Sample Surety Maintenance Bond Form: Your Comprehensive Guide

Understanding surety maintenance bonds

A surety maintenance bond is a type of contract that ensures the obligations of a contractor during the maintenance period of a project are fulfilled. This bond guarantees that the contractor will fix any defects or issues that arise after the completion of the project, essentially covering maintenance responsibilities within a specified timeframe.

Key components of a surety maintenance bond include the principal (the contractor), the obligee (the project owner or client), and the surety (the bonding company). Each component plays a critical role in the bond’s functionality and outlines the responsibilities of each party involved.

The importance of surety maintenance bonds in construction projects cannot be overstated. They provide reassurance to clients that their investment is protected and that any necessary repairs during the maintenance period will be undertaken responsibly by the contractor.

How to navigate the sample surety maintenance bond form

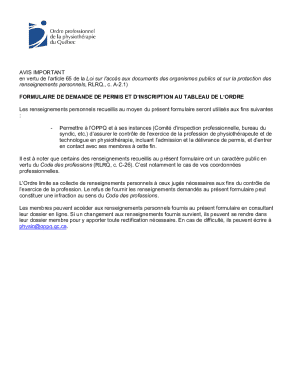

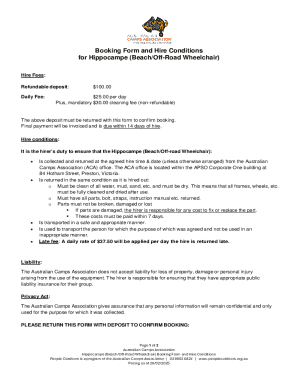

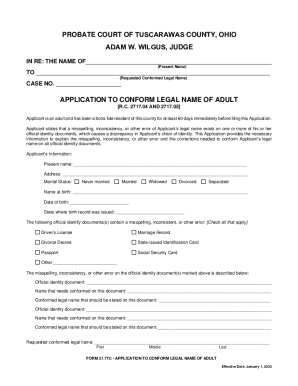

Understanding the layout of the sample surety maintenance bond form is foundational to effectively completing it. Typically, these forms consist of sections dedicated to personal information, project details, financial information, and a declaration of compliance.

Common terms that appear in these forms include 'principal,' 'obligee,' and 'surety,' each of which holds specific meaning in the context of the bond. Familiarizing yourself with these terms can demystify the legal language that often accompanies such documents.

Reading legal language can be daunting. Focus on breaking down complex sentences into simpler phrases and consult a legal glossary or seek assistance if you encounter terms you don’t understand.

Step-by-step instructions for completing the sample surety maintenance bond form

Filling out the sample surety maintenance bond form requires several critical steps to ensure submission accuracy. First, gather the necessary information, including the contractor's details, project specifics, and financial data.

Step 1: Gather necessary information. This includes the name and address of the contractor, the details of the maintenance project, and relevant financial documents. Typical sources for this information might include previous contracts, invoices, or project scopes.

Step 2: Filling out the personal information section involves providing detailed contact information for the contractor, ensuring accuracy to avoid any delays.

Step 3: Completing the project information section means describing the nature of the project, including the location, scope, and timeline.

Step 4: The financial information section requires specifics about the bond amount and payment methods.

Step 5: Attach proof of eligibility and legal compliance, such as insurance documents or licenses. Finally, Step 6: Review the completed form for accuracy, ensuring each section is filled out completely and correctly before submission.

Interactive tools for form completion

pdfFiller provides robust editing features that allow users to fill out the sample surety maintenance bond form seamlessly. Utilize the platform to edit directly on the PDF, ensuring your entries are correct and easy to read.

The eSignature functionality enables you to legally sign the maintenance bond form digitally, which is especially beneficial for contractors and project managers who may not be able to meet in person.

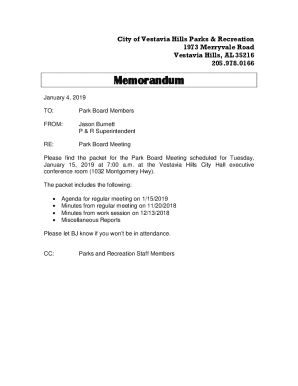

Collaborative tools allow for team input and review, ensuring all stakeholders can provide feedback or additional information directly within the pdfFiller platform.

Handling special circumstances

Mistakes can happen, so it’s essential to know how to handle errors when completing your sample surety maintenance bond form. If you encounter any mistakes, it’s best practice to start fresh rather than attempting to edit the current form, ensuring clarity and professionalism.

If you are managing multiple projects, consider maintaining separate forms for each bond to avoid any confusion. This can help ensure that each project's specific needs are met, reflecting the unique requirements of each job.

Modifying the sample form to meet unique project requirements may be necessary; consult legal counsel or a bonding agency if significant adjustments are needed.

What happens after submitting the form?

Once submitted, understanding the approval process is crucial. The bonding company will review the form, checking that all information is accurate and complete. Delays may occur if documentation is missing or inaccurate.

After approval, it's essential to remain engaged in any potential follow-up actions. The issuer may require additional information or clarifications before finalizing the bond.

Finally, managing your surety maintenance bond post-submission is necessary. This involves tracking expiration dates, ensuring compliance with bond conditions, and keeping all related documentation organized.

Frequently asked questions (FAQs)

Common queries regarding surety maintenance bonds often center around the responsibilities of each party involved and the timeline for processing the bonds. For instance, many users want to know how long it takes for a bond to be issued and what happens if the contractor fails to fulfill their obligations.

Clarifications on legal responsibilities are also a frequent concern, particularly regarding what constitutes a breach of bond terms. It's important to understand that each bond carries specific obligations that must be adhered to, and any deviation can lead to both legal repercussions and financial loss.

Users should expect a processing timeline that can vary widely from just a few days to several weeks based on the complexity of the project and the efficiency of the bonding company.

Related documents and forms

Besides the sample surety maintenance bond form, other related documents can be crucial in the context of maintenance work. This includes performance bonds, payment bonds, and insurance certificates that can offer additional layers of protection and manage risk effectively.

Construction contracts and change order forms may also be necessary to schedule compliance and record modifications to the initial agreement, ensuring all parties remain aligned throughout the project lifecycle.

Looking for something else?

If you need alternative document solutions, pdfFiller offers various templates and forms that can address specific project needs, making it easy to adapt to changing requirements. Their platform also supports the creation of construction contracts, bidding documents, and more.

For a deeper understanding of construction contracts, the resources available on pdfFiller can guide you on best practices for contract management, ensuring compliance and safeguarding your interests.

Keep your document secure

Document management is essential for ongoing compliance and effective project management. Best practices include maintaining regular backups of all important documents and securing them in a centralized location. Digital storage solutions like pdfFiller provide cloud storage that allows users to access documents from anywhere, ensuring safety and availability.

Additionally, regularly updating your bonds and related documents minimizes the risk of using outdated or invalid forms. Carrying out routine checks and renegotiations for renewals can provide continual protection over your projects.