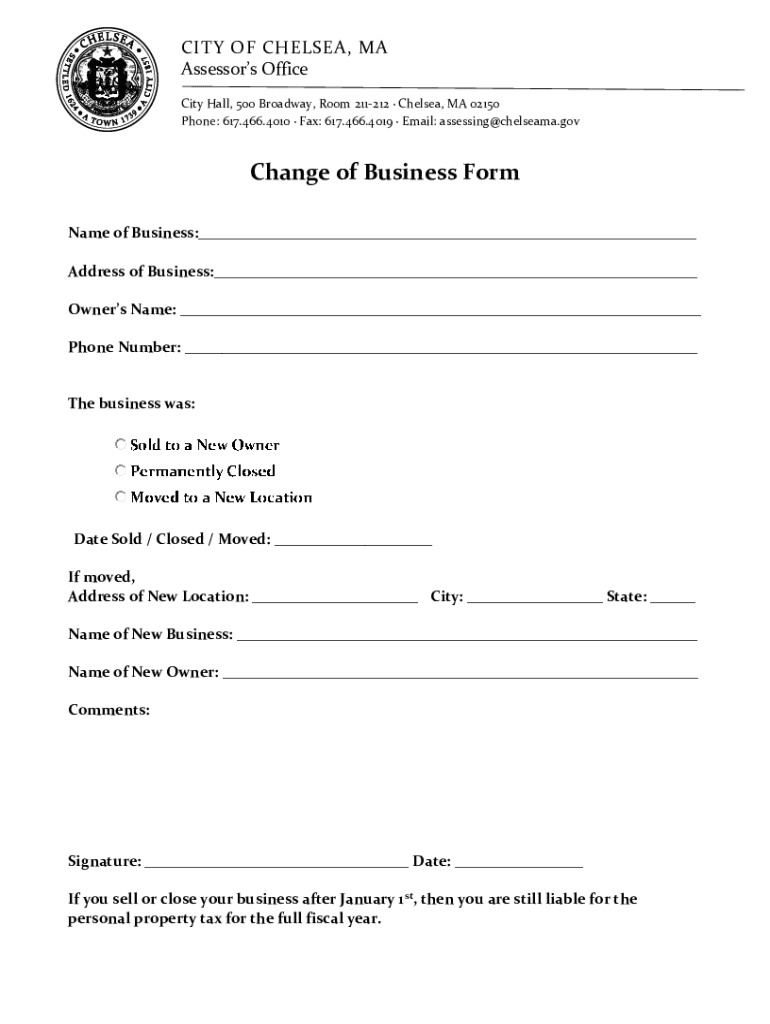

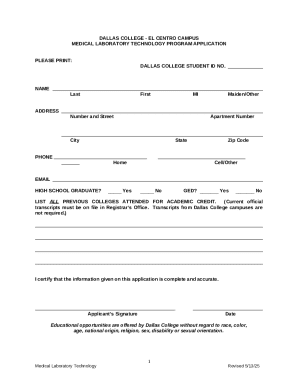

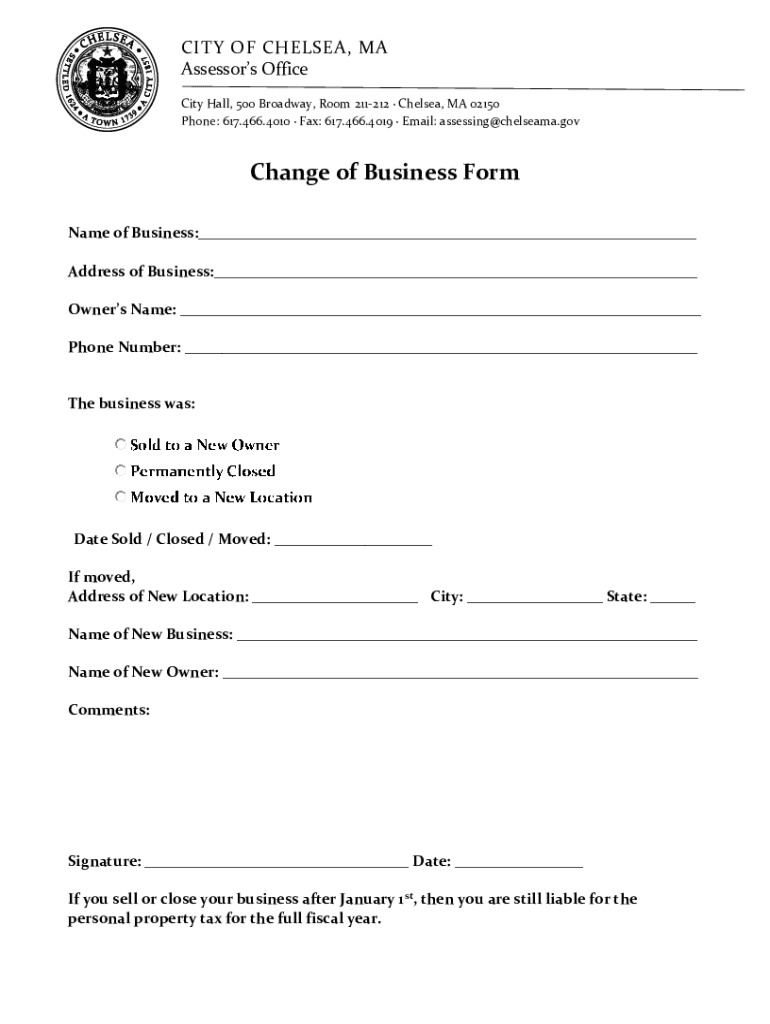

Get the free Change of Business Form

Get, Create, Make and Sign change of business form

Editing change of business form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out change of business form

How to fill out change of business form

Who needs change of business form?

Change of Business Form: A Comprehensive Guide

Understanding the change of business form

Changing your business form is a significant decision that can impact various aspects of your enterprise, from liability to taxation. It refers to the process of altering the structure of your business, which can be essential for adapting to new opportunities or challenges. Such a transformation is crucial not just for compliance, but also for maximizing your business’s potential in an evolving market.

There are several common reasons why businesses opt for a change in structure. These include growth and expansion, which may necessitate a more complex structure like a corporation; liability concerns that might push a sole proprietorship to consider an LLC; tax considerations that can motivate converting to an S-Corp; and the desire to attract new investments which may require a more formal structure.

Types of business forms

When changing your business form, it’s vital to understand the common structures available. The simplest form is a sole proprietorship, where one individual owns the business and assumes all liabilities. Partnerships involve two or more people sharing ownership and responsibilities. A Limited Liability Company (LLC) combines elements of both partnerships and corporations, providing liability protection while allowing for pass-through taxation. Corporations, whether C-Corps or S-Corps, offer comprehensive liability protection but come with more regulations and tax complexities.

Each structure has advantages and disadvantages. For example, sole proprietorships are easy to establish and cost-effective but expose owners to unlimited liability. Partnerships can leverage shared skills and resources, yet they also risk conflicts between partners. LLCs provide personal liability protection without the formalities of a corporation, but they may require more paperwork. Corporations enable easier access to capital and limit personal risk, yet they face double taxation in the case of C-Corps.

The process of changing your business form

Transforming your business form requires a structured approach. Start by assessing your current business structure, evaluating whether it still meets your needs. Next, determine the new business structure that aligns with your growth objectives and risk appetite. This is a critical step, as it sets the direction for your business's future.

Once you have clarity on the new form, consulting with legal and financial advisors is paramount. They can provide insights tailored to your specific situation, helping you understand the implications of each structure. After this, you will need to prepare necessary documentation, such as Articles of Incorporation or Operating Agreements, depending on your chosen structure.

The subsequent steps involve completing the change of business form. Each state has specific forms and requirements, so it’s essential to understand these thoroughly. Once your application is complete, submit it along with any necessary filing fees. Lastly, inform all stakeholders—including employees, clients, and vendors—of the change to maintain transparency and trust.

Legal considerations in changing business form

Legal compliance is critical when changing your business form. Each state has specific laws and regulations that must be adhered to, which can vary significantly. Understanding necessary approvals and licenses is crucial to ensuring that your business remains compliant during and after the transition.

Another vital aspect is protecting intellectual property during this transition. If your business relies heavily on proprietary information or branding, consulting with a legal expert to ensure that these assets remain protected is essential. Careful planning can prevent potential loss when shifting to a new business structure.

Financial implications of changing business form

Changing your business structure can significantly affect your financial standing. Different business forms come with varying tax implications. For instance, corporations face double taxation, whereas LLCs may allow for pass-through taxation, benefiting self-employed individuals. It’s important to assess how these differences impact profits, salary distributions, and reinvestment strategies.

Additionally, the new structure may alter your personal liability and asset protection dynamics. An LLC or corporation typically offers stronger protection against personal liability than a sole proprietorship or partnership, which could safeguard your personal assets against business debts. Accounting considerations also play a crucial role; be prepared for changes in bookkeeping, tax filings, and ongoing compliance requirements associated with your new business form.

Interactive tools for business form change

Navigating the change of business form can be complex, but various interactive tools can help simplify the process. PDF templates, such as fillable PDFs, make it easy to create necessary documents without extensive legal knowledge. Utilizing these fills can streamline your documentation process, saving you time and reducing errors.

Cost estimation tools are also valuable, as they allow business owners to calculate ongoing expenses and initial costs associated with new structures, enabling informed decision-making. Lastly, timeline planning tools can help manage the transition effectively, breaking down the process into actionable steps with specific deadlines, ensuring that you remain organized throughout the change.

Managing the transition

Effectively managing the transition to a new business form is key to preserving stakeholder confidence and maintaining operational continuity. Communication strategies are essential; keep all relevant parties informed about the changes, the reasons behind them, and what they mean for the future. An open line of communication can help alleviate concerns and foster a sense of inclusion among employees and partners.

Employee reactions must be managed thoughtfully. It’s crucial to engage teams in the process and address any anxieties they may have about the new structure. Ensure that all branding and marketing materials are updated to reflect the new business identity, as this can contribute to a seamless transition that positively reassures customers and clients.

Frequently asked questions about changing business structure

Navigating the change of business form can leave many questions unanswered. Some common inquiries involve understanding the timeline for the transformation, and the potential tax implications of different structures such as LLCs and corporations. Many business owners also wonder about the necessary documentation and the intricacies of state-specific filing regulations.

Addressing myths and misconceptions about changing business structures is crucial as well. For example, some may believe that switching to an LLC is overly complicated or expensive, but with the right resources and tools, it can be a straightforward process. To successfully navigate this transition, staying informed and proactive is essential.

Additional support and resources

Beyond the self-management of your business form change, connecting with professionals like legal and business advisors can provide invaluable support. They can offer expert guidance on compliance and strategic planning tailored to your unique situation. Moreover, utilizing online resources and tools can further ease the documentation and filing process.

Community support forums for business owners can also act as great platforms for sharing experiences and solutions. Engaging with others who have undergone similar changes can provide practical insights and strategies that may help you navigate your own transition more effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit change of business form in Chrome?

Can I sign the change of business form electronically in Chrome?

How do I edit change of business form straight from my smartphone?

What is change of business form?

Who is required to file change of business form?

How to fill out change of business form?

What is the purpose of change of business form?

What information must be reported on change of business form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.