Get the free Instructions for Form 8868 (Rev. January 2026)

Get, Create, Make and Sign instructions for form 8868

How to edit instructions for form 8868 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out instructions for form 8868

How to fill out instructions for form 8868

Who needs instructions for form 8868?

Instructions for Form 8868: A Comprehensive Guide for Tax-Exempt Organizations

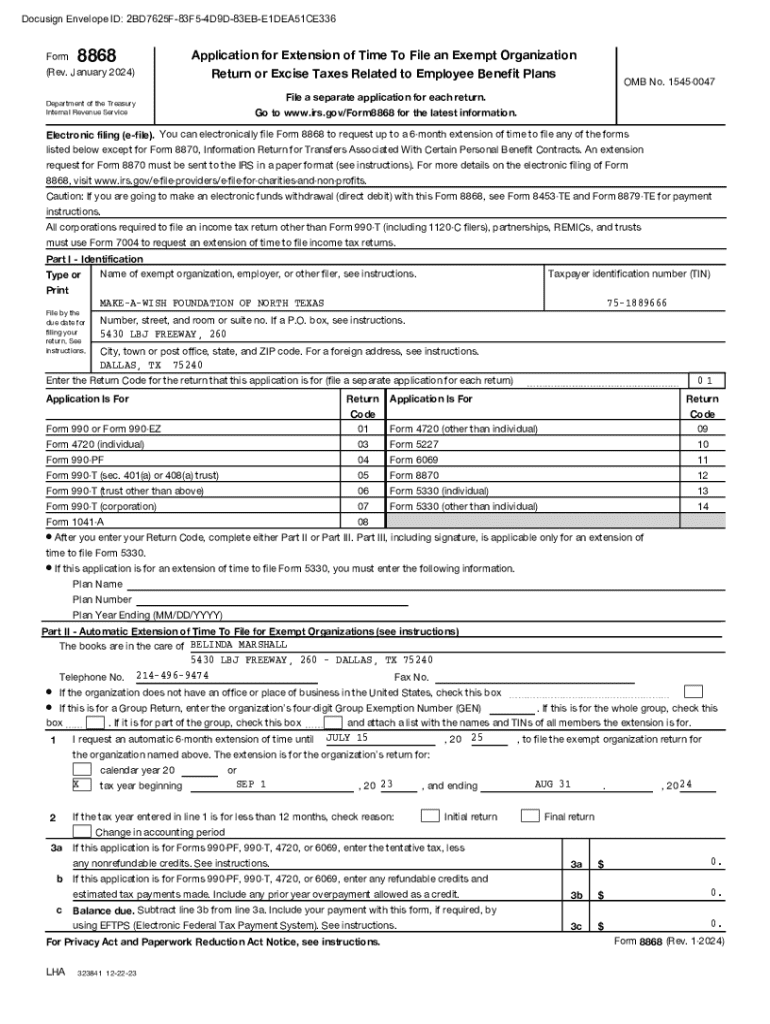

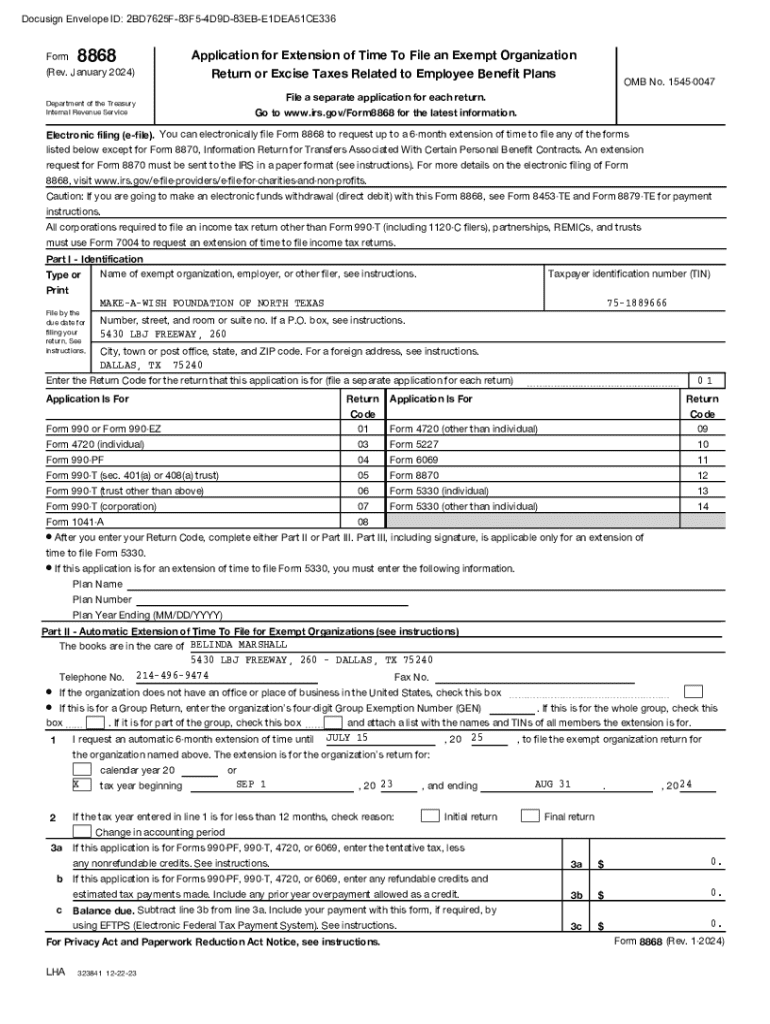

Overview of IRS Form 8868

IRS Form 8868, the Application for Extension of Time to File an Exempt Organization Return, is a critical form for tax-exempt organizations such as charities and non-profits. This form allows these entities to request an automatic six-month extension for filing their annual information returns, such as Form 990, 990-EZ, or 990-PF. The primary purpose of Form 8868 is to provide organizations with additional time to finalize their returns, ensuring they can compile all necessary information accurately to comply with the Internal Revenue Code.

Failing to file on time can lead to penalties and a tarnished reputation, making it essential for tax-exempt organizations to understand when and how to use Form 8868. Both new and established organizations should be aware of the circumstances that necessitate filing this form, as it can significantly impact their compliance status with tax regulations.

Key dates and deadlines for Form 8868 submission

Understanding the deadlines associated with IRS Form 8868 is crucial for tax-exempt organizations. Typically, the deadline for submitting Form 8868 aligns with the due date of the organization's annual return. For instance, if an organization operates on a calendar year and its tax return is normally due by May 15, submitting Form 8868 would also need to be completed by this date. The automatic extension, when granted, allows the organization to file until November 15.

How to obtain IRS Form 8868

Acquiring IRS Form 8868 is straightforward. You can download it directly from the IRS website, ensuring you have the most recent version. Here are the steps to obtain the form:

Step-by-step guide to completing IRS Form 8868

Completing IRS Form 8868 involves three primary parts, which are designed to gather important information about your organization. Below is a detailed breakdown of each part:

Part : Identification of the organization

In Part I, organizations need to provide essential identification details, including the organization's name, address, and Employer Identification Number (EIN). It's crucial to be accurate here; any discrepancy might delay the extension approval.

Part : Reason for the extension

Part II requires organizations to indicate a valid reason for seeking the extension. Common reasons include needing more time due to complex return requirements or pending audits. Organizations should clearly state their reasons, as legitimate reasoning may expedite processing.

Part : Certification of completion

The final section, Part III, includes a certification statement that must be signed by an authorized individual within the non-profit. This step confirms that the application is complete and that the signer has the authority to request the extension on behalf of the organization. Ensuring this section is signed and dated is vital for successful submission.

Common challenges when filling out Form 8868

Filing Form 8868 can be fraught with challenges, especially for organizations that are unfamiliar with the process. Common issues include incomplete information and misunderstandings about the duration of the extension.

Incomplete information

One of the most frequent mistakes made by organizations is failing to provide complete and accurate information. This may include missing fields for the organization's EIN or incorrect contact information. To avoid delays in processing, organizations should double-check all entries for accuracy and completeness.

Misunderstanding of the extension duration

Another common challenge is a misunderstanding of how long the extension lasts. Organizations often think that filing Form 8868 grants them more than six months. It’s essential for tax-exempt entities to recognize that the extension is strictly for six months beyond the original due date of their annual return.

Video walkthrough: How to fill out Form 8868

Visual learners may benefit from video tutorials that illustrate the filling process of Form 8868. These walkthroughs typically highlight each section of the form, providing practical tips and best practices for completion. Including a brief description of what to expect in a tutorial can guide users effectively.

Frequently asked questions about IRS Form 8868

Tax-exempt organizations often have specific questions as they prepare to file Form 8868. Here are some of the most common inquiries and their answers:

What if a non-profit doesn’t submit Form 8868?

Failing to submit Form 8868 by the deadline can result in penalties and the non-profit may be required to file its return without the benefit of the extension. This can lead to inaccuracies and potential fines.

Can an extension be denied?

Yes, while most extensions are granted when the form is filled out correctly, an extension request can be denied. If the IRS finds that the reasons provided are not valid, or if there are discrepancies in the application, they may refuse the extension.

Who should file Form 8868?

Primarily, tax-exempt organizations required to file annual returns under IRS regulations must file Form 8868 if they need additional time. This includes a variety of non-profits including charities and educational institutions.

Tips for managing and tracking your Form 8868 submission

Efficient management and tracking of Form 8868 submissions can ease stress and ensure compliance. Here are some recommended strategies:

Using pdfFiller’s tools for document management

Utilizing document management tools like pdfFiller can enhance the experience of completing and submitting Form 8868. Features such as cloud storage allow organizations to save their form securely, while version control helps track any changes made during the completion process.

Collaborating with team members on Form 8868

Collaboration is vital, especially when multiple team members are involved in preparing Form 8868. Using tools like pdfFiller for collaborative editing enables teams to work on the form simultaneously, ensuring everyone contributes and is aware of the changes made. This collective effort can lead to a more accurate and timely submission.

Related tax articles

For a holistic understanding of the obligations tax-exempt organizations face, reviewing related articles can be beneficial. These readings provide additional context and insights:

Additional support and resources available through pdfFiller

pdfFiller provides a suite of resources and tools designed to support users in managing their tax-related documents efficiently. From editing IRS forms to signing and submitting them electronically, pdfFiller streamlines the entire process.

Interactive tools for editing IRS forms

Users can benefit from interactive tools that facilitate easy editing of IRS forms like Form 8868. Features such as filling in blanks, adding signatures, and even adjusting layouts can be performed online, ensuring that all information is accurate and in compliance.

eSigning features for timely submission

Utilizing pdfFiller's eSigning capabilities allows users to sign documents quickly and efficiently, which is essential for timely submission of Form 8868. With eSigning, you can ensure that your application is signed and submitted well before the deadline, mitigating any risks associated with submission delays.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit instructions for form 8868 from Google Drive?

Where do I find instructions for form 8868?

How do I edit instructions for form 8868 on an Android device?

What is instructions for form 8868?

Who is required to file instructions for form 8868?

How to fill out instructions for form 8868?

What is the purpose of instructions for form 8868?

What information must be reported on instructions for form 8868?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.