Get the free All farms -------- number--

Get, Create, Make and Sign all farms -------- number

How to edit all farms -------- number online

Uncompromising security for your PDF editing and eSignature needs

How to fill out all farms -------- number

How to fill out all farms -------- number

Who needs all farms -------- number?

All Farms Number Form: A Comprehensive Guide

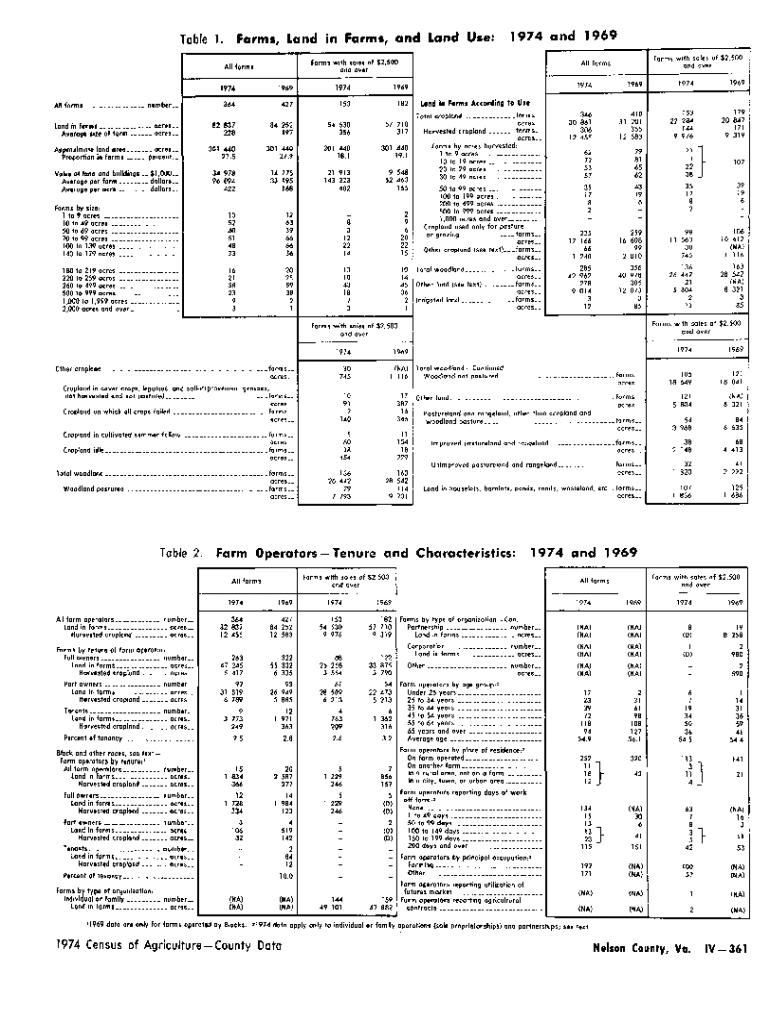

Understanding the importance of a farm number

A farm number is a crucial identifier for agricultural operations, serving multiple purposes across regulatory and administrative frameworks. Essentially, it is a unique numerical designation assigned to a farm, allowing for efficient tracking and management within government databases.

Historically, the system for allocating farm numbers has evolved alongside agricultural practices. Initially, farm identification was informal and often community-based. As farming operations grew in size and complexity, the need for a standardized farm number became apparent, leading to the establishment of formal processes by various governmental organizations, including the USDA.

Every farmer needs a farm number as it facilitates regulatory compliance, ensuring that operations meet federal and state regulations. Additionally, possessing a farm number grants access to numerous agricultural programs and benefits, such as grants and subsidies designed to support farmers.

Benefits of having an all farms number

Obtaining an all farms number extends far beyond mere bureaucracy; it significantly enhances a farmer's credibility and recognition in the agricultural community. Holding a farm number establishes the farmer's identity as a legitimate agricultural producer, which is vital when engaging with consumers, lenders, and potential business partners.

Having a farm number opens doors to funding and grants provided by federal and state programs, which can be essential for operational sustainability. These programs often have eligibility criteria tied to having a registered farm number, creating an economic lifeline for many farmers.

Furthermore, farm numbers can provide significant tax benefits. In many regions, agricultural tax exemptions apply to those who can correctly document their farming activities, allowing greater retention of income that can be reinvested into the farm.

How to obtain a farm number

The process of obtaining a farm number is straightforward but requires attention to detail. Begin by preparing necessary documentation, which typically includes proof of identity, ownership of the property, and any existing EIN (Employer Identification Number) if applicable. Having these documents ready will streamline the application process.

There are two primary methods of submission: online applications through the USDA or your local Farm Service Agency (FSA) office, and traditional paper forms. Online methods are generally faster, but both require careful completion to avoid delays.

Timelines for processing can vary depending on the workload of the office handling your application, so it’s essential to apply well before any critical deadlines.

Common pitfalls to avoid

Many applicants experience delays and complications due to common mistakes in the application process. One prevalent issue is submitting incomplete applications; farmers often forget vital documents or fail to sign forms, resulting in unnecessary setbacks.

Providing incorrect information can also be detrimental. Even small errors can lead to rejection or misclassification in government databases, impacting access to essential programs and services.

Identifying yourself as a farmer

Identification as a farmer can take various approaches. Legally, farmers are defined based on the extent of their operations and generate revenue, which varies across jurisdictions. Thus, understanding how your activities fit within the specific definitions at your state level is essential.

Another important aspect is using your farm number in public records. It not only reinforces your status as a farmer but can also prove valuable when applying for loans, grants, and entering contracts with suppliers and buyers.

Finally, marketing your identity as a farmer can significantly impact your business. This involves clear communication of your identity through various channels, establishing a strong presence within agricultural networks, and leveraging your status to attract consumers and additional resources.

Understanding your business status: hobby vs. commercial farm

Distinguishing between hobby and commercial farming is essential for categorization and compliance. Typically, revenue thresholds define whether an operation is considered a hobby or a commercial venture. For example, if a farm generates a significant income from sales, it is classified as commercial; otherwise, it falls under hobby farming.

Intent and scale of farming activities also play a crucial role in this classification. Farmers are required to document their income correctly to avoid issues with taxation and eligibility for certain programs. Tax implications differ significantly between hobby and commercial operations, influencing decisions regarding registration and compliance with laws.

Frequently asked questions about farm numbers

Farmers sometimes encounter issues with their farm numbers and may need to recover or reapply if they lose their number. The first step is to contact the issuing organization, which is often the local office where your application was fulfilled, and follow their steps to confirm your identification and retrieve your information.

Another common question arises regarding changes to a farm number once issued. It is possible to change details, such as the name linked to the farm number, but specific procedures must be followed. Consult your local FSA office to understand what updates are permissible.

Finally, many wonder about the longevity of farm numbers. In most cases, farm numbers are permanent; however, it is advisable to keep the issuing agency informed about any changes in ownership or operation to maintain accurate records.

Navigating challenges in farming identity and documentation

Clarifying the misconceptions surrounding farm numbers is vital for all stakeholders in the agriculture sector. For instance, some farmers believe that a farm number is solely for tax purposes, but its utility extends into various realms, including eligibility for numerous programs and identification in farming networks.

Support systems for farmers are essential. Community resources such as local agricultural organizations or cooperative extension services can provide valuable guidance on navigating documentation processes and understanding legal stipulations. Furthermore, legal support may be necessary for those facing nuanced issues.

Moving forward: the future of farming and documentation

Emerging trends like digital documentation and cloud solutions are becoming increasingly crucial in agriculture. As more farmers adopt technology, understanding how to manage records electronically will greatly facilitate compliance and communication with vendors, customers, and regulatory bodies.

Collaboration within the farming community also plays a significant role in securing equitable resources. Farmers can advocate for their interests much more effectively when organized, addressing common challenges together and sharing resources, expertise, and support.

Additional tools for document management with pdfFiller

Utilizing tools like pdfFiller can dramatically enhance the documentation processes for farmers. With features for editing and signing agricultural documents, farmers can ensure compliance with minimal hassle. This is especially important for documents that need to be submitted to governmental offices or various agricultural programs.

The accessibility of cloud-based solutions allows farmers to manage their records from anywhere, whether in the field or in the office. This capability represents a significant advancement for efficient farm management. Another noteworthy feature is the ability to create templates for recurring documentation needs, making weekly or monthly reports and submissions streamlined.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get all farms -------- number?

Can I create an electronic signature for the all farms -------- number in Chrome?

Can I edit all farms -------- number on an iOS device?

What is all farms -------- number?

Who is required to file all farms -------- number?

How to fill out all farms -------- number?

What is the purpose of all farms -------- number?

What information must be reported on all farms -------- number?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.