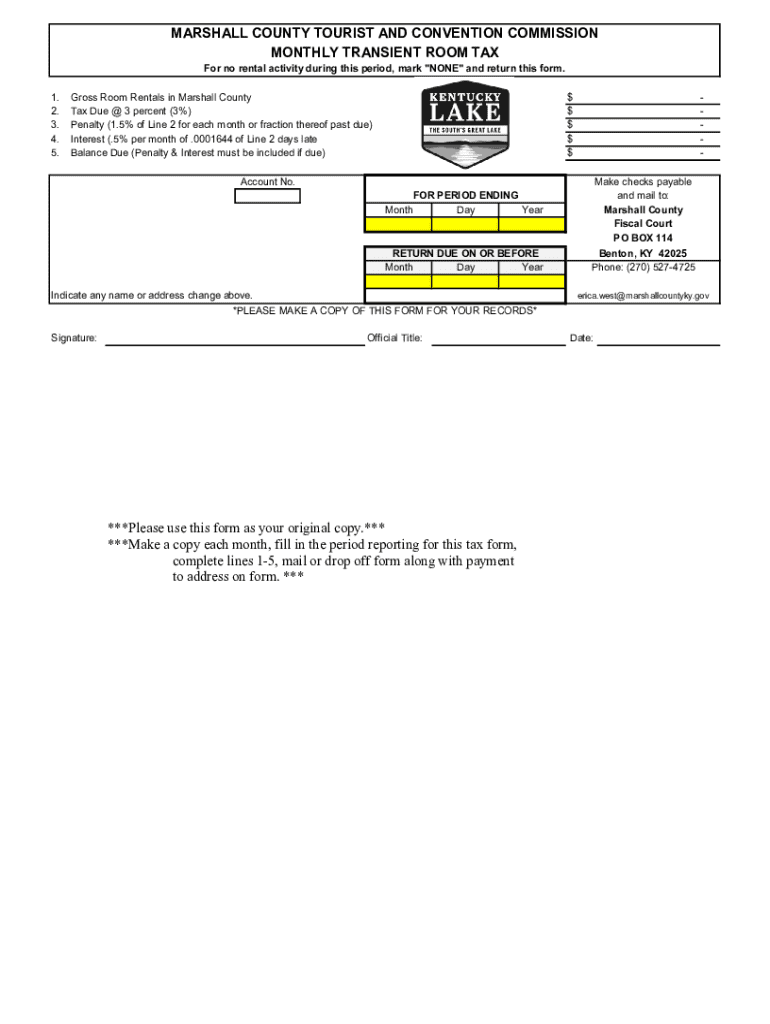

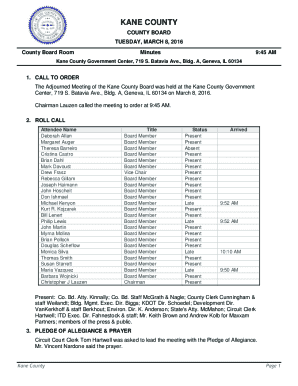

Get the free Transient Tax Payment Form (PDF)

Get, Create, Make and Sign transient tax payment form

How to edit transient tax payment form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out transient tax payment form

How to fill out transient tax payment form

Who needs transient tax payment form?

A Comprehensive Guide to the Transient Tax Payment Form

Understanding the transient tax payment form

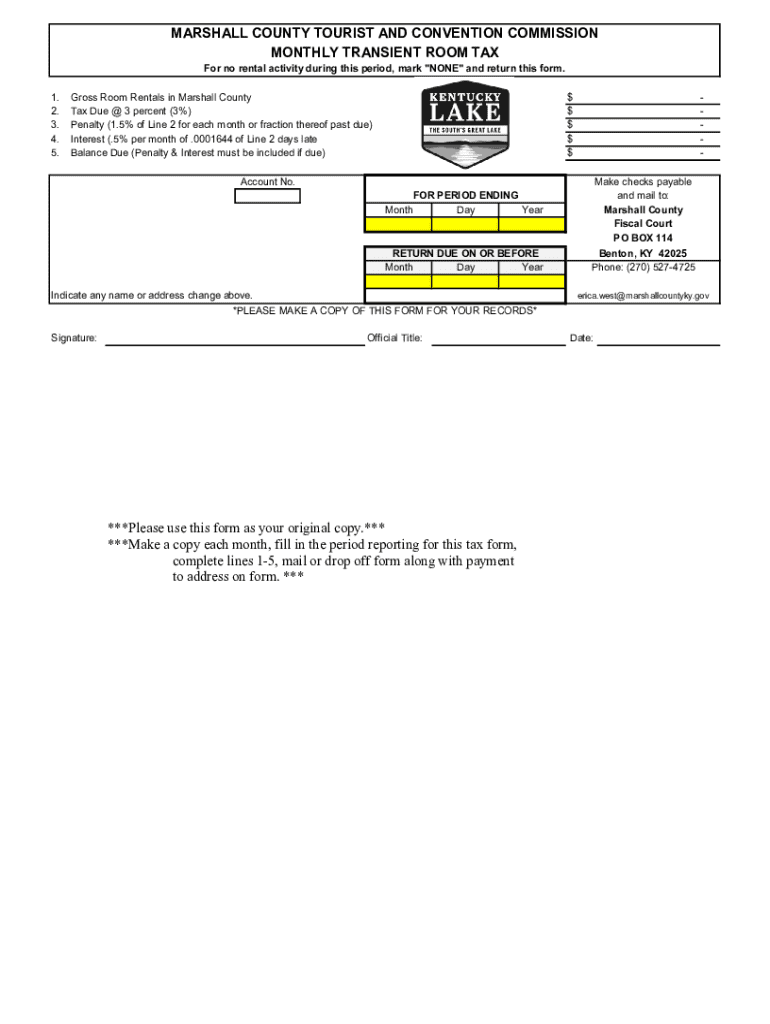

Transient tax is a form of taxation applied to short-term lodging facilities, such as hotels, motels, and vacation rentals. Its purpose is to generate revenue for local municipalities, often funding infrastructure, tourism promotion, and community services. The transient tax payment form is the vital document that individuals and businesses must fill out and submit to comply with these tax regulations. Timely submission of this form is crucial, as it helps avoid penalties and ensures you are abiding by local laws surrounding short-term rentals.

Who needs to fill out the transient tax payment form?

Various stakeholders are required to fill out the transient tax payment form. Primarily, individuals renting out properties through platforms like Airbnb or Vrbo must complete this documentation to report their earnings accurately and pay taxes accordingly. Additionally, property management teams that oversee multiple short-term rental properties are obliged to handle these forms for their clients, ensuring compliance with local tax regulations. Businesses engaged in transient accommodations, such as boutique hotels or serviced apartments, also fall under this requirement.

How to access the transient tax payment form

Accessing the transient tax payment form is straightforward. You can find the form on pdfFiller’s platform, where it is conveniently housed among various tax-related documents. To locate the form on pdfFiller, follow these steps:

Detailed guide on filling out the transient tax payment form

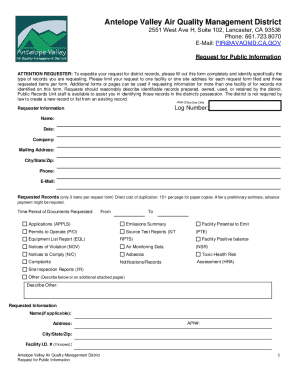

Understanding how to fill out the transient tax payment form correctly is essential. The form generally consists of several sections, including personal information, property details, and tax calculations.

Common pitfalls when filling out the form include accidental misreporting of income and overlooking sections, which can lead to fines. Make sure to double-check each entry and consult local guidelines to avoid costly mistakes.

Interactive tools available for filling out the form

pdfFiller offers an array of interactive tools designed to assist you in accurately filling out the transient tax payment form. Users can leverage features such as inline editing, making it easy to add details directly onto the form. Additionally, the platform includes calculation tools that allow for easy tax computation, ensuring you're accurately reporting earnings.

Data validation tools are also available to check for errors or missing information in real time, which reduces the chance of submitting incorrect forms. By utilizing these features, you can streamline the completion process significantly.

Editing and modifying the transient tax payment form

If you need to make changes to an existing transient tax payment form, pdfFiller allows for easy edits. Users can upload their filled-out forms and, using the editing tools, modify any sections as needed. This can be especially useful if you find discrepancies or wish to update specific information such as rental income.

Best practices for managing documents in cloud-based environments include regularly saving your revisions and maintaining an organized folder structure. This way, you can easily track changes over time and ensure you have access to the latest forms at any given time.

E-signing and approving the transient tax payment form

E-signing the transient tax payment form is a straightforward process on pdfFiller. Users can simply click on the designated signing field within the form and follow the prompts to insert their electronic signature. This method streamlines the signing process, allowing you to complete forms quickly without the need for printing or scanning.

Electronic signatures on pdfFiller are secure and valid under electronic signature laws, ensuring your documents are legally binding. By taking advantage of this feature, you can maintain compliance while saving time in the document management process.

Submitting the transient tax payment form

Once the transient tax payment form is completed and signed, the next step is submission. There are several methods available for submitting the form, including online submissions through pdfFiller, mailing it to your local taxation office, or delivering it in person.

Each submission method may have different processing times, so be sure to check local regulations to ensure you meet all deadlines.

Important policies related to the transient tax

Every jurisdiction has specific policies related to the transient tax that you should be aware of. For instance, there are often deadlines for submission that, if missed, could incur late fees or penalties. Check your local government’s site for cut-off dates to ensure timely submission.

Additionally, there might also be refund policies in place for your transient tax payment. Understanding the process for requesting a refund—should you file an overpayment—will also help you navigate your financial obligations efficiently.

Frequently asked questions about the transient tax payment

Mistakes on the transient tax payment form can happen, and addressing them quickly is essential. If you realize you've made an error after submission, contact your local taxation office to rectify the issue and avoid penalties.

To ensure that your payment has been processed, keep track of any confirmation emails or receipts generated upon submission. These records can serve as proof that you’ve met your obligations. For any further questions regarding the form or your taxation responsibilities, you can reach out to local tax officials or explore online resources on the department of taxation website.

Contact information for assistance

If you find yourself needing assistance with the transient tax payment form, it's crucial to know whom to contact. Local tax authorities typically provide a contact line, and you can often find this information on the department of taxation's web site.

Most agencies have representatives available during standard business hours, so be sure to get in touch when you need help. Keep your questions concise to receive prompt assistance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit transient tax payment form online?

How can I edit transient tax payment form on a smartphone?

Can I edit transient tax payment form on an iOS device?

What is transient tax payment form?

Who is required to file transient tax payment form?

How to fill out transient tax payment form?

What is the purpose of transient tax payment form?

What information must be reported on transient tax payment form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.