Get the free Investment Adviser Public Disclosure - Homepage

Get, Create, Make and Sign investment adviser public disclosure

Editing investment adviser public disclosure online

Uncompromising security for your PDF editing and eSignature needs

How to fill out investment adviser public disclosure

How to fill out investment adviser public disclosure

Who needs investment adviser public disclosure?

Investment Adviser Public Disclosure Form: A How-to Guide

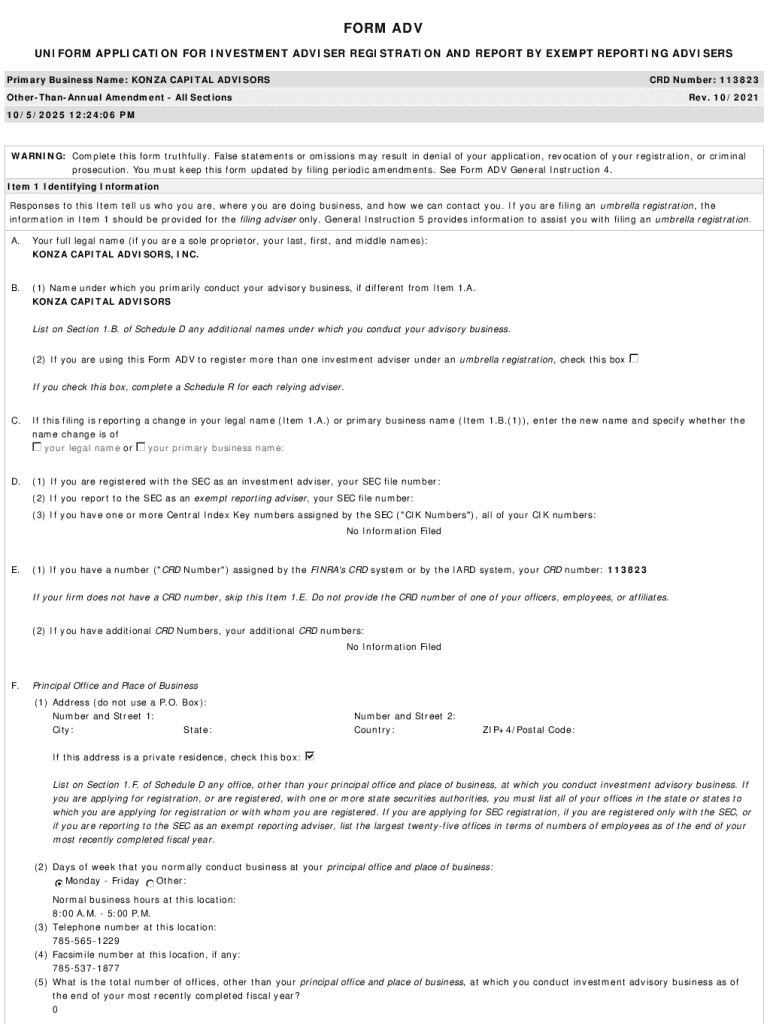

Understanding the investment adviser public disclosure form

The Investment Adviser Public Disclosure (IAPD) serves as a crucial resource for individuals and firms seeking to understand the qualifications and backgrounds of registered investment advisers. It’s a tool designed to promote transparency and integrity within the financial advisory industry. The IAPD, offered by the SEC (Securities and Exchange Commission) and other states, contains comprehensive information that helps investors make informed decisions about whom they choose as their advisers.

With claims of integrity and success often surrounding investment advisers, the IAPD provides a reliable foundation upon which investors can base their evaluations. This form not only lists business practices but also outlines any disciplinary actions against advisers, lending credibility to an adviser’s claims and position in the market.

Why the IAPD matters for investors

The significance of the IAPD for investors cannot be overstated. Transparency is a fundamental pillar in investment advising; it fosters trust between investors and their advisers. By reviewing the IAPD, investors gain access to crucial aspects of an adviser's professional history, which empowers them to discern the authenticity and reliability of potential advisers.

Investors can evaluate potential advisers by referring to the IAPD's detailed reports. These reports include essential information about an adviser's qualifications, any historical issues such as customer complaints or disciplinary sanctions, and the firm’s fee structure. Knowing these details can prevent costly mistakes and help investors make choices aligned with their financial goals.

Key components of the IAPD

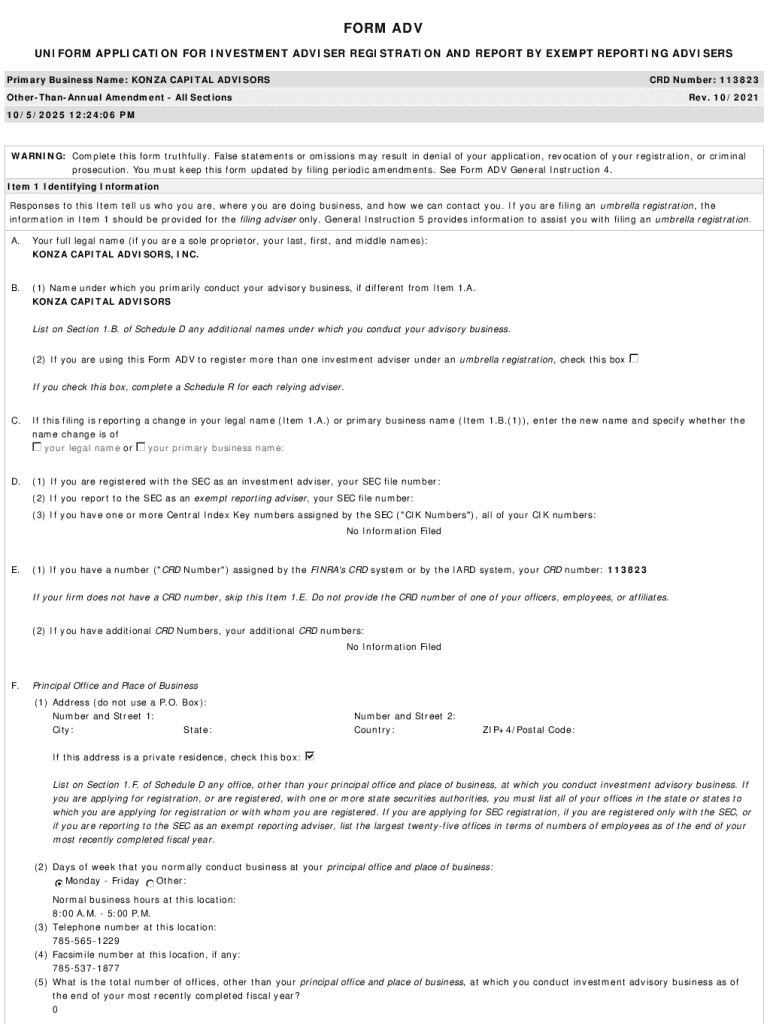

Delving into the IAPD reveals several key components that are important for prospective investors. The form encompasses various types of information that collectively construct a comprehensive profile of an adviser. Major components include the adviser's business background, qualifications, and registration information, which outlines the adviser's educational and professional credentials.

In addition to business backgrounds, the IAPD reveals disclosure of disciplinary history, providing insight into any sanctions or customer complaint information that could indicate potential risks. Investors can also assess the firm’s financial performance and fee structures, ensuring alignment with their personal investment strategies.

Who is required to file an IAPD?

Registered investment advisers are required to file an IAPD as part of their regulatory obligations. An investment adviser is generally defined as an individual or firm that provides advice to clients about securities and manages their investments for a fee. This aspect of the term makes it vital for advisers to comply with both federal and state regulations governing their operations.

The regulatory requirements surrounding the filing of the IAPD aim to ensure public safety and promote ethical conduct within the financial advising sphere. To maintain their registered status, investment adviser firms must periodically update and submit their disclosures, creating a dynamic overview of their business practices.

Accessing the IAPD: A step-by-step guide

Finding your way through the IAPD is straightforward, especially with SEC’s Investment Adviser Search tool designed for user-friendly navigation. This enables investors and advisers alike to efficiently access the required information.

To begin your search, simply visit the SEC website and select the Investment Adviser Search tool. Here, you will have an option to enter your criteria, which can include the adviser's name, location, or other specific parameters. Navigating through the tool effectively will lead you to the pertinent information about the adviser you are investigating.

Searching for specific investment advisers

When searching for specific investment advisers, ensure to input the correct criteria for optimal results. Enter the adviser's name as accurately as possible — spelling errors can lead to frustrating search results. You can refine your search further by including the location or the firm they belong to.

Understanding the search results is also crucial. Each listing will typically include a summary of the adviser’s profile, registration details, and a direct link to the full IAPD report. By analyzing these results, you can gather initial insights, allowing for smarter choices in selecting your investment adviser.

Analyzing the IAPD report

Once you have accessed the IAPD report, it’s important to comprehend the various sections it has to offer. The report is typically organized into key areas: an overview, business history, financial reports, and disciplinary actions, each revealing different dimensions of an adviser’s operational profile.

When evaluating the report, pay attention to red flags that could indicate potential risks. Look for inconsistencies in their historical performance, signs of frequent customer complaints, or any disciplinary history. Such insights are essential for making an informed and calculated investment decision.

Filling out the IAPD: If you're an adviser

For advisers, understanding the process of filling out the IAPD form is as essential as comprehending its significance. Preparation is key; gather all necessary documentation regarding your firm, personnel, and any past disciplinary actions you may need to disclose.

Common pitfalls during completion can include omitting key information or providing misleading data. It's critically important to ensure that every detail is accurate to avoid complications with your registration and compliance processes.

Step-by-step instructions for filling out the form

Filling out the IAPD form should follow a meticulous approach; start with the basic information including your name and the firm’s registration number. Next, input your business history, detailing previous positions held, qualifications, and certifications. Subsequent sections should include financial disclosures on fees and performance, followed by any necessary disclosures of disciplinary actions.

Double-check all entries for accuracy and completeness before submission. Utilize tools that help with document management, like pdfFiller, which simplifies editing, eSigning, and collaborating on these forms to make the process seamless.

Editing and updating your IAPD information

Timely updates to your IAPD information are vital in maintaining compliance and ensuring that potential clients have the most accurate view of your operation. Regularly monitor your profile and make necessary adjustments promptly to foster ongoing trust with your clients.

Navigating changes in your business should also reflect on your IAPD. If your firm experiences any material changes, such as fee adjustments or additions to your disciplinary history, it is crucial to amend your IAPD accordingly to keep stakeholders informed.

Managing your IAPD submission: Best practices

Keeping track of your IAPD submission requires proactive engagement. Establishing tools and methods for monitoring compliance can greatly help advisers remain organized. Setting reminders for updates based on regulatory requirements or changes in business is necessary for maintaining a trustworthy presence in the market.

Using technology can enhance your compliance management practices. For instance, collaborative tools like pdfFiller can assist in document management, ensuring that teams can efficiently make necessary changes and updates to the IAPD while maintaining version control.

Embracing technology in IAPD management

The rise of cloud-based document solutions has revolutionized how advisers manage their IAPD submissions. Accessibility from any location provides convenience for advisers and clients alike, allowing for real-time updates and information sharing.

Enhanced editing and signing capabilities offered by platforms like pdfFiller support the efficient handling of the IAPD process. These tools allow advisers to streamline their workflows and be more responsive to client needs.

Interactive tools for enhanced learning

Interactive tools can greatly facilitate the ease of completing the IAPD form. pdfFiller provides features that simplify form completion, enabling advisers to utilize templates tailored for their specific needs. These resources can significantly enhance efficiency in managing disclosures and updating reports.

Leveraging templates makes it easier for advisers to maintain accuracy and consistency across their IAPD submissions while minimizing errors that could lead to compliance issues.

FAQs about the investment adviser public disclosure form

Advisers and investors often have common questions about the IAPD process. Understanding what the form entails, how to access it, and what to look for are crucial areas of interest. It’s essential to clarify misconceptions, such as the assumption that all advisers are equally qualified, whereas the IAPD can shed light on significant differences.

Regularly addressing typical queries and providing clear answers can demystify the IAPD for many. Ensuring that both advisers and clients are informed can minimize confusion and support a healthier relationship built on transparency.

Troubleshooting while accessing or filling out the IAPD

While accessing or filling out the IAPD, users may face common technical issues that can hinder their progress. Typical problems might include difficulties with the SEC website, issues with login credentials, or challenges in document uploads.

To resolve these issues effectively, users should ensure that their internet connection is stable and try refreshing the webpage. For ongoing issues, contacting support directly or referring to resource guides can provide additional assistance.

Real-world case studies: The importance of the IAPD

The impact of the IAPD can be illustrated through various success stories where investors have utilized the form to make informed decisions. Cases exist where individuals who monitored IAPD disclosures were able to avoid potential pitfalls associated with unqualified advisers, ultimately protecting their financial interests.

Learning from disciplinary actions highlighted on the IAPD is equally valuable. Analyzing former advisers who faced sanctions can reveal common pitfalls in the industry, providing current advisers with insights on best practices and compliance norms.

Future trends in investment adviser disclosure

As regulations evolve, the landscape for investment adviser disclosures is shifting. Increased technology adoption is driving changes, with more integrated systems allowing for real-time updates and disclosures that are easier for investors to access.

The future of IAPD management will likely be characterized by robust digital ecosystems, fostering greater transparency and enhancing the relationship between advisers and clients. As these systems develop, both investors and advisers will benefit from a more streamlined and informative disclosure process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete investment adviser public disclosure online?

Can I create an eSignature for the investment adviser public disclosure in Gmail?

How do I complete investment adviser public disclosure on an iOS device?

What is investment adviser public disclosure?

Who is required to file investment adviser public disclosure?

How to fill out investment adviser public disclosure?

What is the purpose of investment adviser public disclosure?

What information must be reported on investment adviser public disclosure?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.