Get the free Indiana Estimated Tax Forms For 2025 Printable - Fill Online ... - forms in

Get, Create, Make and Sign indiana estimated tax forms

How to edit indiana estimated tax forms online

Uncompromising security for your PDF editing and eSignature needs

How to fill out indiana estimated tax forms

How to fill out indiana estimated tax forms

Who needs indiana estimated tax forms?

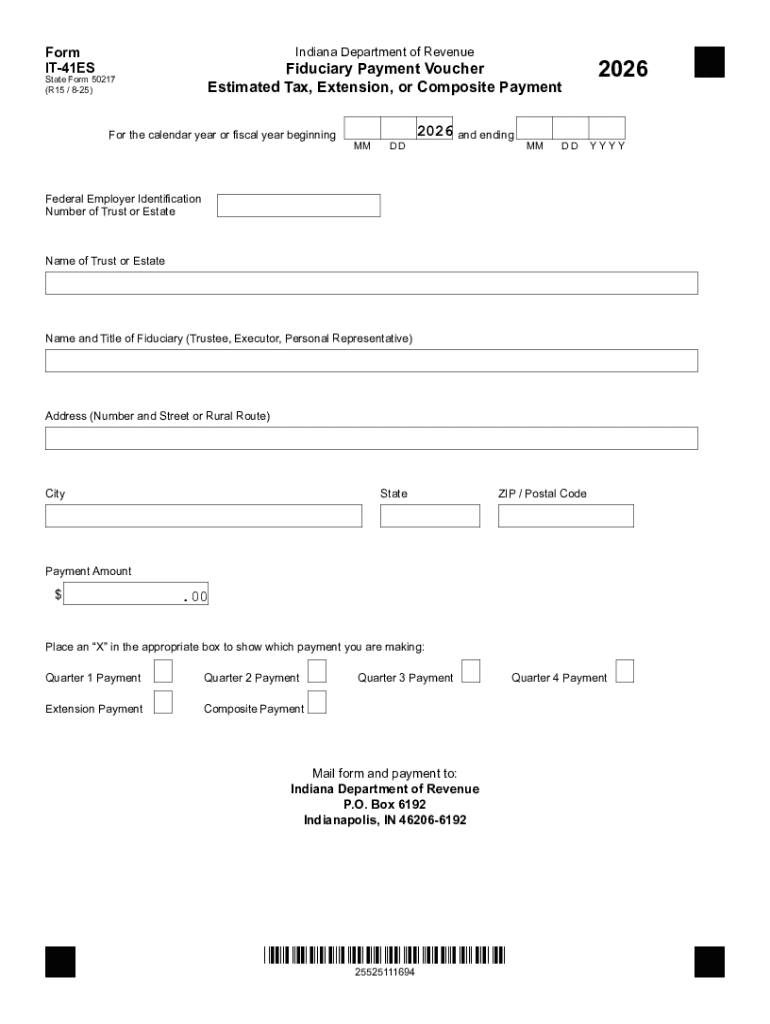

Comprehensive Guide to Indiana Estimated Tax Forms

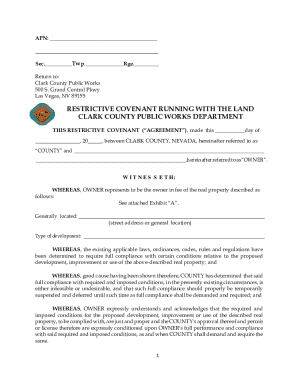

Understanding Indiana estimated tax forms

Estimated tax forms in Indiana are essential for managing tax payments throughout the year, rather than settling the total tax liability at the time of filing annual income tax returns. This system benefits both individuals and businesses by spreading out the tax burden into manageable payments. These estimated tax payments are typically required for taxpayers who expect to owe a significant amount in state income taxes.

Many people may not realize that nearly anyone who earns income can fall into the category of needing to file estimated tax forms, especially if their employer does not withhold enough from their paychecks. Understanding when these forms are necessary is crucial for avoiding penalties associated with underpayment.

Types of estimated tax forms in Indiana

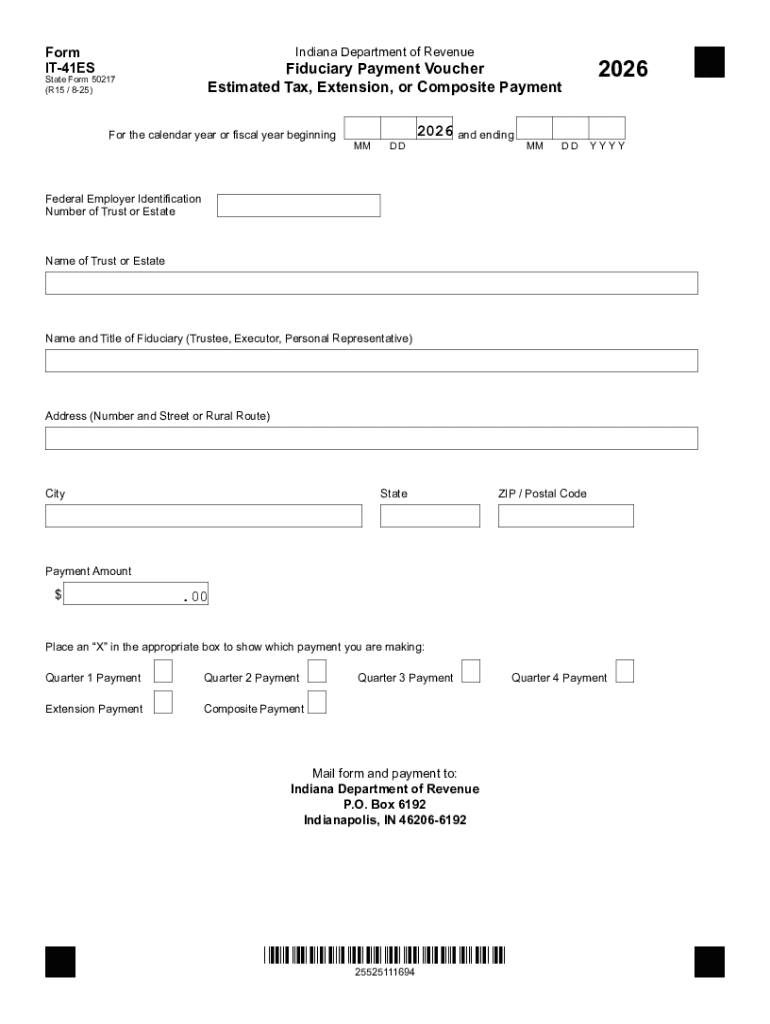

Indiana offers a couple of specific forms for estimated tax payments, namely Form 40ES and Form IT-40P. Each form is tailored to meet different taxpayer needs and scenarios.

Form 40ES is designed for individuals and certain businesses that need to make quarterly tax payments throughout the year. It's particularly useful for those who derive income from sources that do not have taxes automatically withheld.

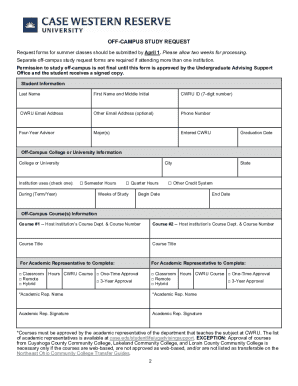

How to complete Indiana estimated tax forms

Completing Indiana Estimated Tax Forms, especially the Form 40ES, requires careful attention to detail. Start by gathering necessary documents such as your Social Security number, estimated income, deductions, and any previous tax return information.

Next, calculating your estimated tax liability is essential. To do this, you will want to account for your expected income, applicable deductions, and credits, then apply the current tax rates.

Step-by-step instructions for Form IT-40P

For Form IT-40P, similar documentation is needed. However, there are additional sections you need to pay attention to, specifically regarding your income sources for the year.

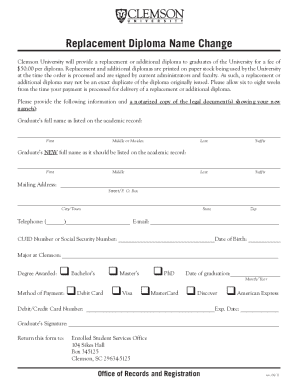

Estimated tax payment timelines

It's crucial to understand the deadlines associated with estimated tax payments in Indiana. Generally, estimated taxes must be paid in four installments throughout the year. Missing these deadlines can result in penalties and interest on unpaid amounts.

For farmers and fishermen, the rules can differ, granting them special treatment so that they may only need to make one payment if they project no significant tax liabilities in the upcoming year.

Methods to pay Indiana estimated taxes

Indiana provides various payment methods for estimated taxes, allowing convenience and flexibility. Online payment through the Indiana Department of Revenue’s website is highly advised for its efficiency and security.

Alternatively, mail-in payments are available by sending a check with the completed estimated tax form. Be sure to send it well before the payment deadline to avoid late fees.

How to manage and track your estimated tax payments

To ensure that you stay on top of your tax obligations, creating a payment calendar is essential. This helps you track due dates and prepare your finances accordingly.

Using tools like pdfFiller can simplify document management, along with offering interactive features that allow for easy editing, signing, and storage. Accessing your documents from any location keeps your tax filings organized.

Penalties for underpayment of estimated taxes

Indiana has established a clear structure for penalizing taxpayers who underpay or miss payment deadlines. Not only do underpayments incur fines, but they can also affect your overall tax liability if not corrected quickly.

Understanding common triggers for underpayment penalties can assist taxpayers in planning effectively to avoid these issues. Staying informed about tax liability projections and payments is vital.

FAQs about Indiana estimated tax forms

Taxpayers often have various questions when it comes to Indiana estimated tax forms. Common queries revolve around when to file, how to calculate due amounts, and the implications of missing deadlines.

Employing online tools like pdfFiller can help resolve common issues, providing trouble-free access to forms and submission guidelines, ensuring all documentation is up to date.

Success stories: How individuals and teams managed their estimated tax forms efficiently

Numerous taxpayers have harnessed the power of tools like pdfFiller to streamline their estimated tax filing process. From simple edits to collaborative workspaces, users report enhanced efficiency and reduced stress when managing tax obligations.

Case studies reveal that utilizing interactive document management not only helps maintain clarity but also allows teams to collaborate seamlessly.

Additional tips for seamless tax management

Adopting a proactive stance when it comes to tax management can alleviate stress and ensure compliance. This involves understanding the latest changes in Indiana tax legislation and implementing systems that simplify your tax process.

Using a platform like pdfFiller not only centralizes your document management but also keeps you fluid and responsive to any tax implications that arise.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get indiana estimated tax forms?

How do I edit indiana estimated tax forms on an iOS device?

Can I edit indiana estimated tax forms on an Android device?

What is Indiana estimated tax forms?

Who is required to file Indiana estimated tax forms?

How to fill out Indiana estimated tax forms?

What is the purpose of Indiana estimated tax forms?

What information must be reported on Indiana estimated tax forms?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.