Get the free Business or Non-profit)

Get, Create, Make and Sign business or non-profit

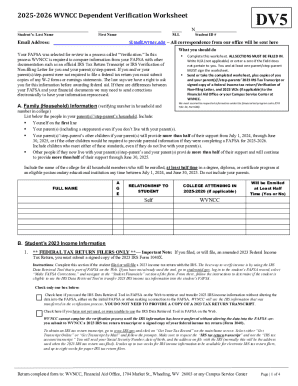

Editing business or non-profit online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business or non-profit

How to fill out business or non-profit

Who needs business or non-profit?

Business or Non-Profit Form: A Comprehensive How-to Guide

Understanding the importance of business and non-profit forms

Understanding the distinction between business and non-profit forms is essential for anyone looking to establish an organization. A business form refers to the legal structure under which a company operates, such as a limited liability company (LLC), corporation, or sole proprietorship. In contrast, a non-profit form is specifically designed to facilitate organizations that aim for a social purpose, rather than profit-making. Properly utilized forms are pivotal for legal compliance and administrative functionality, as they outline the operational parameters and regulatory obligations of the organization.

The legal and administrative significance of having the correct forms cannot be overstated. A business form dictates taxation, liability, and operational structures, while a non-profit form governs tax-exempt status, governance, and accountability. Although both types of forms require adhering to specific regulations, they do share commonalities such as the need for accurate documentation and transparency.

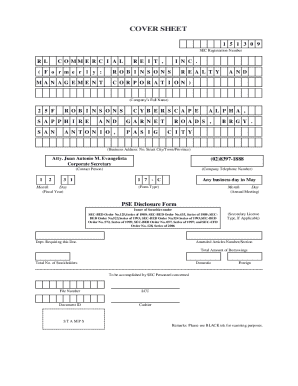

Key forms for business and non-profit organizations

Navigating the essential forms for business and non-profit organizations starts with understanding the most relevant documents required for each type. For businesses, the foundational forms include those associated with the chosen structure, such as Articles of Incorporation for corporations or an Operating Agreement for LLCs. Non-profits, on the other hand, must fill out registration forms to establish themselves, such as Form 1023, which is crucial for obtaining 501(c)(3) tax-exempt status.

Additionally, organizations may require specific licenses and permits depending on the nature of their activities and where they operate. This could include local business licenses, health permits, or charitable solicitation permits. It’s essential to remember that compliance can also vary by state, necessitating a check on state-specific requirements for additional forms that must be filled out.

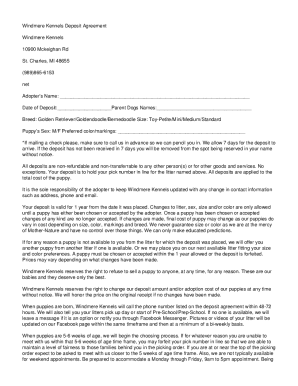

Step-by-step guide to filling out the most common forms

Completing Form 1023 for non-profits requires attention to detail. This form necessitates the inclusion of specific information such as the organization’s mission statement, which should clearly articulate the purpose, objectives, and goals. A comprehensive budget must also be included, detailing expected income, revenue sources, and operational expenditures to provide the IRS with a clear picture of financial sustainability.

Common mistakes often stem from incomplete information or inaccuracies. For example, ensuring that the mission statement aligns with the organization’s activities is crucial; discrepancies may lead to delays or denials. Similarly, for businesses, the process of filling out registration forms typically requires detailing the business name, ownership structure, and nature of the business. Keeping accurate records and information ensures a smoother submission process.

Editing and customizing your forms

In today’s digital age, utilizing tools like pdfFiller can significantly enhance the editing and customizing process for your forms. pdfFiller allows users to modify documents efficiently, granting the ability to insert, delete, and move sections as needed. This flexibility helps tailor forms to fit the specific needs of your organization.

Furthermore, you can enrich your forms with interactive fields, such as signature blocks and checkboxes, which improve usability and streamline the completion process. With the right tools, organizations can create professional-looking documents that meet both aesthetic and functional requirements.

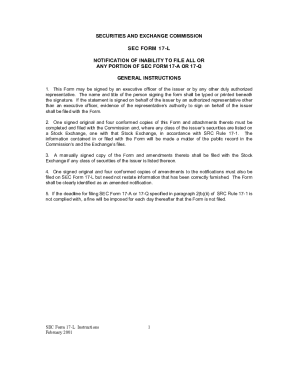

Utilizing eSignature tools for business and non-profit forms

The legal landscape today acknowledges the acceptance of eSignatures, which has transformed how organizations handle documentation. Utilizing tools like pdfFiller for eSigning documents not only speeds up the process but also provides legal validity to the signed forms. Understanding how to eSign is crucial for those looking to streamline document workflows.

The eSigning process with pdfFiller is simple yet effective. Users can upload their documents, specify which fields require signatures, and send the document for signing. This platform also offers tracking features that allow organizations to monitor the status of signatures in real-time, ensuring that documents are signed promptly and keeping everyone in the loop.

Collaborating with teams on form completion

Collaboration is key when it comes to completing complex forms. Best practices for collaborative editing include assigning specific roles and permissions to team members. This ensures that all contributors know their responsibilities and can work efficiently. Utilizing cloud-based solutions like pdfFiller allows team members to access documents from anywhere, encouraging flexibility and operational effectiveness.

Moreover, pdfFiller provides real-time feedback and commenting tools, enabling team members to leave suggestions or ask questions directly within the document. This instant communication helps clarify misunderstandings and leads to a more polished final output. Overall, collaboration within a unified platform can enhance both productivity and form accuracy.

Managing your forms post-completion

Once forms are completed, proper management is essential to ensure compliance and accessibility. It's critical to implement a robust system for storing and organizing completed forms; this can greatly ease retrieval during audits or reviews. Utilizing cloud-based storage options provided by platforms like pdfFiller ensures that documents are not only secure but also quickly accessible when needed.

Sharing forms securely within your organization can also safeguard sensitive information. Ensuring that only authorized individuals have access to specific documents fosters transparency and accountability. Additionally, arming your organization with a solid archiving strategy for forms creates a valuable resource for future reference or compliance audits, thus enhancing operational efficiency.

FAQs about business and non-profit forms

Individuals and teams often have similar queries when it comes to business and non-profit forms. One common question is, 'What form do I need for my non-profit?' Understanding which forms apply can often be perplexing; usually, the IRS Form 1023 is essential for organizations aspiring for tax-exempt status under 501(c)(3).

Another frequent inquiry involves the frequency of form updates: 'How often do I need to update my business forms?' Regular evaluations of your compliance and operational needs can dictate when forms should be reviewed or updated, especially if there are changes in organizational leadership or operational scope.

Benefits of using pdfFiller for form management

pdfFiller offers comprehensive solutions tailored to meet the document needs of both businesses and non-profits. By providing a seamless experience for filing, signing, and collaborating on documents, users can manage their forms more efficiently than ever. This platform not only simplifies the completion of business and non-profit forms but also ensures that compliance with legal standards is maintained.

Feedback from users highlights the ease of navigating pdfFiller’s features, from editing to eSigning. Case studies abound where organizations have successfully streamlined their processes, reducing turnaround times significantly through the use of this powerful tool.

Next steps for businesses and non-profits

To start reaping the benefits of effective form management, organizations should consider setting up an account on pdfFiller. The process is straightforward and should take only a few minutes. Upon account creation, users can dive into their first form, utilizing the extensive resources available to guide them through completion and submission.

Moreover, maintaining a system of ongoing management and compliance is essential. Regular check-ins on the status of forms and document management strategies can lead to increased organizational integrity and operational success. Taking these proactive steps can greatly enhance both the effectiveness and sustainability of your organization.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit business or non-profit from Google Drive?

Can I create an electronic signature for the business or non-profit in Chrome?

How can I fill out business or non-profit on an iOS device?

What is business or non-profit?

Who is required to file business or non-profit?

How to fill out business or non-profit?

What is the purpose of business or non-profit?

What information must be reported on business or non-profit?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.