Get the free Income Tax Documents & Forms Center

Get, Create, Make and Sign income tax documents amp

Editing income tax documents amp online

Uncompromising security for your PDF editing and eSignature needs

How to fill out income tax documents amp

How to fill out income tax documents amp

Who needs income tax documents amp?

Income tax documents and forms: A comprehensive guide

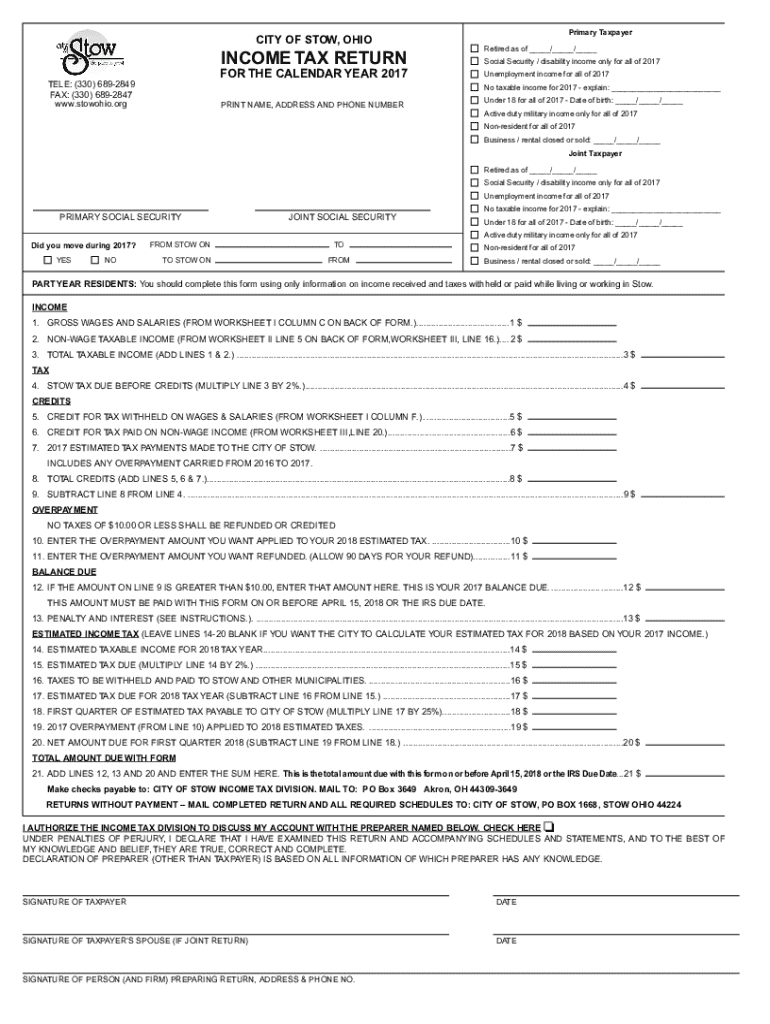

Understanding income tax documents

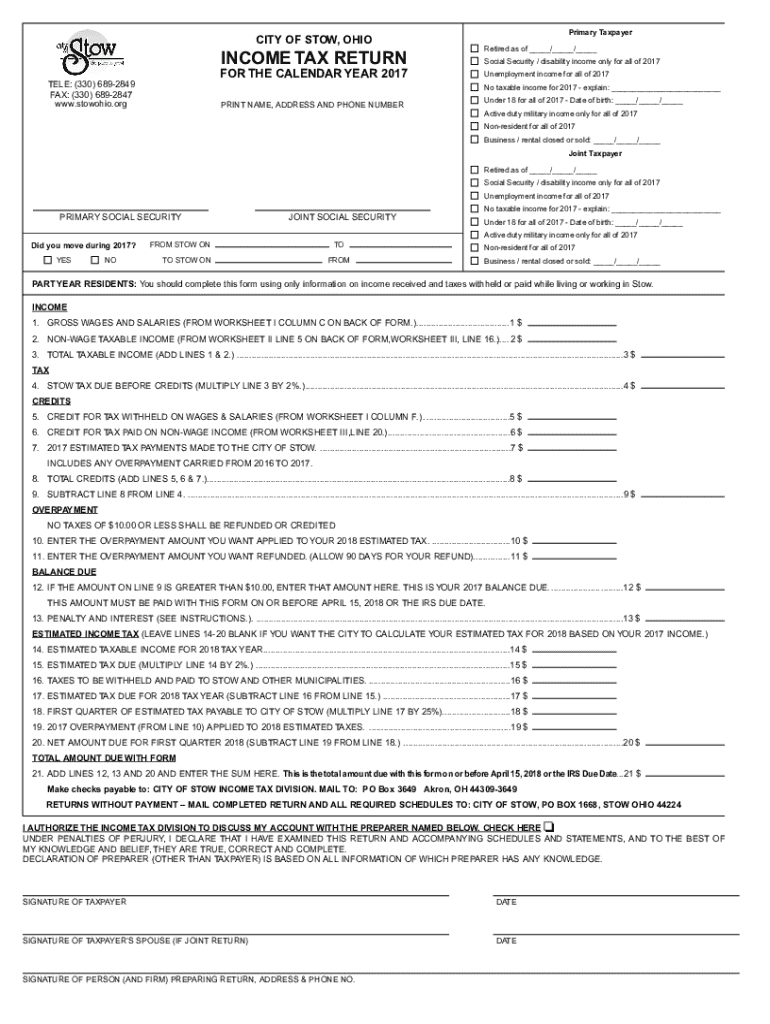

Income tax documents encompass any paperwork required for filing your taxes with the government. These documents are crucial as they ensure that your income is accurately reported and taxed accordingly. Failure to maintain correct documentation can lead to issues such as audits, fines, or even legal problems. In the U.S., several forms are commonly used for income tax purposes, each serving specific functions in the tax filing process.

Types of income tax forms

Three specific types of forms dominate the income tax landscape: W-2, 1099, and 1040 forms. Each form serves a distinct purpose and provides essential data for calculating your taxable income.

W-2 form

The W-2 form is provided by employers to their employees and details the total earnings and taxes withheld during the year. It is crucial for employees as it summarizes their annual income.

1099 form series

The 1099 form series is used to report various types of income other than wages, salaries, and tips. Most notably, the 1099-MISC and 1099-NEC forms are utilized to report payment transactions made to independent contractors or freelancers.

1040 form

The 1040 form is the standard individual income tax return form used to report income, claim deductions, and calculate tax liability. There are variants, including 1040A and 1040EZ, designed for specific taxpayer situations.

Additional schedules

Additional schedules, such as Schedule A for itemized deductions, Schedule C for self-employment income, and Schedule D for capital gains and losses, further assist in detailing taxpayer financials.

Gathering necessary documentation

Preparing your tax documents begins with collecting essential information to complete your forms accurately. The primary areas to focus on include personal information, income records, and deduction records.

Personal information

This includes your Social Security Number (SSN) to identify you in the tax system and your bank information for direct deposits.

Income records

You'll also need thorough documentation of your income, including pay stubs, business income statements, or investment income statements. These records provide proof of earnings when filling out your tax forms.

Deduction records

Lastly, maintaining records of potential deductions will help maximize your tax benefits. This includes mortgage interest statements, receipts for charitable contributions, and documentation of medical expenses.

Step-by-step guide to filling out income tax forms

Filling out income tax forms can be daunting, but breaking it down into clear steps can simplify the process. Begin by accessing the forms, then move on to filling them out with accurate data.

Accessing forms

Access forms easily through pdfFiller, where you can download PDFs or use interactive tools to complete them online. This reduces the hassle of printing and ensures that you can fill out forms from anywhere.

Filling out key information

Begin by entering personal identification information. Ensure your SSN is correct, and then move to the income section, accurately reporting all sources of income, including wages, business earnings, and any other income streams.

Using pdfFiller’s editing tools

pdfFiller offers convenient editing tools to modify PDFs directly. You can add your information, insert signatures, and dates easily, making the process smooth and efficient.

Avoiding common mistakes

Mistakes in your tax return can lead to delays or financial penalties. To mitigate this risk, pay close attention to detail and stay aware of filing deadlines.

Missing information

Double-check all required fields and ensure that numbers are accurate. Simple errors can lead to complications with the IRS.

Filing deadlines

Keep track of key dates, such as the traditional April 15th filing deadline. Missing deadlines can result in penalties or loss of tax benefits.

Review and submit

Before submitting, thoroughly review all forms. Use best practices for electronic filing through platforms like pdfFiller to ensure your data remains secure during transmission.

Managing and tracking your tax documents

Post-filing, managing, and tracking your tax documents is essential for future reference and audits. Utilizing cloud-based solutions offers a secure way to store your documentation and access it from anywhere.

Storing documentation securely

Cloud storage solutions help keep your data organized and safe, preventing loss from physical methods of storage. Consider categorizing documents by year or type for easy retrieval.

Accessing your forms later

Using pdfFiller allows you to retrieve previous years’ documents effortlessly. You can also collaborate with team members on tax preparation tasks without needing to physically pass around files.

eSignature and legal compliance

The use of eSignatures has transformed document signing for tax forms, offering a legally valid method that complies with IRS standards when necessary.

Understanding the legal validity of eSignatures

eSignatures are legally recognized if performed in compliance with the Electronic Signatures in Global and National Commerce (ESIGN) Act. Ensure you understand when an eSignature is required to streamline your filing process.

Using pdfFiller for eSignature

pdfFiller provides a straightforward method for signing documents. You can manage multiple signatures, catering to team filings or collaborative document preparations.

Frequently asked questions (FAQs) about income tax documentation

As income tax season approaches, many questions arise regarding tax documents. Knowing how to manage discrepancies and handle inquiries can save you time and stress.

Additional tips for efficient tax filing

Leverage technology for tax preparation by utilizing templates in pdfFiller to make your filing process efficient. Keeping track of tax deductions can maximize your potential refunds.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify income tax documents amp without leaving Google Drive?

How do I make changes in income tax documents amp?

How do I fill out the income tax documents amp form on my smartphone?

What is income tax documents amp?

Who is required to file income tax documents amp?

How to fill out income tax documents amp?

What is the purpose of income tax documents amp?

What information must be reported on income tax documents amp?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.