Get the free Forms - Homestead Exemption

Get, Create, Make and Sign forms - homestead exemption

How to edit forms - homestead exemption online

Uncompromising security for your PDF editing and eSignature needs

How to fill out forms - homestead exemption

How to fill out forms - homestead exemption

Who needs forms - homestead exemption?

Comprehensive Guide to Homestead Exemption Forms: Understanding, Completing, and Managing Your Application

Understanding the homestead exemption

The homestead exemption is a legal provision that provides homeowners with property tax relief, helping to protect a portion of their home’s value from taxation. This exemption significantly reduces the taxable value of a homeowner's property, thereby lowering their property tax bill.

The primary purpose of the homestead exemption is to promote homeownership by making it more affordable. This can be particularly beneficial for individuals and families on a tight budget, enabling them to allocate their financial resources more effectively. The benefits of homestead exemptions can vary significantly depending on the state, but common advantages include tax reductions, protection against creditors, and eligibility for various local or state programs designed to support homeowners.

Qualification for a homestead exemption typically requires homeowners to meet specific criteria. Generally, applicants must occupy the home as their primary residence and prove their ownership, usually through property documents. However, regulations often vary from state to state, so it is crucial for homeowners to review their local guidelines.

State-specific homestead exemption guidelines

Variations in homestead exemptions can be vast across states in the U.S., with each state establishing its own qualifications, exemption amounts, and application processes. For example, some states provide a flat-rate exemption, while others base their exemptions on property value or local assessment rates.

Key differences might include the amount exempted, eligibility requirements, and deadlines for application submission. States like Florida offer substantial exemptions, while others may have more modest benefits. Local governments may also provide additional homestead exemptions and valuation freeze options, which can benefit seniors or disabled individuals. Understanding these differences is essential for homeowners to maximize their tax savings.

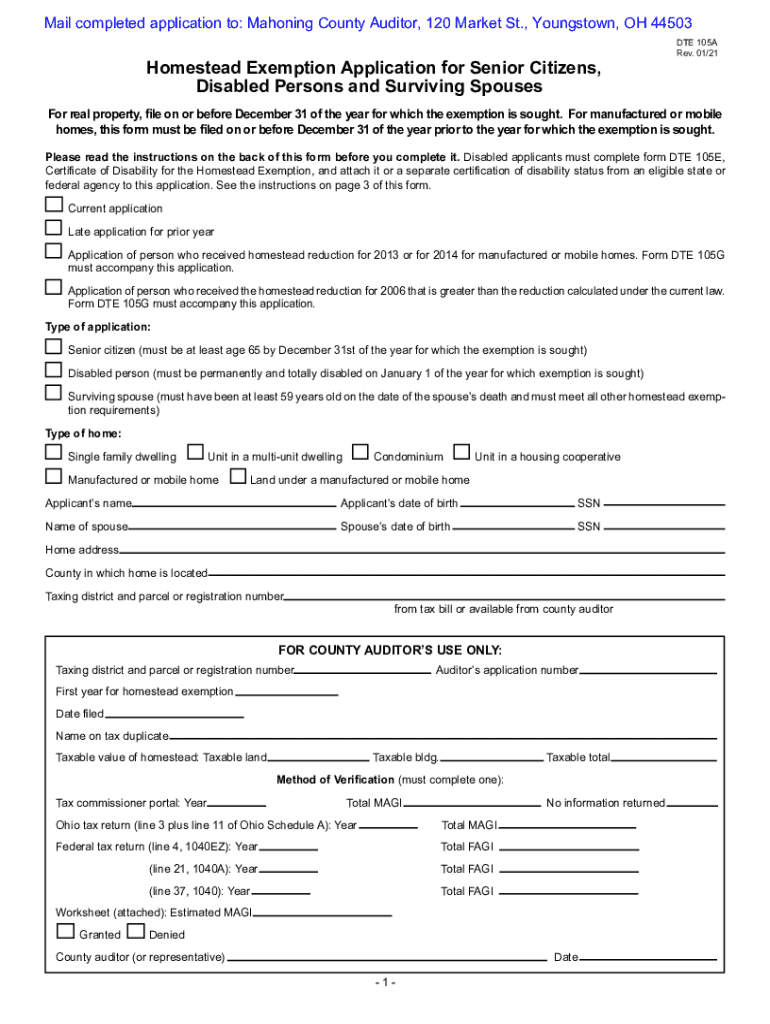

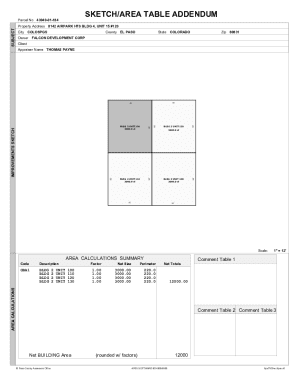

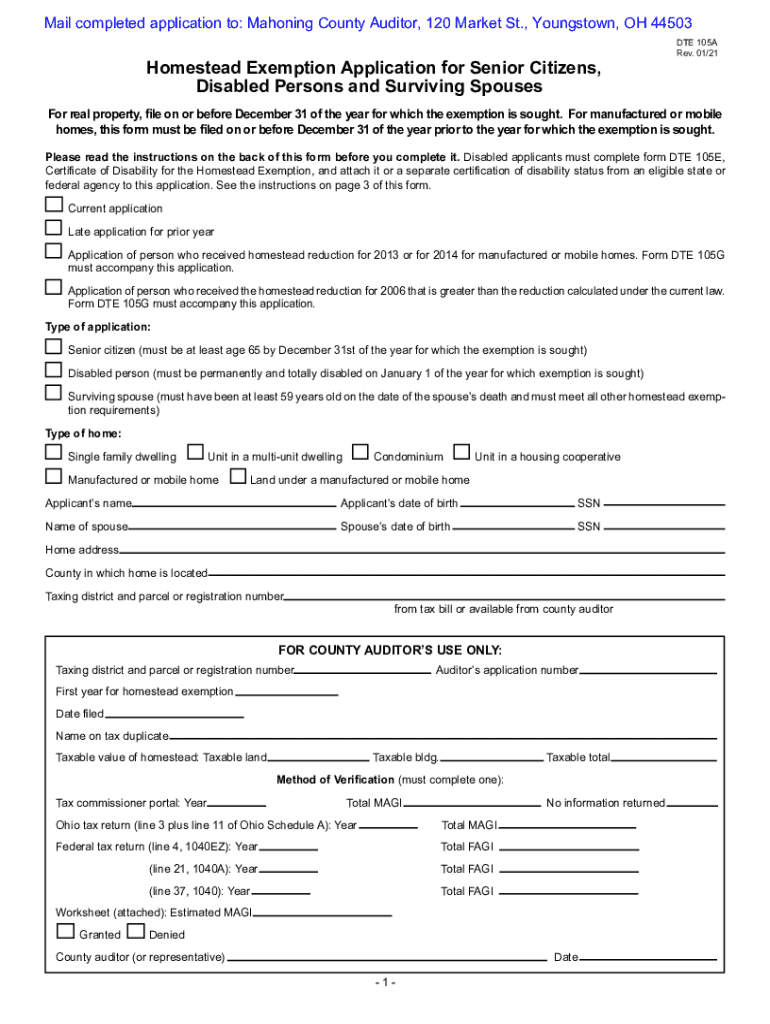

Key features of the homestead exemption form

Filing a homestead exemption form involves gathering specific information about both the homeowner and the property. Essential sections in the homestead exemption form typically include the homeowner's personal details, property information, and necessary supporting documentation. This ensures that the assessment can be processed efficiently.

The personal information section usually requires full name, address, and social security number of the applicant, while the property information section will ask for details related to the property, such as tax parcel number and the property's assessed value. Supporting documents, often required, can include proof of residency, ownership documentation, and identification.

It’s crucial to follow specific instructions for each section to avoid errors or delays in processing the form.

Step-by-step guide to completing the homestead exemption form

Completing the homestead exemption form can seem daunting, but with a systematic approach, it becomes manageable. Start by gathering all necessary documents, such as proof of identity, residency, and ownership of the property. This preparation lays a strong foundation for the process.

Once you have the required documents, proceed to fill out the form. For the first step, enter your personal information accurately. This includes your full name, current address, and the last four digits of your social security number. Next, in the property information section, provide the required details about your home, including its address and tax identification number.

Attach the necessary supporting documentation as specified. Review the form carefully to ensure that all entries are accurate and complete. After this thorough review, finalize the form by signing it, either physically or electronically using platforms like pdfFiller.

Common mistakes to avoid when filling out the homestead exemption form

Completing the homestead exemption form can lead to pitfalls if proper attention is not given. One of the most common mistakes is providing incomplete information. Leaving sections blank or neglecting required fields can result in application denials or delays.

Another frequent error involves supplying incorrect supporting documentation. For instance, submitting outdated identification or inadequate proof of residency may not meet state requirements. Additionally, failing to submit the application by the deadline can jeopardize your exemption eligibility.

Editing and managing your homestead exemption form

Oftentimes, you might need to edit your homestead exemption form after filling it out, and this is where tools like pdfFiller come into play. With pdfFiller, you can easily edit your document from anywhere, saving you time and hassle. It allows you to make necessary changes quickly and efficiently.

Effective document management is also crucial. Organize your paperwork systematically and save drafts for future reference. Utilize the cloud-based platform to store your completed forms securely, allowing for easy access whenever needed. Keeping well-organized files will enable quick retrieval when it’s time to reapply or manage your homestead exemption.

eSigning the homestead exemption form

E-signing your homestead exemption form is an essential step in ensuring its validity and expediency. Using pdfFiller for eSigning means you can sign documents in a secure and legally compliant manner. This reduces the time spent on mailing or routing physical copies while maintaining a professional presentation.

To eSign using pdfFiller, upload your completed document, navigate to the eSignature field, and follow the prompts to affix your digital signature. Be sure to record your eSignature details for future reference, confirming that you have formally signed the document.

Tracking the status of your homestead exemption application

After submitting your homestead exemption application, it's important to track its status. Many states offer online portals where homeowners can check the progress of their applications. This feature provides peace of mind and helps ensure that your exemption is processed in a timely manner.

In case your application is denied, don’t panic. Homeowners typically have the option to appeal the decision, so familiarize yourself with the appeals process specific to your state. Collect any additional evidence that may support your case for reconsideration, and follow the necessary guidelines to ensure your appeal is heard.

Frequently asked questions about the homestead exemption form

Each state has its own deadline for submitting the homestead exemption form, so it’s crucial to check your local regulations. Deadlines may vary based on circumstances such as reassessment periods or new property purchases. Generally, you might need to reapply whenever there’s a change in your eligibility status, such as an ownership transfer.

Understand that it is possible to lose your exemption if you no longer qualify. This can occur if you sell the property, change your primary residence, or fail to meet the qualifying requirements stipulated by your local laws. Homeowners should stay informed about their status and proactively manage their exemptions.

Contacting local authorities for support

If you have questions or require assistance with your homestead exemption, local tax assessor offices are invaluable resources. These offices can provide detailed information about the application process, deadlines, and eligibility requirements. Finding the nearest assessor office can often be done through official government websites.

Be sure to check their hours of operation and contact information for direct inquiries. Many local authorities also offer online resources to guide homeowners through the homestead exemption process, thus providing a wealth of assistance beyond office hours.

Leveraging pdfFiller for all your form needs

pdfFiller is designed to enhance your experience when dealing with forms like the homestead exemption application. The platform offers robust features that simplify document management, including seamless editing, eSigning, and collaboration tools that enable users to work together on forms easily.

Utilizing pdfFiller will save you not just time, but also significantly enhances the organization of your documents. Share your completed forms with relevant parties without the hassle of paper trails. This cloud-based service means you can access, edit, and manage your documents from virtually anywhere, allowing for a smooth workflow tailored to your needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the forms - homestead exemption in Chrome?

Can I create an eSignature for the forms - homestead exemption in Gmail?

How can I fill out forms - homestead exemption on an iOS device?

What is forms - homestead exemption?

Who is required to file forms - homestead exemption?

How to fill out forms - homestead exemption?

What is the purpose of forms - homestead exemption?

What information must be reported on forms - homestead exemption?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.