Get the free Its February, and that

Get, Create, Make and Sign its february and that

Editing its february and that online

Uncompromising security for your PDF editing and eSignature needs

How to fill out its february and that

How to fill out its february and that

Who needs its february and that?

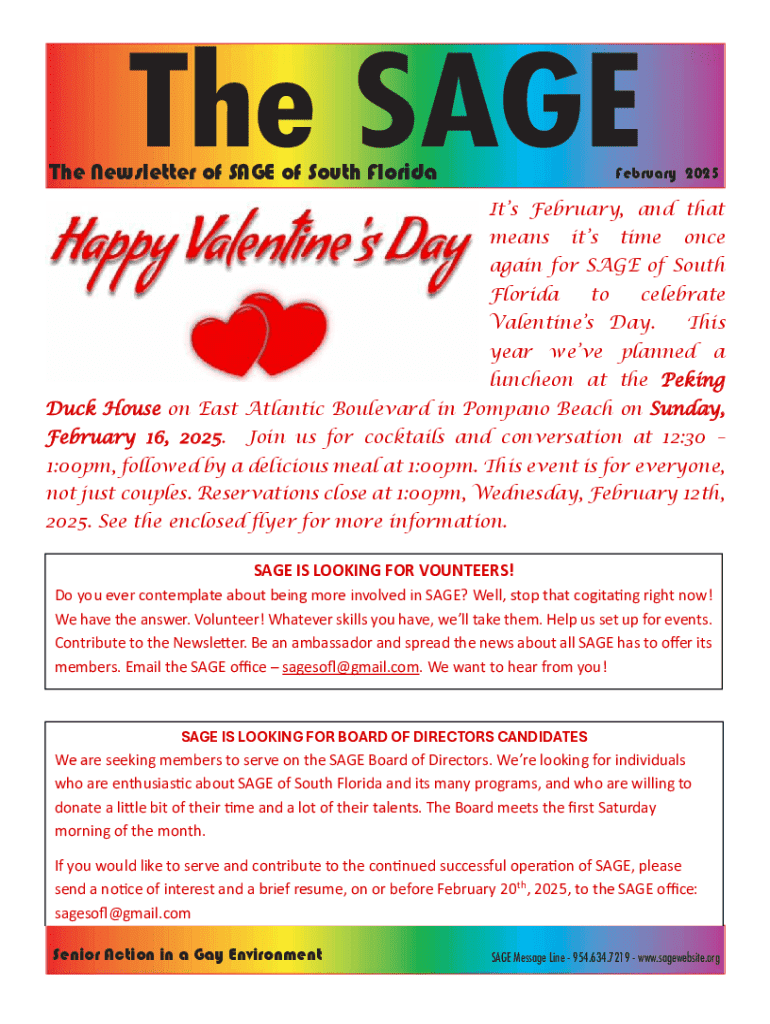

It's February and That Form: A Comprehensive Guide to February Form Management

Understanding the significance of February forms

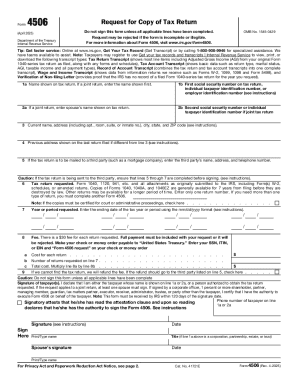

February is often seen as a transitional month, yet it holds critical significance for form submissions, especially in the context of tax and financial reporting. For individuals and businesses alike, this month is pivotal for meeting key deadlines related to form submissions. Missing these deadlines can lead to fines and complications in reporting, making it essential to prioritize getting forms in on time.

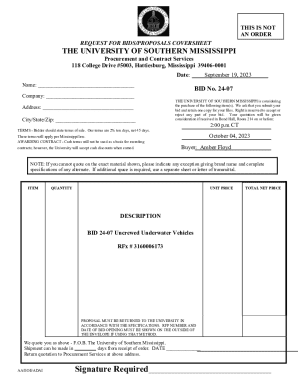

Common forms associated with February include important federal tax forms like the 1040 and W-2, as well as state-specific forms that differ in requirement and deadline. Keeping track of these forms is essential to maintaining compliance.

Step-by-step guide to filling out February forms

The process of filling out February forms can seem daunting, especially without proper documentation and understanding of the forms themselves. To start, it is crucial to gather the necessary documentation before diving into form completion.

Once you have your documents organized, using tools like pdfFiller can streamline the editing process. Upload the forms you need and begin customizing them using the editing tools provided. Follow this detailed walkthrough of the 1040 form as an example:

Be cautious of common mistakes, such as miscalculations or omitted information, as they can delay processing and lead to penalties. Always double-check your entries before hitting submit.

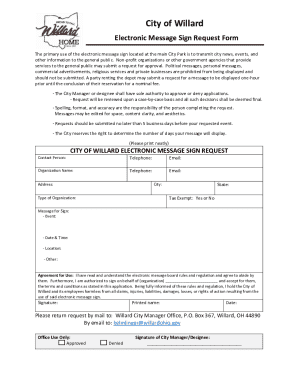

E-signing and submitting your February forms

Once your February form is filled out correctly, it’s time to sign and submit. Using pdfFiller’s e-signing capabilities makes this process smooth and efficient. The following is a guide on how to e-sign your documents.

Advantages of using electronic signatures include faster processing times and increased security. When it comes to submitting, always ensure you’re using a compliant method as outlined by the relevant authorities.

The secure document submission process provided by pdfFiller guarantees that your sensitive information remains safe during transmission. By following best practices in e-submission, you can avoid potential legal pitfalls.

Collaboration and team management for February forms

For teams, collaborating on form preparation is often necessary. pdfFiller offers excellent collaboration features that allow multiple users to contribute effectively to the document. Instead of sending files back and forth via email, you can work in real-time with your team.

By effective tracking of changes, teams can maintain accuracy, which is particularly important when preparing forms that impact financial reporting. Always reference previous submissions to resolve any discrepancies.

Additional features of pdfFiller for February document management

Exploring pdfFiller's extensive suite of interactive tools can further enhance the form-filling process. Features like templates designed specifically for February forms can drastically reduce the time needed to complete documentation.

This flexibility is particularly beneficial for teams that need to manage their documents from various locations or devices. pdfFiller provides a comprehensive solution that adapts to your specific needs.

FAQs about February forms

As February rolls around, many individuals and organizations have questions regarding form submissions. Here are some frequently asked questions that can provide clarity:

Being proactive about understanding deadlines and available resources can ease the stress of the form management process. Keep an eye on notification updates from pdfFiller to stay informed.

Leveraging pdfFiller for future forms

As you complete your forms this February, it’s important to also prepare for the upcoming tax seasons. Setting reminders for next February’s form submissions can help maintain a consistent schedule.

By leveraging pdfFiller, users can streamline their document workflows and ensure all necessary forms are completed efficiently, every February.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in its february and that?

How do I edit its february and that in Chrome?

How can I edit its february and that on a smartphone?

What is its february and that?

Who is required to file its february and that?

How to fill out its february and that?

What is the purpose of its february and that?

What information must be reported on its february and that?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.