Get the free ILl 40 I

Get, Create, Make and Sign ill 40 i

How to edit ill 40 i online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ill 40 i

How to fill out ill 40 i

Who needs ill 40 i?

40 Form: A Comprehensive How-to Guide

Understanding the 40 Form

The Ill 40 I Form is a critical document used within various administrative processes, particularly relating to health and social services. This form essentially serves as a declaration for individuals seeking specific reliefs or benefits that necessitate formal reporting of their health status and other pertinent personal information.

Situations requiring the Ill 40 I Form often arise in contexts such as disability claims, medical leave requests, or other scenarios where proof of illness or incapacity is needed. Without the Ill 40 I Form, individuals may struggle to validate their eligibility for benefits, leading to delays or denial.

Thus, understanding the structure and importance of this form is paramount for anyone engaging with health-related administrative tasks.

Importance of the 40 Form

Completing the Ill 40 I Form accurately has significant repercussions. Improper completion can result in serious consequences including delays in receiving necessary benefits, or worse, outright denial of claims. When a form is filled inaccurately, agencies may require additional documentation or clarifications, prolonging the process and exacerbating the challenges faced by individuals needing immediate assistance.

From a legal standpoint, the Ill 40 I Form may serve as essential evidence in appeals or disputes regarding benefits. Ensuring that this form is completed in adherence to regulations not only facilitates a smoother processing journey but also strengthens the applicant’s legal positioning.

Step-by-step guide to filling out the 40 Form

Filling out the Ill 40 I Form requires attention to detail and accuracy. Below is a comprehensive guide on how to navigate each section effectively.

Gather necessary information

Start by assembling all necessary documents and personal information that you will need to complete the form. Typical documents you might require include:

The accuracy of your information is crucial as discrepancies can lead to complications in processing your form.

Detailed instructions for each section

As you sit down to fill out the Ill 40 I Form, follow these detailed guidelines for each section.

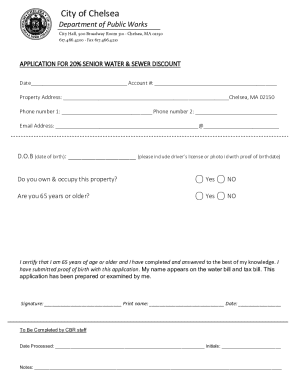

Header section

Ensure that the form is properly titled with 'Ill 40 I Form' in the header. Depending on the context, also include other relevant information such as the date of completion and any case or reference numbers applicable.

Personal information

This section requires complete details about your identity including full name, address, and contact information. Double-check that you have spelled everything correctly to avoid issues down the line.

Employment information

Here, you need to provide details regarding your employment status. Include your job title, the name of your employer, and the duration of your employment. If you are unemployed, indicate that clearly.

Financial information

In this part of the form, declare your financial details as required. This might include your income, savings, or other forms of financial support that are pertinent to your application. Transparency is key, as inaccurate information could complicate your case.

Signature and date

Finally, remember to sign and date the form. Your signature is a confirmation that the information provided is accurate to the best of your knowledge. Without this, your application will not be processed.

Editing and customizing the 40 Form

Once you have completed the Ill 40 I Form, there may be a need to tweak or edit certain details. Utilizing platforms like pdfFiller can streamline this editing process significantly.

Utilizing pdfFiller for document editing

pdfFiller enables you to upload the Ill 40 I Form directly onto their platform. Once uploaded, you can use tools available to make real-time edits, ensuring your form reflects the latest and most accurate information.

Common edits to consider

Standard modifications often needed may include:

Signing and submitting the 40 Form

Completing your form is only half the battle; proper submission is essential. Here’s how to ensure your Ill 40 I Form reaches the necessary authorities accurately.

How to eSign the 40 Form

With pdfFiller, eSigning your Ill 40 I Form is straightforward. After filling in your details, choose the eSignature option. Follow prompts to create a digital signature that you can affix to your document. This process shows that you affirm the contents of the form and it expedites the overall submission.

Submission methods

Once signed, you have multiple options to submit your completed form:

It’s essential to track your submission, especially if it’s mailed. Using certified mail or delivery confirmation services can provide peace of mind.

Managing your 40 Form after submission

Post-submission management is vital to ensure your claims are processed smoothly. Here’s how to handle your form after it has been submitted.

Tracking your submission status

To check if your Ill 40 I Form has been processed, regularly contact the relevant authorities or use online tracking systems provided by agencies, which some have implemented for public convenience.

Making amendments

If changes become necessary after submission, it can be a bit tricky. Typically, agencies may require you to fill out a new form indicating the changes. Still, pdfFiller allows you to keep an organized history of your documents, making the process of tracking and re-editing much simpler.

Troubleshooting common issues with the 40 Form

While using the Ill 40 I Form may seem straightforward, several pitfalls can trip users up. Being aware of these common issues and how to avoid them can save you time and hassle.

Common pitfalls to avoid

Frequent mistakes made during completion include:

FAQs about the 40 Form

It's common to have questions while filling out the Ill 40 I Form. Some frequently asked questions include concerns about processing times, the necessity of certain documents, or how to handle denial of claims.

Advanced tips for effective form management

To further streamline your experience with the Ill 40 I Form, here are advanced tips that can help you navigate the process with ease.

Maximizing the pdfFiller experience

Leverage pdfFiller's features beyond editing. Utilize version history to revert to earlier document states if necessary and take advantage of their cloud storage, which ensures your forms are accessible anywhere.

Collaborating with teams

If you’re working within a team, pdfFiller provides tools for collaboration. Share your forms with teammates for joint editing and feedback, making the task more efficient.

Case studies: real-world applications of the 40 Form

Understanding the practical implications of the Ill 40 I Form through case studies can provide insights into its impact and effectiveness.

Success stories

Numerous individuals have successfully navigated their claims process using the Ill 40 I Form, resulting in timely access to benefits. For instance, a claimant experiencing a prolonged illness submitted their form accurately and received approval swiftly because all necessary documentation was included.

Lessons learned

However, not every case has a straightforward resolution. Common lessons learned from unsuccessful claims include the importance of verifying details and ensuring comprehensive documentation is attached.

Future enhancements and updates on the 40 Form

As with any administrative form, the Ill 40 I Form may undergo improvements. Keeping abreast of these changes ensures that users provide accurate and up-to-date information when completing their forms.

Staying informed

Follow official websites and community forums related to administrative forms as they can present the latest updates and alterations to the Ill 40 I Form, making sure you are not caught off-guard by unexpected changes.

Engaging with user community

Engaging with forums dedicated to experiences with the Ill 40 I Form can provide valuable insights. Not only can you learn from others, but you can also share your own experiences and advice, fostering a supportive network.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send ill 40 i to be eSigned by others?

Where do I find ill 40 i?

How do I edit ill 40 i on an iOS device?

What is ill 40 i?

Who is required to file ill 40 i?

How to fill out ill 40 i?

What is the purpose of ill 40 i?

What information must be reported on ill 40 i?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.