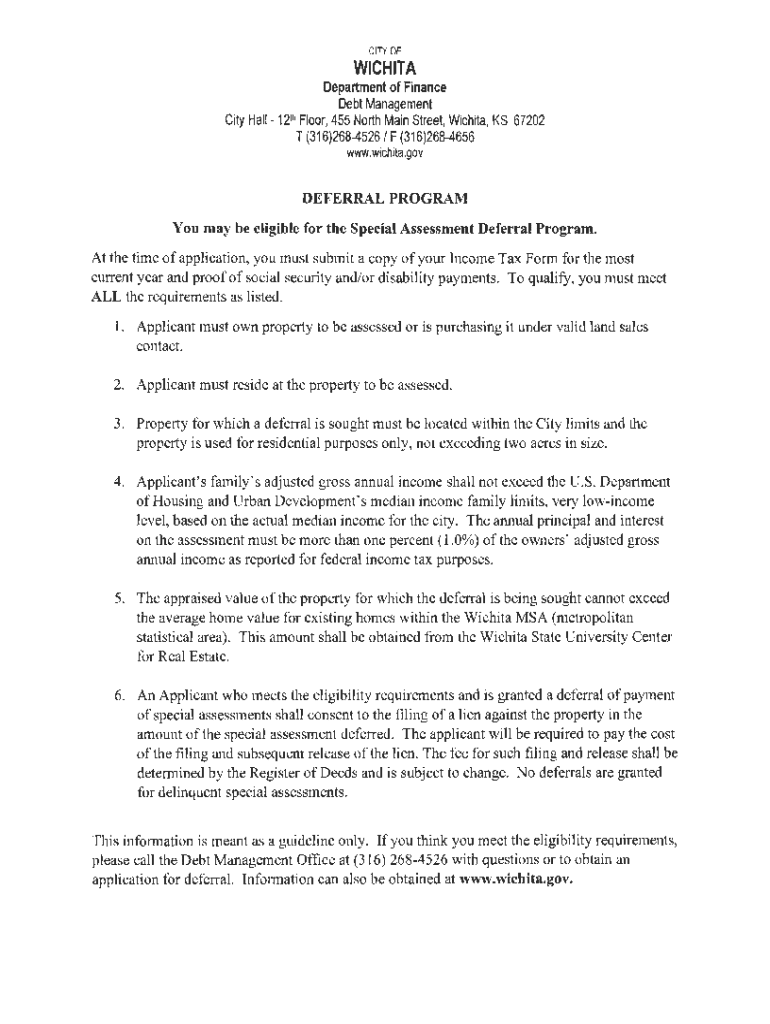

Get the free Department of Finance Debt Management City Hall

Get, Create, Make and Sign department of finance debt

How to edit department of finance debt online

Uncompromising security for your PDF editing and eSignature needs

How to fill out department of finance debt

How to fill out department of finance debt

Who needs department of finance debt?

A Comprehensive Guide to the Department of Finance Debt Form

Understanding the Department of Finance Debt Form

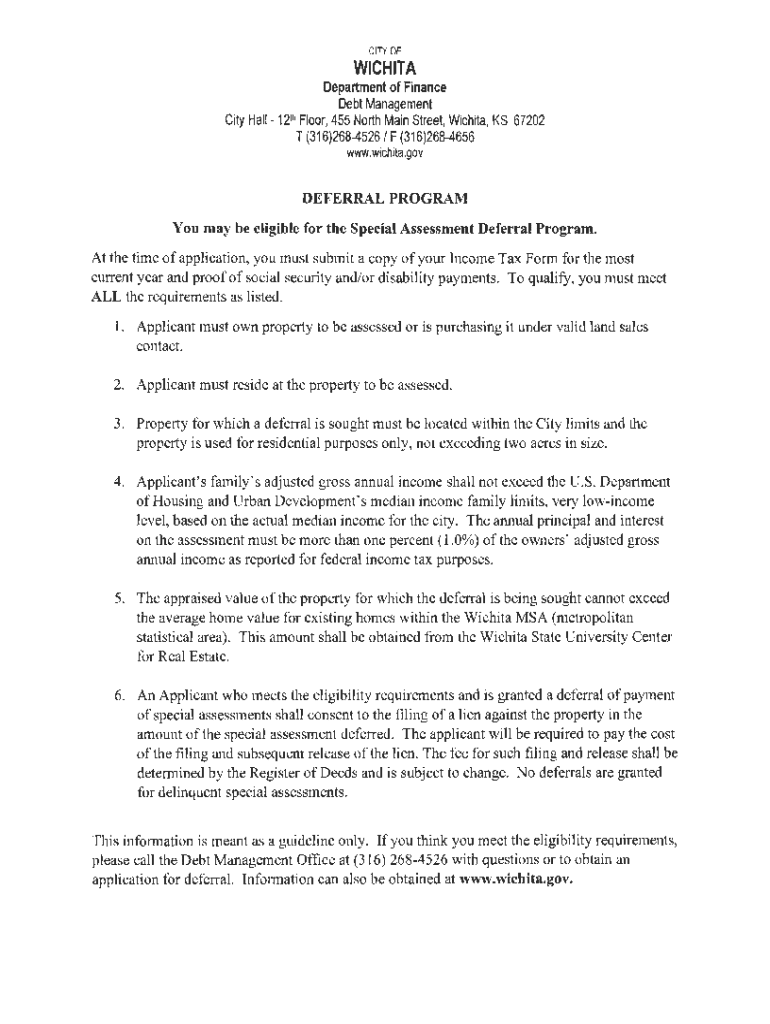

The Department of Finance Debt Form is a critical document designed to collect relevant information from individuals and businesses facing outstanding financial obligations. Its primary purpose is to assess financial situations and determine eligibility for various relief programs or repayment plans. Completing this form accurately is essential for obtaining assistance and avoiding further complications with creditors.

Accurate submission of the debt form ensures that the Department can effectively evaluate your circumstances and facilitate appropriate support. Misinformation or incomplete applications can lead to delays or rejection of requests for financial relief, which can exacerbate existing financial difficulties.

Who needs to use the debt form?

The Department of Finance Debt Form is required for anyone with outstanding debt obligations. This includes individuals who may be struggling with personal loans, credit card debts, or mortgage repayments. Furthermore, businesses and organizations seeking financial assistance or restructuring are also expected to complete this form. To determine if you qualify for submission, evaluate your financial situation and the specific assistance programs offered by the Department.

Step-by-step guide to completing the Department of Finance Debt Form

Completing the debt form can seem daunting, but breaking it down into manageable steps simplifies the process. Start by gathering all required information to ensure a smooth application.

Gathering required information

Filling out the form

When filling out the debt form, pay particular attention to each section to avoid errors. The form typically includes three main sections:

Tips for successful form submission

Submitting the debt form without care can lead to setbacks. To maximize your chances of approval, follow these tips.

Interactive tools to assist with form completion

Taking advantage of interactive tools can facilitate a smoother experience while completing your Department of Finance Debt Form.

Document editing features on pdfFiller

pdfFiller offers a user-friendly interface to edit and customize your forms. You can add text, check boxes, and more to personalize your document as required. These tools ensure that you present all necessary information accurately.

eSigning options for quick approval

With pdfFiller's eSigning options, you can electronically sign your form, expediting the approval process. This feature eliminates the need for printing, scanning, and mailing documents, making submission more efficient.

Collaboration features

If you’re working with a financial advisor or a team, pdfFiller's collaboration tools allow multiple users to contribute to completed forms. This ensures thoroughness and accuracy in your submission.

Managing your submission

Once you've submitted your Department of Finance Debt Form, managing your submission is crucial for tracking its status and responding to any queries.

You can track your submission through the Department of Finance's online portal or by reaching out directly. Once submitted, be prepared to respond promptly to any feedback or requests for additional documents as they arise.

Common outcomes of debt form submissions

Submitting your debt form may lead to several possible outcomes, including approval for financial relief, requests for additional information, or potential rejection. Understanding these outcomes helps you prepare for the next steps.

Frequently asked questions (FAQs)

Navigating the process of submitting a debt form may raise several questions. Here are some common inquiries:

Utilizing additional resources and support

When dealing with debt forms, access to additional resources can greatly assist in ensuring you complete your form correctly and effectively. pdfFiller offers various online support mechanisms, including user guides and video tutorials aimed at enhancing your understanding of the process.

For specific inquiries regarding your debt form, contacting the Department of Finance directly is advisable. They can provide tailored guidance and clarity on procedures that may affect your submission.

Success stories: How others have utilized the debt form

Many individuals and businesses have successfully navigated their financial distress through the Department of Finance Debt Form. Consider looking into case studies of those who received financial relief after submitting their forms correctly.

Testimonials often highlight the efficiency and effectiveness of using pdfFiller's tools. Financial advisors recommend these tools to manage debt effectively and secure necessary support from the Department.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my department of finance debt in Gmail?

How do I complete department of finance debt on an iOS device?

How do I fill out department of finance debt on an Android device?

What is department of finance debt?

Who is required to file department of finance debt?

How to fill out department of finance debt?

What is the purpose of department of finance debt?

What information must be reported on department of finance debt?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.