Get the free 2025 Declaration of Personal Property MOTOR VEHICLE

Get, Create, Make and Sign 2025 declaration of personal

Editing 2025 declaration of personal online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 declaration of personal

How to fill out 2025 declaration of personal

Who needs 2025 declaration of personal?

2025 Declaration of Personal Form: A Comprehensive How-To Guide

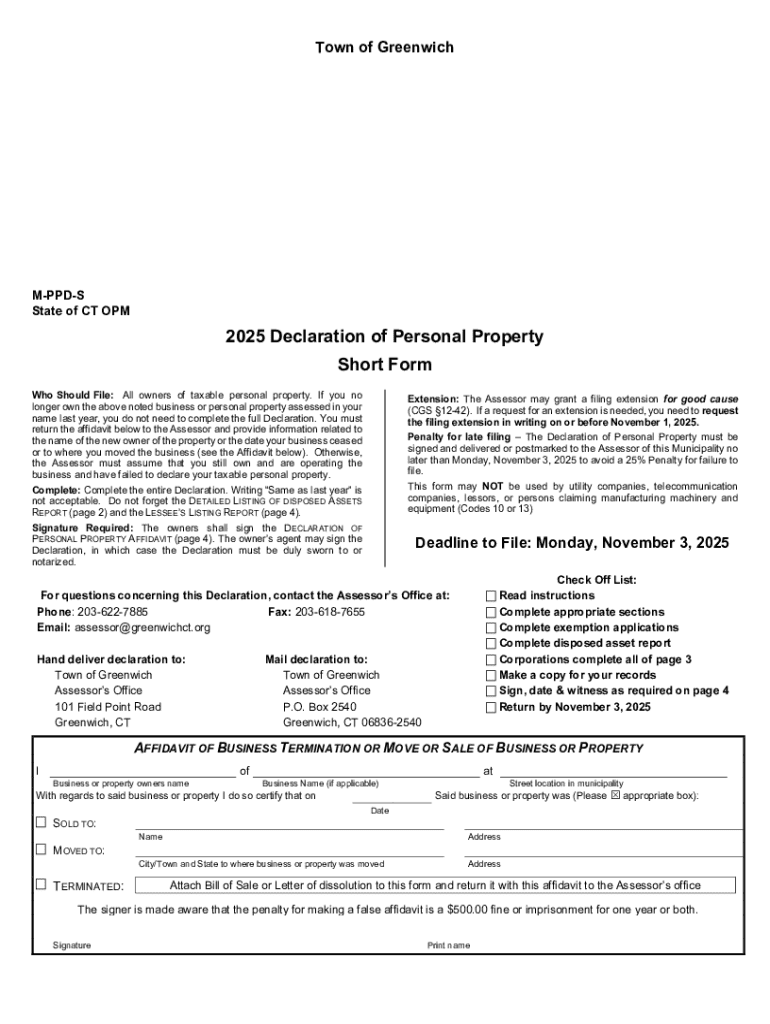

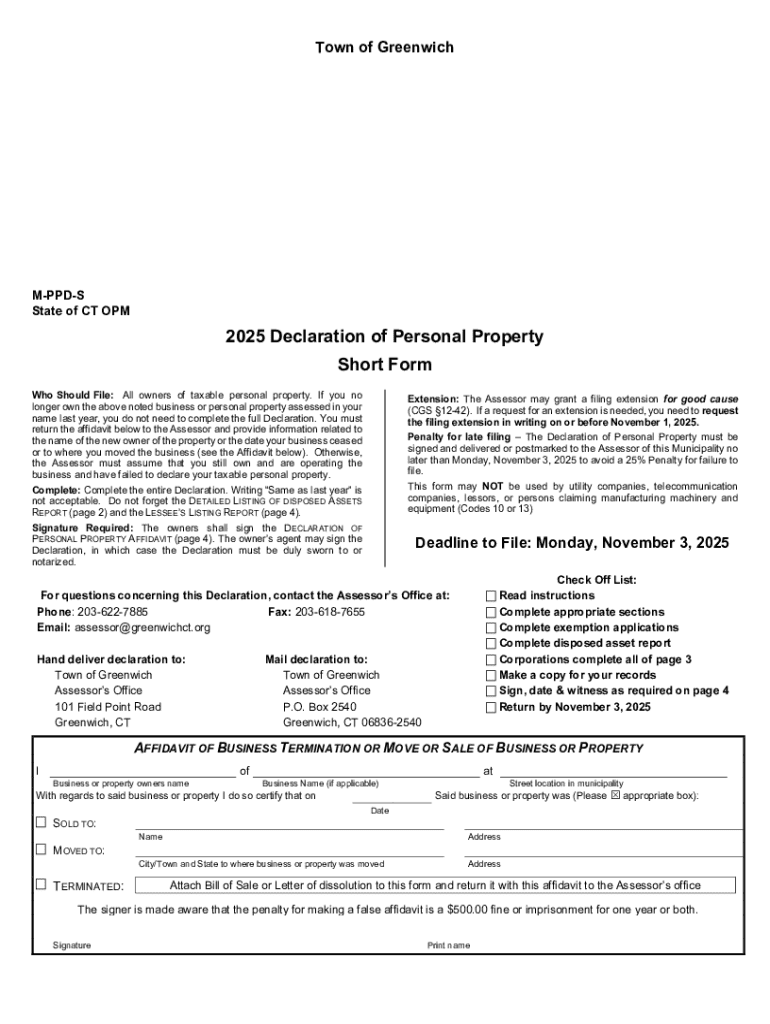

Understanding the 2025 declaration of personal form

The 2025 declaration of personal form is a vital document designed for individuals to declare essential personal and financial information. This declaration plays a crucial role in transparency, particularly in personal finance, ensuring individuals remain compliant with various reporting requirements. As personal circumstances and legislation evolve, the 2025 declaration reflects recent changes aimed at enhancing clarity and usability.

The importance of the declaration cannot be overstated. It aids in establishing an accurate financial profile, necessary for applications like loans, grants, and even property purchases. Understanding key changes in 2025, such as amended filing procedures and new exemption classifications, can significantly impact how individuals approach their financial dealings.

Who needs to complete the declaration?

Individuals required to complete the 2025 declaration include anyone with taxable income, property holdings, or major investment portfolios. If you've recently experienced changes in personal status, such as marriage or divorce, you must update your declaration accordingly. Special circumstances, such as inheriting property or starting a new business, may also necessitate filing.

Organizations and teams might also need to take action, particularly if they are involved in collaborative projects that require financial disclosures for grant applications. When multiple stakeholders are investing in a project, it is essential to have a comprehensive understanding of each member's financial status, emphasized by the 2025 declaration.

Preparing to complete your declaration

Before you embark on completing your 2025 declaration of personal form, gathering essential information is crucial. You'll need your personal identification details, including social security numbers and valid identification documents. Additionally, financial records, such as income statements, taxes paid, and property assessments are important for accurate reporting.

To streamline the preparation process, utilizing resources like pdfFiller’s document management features can significantly ease the task. They offer recommended checklists that help ensure you've gathered all necessary documents, preventing any last-minute panics when you're filling out the form. This preparation is key to an efficient filing experience.

Step-by-step guide to filling out the 2025 declaration of personal form

Navigating the 2025 declaration of personal form involves understanding its various fields and sections. Start by carefully entering your personal information, such as your name, address, and contact details. Next, you’ll need a clear financial overview, detailing your income, assets, and any liabilities. Each section of the form warrants careful attention to avoid common mistakes such as misreporting income or omitting vital financial information.

A detailed walkthrough of each section is essential. The personal information section typically requires basic details but may also request information pertaining to family status if applicable. Financial overviews will require a comprehensive breakdown of your income streams and property values. Lastly, acknowledgment and signatures validate the submission, confirming adherence to the declaration requirements.

Editing and finalizing your declaration

Once your form is filled out, utilizing pdfFiller’s PDF editing tools is advisable to ensure everything is in order. Review for any accuracy, cross-referencing the information provided with your documents. A careful check can prevent issues arising from misreported figures or incorrect details.

Adding eSignatures securely is another beneficial feature of pdfFiller. Ensure you follow the outlined protocols for signing the document, as this adds an extra layer of verification and legality to your form. This step is crucial, especially for documents submitted electronically, as it confirms that you are attesting to the veracity of the information presented.

Submitting your declaration

Submitting your 2025 declaration can be done in several ways. Filing online with pdfFiller is often the easiest route, allowing for an expedited process and immediate confirmation of receipt. Alternatively, if you choose to file by mail, ensure you follow the specified steps, including sending it to the correct address and preserving your submission copy until you receive a confirmation e-mail.

Be mindful of important deadlines associated with the form, as these can vary based on your filing method or state requirements. After submission, expect to receive acknowledgment from the relevant authorities; this confirmation ensures that your declaration has been processed and received.

FAQs about the 2025 declaration of personal form

With questions surrounding the 2025 declaration of personal form, it’s important to address common queries and debunk prevalent myths. For instance, many individuals wonder about the repercussions of errors made post-submission. Addressing features for correcting submissions after filing is critical; utilizing the tools provided by pdfFiller can enlighten users on how to amend their declarations efficiently.

Additionally, support services from pdfFiller are available for those who require further assistance. Agents can help individuals navigate complexities related to their unique situations, ensuring that everyone can fulfill their filing obligations accurately. Clearing any doubts leads to a smoother experience and fosters a better understanding of the filing process.

Managing your personal declaration records

Post-submission, managing records associated with your declaration is essential. Best practices for document management include maintaining electronic copies of your submissions and creating backups in the cloud via platforms like pdfFiller. This practice not only secures your records but allows for easy access anytime you need to reference your financial situation.

For teams, collaboration tools provided by pdfFiller enable multiple users to access shared documents and manage updates effectively. Ensuring that all team members are on the same page regarding documentation can significantly streamline processes in situations requiring joint declarations or other shared filings.

Specific considerations for unique cases

Unique cases may warrant special attention when filing the 2025 declaration of personal form. For instance, handling changes in personal status, such as marriage or divorce, necessitates careful reevaluation of your financial documentation to reflect new circumstances accurately.

Additionally, self-employed individuals often have different reporting requirements that can complicate the declaration process. Understanding and adhering to knowledge about state-specific requirements ensures compliance while maximizing potential exemptions and benefits available to different categories of filers.

Leveraging pdfFiller for ongoing document management

Utilizing pdfFiller extends well beyond navigating the 2025 declaration of personal form. This platform empowers users to manage various documents seamlessly, providing access to interactive tools that facilitate future filings. From tax forms to business documentation, pdfFiller’s capabilities promote an organized approach to document management.

The benefits of a cloud-based document management platform are numerous. Accessibility from anywhere ensures that individuals and teams can collaborate more effectively while also safeguarding sensitive information. As needs evolve, pdfFiller remains a pivotal part of maintaining well-organized personal and professional records, streamlining the overall filing process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 2025 declaration of personal to be eSigned by others?

How can I fill out 2025 declaration of personal on an iOS device?

How do I complete 2025 declaration of personal on an Android device?

What is 2025 declaration of personal?

Who is required to file 2025 declaration of personal?

How to fill out 2025 declaration of personal?

What is the purpose of 2025 declaration of personal?

What information must be reported on 2025 declaration of personal?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.