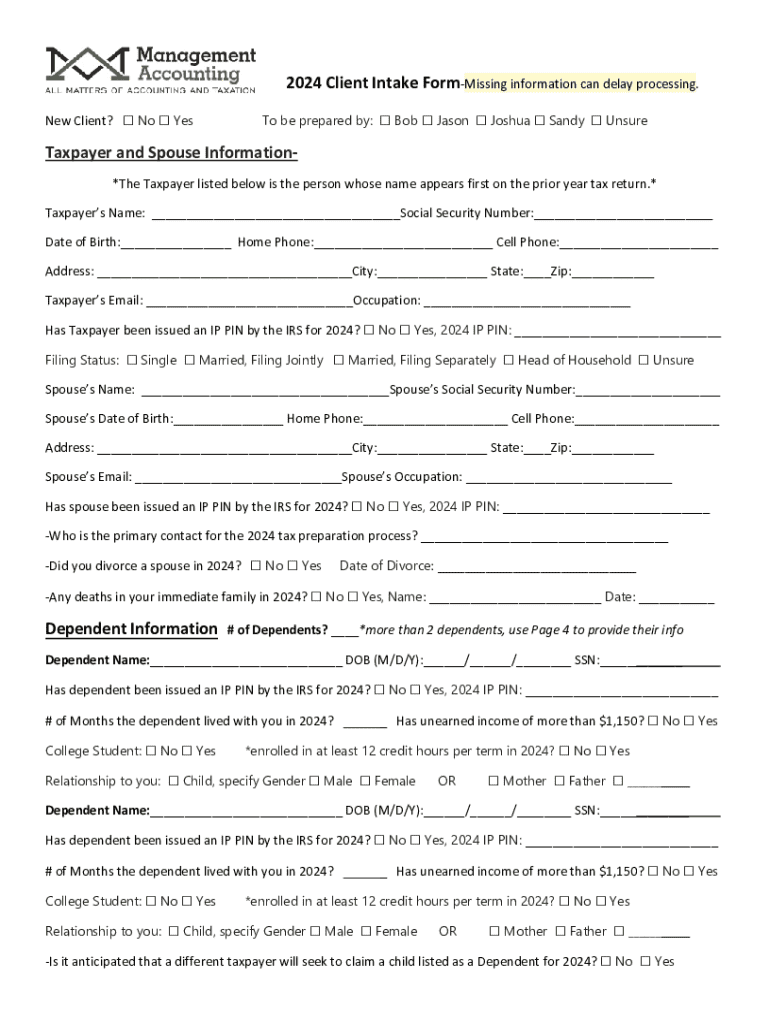

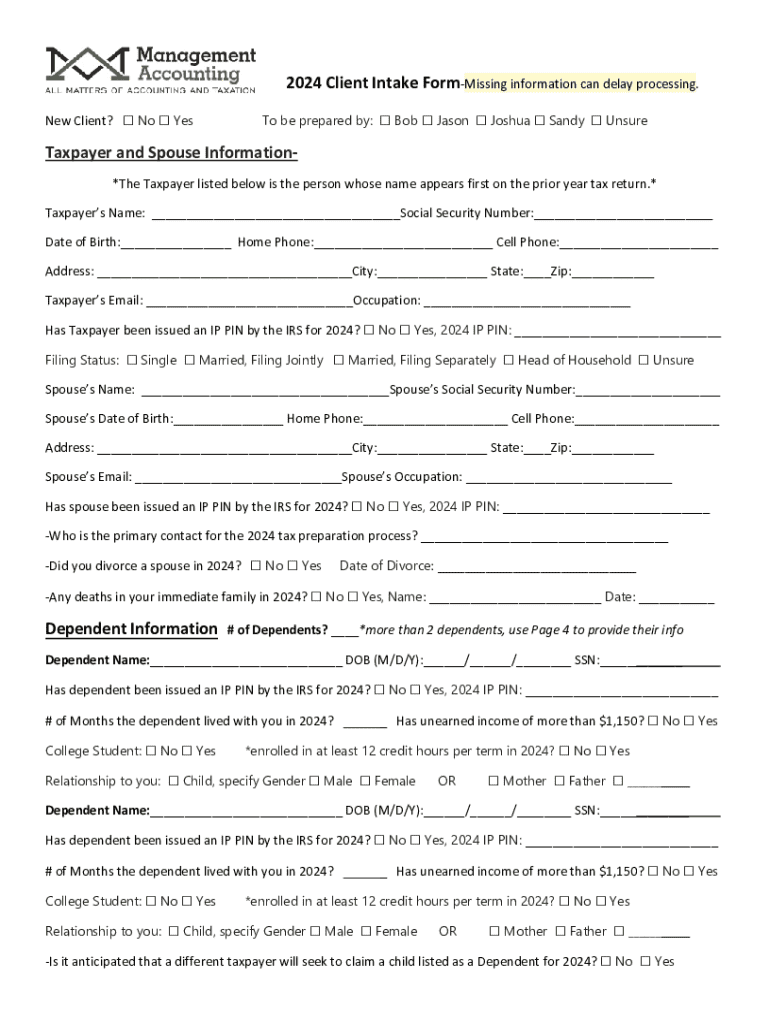

Get the free Taxpayer and Spouse Information-

Get, Create, Make and Sign taxpayer and spouse information

How to edit taxpayer and spouse information online

Uncompromising security for your PDF editing and eSignature needs

How to fill out taxpayer and spouse information

How to fill out taxpayer and spouse information

Who needs taxpayer and spouse information?

Your Comprehensive Guide to the Taxpayer and Spouse Information Form

Understanding the taxpayer and spouse information form

The taxpayer and spouse information form is a critical document utilized in tax preparation and filing. This form ensures that pertinent data regarding the taxpayer and their spouse, if applicable, is accurately reported for tax purposes. Properly completing this form is vital as it informs the Internal Revenue Service (IRS) about your filing status, allows for the processing of tax credits, adjustments, and acts as a foundational piece of evidence in case of audits.

Accurate reporting on this form is essential because even small errors can delay the processing of your tax return, lead to complications with refunds, or result in underpayment penalties. Common scenarios requiring this form include joint tax filing, changes in filing status due to marriage or divorce, or updates on dependents.

Key components of the taxpayer and spouse information form include personal and contact information for both individuals, Social Security numbers, income data, and information about deductions and credits claimed. Documentation such as W-2 forms, 1099 forms, and any relevant tax documents are typically required to complete the form accurately.

Who needs to fill out this form?

The taxpayer and spouse information form must be completed by all eligible taxpayers who are filing jointly with a spouse or who are claiming dependents. An eligible taxpayer is typically defined as an individual who has earned income during the tax year, including wages, self-employment income, or interest income. Couples must also provide pertinent details about their combined income and financial situation.

However, there are exemptions and exceptions to filing this form. For instance, single taxpayers without a spouse or dependents do not need to fill it out. Additionally, certain low-income filers may qualify for a simplified or alternative tax filing method that bypasses the traditional use of the taxpayer and spouse information form.

Step-by-step guide to completing the form

Completing the taxpayer and spouse information form can be straightforward if approached methodically. Here’s a step-by-step guide to ensure accuracy and completeness:

Editing and managing your form

Using pdfFiller, users can take advantage of advanced editing tools to manage their taxpayer and spouse information form efficiently. To edit the PDF form, start by accessing your document through the pdfFiller platform and navigate through its user-friendly interface.

Once in the editor, you can add annotations, comments, or additional information as needed. It is especially useful when collaborating with your spouse or tax preparer, as you can share insights or raise questions digitally without printing unnecessary paper documents.

For saving and storing your document, consider utilizing cloud storage options provided by pdfFiller. By adhering to best practices for file management and ensuring your documents are organized by year or tax period, you can quickly retrieve them when needed. Protecting your information by using secure passwords or multi-factor authentication is also advisable.

eSigning and collaboration

One of the standout features of pdfFiller is its robust eSigning functionality, streamlining the process of signing your taxpayer and spouse information form. Electronic signatures provide legal validity, making it easy to finalize your documents without the hassle of physical paperwork.

To ensure that all required signatures are obtained, simply send an invitation through pdfFiller to your spouse or any collaborating parties for review and approval. This collaborative feature enhances communication, allowing you to discuss changes right within the platform, avoiding back-and-forth emails or delays.

Common issues and how to resolve them

While completing the taxpayer and spouse information form, many users encounter common errors that can hinder processing. A frequently asked question relates to submission problems – for instance, users may receive notifications of missing data or mismatched information. It is crucial to follow prompts carefully and ensure all sections are filled correctly.

If you face issues, check for simple mistakes such as incorrectly inputting Social Security numbers or missing signatures. For step-by-step solutions, pdfFiller provides an extensive support resource section that addresses typical errors and troubleshooting steps. If problems persist, contacting pdfFiller’s dedicated support team is recommended.

Keeping your information secure

Data privacy is non-negotiable when handling sensitive tax documents. PdfFiller emphasizes user security, employing top-notch encryption and protection measures to safeguard user information against unauthorized access or breaches.

As a user, you should also adopt best practices for maintaining confidentiality, such as regularly changing passwords, using unique credentials for financial documents, and enabling two-factor authentication where possible. These measures ensure that sensitive information related to your taxpayer and spouse information form remains protected.

Frequently asked questions (FAQs)

When it comes to the taxpayer and spouse information form, many users have questions that can be easily addressed. For example, a common query is whether changes to marital status affect the need to fill out this form again. Yes, changes can necessitate a new form to ensure the IRS has the most accurate and updated information regarding your filing status.

Another frequent concern touches on filing deadlines and the implications of missing them. Missing deadlines can result in penalties or complications, thus it is advisable to remain proactive in gathering necessary documentation ahead of time. Clearing up misconceptions about the form and its complex requirements can be achieved through reliable resources like pdfFiller’s support or blog for additional guidance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get taxpayer and spouse information?

Can I sign the taxpayer and spouse information electronically in Chrome?

How do I complete taxpayer and spouse information on an iOS device?

What is taxpayer and spouse information?

Who is required to file taxpayer and spouse information?

How to fill out taxpayer and spouse information?

What is the purpose of taxpayer and spouse information?

What information must be reported on taxpayer and spouse information?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.