Get the free Annual Account of Fiduciary: The Basics

Get, Create, Make and Sign annual account of fiduciary

Editing annual account of fiduciary online

Uncompromising security for your PDF editing and eSignature needs

How to fill out annual account of fiduciary

How to fill out annual account of fiduciary

Who needs annual account of fiduciary?

Annual account of fiduciary form: A comprehensive how-to guide

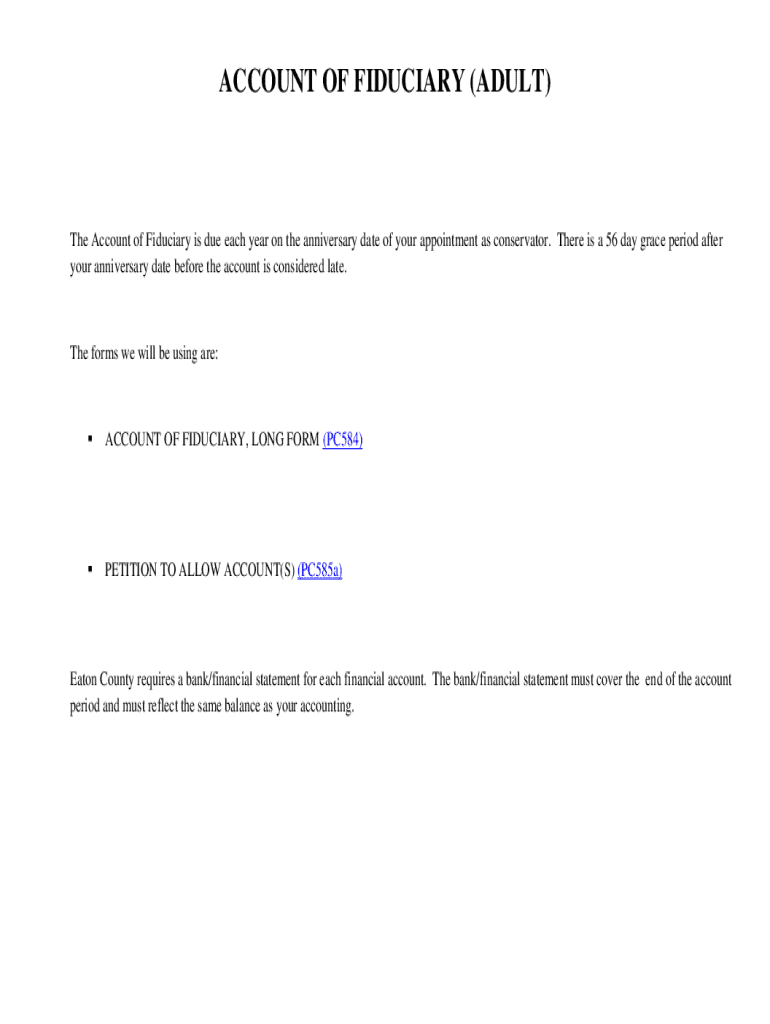

Understanding the annual account of fiduciary form

The annual account of fiduciary form is a crucial document that fiduciaries — individuals or organizations entrusted with managing another person's assets — must complete annually. This form provides transparency regarding how assets were handled and ensures accountability to the beneficiaries. Understanding this form is not merely a formality: it serves to protect both fiduciaries and beneficiaries by documenting the management of funds and making financial practices clear.

Fiduciaries play a pivotal role in financial management, especially in trust accounts, estates, or situations involving power of attorney. Their responsibility extends beyond merely managing assets; they have a legal obligation to act in the best interests of the beneficiaries, making the accurate and timely completion of the annual account of fiduciary form essential.

When is the annual account of fiduciary needed?

The annual account of fiduciary form is typically required in several key situations. First, trust accounts mandate annual reporting to beneficiaries to ensure transparency about asset management and to detail any income or distributions made. Similarly, during estate management, the executor is often required to submit this form periodically to demonstrate proper handling of estate assets and expenses related to probate.

Lastly, the form is vital in power of attorney situations, where fiduciaries must prove that they have acted within their authority and in the best interests of the principal. In failing to file this form, a fiduciary may face legal repercussions, including potential allegations of mismanagement or breach of duty, which could lead to costly litigation.

Components of the annual account of fiduciary form

The annual account of fiduciary form consists of several critical sections that provide a comprehensive overview of a fiduciary's activities. At its core, this form typically breaks down into income and expenses incurred throughout the year. It is essential to detail every transaction, as this contributes to the overall financial picture captured in the report.

In addition to income and expenses, fiduciaries must also report on asset valuations and distributions. This section includes information about any distributions made to beneficiaries, ensuring they are aware of what they have received and the current value of remaining assets. Notable disclosures may also be required, particularly if funds are being allocated in ways that deviate from expectations. Common mistakes in this area include neglecting to report certain expenses or distributions, which can lead to complications or disputes.

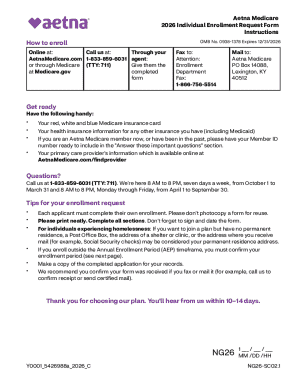

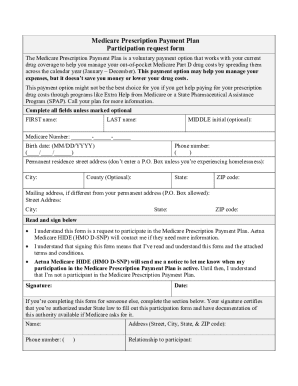

Filling out the annual account of fiduciary form

Filling out the annual account of fiduciary form can be a straightforward process when approached methodically. Start by gathering all necessary documentation, including financial statements, invoices, and receipts for expenses incurred over the reporting period. Organizing this information beforehand will facilitate accurate reporting.

Next, access the annual account of fiduciary form via pdfFiller, which simplifies the process with its interactive tools. Begin filling in the required fields, ensuring you accurately report the income and expenses as outlined in the gathered documentation. It's also helpful to double-check entries for accuracy and completeness, as errors can complicate matters significantly.

Editing and customizing the form

Editing the annual account of fiduciary form using pdfFiller is a seamless experience due to its robust features. The platform allows users to modify text, images, and fields easily. If you’re looking for personalization, you can utilize templates designed specifically for fiducial reports. This not only saves time but also helps ensure compliance with standard requirements.

Additionally, pdfFiller enables collaborative features, making it easy to request signatures and comments from stakeholders. This is especially helpful in maintaining transparency and gaining approval from beneficiaries or other interested parties. The platform tracks all changes, ensuring that document integrity is preserved throughout the editing process.

Signing and submitting the annual account of fiduciary form

Once the annual account of fiduciary form is completed, signing it electronically through pdfFiller is a secure and straightforward process. Setting up electronic signatures can be done in just a few clicks. pdfFiller ensures security throughout the e-signing process, providing encryption features that protect sensitive information during submission.

After signing, the form needs to be submitted according to local laws or regulations. Typically, this may involve mailing a hard copy or, in some cases, submitting it electronically to a governing authority. Be sure to confirm the submission process and retain documentation confirming receipt, which aids in maintaining accountability and can be useful for future reference.

Managing and storing the annual account of fiduciary form

Effective document management after submitting the annual account of fiduciary form is vital. Best practices include organizing electronic files in a way that allows easy access for both the fiduciary and beneficiaries. Utilizing secure cloud storage solutions ensures that sensitive information is protected while remaining accessible when necessary.

What you do after submission matters, as well. Keeping accurate records for future reference is crucial, especially should any audits or inquiries arise. These records not only protect against potential disputes but also help provide a clear history of fiduciary activities should any legal issues need addressing.

Frequently asked questions (FAQs)

Many individuals have concerns regarding the annual account of fiduciary form. For instance, what happens if you miss a filing deadline? Generally, the repercussions can range from legal complications to penalties depending on jurisdiction. It’s crucial to take proactive measures to stay informed of deadlines and repercussions. Understanding how to amend the form if inaccuracies are discovered post-submission is also essential.

Experts suggest that fiduciaries remain diligent about their responsibilities to minimize risk. Recommendations include timely filing, precise reporting, and maintaining clear lines of communication with beneficiaries and legal advisors to enhance transparency and avoid disputes.

Interactive user experience

Utilizing pdfFiller for preparing the annual account of fiduciary form offers many advantages. Its cloud-based platform significantly reduces frustration compared to traditional document handling. Users can complete forms from virtually anywhere, ensuring that fiduciaries can manage their obligations effectively, even while on the go.

User testimonials highlight the efficiency and effectiveness of pdfFiller’s document management system. Many have reported streamlined processes that significantly reduce the time taken from form preparation to submission, facilitating better compliance and transparency within fiduciary duties.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my annual account of fiduciary in Gmail?

Can I create an electronic signature for signing my annual account of fiduciary in Gmail?

Can I edit annual account of fiduciary on an Android device?

What is annual account of fiduciary?

Who is required to file annual account of fiduciary?

How to fill out annual account of fiduciary?

What is the purpose of annual account of fiduciary?

What information must be reported on annual account of fiduciary?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.