Get the free Account Opening FormPDFIdentity DocumentStocks

Get, Create, Make and Sign account opening formpdfidentity documentstocks

How to edit account opening formpdfidentity documentstocks online

Uncompromising security for your PDF editing and eSignature needs

How to fill out account opening formpdfidentity documentstocks

How to fill out account opening formpdfidentity documentstocks

Who needs account opening formpdfidentity documentstocks?

Account Opening Form: A Comprehensive Guide

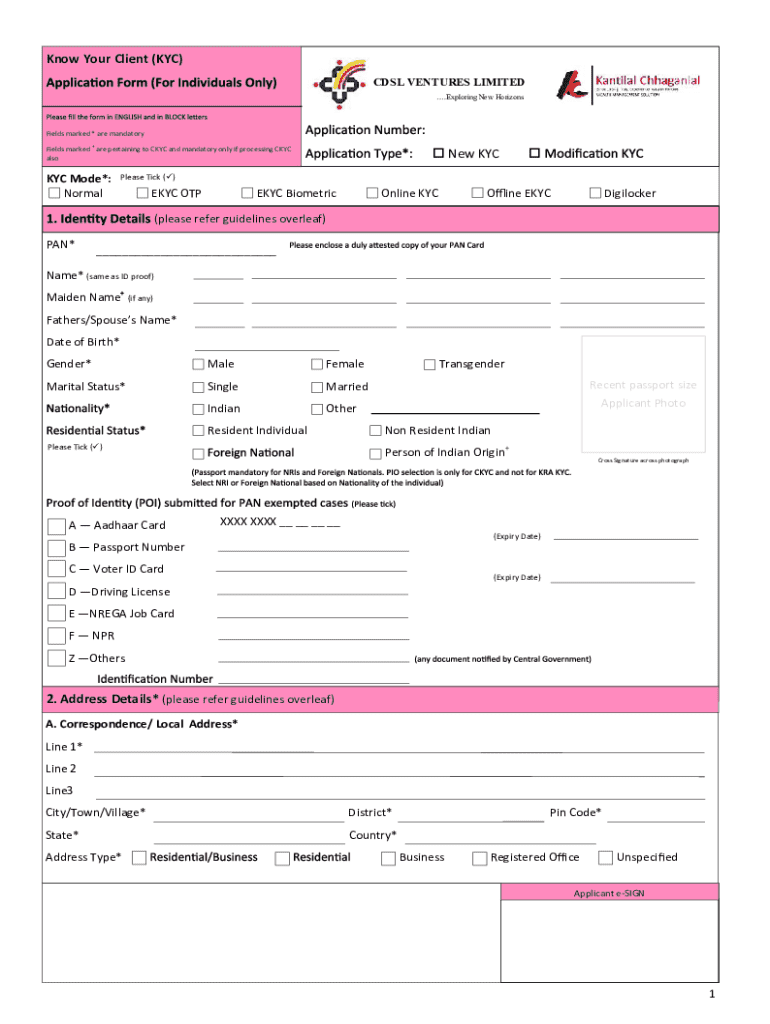

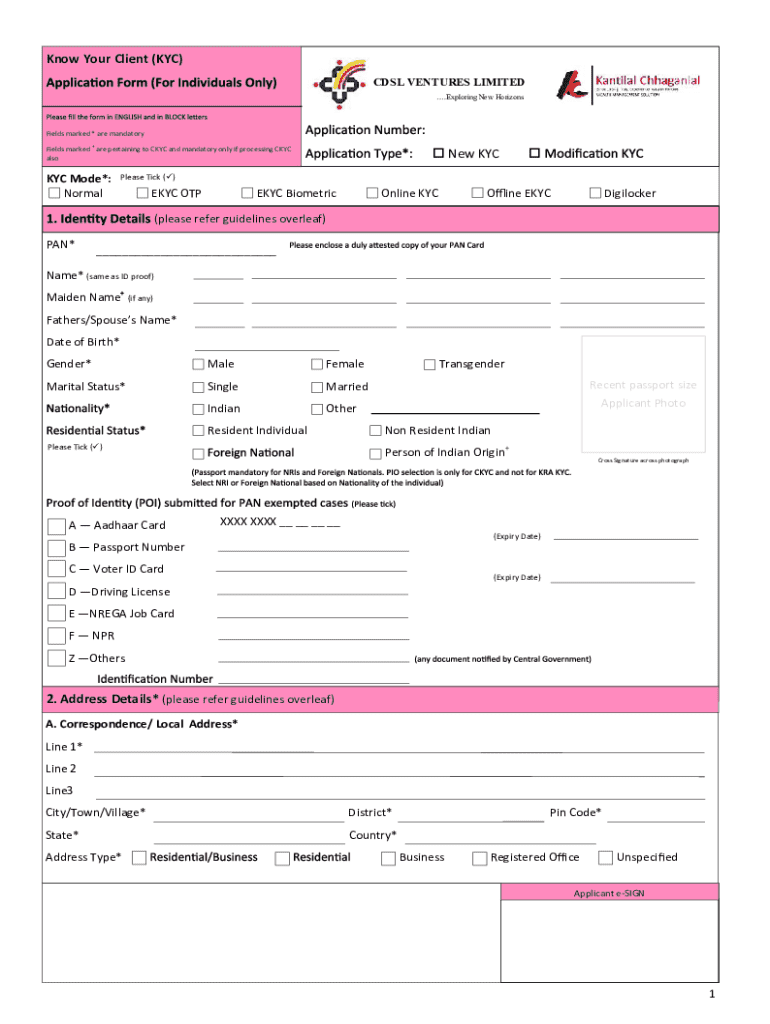

Understanding the Account Opening Form

An account opening form serves as a vital document required by banks and financial institutions when an individual or business intends to establish a financial account. This form collects detailed information about the applicant and plays an essential role in ensuring compliance with regulations. Accurate information is paramount; any discrepancies could delay or even deny the application.

There are several types of accounts that necessitate an account opening form, including personal bank accounts, business accounts, and investment or brokerage accounts. Each of these accounts has distinct requirements but fundamentally relies on the same core information provided through this form.

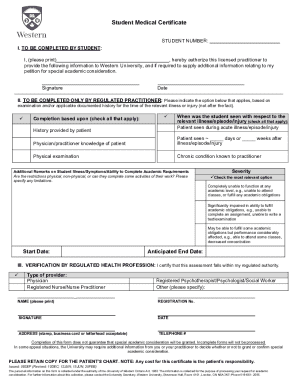

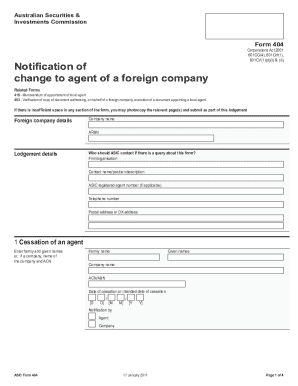

Key Components of the Account Opening Form

The account opening form is generally divided into several sections, each requiring specific information. The personal information section is critical; it usually requests your full name, residential address, contact information, and date of birth. Providing accurate details in this section is essential to establish your identity and facilitate communication.

Next, the form requires a section dedicated to identity document requirements. Financial institutions often ask for specific forms of identification to verify your identity. Acceptable documents typically include government-issued IDs such as passports or driver's licenses. It's advisable to follow the guidelines provided by the institution closely when submitting these documents to avoid any delays.

How to fill out the account opening form

Filling out the account opening form can appear daunting, but breaking it down into manageable steps simplifies the process considerably. Start by preparing all the necessary documents, such as your ID and proof of address, to ensure you have all information at hand before you begin filling out the form.

Next, focus on accurately completing your personal details. It’s important to take your time here and avoid common mistakes, like misspellings or providing inconsistent information between your form and your identification. Identifying your employment and income details follows. This section usually requires proof of income, which may involve attaching payslips or tax returns.

Editing and signing the account opening form with pdfFiller

Utilizing pdfFiller enhances your experience when editing the account opening form. Upon accessing the form through pdfFiller, you can utilize various tools to add or modify information without the hassle of starting over. This not only saves time but also minimizes errors.

After filling out the form, you need to electronically sign it. pdfFiller simplifies this process significantly. The platform allows you to eSign documents securely, ensuring that your signature is legal and binding. Moreover, pdfFiller utilizes encryption to safeguard your personal information, providing peace of mind while you manage your documents.

Managing your account opening form post-submission

After submitting the account opening form, tracking your submission is crucial. It’s advisable to follow up with the financial institution within a week to verify that your application is being processed. This proactive approach can help clarify any requirements they may need further clarification on.

If you experience delays or issues, understanding common reasons can help. Sometimes, the application may require additional documentation or identity verification. If your form is rejected, contacting customer service of the institution directly is the best course of action to address the reasons for denial.

FAQs about the account opening form

Frequently asked questions about the account opening form often revolve around its necessity and the post-submission process. Many individuals wonder why an account opening form is needed in the first place. The answer lies in regulatory compliance; financial institutions require this documentation to ensure they know their customers and can prevent illegal activities.

What happens after submission? Applicants can expect a response regarding their application status within a few business days, although processing times can vary. Businesses asking, 'Can I use pdfFiller for business accounts?' should know that pdfFiller is designed to handle a range of document management needs, applicable to both individuals and corporations. Security remains a top priority; pdfFiller uses encryption methods to protect sensitive information during and after form completion.

Interactive tools for a smooth experience

pdfFiller offers a suite of interactive tools that enhance the form-filling experience. With document templates available, users can easily access pre-formatted forms tailored for specific financial institutions. This feature accelerates the filling process and ensures you don’t miss any essential information. Furthermore, sharing options allow for collaborative input, making it easier for teams to manage multiple applications simultaneously.

With mobile access, users can fill out forms anytime and anywhere, accommodating your dynamic lifestyle. This flexibility means you can complete necessary paperwork while on the go, without sacrificing efficiency. Leveraging technology, pdfFiller allows individuals and teams to simplify document creation and management seamlessly.

Conclusion and quick tips

The process of opening a financial account begins with the account opening form, a document essential for proper identification and compliance. To ensure a successful experience, double-check all provided information before submission. Using platforms like pdfFiller offers an organized method for managing your forms, mitigating the risk of errors during the process.

Harnessing technology not only streamlines document management but also boosts efficiency. As you embark on your account creation journey, remember these tips and trust in pdfFiller to simplify every step of the way.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the account opening formpdfidentity documentstocks in Gmail?

Can I edit account opening formpdfidentity documentstocks on an iOS device?

How do I complete account opening formpdfidentity documentstocks on an Android device?

What is account opening formpdfidentity documentstocks?

Who is required to file account opening formpdfidentity documentstocks?

How to fill out account opening formpdfidentity documentstocks?

What is the purpose of account opening formpdfidentity documentstocks?

What information must be reported on account opening formpdfidentity documentstocks?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.