Get the free TX Harris County Appraisal District GTAIAD016 Form - Fill ...

Get, Create, Make and Sign tx harris county appraisal

Editing tx harris county appraisal online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tx harris county appraisal

How to fill out tx harris county appraisal

Who needs tx harris county appraisal?

Understanding the TX Harris County Appraisal Form: A Comprehensive Guide

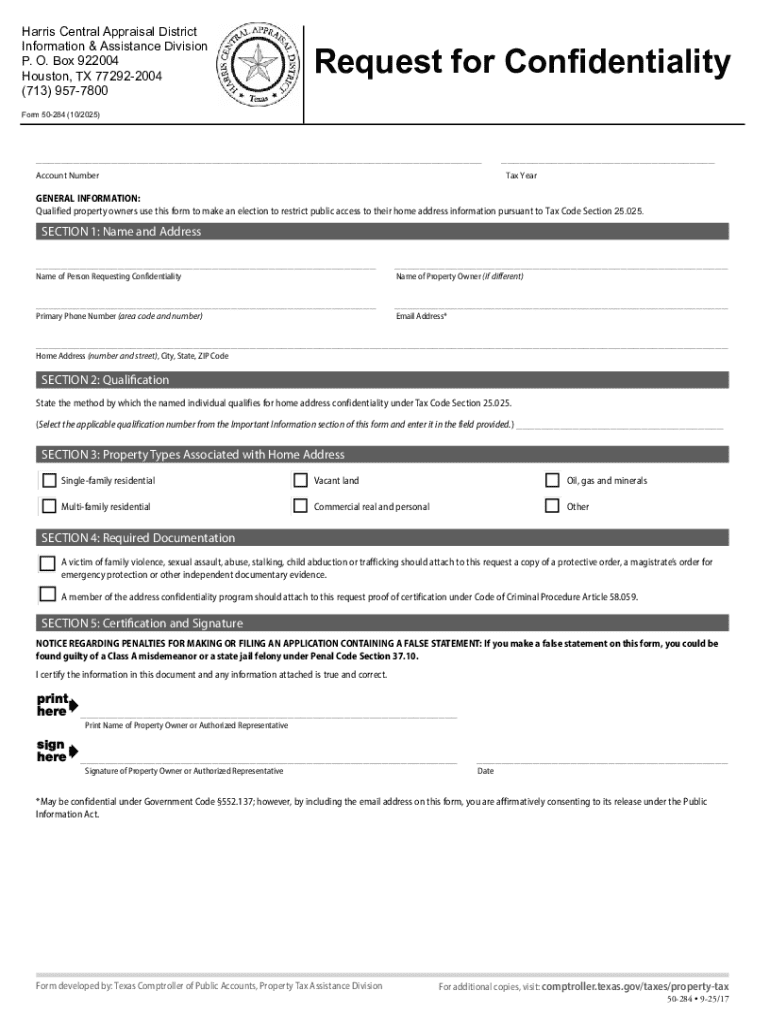

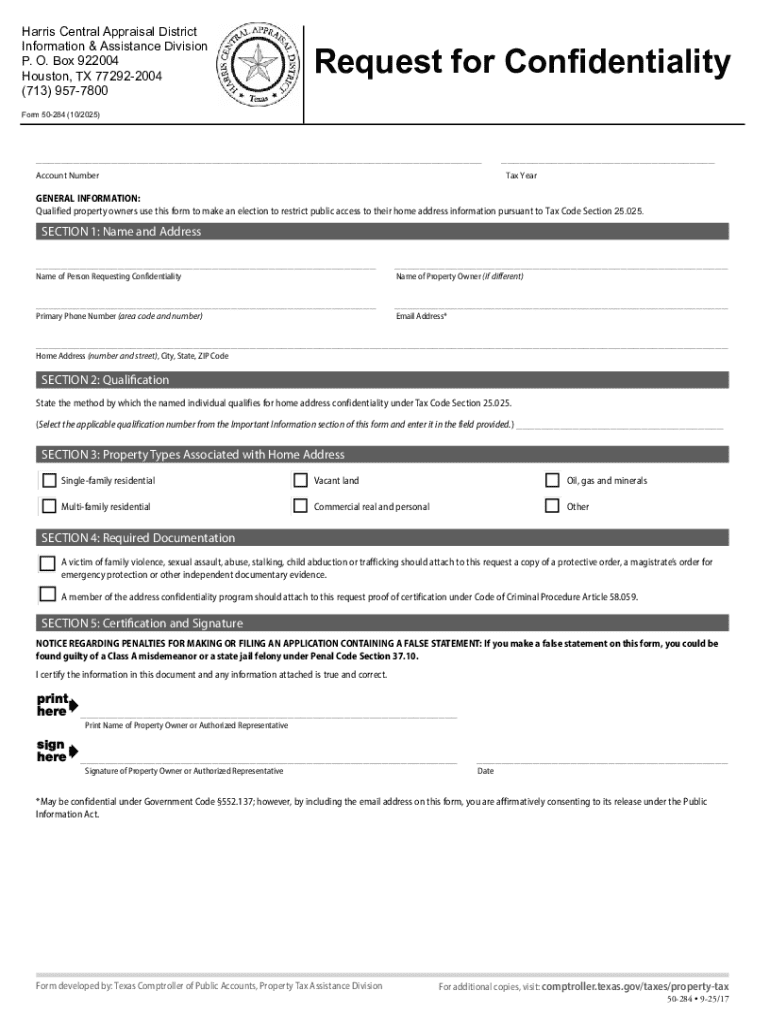

Overview of the TX Harris County Appraisal Form

The TX Harris County Appraisal Form is an essential document that property owners and businesses in Harris County must navigate efficiently. Its primary purpose is to aid in the assessment of property values, which is crucial for determining property taxes. Understanding this form not only ensures compliance but also empowers property owners to evaluate their tax responsibilities accurately.

Timely submission of the appraisal form is vital, with key deadlines usually falling around April 15 each year. It is essential to submit this form to the Harris County Appraisal District (HCAD) to ensure your property’s value is assessed fairly. Missing these deadlines can lead to unfavorable tax increases or lost exemptions.

Understanding the appraisal process in Harris County

In Texas, property assessment occurs annually, determining the market value of real estate based on various factors, including location, condition, and sales trends. The Harris County Appraisal District (HCAD) plays a central role in this process, utilizing detailed criteria to analyze and evaluate the worth of properties across the district.

The appraisal process involves gathering data, conducting field inspections, and applying uniformity in property valuation methods. Harris County utilizes a mass appraisal approach, meaning that properties of similar types are assessed using comparable data, leading to standardized property values that are fair and transparent.

Accessing the TX Harris County Appraisal Form

Locating the TX Harris County Appraisal Form is straightforward. Property owners can find this vital document on the official HCAD website. The form is available in PDF format, allowing for easy downloads and printing for immediate handling.

For users seeking flexibility and enhanced functionalities, pdfFiller offers a robust platform. Users can access the form directly through pdfFiller to fill, edit, and eSign, benefiting from cloud-based services to ensure essential forms are prepared promptly and accurately. This method minimizes hassle and blends seamlessly with digital workflows.

Step-by-step instructions for filling out the form

Filling out the TX Harris County Appraisal Form requires diligence. Before you start, gather necessary documentation, including legal property descriptions, previous tax statements, and any existing exemption certificates. Understanding the required information will streamline your filling process.

Finally, ensure your form is signed. Electronic signatures can be easily added using pdfFiller, simplifying your submission process, whether online or via mailing forms directly to HCAD.

Common mistakes to avoid in the appraisal form

Submitting the TX Harris County Appraisal Form comes with its pitfalls. It is crucial to avoid inaccuracies in the information you provide. This can lead to incorrect property valuations that affect your tax bill.

Tools and features of pdfFiller for managing the appraisal form

With pdfFiller, managing the TX Harris County Appraisal Form becomes significantly more manageable. The platform offers user-friendly editing tools, enabling the addition and removal of information seamlessly. You can highlight changes and comments for easy review, making the process collaborative for teams.

After submission: Next steps and appeal process

After submitting the TX Harris County Appraisal Form, expect to hear back from HCAD regarding your property assessment. You will receive a notice detailing the amount assessed. If you disagree with this assessment, understanding the appeals process is paramount.

Special considerations and exemptions

Harris County offers several property exemptions that can significantly impact tax liabilities. Understanding these exemptions allows property owners to take full advantage of available tax benefits.

Before filing, ensure you have necessary forms related to these exemptions, which can also be conveniently completed using pdfFiller.

Local resources for Harris County property owners

Harris County property owners have access to numerous resources for support throughout the appraisal process. The HCAD provides detailed guides and personalized assistance via its information center.

Frequently asked questions (FAQs)

Property owners often have pressing questions regarding the TX Harris County Appraisal Form. Common inquiries include how the appraisal process works, and available exemptions, and what to do if a property valuation is disputed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute tx harris county appraisal online?

How do I edit tx harris county appraisal online?

Can I create an electronic signature for the tx harris county appraisal in Chrome?

What is tx harris county appraisal?

Who is required to file tx harris county appraisal?

How to fill out tx harris county appraisal?

What is the purpose of tx harris county appraisal?

What information must be reported on tx harris county appraisal?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.