Get the free All farms numbeL

Get, Create, Make and Sign all farms numbel

How to edit all farms numbel online

Uncompromising security for your PDF editing and eSignature needs

How to fill out all farms numbel

How to fill out all farms numbel

Who needs all farms numbel?

All Farms Number Form: A Comprehensive Guide for Farmers

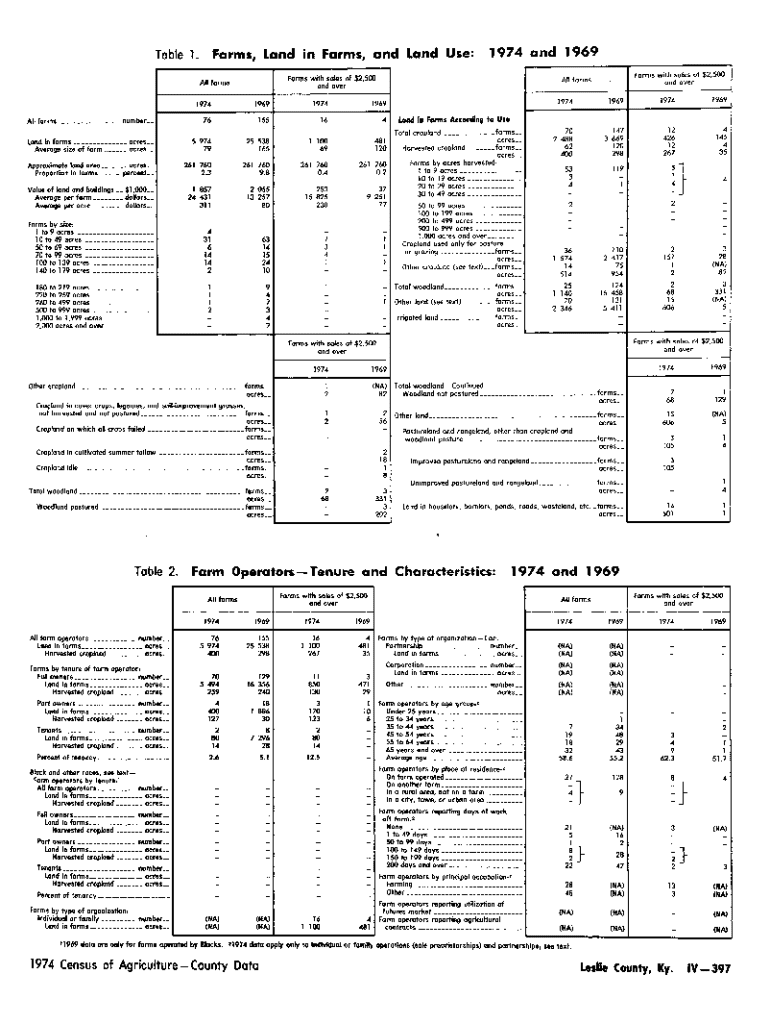

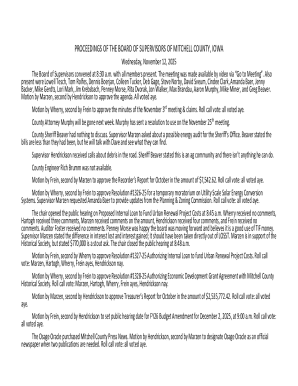

Understanding the All Farms Number Form

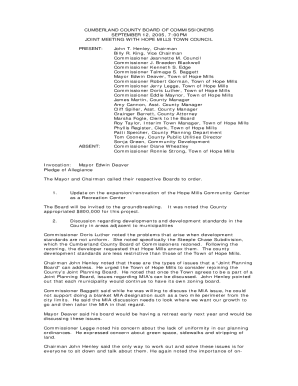

An All Farms Number (AFN) serves as a unique identifier for agricultural operations, streamlining interactions between farmers and government entities. The AFN is utilized for a variety of purposes, ranging from tax reporting to eligibility for government programs aimed at supporting agricultural sustainability and growth. In the context of compliance, having an All Farms Number assures that farmers remain accountable for their practices and meet regulatory standards.

This number is essential for maintaining organized records and accessing benefits that can significantly enhance farm operations. By providing a way to uniquely identify each farm, the All Farms Number facilitates easier management of agricultural records and compliance with federal and state regulations.

Who needs an All Farms Number?

The All Farms Number is crucial for a wide range of agricultural stakeholders. Primary users include farmers, agricultural enterprises, and entities involved in agricultural production or processing. Farmers generally must apply for this number to ensure they can access essential programs and benefits offered by government bodies, including the USDA and FSA.

Benefits of obtaining an All Farms Number

Having an All Farms Number provides significant advantages for farmers. Firstly, it opens doors to various government programs specifically designed to support farmers and enhance their operations. For example, many programs tied to disaster relief or crop insurance require the farmer to have an AFN for eligibility. This simple number acts as a gateway to financial assistance and resources.

Moreover, with an All Farms Number, farmers experience a more streamlined process when interacting with regulatory bodies. This leads to simplified communication for permits, inspections, and compliance checks, greatly reducing the time and effort typically spent on bureaucratic procedures.

Enhancing farm management

Beyond government interaction, the All Farms Number makes documentation and record-keeping far more efficient. It helps farmers manage operational data better, as all relevant records are linked to their unique number. This allows for easier access to information, which is especially vital for tax reporting and compliance purposes.

Step-by-step guide to obtaining your All Farms Number

Gathering required information

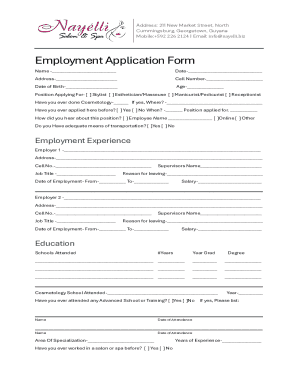

To start the process, gather all necessary documents and operational details about your farm. This includes, but is not limited to, your farm's legal name, address, type of farming practices, as well as any relevant identification numbers such as an Employer Identification Number (EIN) if applicable. Organizing this information ahead of time can streamline the application process.

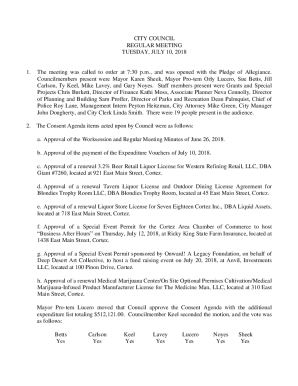

Filling out the All Farms Number form

Next, carefully fill out the All Farms Number form. Each section requires accurate information, so take your time to ensure clarity and correctness. Common mistakes to avoid include typos in the farm name or address, using outdated information, and failing to double-check eligibility criteria.

Submitting your application

After completing your form, choose your preferred submission method. Applications can be submitted online or through the mail. If done online, follow any instructions for digital submission closely to avoid delays. Expect processing timelines to vary; typically, you might receive your All Farms Number within a few weeks, but it can take longer depending on various factors.

Identifying yourself as a farmer: essential credentials

Valid forms of identification

When applying for an All Farms Number, valid identification is a prerequisite. Acceptable forms of ID can range from a state-issued driver's license to a farm business registration certificate. It is crucial to provide accurate identification, as discrepancies can lead to application delays or rejections.

Understanding tax exemption status

Farmers may be eligible for tax exemptions that apply when they hold an All Farms Number. Understanding these exemptions can lead to significant savings. It's advisable to keep abreast of the forms required to apply for such exemptions, as well as the periodic reporting needed to maintain valid status.

Is your farming operation a hobby or a business?

Distinguishing between hobby farming and business ventures

Hobby farming typically entails small-scale farming primarily for personal enjoyment or supplemental income, while commercial farming aims for profit and scale. Understanding this distinction is crucial, particularly regarding tax implications and eligibility for government programs. Commercial farmers often sustain larger operations, securing their livelihoods directly from agricultural productivity.

Impacts on application for All Farms Number

The decision of whether your farming operation is classified as a hobby or a business affects the eligibility for an All Farms Number. While hobby farmers may not require an AFN for tax purposes, commercial farmers should prioritize obtaining it to access a wide range of agricultural programs and services that will enhance their operational capabilities.

Addressing common questions and concerns

Frequently asked questions about the All Farms number

Many applicants have questions regarding the All Farms Number, such as the necessity of renewal, how to rectify mistakes on their forms, or eligibility nuances specific to their situation. Providing clear answers to these inquiries can alleviate anxieties around the application process. For instance, it's typically unnecessary to renew the All Farms Number unless there are substantial changes to the farm's operations or ownership.

Troubleshooting application challenges

In case your application is delayed or rejected, it’s essential to have a clear plan. First, review any communication from the relevant offices for specific reasons. If further assistance is needed, reach out directly to the office that processes these applications. Keeping detailed notes of any correspondence can facilitate a more effective dialogue.

Special considerations for transitioning and advancing your farm

Taking over the family farm

Inheriting a family farm can be an incredible opportunity but can also involve navigating regulatory changes, especially regarding re-registering the farm. Documentation important for this process includes wills or estate documents, proof of farm operation succession, and any prior farm records.

Transitioning your farm to higher-value markets

As market demands change, transitioning your farming operation to higher-value markets becomes crucial. This might include introducing organic produce or specialty crops to capture lucrative market segments. Tools such as pdfFiller assist in managing the necessary documents, contracts, and marketing plans that facilitate this shift.

Advocating for fair agricultural practices

Challenges in the agricultural sector

The agricultural sector faces significant challenges, including unjust food systems that often marginalize smaller farms. Issues such as fluctuating crop prices, unfair labor practices, and lack of access to resources can inhibit progress. Acknowledging these challenges is vital for advocating for equitable treatment across the industry.

How to get involved and make a difference

Farmers and stakeholders looking to make an impact can do so by joining local advocacy groups aimed at promoting fair practices in agriculture. Leveraging resources provided by these organizations can help support equitable farming communities, encourage sustainable agricultural practices, and foster community engagement within the sector.

Interactive tools and resources

Interactive forms and templates

pdfFiller offers editable PDFs that encompass the All Farms Number Form, making it easier for users to manage critical agricultural documentation. These tools are specifically designed for farmers, providing user-friendly formats that simplify data entry and ensure compliance with agricultural standards.

Expert guidance and support

Using pdfFiller's platform enhances your document management experience for agriculture. With collaboration features, teams can work together seamlessly to edit, sign, and share important documentation, thereby streamlining administrative tasks and ensuring that agricultural operations run smoothly and effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify all farms numbel without leaving Google Drive?

How can I get all farms numbel?

How do I edit all farms numbel on an Android device?

What is all farms numbel?

Who is required to file all farms numbel?

How to fill out all farms numbel?

What is the purpose of all farms numbel?

What information must be reported on all farms numbel?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.