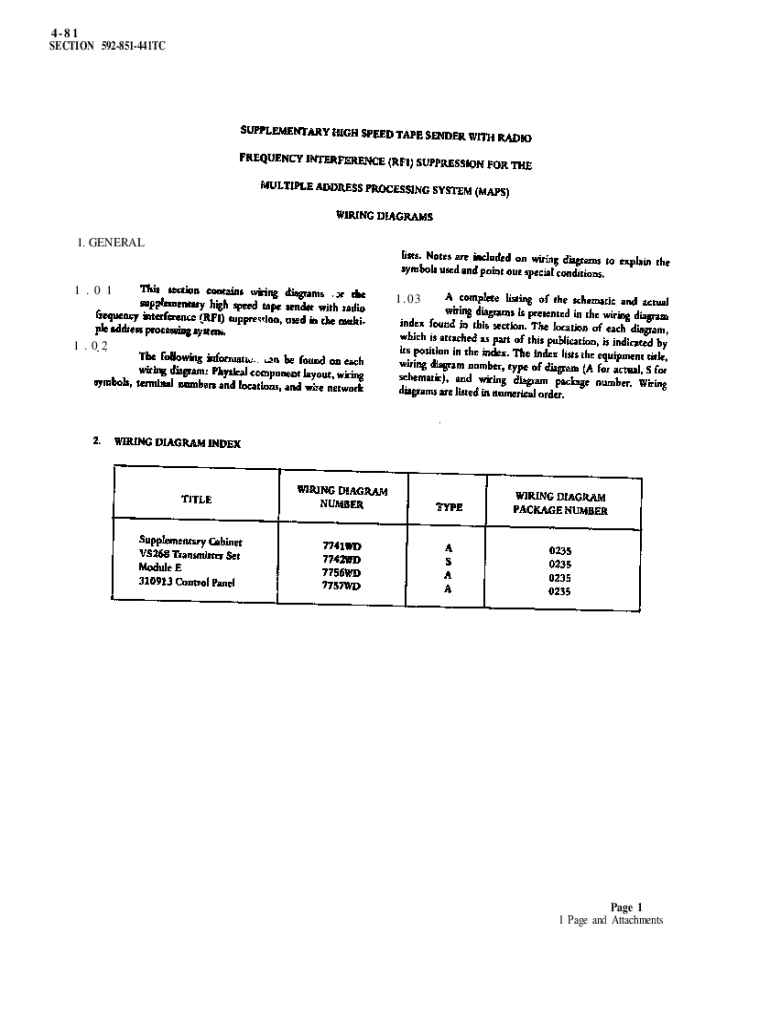

Get the free SECTION 592-851-441TC

Get, Create, Make and Sign section 592-851-441tc

How to edit section 592-851-441tc online

Uncompromising security for your PDF editing and eSignature needs

How to fill out section 592-851-441tc

How to fill out section 592-851-441tc

Who needs section 592-851-441tc?

Section 592-851-441TC Form Guide

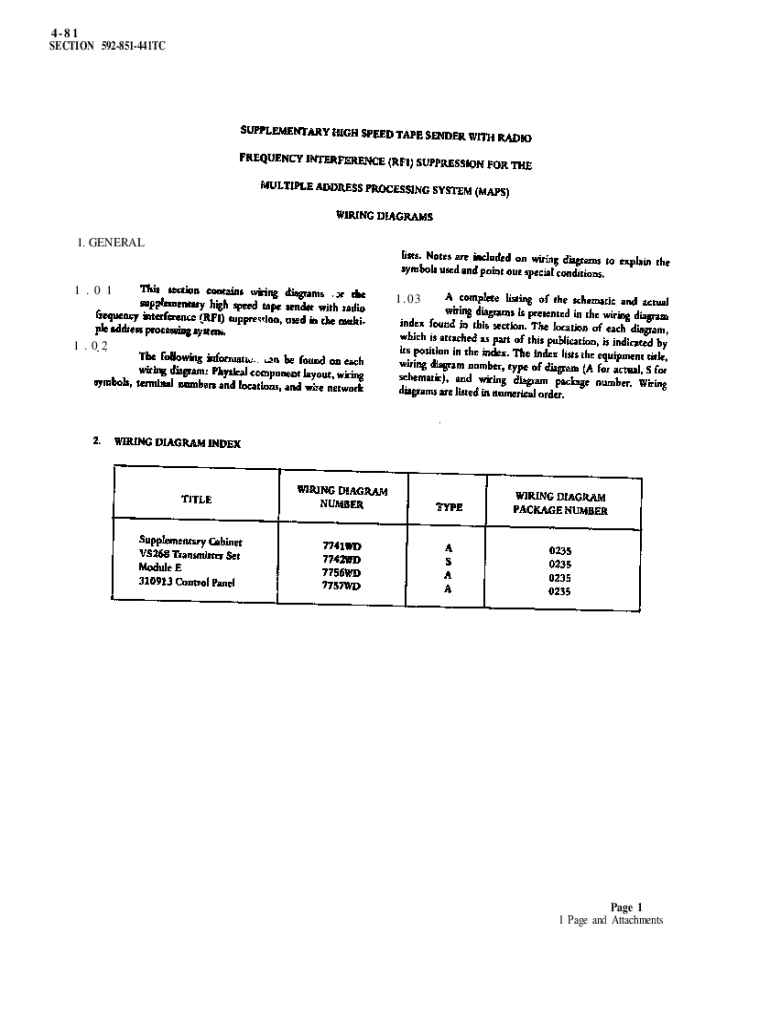

Understanding the Section 592-851-441TC form

The Section 592-851-441TC form is a key document designed to facilitate tax compliance for both individuals and businesses. Specifically, it serves the purpose of reporting and verifying tax withholdings, which is crucial for maintaining transparency with tax authorities. Understanding this form's role is essential for anyone needing to ensure accurate tax reporting and compliance.

The importance of the Section 592-851-441TC form cannot be overstated. For businesses, it's a vital component of their financial reporting, while individuals may find it beneficial for reconciling tax liabilities. Proper management of this form aids in avoiding penalties and ensures an optimized tax situation.

Who needs this form?

The Section 592-851-441TC form is primarily targeted at businesses engaged in activities that have withholding tax obligations, including employers who withhold wages for income tax purposes. Additionally, independent contractors and freelancers who receive payments subject to withholding tax also require this form. Consequently, it affects a wide range of stakeholders, including payroll departments, finance teams, and individual contractors.

Detailed breakdown of the form

The structure of the Section 592-851-441TC form is straightforward, segmented into clear sections for ease of use. Each section addresses critical components required for accurate reporting. Typically, these sections include personal information, income reporting, deductions, and credits, along with areas designated for signatures.

Common terminology used in the form

Familiarity with specific terminology is essential for accurately completing the Section 592-851-441TC form. Key terms include:

Step-by-step instructions for filling out the form

To complete the Section 592-851-441TC form accurately, certain information and documentation are necessary beforehand. Gather items such as personal identification details, financial statements, and previous tax records to streamline the process.

Filling out each section

Tips and best practices for editing and finalizing the form

Reviewing your completed Section 592-851-441TC form for accuracy is crucial. Ensure that all numbers are correct, and double-check against your documentation. An effective checklist can include checking the calculation accuracy, confirming all signature requirements, and ensuring that no sections are left incomplete.

When collaborating with team members on filling out the form, utilizing tools like pdfFiller can enhance productivity. Real-time collaboration features streamline communication and ensure that everyone involved is on the same page, allowing for seamless edits and feedback.

eSigning the Section 592-851-441TC form

eSigning the Section 592-851-441TC form has become an essential aspect of document management. eSignatures are legally recognized and hold the same validity as handwritten signatures, making them a practical choice for busy professionals.

Using pdfFiller, users can easily create an eSignature by following a few simple steps. This not only saves time but also adds security and convenience when finalizing the form.

Steps to eSign using pdfFiller

Submitting the form

Once your Section 592-851-441TC form is completed and signed, the next step is submission. You have options for online submissions or traditional offline methods such as mail. Choose the method that best fits your needs based on your situation and preferences.

Deadlines and important dates

Be mindful of submission deadlines associated with the Section 592-851-441TC form. Failing to submit on time can result in penalties or other legal issues. Confirm your specific deadlines based on the tax year and regulations in your jurisdiction.

Troubleshooting common issues

Many users encounter common issues while completing the Section 592-851-441TC form. Problems such as incorrectly calculated income, unverified tax credits, or missing signatures are among the most prevalent.

Fortunately, resources like pdfFiller provide support options, helping users troubleshoot and resolve these issues. Their customer service teams are equipped to assist with any concerns that may arise during the form-filling process.

Utilizing pdfFiller's interactive tools

pdfFiller offers an array of features designed to streamline the management of the Section 592-851-441TC form. Interactive tools allow for easy editing, collaboration, and secure document storage, all in one platform. Users can leverage these tools to enhance their workflow, ensuring efficient form handling.

Moreover, pdfFiller can integrate seamlessly with other platforms such as Google Drive and Dropbox, enhancing usability and ensuring that your documents are easily accessible from anywhere. This integration fortifies the document management process, making it smoother and more efficient.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the section 592-851-441tc electronically in Chrome?

How do I edit section 592-851-441tc straight from my smartphone?

How do I edit section 592-851-441tc on an Android device?

What is section 592-851-441tc?

Who is required to file section 592-851-441tc?

How to fill out section 592-851-441tc?

What is the purpose of section 592-851-441tc?

What information must be reported on section 592-851-441tc?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.