Get the free l 848

Get, Create, Make and Sign l 848

How to edit l 848 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out l 848

How to fill out l 848

Who needs l 848?

848 form - How-to Guide

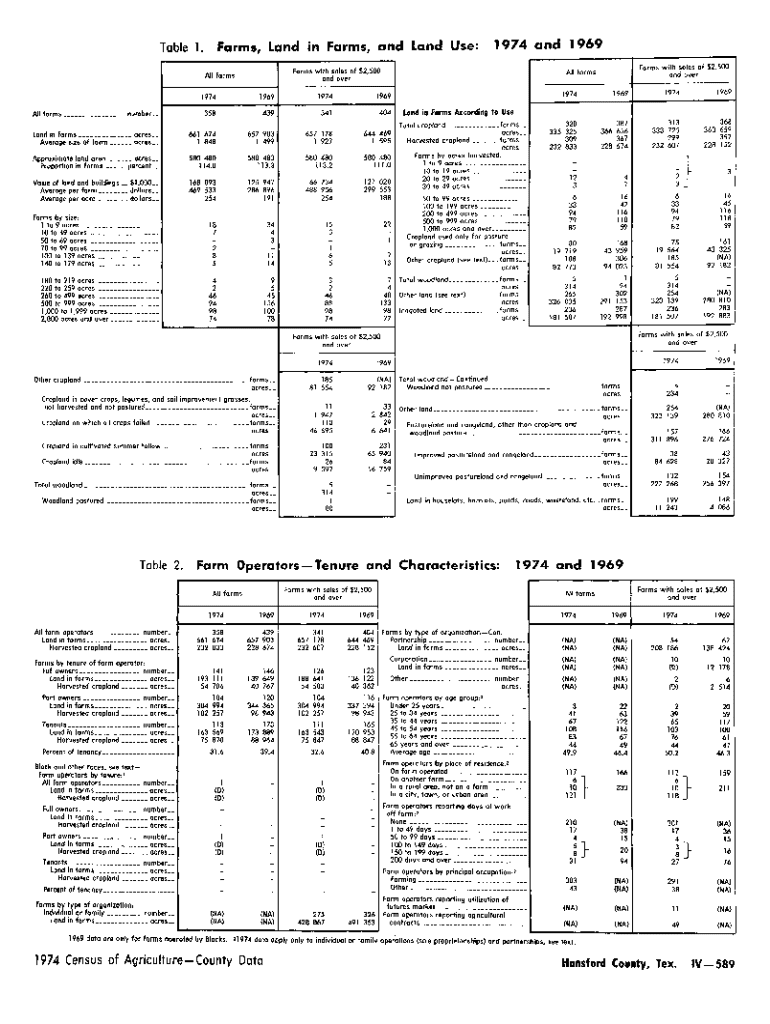

Overview of the 848 Form

The l 848 form is a vital document used in various sectors, including finance and government, designed to collect critical data from users and streamline submissions. Its primary purpose is to ensure accurate reporting and compliance with legal requirements, especially for taxpayers. Understanding the structure and functionality of the l 848 form is essential for individuals and teams tasked with document management.

The importance of the l 848 form cannot be overstated in the domain of document management. It eases the burden of paperwork while ensuring records are kept in an organized and accessible manner. By utilizing this form effectively, users can enhance their workflow, reduce errors, and comply with relevant regulations.

Key features of the 848 Form

The l 848 form consists of several essential components designed to gather comprehensive information from the user. Key features include various fields and sections that prompt for necessary details such as personal identification, financial data, and compliance assertions. Each section of the form is constructed to facilitate the accurate collection of information, minimizing the chance of errors.

Using the l 848 form offers numerous benefits, notably improved accuracy and compliance. By inputting structured data, users can enhance team collaboration while reducing the risks associated with manual entry errors. Furthermore, the streamlined workflow facilitated by the form contributes significantly to efficiency, enabling teams to focus on more strategic tasks.

Step-by-step guide to filling out the 848 Form

Filling out the l 848 form correctly can be straightforward if you break the process down into manageable steps.

Step 1 involves gathering necessary information. This includes collecting all required documents like identification forms, proof of income, and prior tax filings. It’s essential to double-check this information to avoid common pitfalls such as incorrect values or missing data.

Step 2 requires accessing the l 848 form through pdfFiller. Users should navigate to the official site, where they can easily search for the l 848 form and choose whether to download it for offline use or edit it directly online. This platform's user-friendly interface makes accessing and managing forms considerably easier.

Step 3 focuses on filling out the form. Each section demands specific inputs. Users should provide accurate personal information, including their full name and taxpayer number, and then move on to financial details that require careful attention to avoid mistakes. For digital signing and eSigning, pdfFiller provides intuitive options that simplify the process.

Step 4 emphasizes the importance of reviewing your form. Proofreading every detail helps catch errors that may lead to form rejection. Collaboration features, such as real-time editing and comments on pdfFiller, allow teams to work together effectively, ensuring nothing is overlooked before final submission.

Editing and customizing the 848 Form

Editing an existing l 848 form is seamless using pdfFiller's robust tools. Users can easily modify any section, update information, or correct errors, ensuring that their records remain accurate and up to date. The platform provides various editing features, including text boxes, highlights, and annotations.

Additionally, adding interactive elements enhances the form’s usability. For instance, checkboxes, dropdown menus, and signature fields can be integrated into the l 848 form if custom adjustments are needed. This flexibility in design allows the form to cater to users' unique requirements.

For efficient management, pdfFiller's version control feature enables users to save and track changes made to the l 848 form. This facilitates better organization, especially for teams working on multiple versions of documents over time.

Submitting the 848 Form

Once the l 848 form has been completed, users have several options for submission. E-filing is a popular and efficient method, allowing for instant processing. Ensure you are familiar with the e-filing procedures, which may vary depending on whether it's a government-related form or one pertaining to a business tax.

After submission, tracking your status is crucial. Users can contact the respective offices to verify receipt of their form if they opt for mailing or in-person submission. It's also wise to understand the amendment process, in case there are any errors that necessitate revisiting the l 848 form.

Troubleshooting common issues with the 848 Form

Despite its user-friendly design, users may encounter issues when working with the l 848 form. Common problems include technical glitches on the pdfFiller platform, which might cause frustration during form completion or submission.

To assist users in these scenarios, pdfFiller provides robust customer support for troubleshooting. Users can consult the help center resources or visit community forums to get insights from other users who may have faced similar challenges, fostering a reliable support system.

Related forms and templates

The l 848 form often involves various related forms that users may need to complete in conjunction. For instance, Form l 849 and Form l 850 may also be relevant for users dealing with specific angles of financial reporting and taxpayer compliance.

pdfFiller can seamlessly integrate these forms, enabling users to access and manage their document needs from a single, cloud-based platform. This integration removes the hassle of managing multiple documents and ensures consistency across all submissions.

Frequently asked questions (FAQs)

Many users have questions regarding the l 848 form that often center around filling out, submission, and compliance with regulations. One common query focuses on best practices for managing this form to ensure efficient processing.

Users seeking clarifications on eSigning and document security can rest assured that pdfFiller prioritizes data integrity and privacy, providing a secure environment for handling sensitive documents, including the l 848 form.

Case studies and user testimonials

Numerous individuals and businesses have successfully leveraged the l 848 form to enhance their document management process. Success stories showcase how using pdfFiller led teams to significantly reduce processing times and eliminate the stress associated with manual paperwork.

These unique use cases highlight how pdfFiller not only simplifies handling the l 848 form but also adds significant value to overall workflow efficiency.

Final words of advice on the 848 Form

To maximize efficiency in document management, embracing digital solutions like pdfFiller is essential. Proper handling of the l 848 form simplifies the submission process and enhances compliance and accuracy, benefiting both individual users and teams alike.

By adopting best practices and utilizing the available tools, such as pdfFiller's cloud-based features, users can ensure their forms are completed correctly and submitted on time, making the l 848 form a powerful ally in financial and administrative processes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my l 848 in Gmail?

How can I modify l 848 without leaving Google Drive?

How do I fill out l 848 using my mobile device?

What is l 848?

Who is required to file l 848?

How to fill out l 848?

What is the purpose of l 848?

What information must be reported on l 848?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.