IRS Instructions 8990 2025-2026 free printable template

Get, Create, Make and Sign IRS Instructions 8990

How to edit IRS Instructions 8990 online

Uncompromising security for your PDF editing and eSignature needs

IRS Instructions 8990 Form Versions

How to fill out IRS Instructions 8990

How to fill out instructions for form 8990

Who needs instructions for form 8990?

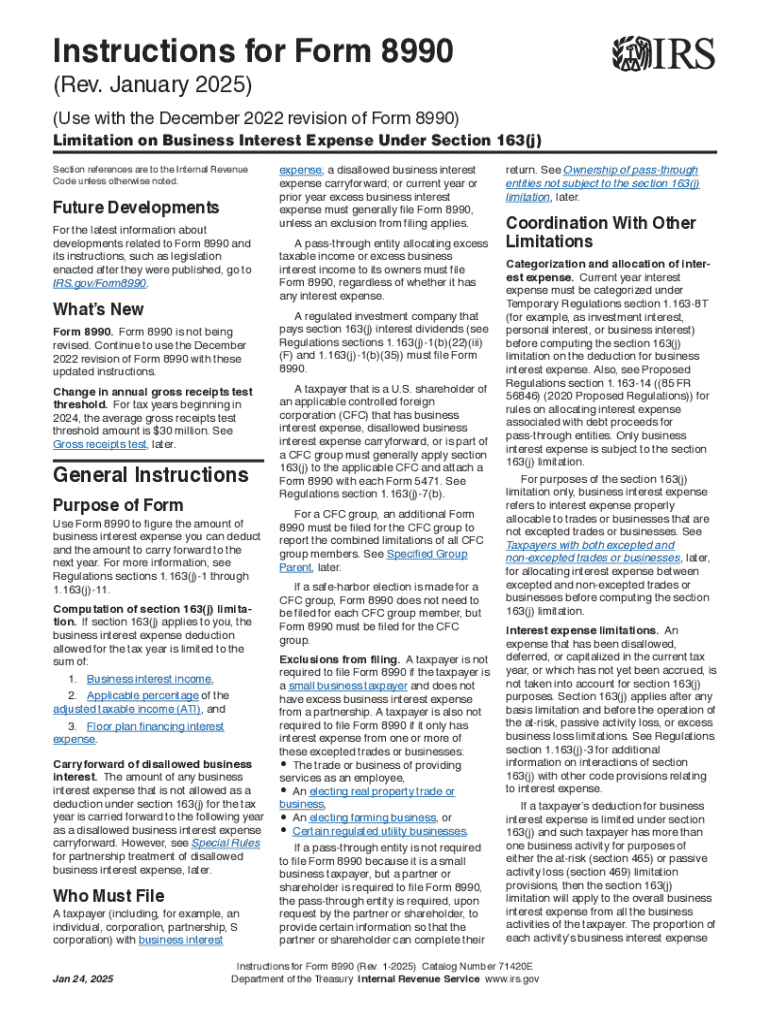

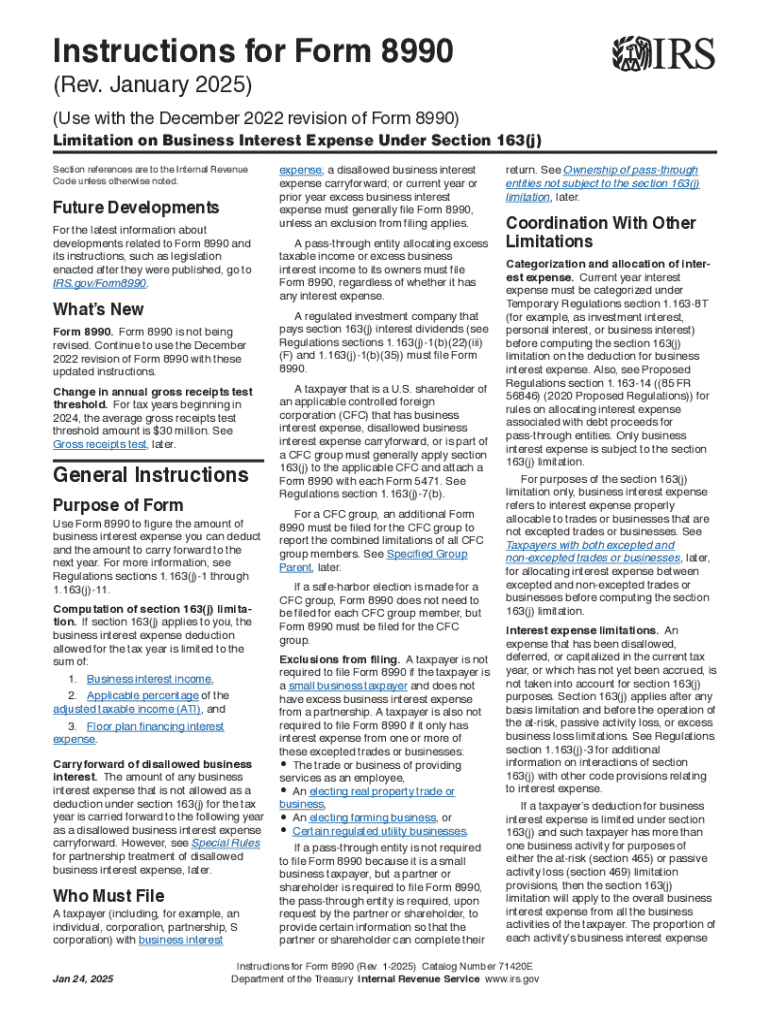

Instructions for Form 8990

Overview of Form 8990

Form 8990 is crucial for businesses, particularly for those with substantial interest expense deductions. The form is designed to help taxpayers compute the business interest expense limitation under Section 163(j) of the Internal Revenue Code. Correctly filling out Form 8990 is essential as it can directly impact your ability to deduct business interest expenses on your tax return, ultimately affecting your overall tax liability.

In many cases, taxpayers can benefit significantly from understanding how to navigate this form, especially when it comes to the complex calculations involved. By properly completing Form 8990, businesses can ensure they maximize their interest expense deductions while remaining compliant with IRS regulations.

Who needs to file Form 8990?

Generally, any taxpayer that is subject to the business interest limitation rules under Section 163(j) must file Form 8990. This includes corporations, partnerships, and primary sole proprietorships that incur interest expenses on their business activities. Notably, if your business has gross receipts that exceed a certain threshold or if you have an average annual gross receipt of more than $25 million, the filing of Form 8990 is not only recommended but mandatory.

Neglecting to file this form can lead to unnecessary tax liabilities or missed opportunities for deductions, which can be costly. It's imperative for business owners and taxpayers to assess their situation carefully to determine their need to file Form 8990 to avoid penalties.

Key definitions and terms

Understanding key terms associated with Form 8990 is essential for proper completion. Some of the most critical definitions include: Business Interest Expense – This is the interest paid or accrued on indebtedness that is properly allocable to a trade or business. Adjusted Taxable Income (ATI) – This figure is used to determine the limitation on the business interest expense deduction and is calculated as taxable income before interest expense, taxes, depreciation, and amortization.

Business taxpayers must also understand the rules surrounding Attribution, which affects how interest expense is allocated among related entities. Ensuring familiarity with these terms can help streamline the filing process and avoid mistakes that often stem from misunderstandings.

Step-by-step guide to completing Form 8990

Completing Form 8990 requires a detailed approach to each section. Below, we break down the form into manageable sections to help simplify the process.

Common mistakes to avoid

Filing Form 8990 can be multi-faceted, leading to some typical errors that taxpayers should be keen to avoid. Some common mistakes include: Incorrect calculation of Adjusted Taxable Income: Miscalculating your ATI can lead to underreporting or overreporting your interest deductions. Omitting related entities: Failing to report all required entities under the attribution rules can raise red flags for the IRS.

Incomplete forms: Inadequate completion of required fields can lead to processing delays. Vigilance at each step can prevent these common pitfalls, ensuring a smooth filing process.

Tips for effortless completion

To make completing Form 8990 as easy as possible, consider the following best practices: Organize your financial documents: Ensure that you have all necessary financial records, such as your income statements and interest expenses, ready to go. Use designated software or tools: Platforms like pdfFiller offer exceptional features to edit, eSign, and collaborate on documents seamlessly.

Take your time: Being deliberate about each section will help prevent mistakes. By following these strategies, you can take the difficulty out of filing Form 8990 and minimize the risk of errors.

Video walkthrough of Form 8990

For a more interactive approach to understanding Form 8990, consider utilizing video walkthroughs. These videos often visually illustrate each section of the form, making it easier to grasp complex elements, such as the calculation of limitations and attribution rules.

Many videos also include annotations and examples that further aid comprehension. Utilizing these resources can enhance your understanding and confidence in filling out the form.

Frequently asked questions (FAQs)

Many taxpayers may have questions about Form 8990 before they file. Here are some common queries, along with comprehensive answers: What is the purpose of Form 8990? It is used to calculate the business interest expense limitation for taxpayers subject to IRC Section 163(j). What happens if I don’t file? Failing to file could result in ineligibility for business interest deductions or penalties from the IRS.

Can I amend a previous return if I didn’t file Form 8990? Yes, taxpayers can amend returns to include Form 8990 if they meet the filing requirements afterward. These FAQs serve to alleviate common concerns regarding filling out Form 8990.

Where to find additional assistance

For further assistance with Form 8990, taxpayers can rely on various resources. The IRS provides a robust website with instructions and FAQs specific to Form 8990, ensuring accurate information and guidance. Seeking help from tax professionals can also provide clarity and support in your filing journey.

Online platforms like pdfFiller also offer diverse resources, including community forums and help centers, where users can share tips or seek direct assistance when navigating this complex form.

Related tax forms and documents

Alongside Form 8990, several other tax forms and documents may be relevant, including: Form 1065 (U.S. Return of Partnership Income): Used by partnerships to report income and losses. Form 1120 (U.S. Corporation Income Tax Return): Required for corporations to report their income and tax liability. Each of these forms may intersect with the information reported on Form 8990, thus understanding their interrelation is critical for comprehensive tax reporting.

Taxpayers are encouraged to familiarize themselves with these related forms to ensure thorough and compliant tax reporting.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit IRS Instructions 8990 from Google Drive?

How can I get IRS Instructions 8990?

How do I complete IRS Instructions 8990 online?

What is instructions for form 8990?

Who is required to file instructions for form 8990?

How to fill out instructions for form 8990?

What is the purpose of instructions for form 8990?

What information must be reported on instructions for form 8990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.