Get the free 2025 Instructions for Form IT-203, Nonresident and Part-Year ...

Get, Create, Make and Sign 2025 instructions for form

Editing 2025 instructions for form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 instructions for form

How to fill out 2025 instructions for form

Who needs 2025 instructions for form?

2025 Instructions for Form: A Comprehensive Guide

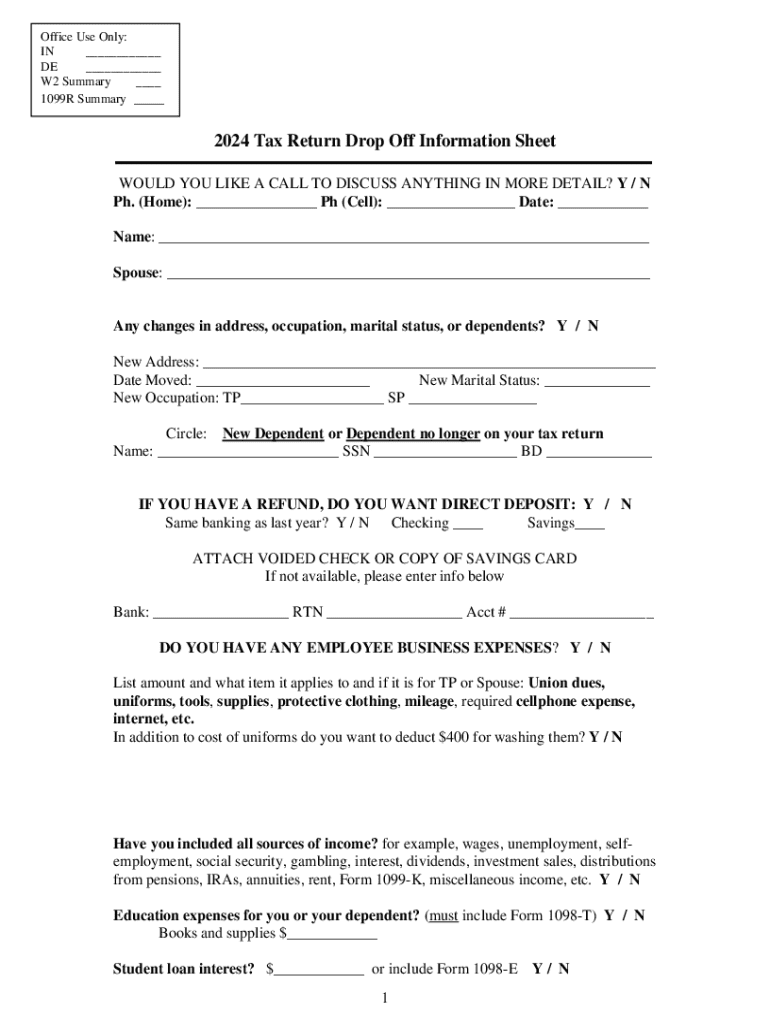

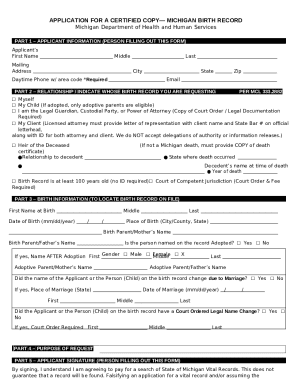

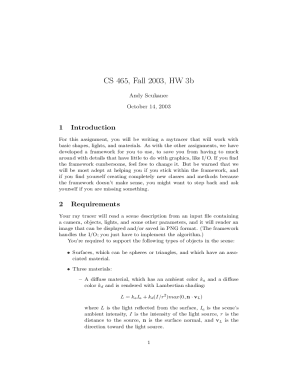

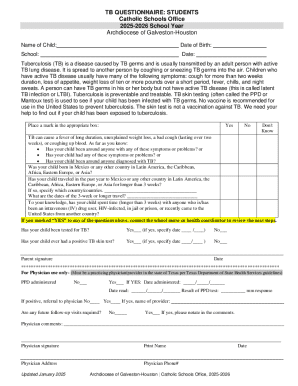

Overview of the 2025 form

The 2025 form is a crucial document utilized in various contexts such as tax reporting, business registrations, and compliance with statutory regulations. This form serves the primary purpose of gathering essential information required by state agencies or tax authorities. Specifically, in the realm of taxation, it allows individuals and entities to report income, deductions, and other relevant details in accordance with the tax code, facilitating accurate assessment and collection of taxes.

Understanding the significance of the 2025 form is vital for taxpayers, as it directly impacts their compliance status, potential tax liabilities, and eligibility for benefits. With appropriate and timely submission, users can avoid penalties and ensure smoother processing of their reports.

Key changes for 2025

The 2025 form introduces several key changes compared to previous years, reflecting updates in the tax code and reporting requirements. Notably, the inclusion of gross receipts reporting will require more stringent documentation for businesses, particularly those registered in Texas. This aligns with the enhanced emphasis on transparency and accountability in business operations.

The changes not only affect individual taxpayers but also impact entities engaging in commercial activities. Understanding these updates is critical for ensuring compliance and for the utilization of the no tax due report, which can simplify submissions for certain entities. As an example, the revised instructions indicate that improved digital tools and submission methods are expected to streamline the process, making it easier for users.

Step-by-step guide to completing the 2025 form

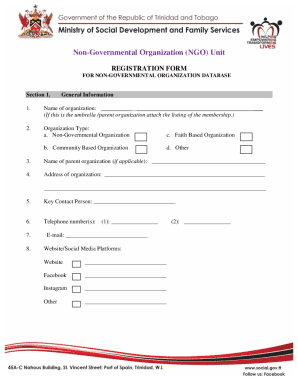

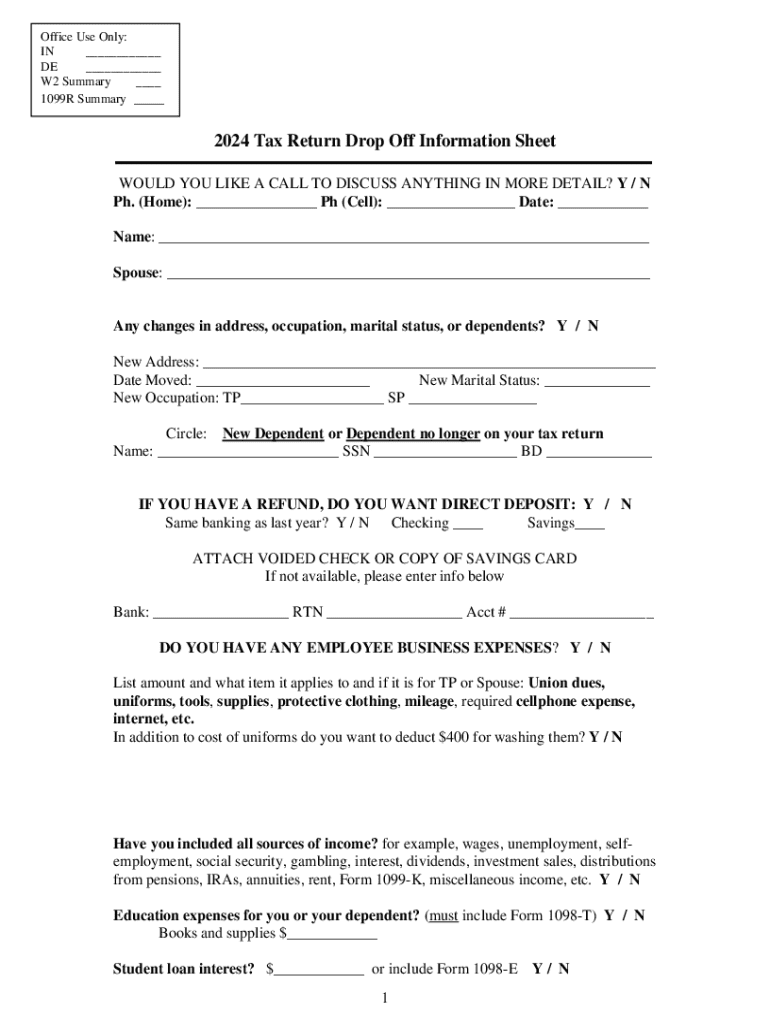

Before diving into the completion of the 2025 form, it’s necessary to gather all required documents and data. This preparatory step can significantly ease the process and reduce errors during submission. Key documents might include previous filings, identification details such as the Ownership Information Report (OIR), and any necessary tax identification numbers.

Organizing this information before starting the form can save time and enhance accuracy. For instance, creating a checklist or using document management software like pdfFiller can help keep everything in one accessible place.

Section-by-section breakdown

The 2025 form is divided into several sections, each requiring specific information. Here’s a detailed breakdown of what to include:

Editing and managing your form

Using pdfFiller’s tools for editing enhances your experience while managing the 2025 form. With features such as highlighting and annotating, it's easy to make corrections directly on the digital document. For instance, if you find an error in financial reporting or personal information during your process, you can swiftly amend it without the hassle of starting over.

To edit a document in pdfFiller, users simply upload the PDF and use the editing tools available. This includes text boxes for modifying existing text and the ability to add notes or comments where clarification is needed. Moreover, managing the storage of these forms is crucial. pdfFiller allows you to save and access your forms from any cloud-based setup, which promotes efficient organization.

Submitting your 2025 form

The submission of the 2025 form can occur through various methods. Knowing the options available can help you choose the best approach for your circumstances. The primary submission methods include online, mail, or in-person.

Be aware of the important deadlines for submission, as late filings often incur penalties. Mark your calendar with due dates specific to your state or submission requirements to ensure timely compliance and avoid unexpected charges.

Troubleshooting common issues

Users often encounter questions or problems while filling out the 2025 form. Addressing common issues can save significant time and frustration. For example, missing documents, incorrect signatures, or misunderstanding sections are frequent pain points.

A useful approach to problem-solving is to consult the FAQ section on pdfFiller or contact their support team. They provide insights on common inquiries and solutions that users might face when submitting their form, ensuring that you stay informed and prepared.

Additionally, consider various resources like help centers or tutorial videos that are available online for further assistance. Keeping a list of common troubleshooting points can also equip users with information at their fingertips when they face issues.

Collaborative features of pdfFiller

pdfFiller stands out with its collaborative features, allowing teams to work together efficiently. Users can easily share forms and collaborate in real-time. This is particularly advantageous for teams needing to review complex forms, as they can add comments and suggestions directly on the document.

When collaborating on forms, it's important to manage user permissions effectively to ensure that only authorized personnel can make changes. This helps maintain the integrity of the document while promoting teamwork. Tracking changes and document history is another vital feature — you can monitor who made edits and revert to previous versions if necessary, preserving the workflow clarity.

Benefits of using pdfFiller for your forms

Using pdfFiller for your 2025 form offers extensive advantages. Its comprehensive editing and document management capabilities set it apart from traditional methods. Users have highlighted how the cloud-based functionalities enhance their document handling processes, enabling easy access from anywhere and reducing the overhead associated with physical forms.

Moreover, security features provided by pdfFiller ensure that sensitive information remains protected. The platform complies with relevant regulations such as HIPAA for healthcare records and GDPR for personal data, offering peace of mind to users handling sensitive documents. These factors combine to present pdfFiller as an effective solution for managing various types of forms.

Next steps after submission

After successfully submitting your 2025 form, staying proactive is vital. Following up on your submission status will help you verify that everything is processed correctly. Most state agencies provide online tracking options, or you can contact them directly for inquiries.

Furthermore, maintaining proper records is crucial. Keeping copies of your submitted forms aids in future reference and compliance checks. Utilizing pdfFiller's document management features helps in organizing and maintaining these records digitally, ensuring you can access them when needed without hassle.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 2025 instructions for form to be eSigned by others?

How do I complete 2025 instructions for form on an iOS device?

How do I fill out 2025 instructions for form on an Android device?

What is 2025 instructions for form?

Who is required to file 2025 instructions for form?

How to fill out 2025 instructions for form?

What is the purpose of 2025 instructions for form?

What information must be reported on 2025 instructions for form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.