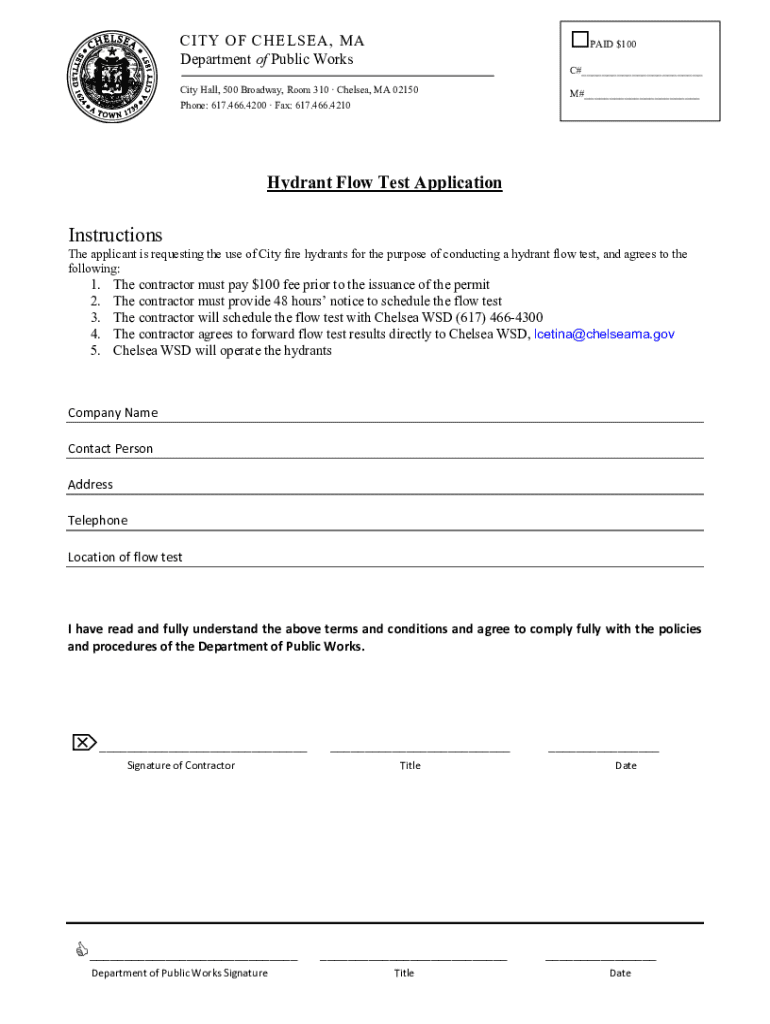

Get the free PAID $100

Get, Create, Make and Sign paid 100

Editing paid 100 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out paid 100

How to fill out paid 100

Who needs paid 100?

A comprehensive guide to the paid 100 form

Understanding the paid 100 form

The Paid 100 Form is a vital document in transaction-related processes, especially concerning payment verification and documentation. This form offers a streamlined method for organizations and individuals to confirm that payments have been executed, serving as a key reference point in financial dealings. Understanding its components and functionality is essential for effective document management.

The importance of the Paid 100 Form cannot be overstated, as it helps prevent discrepancies in financial transactions. Proper documentation is crucial in maintaining transparency and accountability. This form is particularly relevant in scenarios where organizations are handling payments, ensuring that all parties have a clear record.

Various stakeholders require the Paid 100 Form, including businesses, freelancers, and government agencies. Understanding who needs this form helps tailor its use and ensures compliance with relevant guidelines.

Key components of the paid 100 form

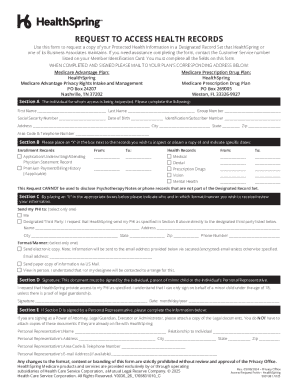

The Paid 100 Form consists of several crucial sections that are essential for its proper completion. These include Personal Information, Payment Details, and Signature and Date sections, which are critical for validating the document.

Within these sections, it’s important to differentiate between required fields and optional fields. Required fields typically include your name, address, payment amount, and date, while optional fields might include additional comments or annotations. Knowing which fields are mandatory ensures the form's acceptance.

Familiarity with commonly used terminology speeds up the form's completion process. Terms like 'remitter,' 'payee,' and 'transaction ID' are frequent in financial documentation, making understanding them essential.

Step-by-step instructions for filling out the paid 100 form

Filling out the Paid 100 Form involves a few clear steps designed to ensure accuracy and compliance. The first step is gathering necessary information, which typically includes identification details and data related to the specific payment being documented.

Once you have your documents ready, start by completing the Personal Information Section accurately. This section generally requires your full name, contact information, and, effectively, your identity.

Next, accurately fill in the Payment Details. This involves entering the payment amount, method, and any transaction references, which are crucial for verification purposes.

Lastly, review and verify your entries thoroughly. Common mistakes to avoid include incorrect amounts, missing signatures, or outdated information. Taking a moment to check your work can save you from potential future issues.

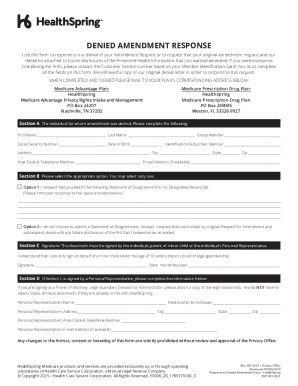

Editing and customizing the paid 100 form

Editing your Paid 100 Form is easy with tools like pdfFiller, which allow for seamless adjustments. In the age of digital documentation, being able to modify forms quickly is a significant advantage.

Adding annotations and comments directly on the form can help in collaboration and sharing additional insights with others involved in the transaction. Ensure that changes are saved properly to avoid loss of critical information.

It's beneficial to save versions of your completed forms, as pdfFiller offers a history of changes. This feature allows for easy access and retrieval of previous edits, ensuring that you can track changes made to the document over time.

Signing the paid 100 form

The next step in the process is signing your Paid 100 Form. Electronic signatures have become a standard practice, providing an efficient means of completing transactions remotely. It's essential to ensure that all required signatures are included, which may vary depending on your organization’s protocol.

In collaborative environments, utilizing a collaborative signing process can streamline approvals. Teams can sign off on the document in a shared digital environment, eliminating delays inherent in traditional methods.

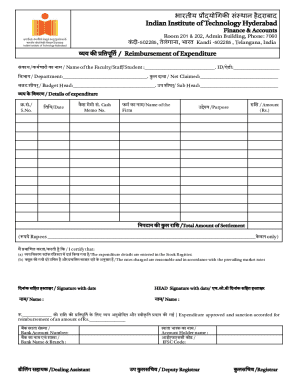

Managing your completed paid 100 form

Once completed, efficiently managing your Paid 100 Form is essential for its intended use. Store your forms in secure locations, with cloud-based storage options like pdfFiller providing convenience and security for quick access.

Sharing the Paid 100 Form with other stakeholders is also straightforward. Ensure that you use secure methods of sharing to maintain confidentiality, especially when dealing with sensitive financial data. Keeping tabs on the status of the document and tracking responses can significantly improve communication within your team.

Navigating common issues

Common issues related to the Paid 100 Form often arise during the submission process. Errors can occur if required fields are left blank or if the provided payment details are inconsistent with other documentation. In such cases, timely intervention is necessary to rectify discrepancies.

To correct mistakes after submission, review the guidelines provided by your state offices or the organization requiring the form. This may include resubmitting a corrected version or providing additional verification as needed.

Most questions regarding the Paid 100 Form can generally be answered through FAQs available on the issuing authority's website. Knowing where to find answers can save time and reduce frustration.

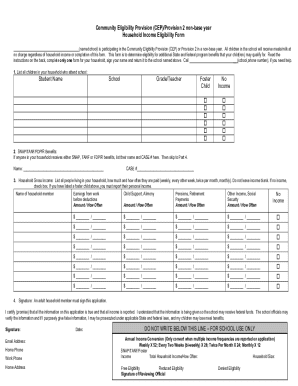

Related forms and resources

When dealing with the Paid 100 Form, it's important to recognize other forms that might intersect with it, such as tax forms or other payment verification documents. Understanding which forms to use in different scenarios ensures compliance and efficiency.

Legal and compliance considerations should also be accounted for, especially when submitting financial forms that may have implications based on your location or tax type. Some forms might be needed for audits or compliance checks, thus knowing your requirements ahead can be instrumental.

Utilizing pdfFiller for your document needs

With pdfFiller, users can access a range of features specifically designed to simplify the process of managing the Paid 100 Form. It offers efficient tools for editing, eSigning, and collaborating, all in one cloud-based platform, making document management hassle-free.

Beyond time-saving aspects, pdfFiller enhances accessibility by providing various templates and integration capabilities with numerous forms, streamlining the document processing pipeline for individuals and teams alike.

User testimonials highlight how pdfFiller has transformed document management by providing intuitive solutions that reduce paperwork and improve workflow efficiency. These experiences underscore the importance of a comprehensive document platform.

Tips and best practices

To optimize your approach to the Paid 100 Form, consider implementing expert tips for efficient form management. This includes keeping a checklist of required documents to ensure nothing is overlooked and establishing a routine for regular reviews and updates.

Best practices for document collaboration emphasize the importance of clear communication among team members. Using tools that allow for real-time collaboration can significantly reduce errors and speed up the approval process.

To maintain security during electronic signing, choose platforms that guarantee end-to-end encryption and authentication processes. This ensures that your signed documents remain secure and protected from unauthorized access.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit paid 100 on a smartphone?

Can I edit paid 100 on an Android device?

How do I fill out paid 100 on an Android device?

What is paid 100?

Who is required to file paid 100?

How to fill out paid 100?

What is the purpose of paid 100?

What information must be reported on paid 100?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.