Get the free Harris County Appraisal District - Overview, News & Similar ...

Get, Create, Make and Sign harris county appraisal district

Editing harris county appraisal district online

Uncompromising security for your PDF editing and eSignature needs

How to fill out harris county appraisal district

How to fill out harris county appraisal district

Who needs harris county appraisal district?

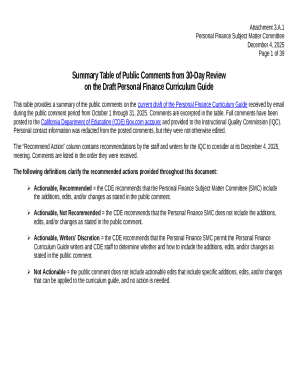

Navigating the Harris County Appraisal District Form: Your Comprehensive How-to Guide

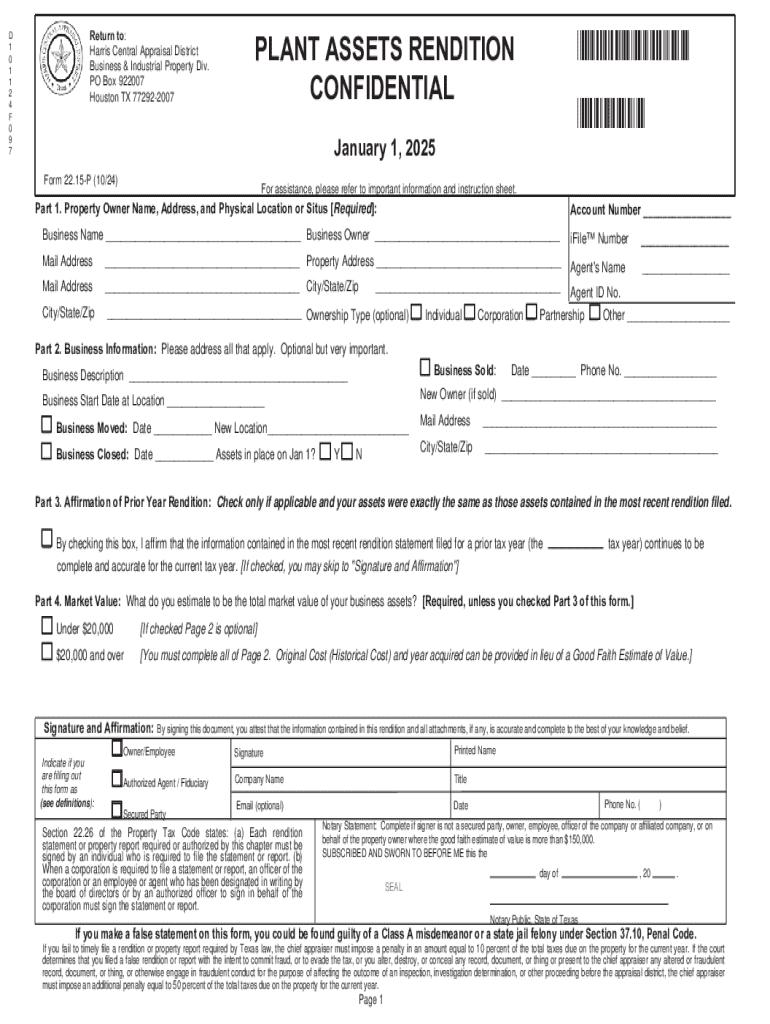

Understanding the Harris County Appraisal District Form

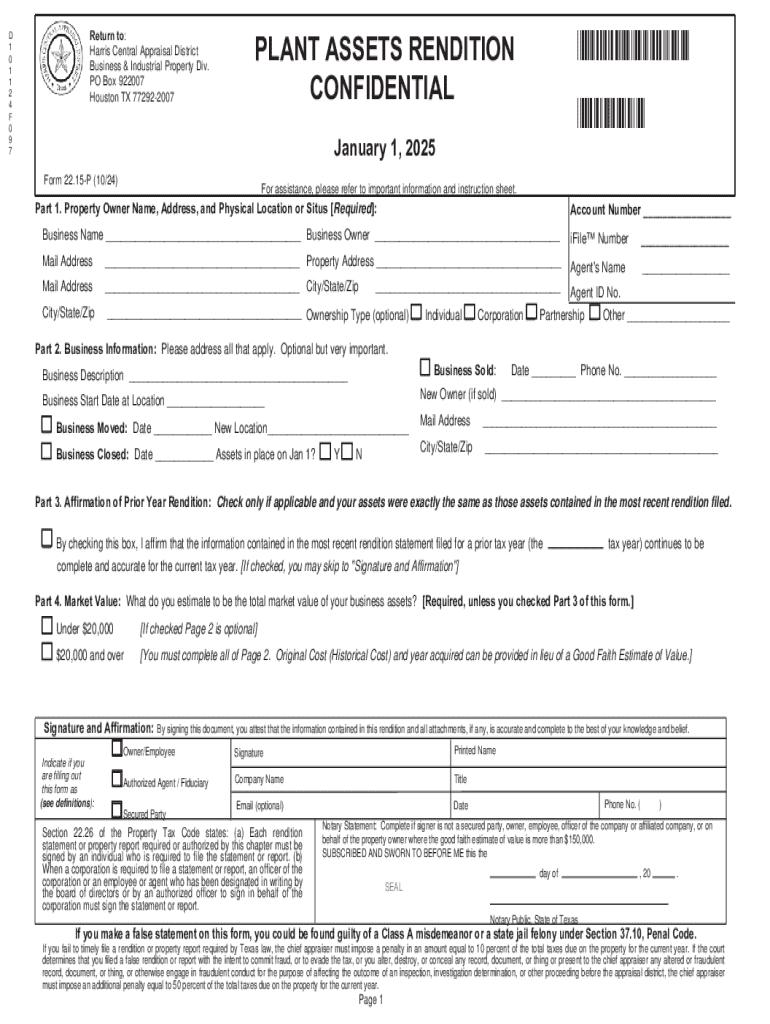

The Harris County Appraisal District (HCAD) is the entity responsible for appraising real property in Harris County, Texas. Whether you are a homeowner, a commercial property owner, or a real estate professional, understanding the function of HCAD is crucial for managing property taxes effectively. The appraisal district form serves as a primary tool for communicating property evaluation details, ensuring applicable taxes are accurately assessed.

The importance of this form cannot be overstated; it is essential for tax assessments, exemption claims, and appeals. Homeowners may use it to apply for homestead exemptions, while commercial property owners may need it for valuation purposes. Real estate professionals must also be familiar with the form to better assist their clients. Thus, becoming proficient in using this form can lead to significant financial benefits.

Key components of the HCAD form

The structure of the HCAD form is designed for clarity and ease of use, ensuring all necessary information can be collected effectively. The form typically includes various sections where you must provide detailed information about the property and the owner's details.

Each field is crucial for the processing of your application. Required information often encompasses: a) Property identifier number, b) Physical address, c) Owner’s name and mailing address, and d) Any applicable exemption type. Understanding how to accurately fill these sections is vital to avoid delays or rejections.

Attachments and supporting documents must also accompany the form. Common documents include property tax receipts, previous appraisal notices, and proof of ownership. Additionally, be aware that certain applications may require notarization and signatures to remain legally binding.

Step-by-step instructions for completing the HCAD form

To successfully complete the HCAD form, start by gathering all necessary information beforehand. This includes verifying property details and reviewing previous appraisal history, which can give context to your current application. The telephone information center at HCAD can be a valuable resource for getting this information.

Next, systematically fill in the form, ensuring that each field is accurately populated. Focus on each section, addressing the property type, location, and ownership details without leaving any gaps. There are common mistakes that individuals make, such as missing signatures or incorrect property identification numbers, which can lead to application delays.

Reviewing and verifying your completed application is critical. Maintain a checklist of the required fields and documents to double-check everything before the official submission to avoid potential rejection.

Electronically managing your HCAD form

In today's digital age, managing forms electronically streamlines the process significantly. Using pdfFiller, users can access the HCAD appraisal form online, making it easier to create and fill out documents from anywhere. The interactive tools provided by pdfFiller allow for smooth editing and filling of the form.

eSigning the form is a crucial feature that speeds up submission. With pdfFiller, you can electronically sign and date your document effortlessly. This not only enhances the confirmation process but also guarantees that your form is legally compliant without the hassle of printing and mailing physical documents.

Moreover, pdfFiller allows users to share completed forms with third parties easily. This feature can be especially beneficial for real estate professionals needing to collaborate with clients or other stakeholders.

Common issues and solutions

While navigating the HCAD form can be straightforward, certain issues can arise. A common challenge includes incomplete fields or missing documentation, which usually results in delays. Ensuring you have a checklist can mitigate this problem. Contacting HCAD can also resolve specific queries related to your application.

Furthermore, frequently asked questions about the appraisal process often highlight concerns like deadlines for submissions and appeal processes. For immediate assistance, consider utilizing the contact information provided by HCAD support, which can guide you through common challenges.

Important deadlines and timelines

Knowing the deadlines for submitting the HCAD form is critical to maintaining good standing with your property taxes. There are key dates each year that mark the beginning and end of submission periods. Understanding these deadlines ensures you can apply for exemptions or lodge appeals in a timely manner.

Once your HCAD form is submitted, you can expect a timeline for communication from HCAD regarding the status of your application. The timely response by HCAD can greatly influence your financial planning for property taxes and potential expenditures for the following year.

Additional forms related to HCAD

The landscape of property evaluation and taxation is diverse, reflecting the various needs of different property owners. Apart from the primary HCAD appraisal form, numerous other forms address specific purposes, including residential exemption forms, commercial valuation forms, and correction appeal forms.

For instance, homeowners can utilize residential exemption forms to apply for homestead exemptions. Commercial property owners must know the specific forms associated with property valuations for their businesses. Understanding the nuances between these forms can significantly impact property tax liabilities and potential savings.

The role of abatements and exemptions

Property tax abatements and exemptions significantly affect the financial landscape for property owners in Harris County. Abatements serve as temporary reductions in property tax obligations, while exemptions can provide permanent relief. Both can alleviate the overall tax burden if applied correctly.

Understanding the qualifications for different types of exemptions is essential. For instance, veterans, seniors, and disabled individuals may qualify for specific exemptions that can drastically cut their property tax bills. Engaging with the local government to learn about available options is therefore beneficial.

Real-life examples and case studies

Real-life examples help illuminate the process of effectively using HCAD forms. Many individuals and businesses have successfully navigated the complexities of the appraisal district process, securing tax savings and benefits through well-prepared applications.

Tips from users who have gone through the experience indicate that preparation is key. Having all required documents organized and proactively reaching out for assistance when uncertainties arise can make a significant difference in the outcomes.

Engaging with the Harris County Appraisal District

To further enhance your understanding and efficiency in dealing with the HCAD, consider tapping into online resources. The HCAD website features a plethora of information, including guidelines and frequently updated documentation that can assist property owners in navigating the appraisal landscape.

Participation in public meetings or forums regarding property taxes can also provide valuable insights. Engaging with other property owners and HCAD representatives can clarify many aspects of the process and ensure you're well-prepared for upcoming deadlines and changes in regulations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my harris county appraisal district directly from Gmail?

Can I sign the harris county appraisal district electronically in Chrome?

How do I fill out harris county appraisal district using my mobile device?

What is harris county appraisal district?

Who is required to file harris county appraisal district?

How to fill out harris county appraisal district?

What is the purpose of harris county appraisal district?

What information must be reported on harris county appraisal district?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.