Get the free 2025 Form OR-19-AF Instructions, Oregon Affidavit for a ...

Get, Create, Make and Sign 2025 form or-19-af instructions

Editing 2025 form or-19-af instructions online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 form or-19-af instructions

How to fill out 2025 form or-19-af instructions

Who needs 2025 form or-19-af instructions?

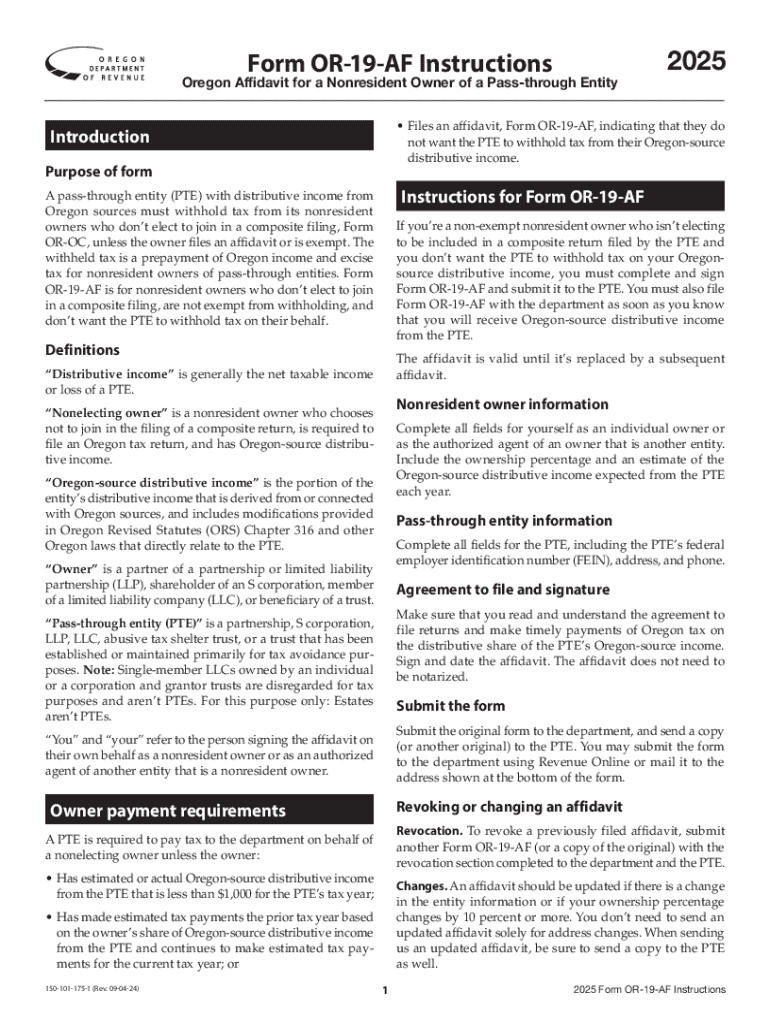

Comprehensive Guide to the 2025 Form OR-19-AF Instructions

Overview of the 2025 Form OR-19-AF

The 2025 Form OR-19-AF is a vital document used for reporting state tax information in Oregon. It serves multiple purposes, including determining individual tax liabilities, claiming various deductions, and ensuring compliance with state tax regulations. For individuals and businesses alike, understanding and accurately completing this form can significantly impact financial responsibilities and returns.

This form is generally required for residents of Oregon who meet certain income thresholds or who are claiming specific tax benefits. Whether you are a sole proprietor, a partnership, or simply an individual employee with additional income sources, you may need to fill out this form to ensure that you meet state tax obligations.

Key features of the 2025 Form OR-19-AF

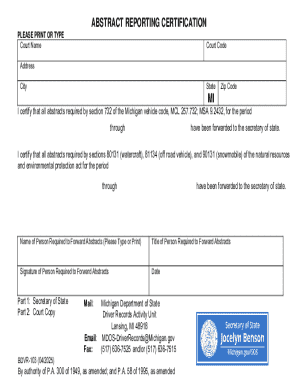

The 2025 Form OR-19-AF is structured to provide a comprehensive overview of an individual’s or business’s financial activity. Key sections of the form include personal information, detailed income reporting, deductions, tax credits, and signature requirements. Each section is designed to capture necessary data that reflects your financial situation accurately.

Notable changes in the 2025 version of the form include updated income brackets and adjustments to deduction limits, reflecting the current economic landscape. Comparing it with previous years’ forms reveals a shift toward more comprehensive income reporting, aiming to reduce discrepancies and ensure fair computing of tax obligations. These changes have significant implications, particularly for those who rely on specific deductions or credits in their financial planning.

Step-by-step instructions for completing the 2025 Form OR-19-AF

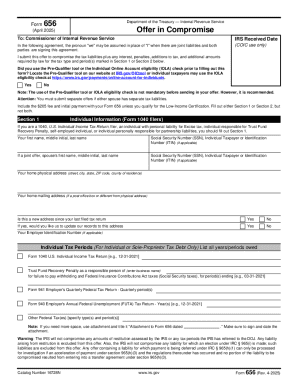

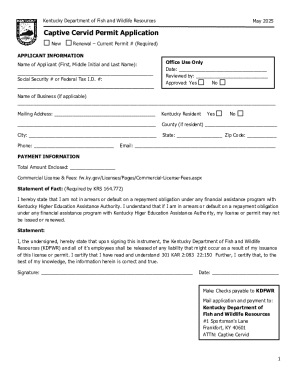

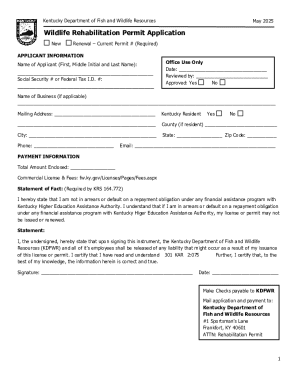

Before you begin filling out the 2025 Form OR-19-AF, it’s crucial to gather all necessary documents. This includes income statements such as W-2s and 1099s, any identification details needed, and information about deductions you might be claiming. Utilizing tools like pdfFiller simplifies editing and filling your PDF forms, making the process smoother.

Tips for successfully managing your 2025 Form OR-19-AF

Organizing your documents is key to avoiding stress during tax season. Create a checklist of documents needed before you start, and keep them in a designated folder. Categorizing receipts and forms can save immense time and recognize what’s deductible.

Using pdfFiller for Form OR-19-AF

Utilizing pdfFiller for the 2025 Form OR-19-AF offers numerous benefits, enhancing the user experience with seamless editing capabilities for PDFs. The platform facilitates a stress-free form-filling experience, allowing you to complete, sign, and submit your form from any device.

Moreover, pdfFiller offers interactive features that guide you in filling out forms effectively. With a live form-filling demo available, users can engage with the platform optimally. Enhancing user understanding through a step-by-step guide on saving and managing your forms guarantees that everyone knows how to utilize the tool efficiently.

Frequently asked questions (FAQs)

Many users encounter difficulties while filling out forms, leading to a variety of questions about the process. First and foremost, if you make a mistake on your form, you can simply correct it either by crossing the error out or using pdfFiller to edit it directly. Don't forget to double-check your entries during the review phase.

Additional support and assistance

For deeper inquiries or complicated filings regarding the 2025 Form OR-19-AF, reaching out to qualified tax professionals can provide invaluable guidance. Online resources, such as local tax advisors’ directories, make it easy to find experts who can clarify specific concerns or assist in preparing the form accurately.

Additionally, community forums can be a helpful destination for individuals looking to share experiences and ask questions related to filling out tax forms. Engaging with a community of peers can provide emotional support while enhancing your understanding of the filing process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 2025 form or-19-af instructions without leaving Google Drive?

How can I get 2025 form or-19-af instructions?

Can I create an electronic signature for the 2025 form or-19-af instructions in Chrome?

What is 2025 form or-19-af instructions?

Who is required to file 2025 form or-19-af instructions?

How to fill out 2025 form or-19-af instructions?

What is the purpose of 2025 form or-19-af instructions?

What information must be reported on 2025 form or-19-af instructions?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.