IRS 13715 2025-2026 free printable template

Get, Create, Make and Sign IRS 13715

How to edit IRS 13715 online

Uncompromising security for your PDF editing and eSignature needs

IRS 13715 Form Versions

How to fill out IRS 13715

How to fill out form 13715 rev 10-2025

Who needs form 13715 rev 10-2025?

A Comprehensive Guide to Form 13715 Rev 10-2025

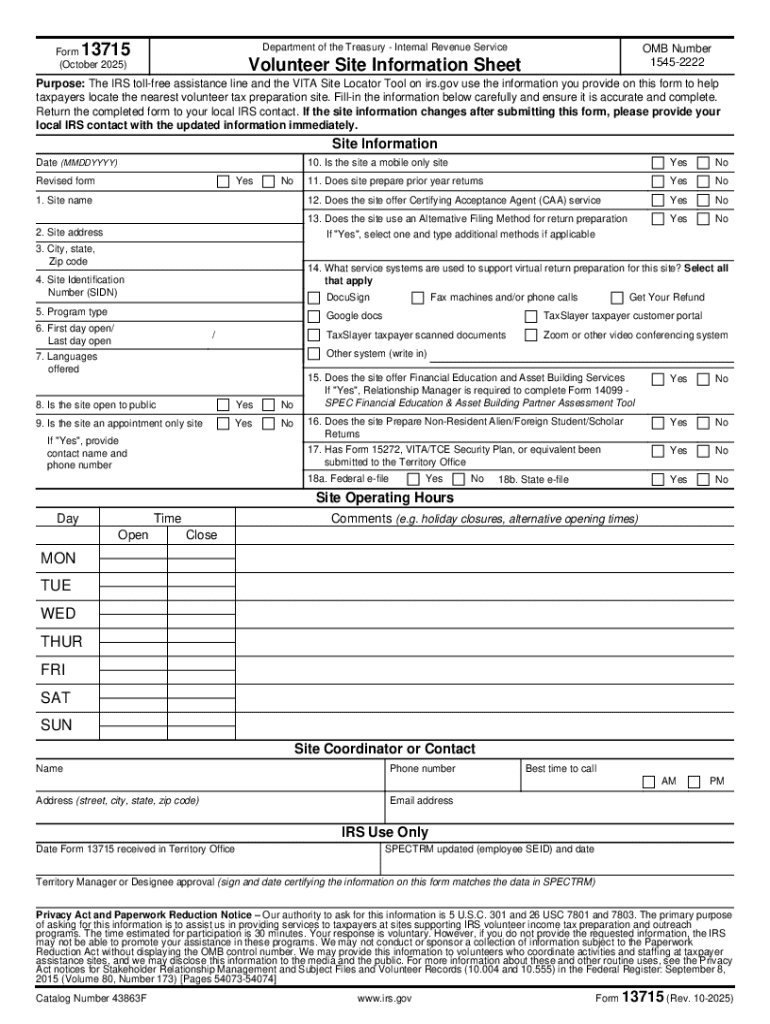

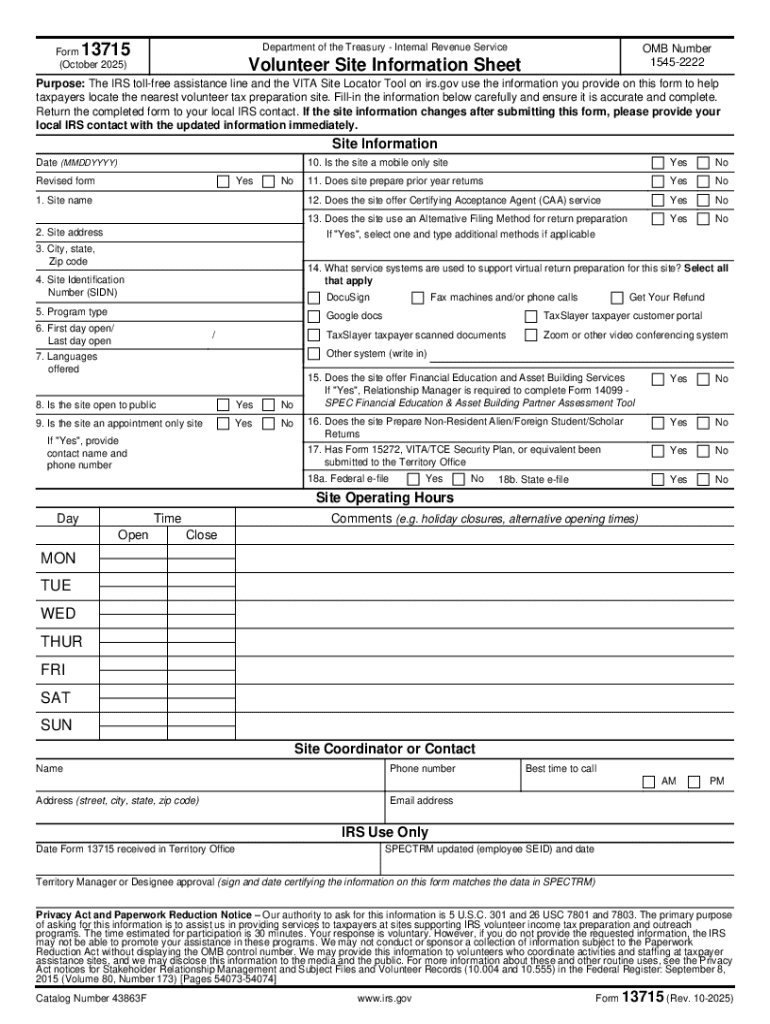

Overview of Form 13715

Form 13715, particularly in its October 2025 revision, serves as a crucial document for reporting financial information and personal data. This form is often used in various administrative processes to ensure transparency and compliance with regulations.

The primary purpose of Form 13715 is to collate necessary personal and financial information, which acts as a foundation for various regulatory requirements. Its accurate submission can significantly impact transaction processing and regulatory compliance.

The importance of this form lies in its role in ensuring that individuals and organizations meet legal requirements. By providing comprehensive data, users can avoid potential fines or issues with authorities related to non-compliance.

The 10-2025 revision introduces several key changes aimed at improving clarity and usability, ensuring that all users can complete the form efficiently while maintaining accuracy.

Understanding the sections of Form 13715

Form 13715 is segmented into several sections that guide users in providing essential information. Each section is designed to capture specific details about the individual or organization submitting the form.

Section 1: Personal information

This section gathers essential personal details. Users need to fill out their name, address, date of birth, and other identifying details.

Required fields

Common pitfalls in this section include misspellings and incorrect addresses, which can delay processing. Double-checking for accuracy before submission is crucial.

Section 2: Financial information

In this part, users provide details on their financial status, including income sources and expenses.

Income details

Expense reporting

Accurate reporting in this section is vital for an accurate financial portrayal, which can affect eligibility for various programs.

Section 3: Signature and verification

Signature is critical to validate the information provided on Form 13715. This section ensures that all declarations are verified by the submitter.

Signing requirements

The use of electronic signatures is gaining ground as a legitimate form of verification, streamlining submission processes. This can enhance the workflow for individuals and businesses alike.

Section 4: Attachments and supporting documents

Completing Form 13715 often requires additional documents to substantiate the information provided. This section offers guidance on necessary attachments.

Necessary accompanying documents

Understanding which attachments are required can smooth the submission process, reducing unnecessary back-and-forth with administrative offices.

Step-by-step guide to filling out Form 13715

Successfully completing Form 13715 requires careful attention and organization. Below is a comprehensive step-by-step guide to facilitate this process.

Gathering required information

Before filling out Form 13715, prepare all necessary information. This can streamline the completion process considerably.

Checklist of information to prepare

Filling out each section in pdfFiller

Using pdfFiller, users can easily navigate and fill out each section of the form. The platform provides interactive fields that minimize errors.

Interactive fields explanation

Each field on pdfFiller allows users to click and type directly, with real-time validation for correctness. This feature significantly enhances user experience and efficiency.

Tips for avoiding common mistakes

Editing and modifying the form

pdfFiller’s editing tools allow for swift amendments post-filling. Should errors be identified after initial completion, revisions are simple and straightforward.

Utilizing pdfFiller’s editing tools

eSigning Form 13715 efficiently

With the rise of digital document management, eSigning has become a convenient and secure option. pdfFiller offers an efficient way to eSign Form 13715.

How to eSign in pdfFiller

Signing electronically involves a straightforward process. Users can click the eSign button, create their signature, and place it in the designated area.

Step-by-step eSignature process

Benefits of eSigning your form

eSigning enhances efficiency by allowing users to complete transactions without the need for physical paperwork. It also provides a secure and easily traceable method for ensuring document integrity.

Collaborating with teams using pdfFiller

PdfFiller facilitates collaboration, enabling teams to work on Form 13715 collectively. Users can share drafts for reviews and gather feedback swiftly.

Share for reviews and feedback

Real-time collaboration features

With real-time editing and commenting capabilities, teams can work simultaneously on the form, ensuring that feedback is immediate and efficient.

Managing Form 13715 after completion

Once Form 13715 is completed and submitted, effective management of the document is paramount.

Saving and storing the completed form in pdfFiller

pdfFiller provides robust cloud storage options, ensuring the completed form is securely saved.

Cloud storage benefits

Tracking form submission and status updates

Monitoring the status of Form 13715 submission can provide peace of mind. Users can easily track their forms within pdfFiller, receiving notifications on updates or required actions.

Navigating possible follow-ups or revisions

In the event of submission errors or requested changes, pdfFiller makes it simple to navigate corrections efficiently.

How to handle corrections post-submission

Frequently asked questions (FAQs)

Addressing common concerns can enhance the user experience. Below are frequently asked questions about Form 13715 and its use.

What to do if you make a mistake on Form 13715?

If a mistake is identified after submission, users can utilize pdfFiller's editing features to rectify the error. Depending on the instructions from the receiving entity, resubmission might be necessary.

Where to find help with Form 13715?

PdfFiller offers extensive support documentation and customer service. Furthermore, forums and community discussions can provide additional insights into common issues.

Common issues and troubleshooting tips

Additional features of using pdfFiller for form management

PdfFiller not only simplifies the process of completing Form 13715, but it also offers a multitude of other features designed to enhance document workflow.

Integration with other tools and services

PdfFiller seamlessly integrates with various tools, such as Google Drive and Dropbox, allowing for effortless document management across platforms.

Security features for your documents

Security is a top priority at pdfFiller. Users' documents are protected through encryption and secure access, ensuring confidentiality.

Accessing Form 13715 anywhere, anytime

The cloud-based nature of pdfFiller allows users to access their forms from any device, facilitating work-from-anywhere scenarios and enhancing productivity.

User testimonies and case studies

Real-life experiences from others can be invaluable. Here, we share success stories and insights from different users of pdfFiller.

Success stories from teams using pdfFiller for Form 13715

Many organizations have transitioned to using pdfFiller for Form 13715, reporting increased efficiency, improved accuracy, and enhanced collaboration among teams.

Individual experiences: transitioning to digital forms

Individuals have also shared positive transitions to digital formats, experiencing time savings and ease of access. These user narratives highlight the transformative impact of utilizing pdfFiller for form management.

People Also Ask about

What is the IRS consent to disclosure?

Does form 15272 need to be approved?

What is IRS form 15272?

What is the taxpayer consent form?

What is a 14446 form?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify IRS 13715 without leaving Google Drive?

How do I edit IRS 13715 online?

How can I fill out IRS 13715 on an iOS device?

What is form 13715 rev 10-2025?

Who is required to file form 13715 rev 10-2025?

How to fill out form 13715 rev 10-2025?

What is the purpose of form 13715 rev 10-2025?

What information must be reported on form 13715 rev 10-2025?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.