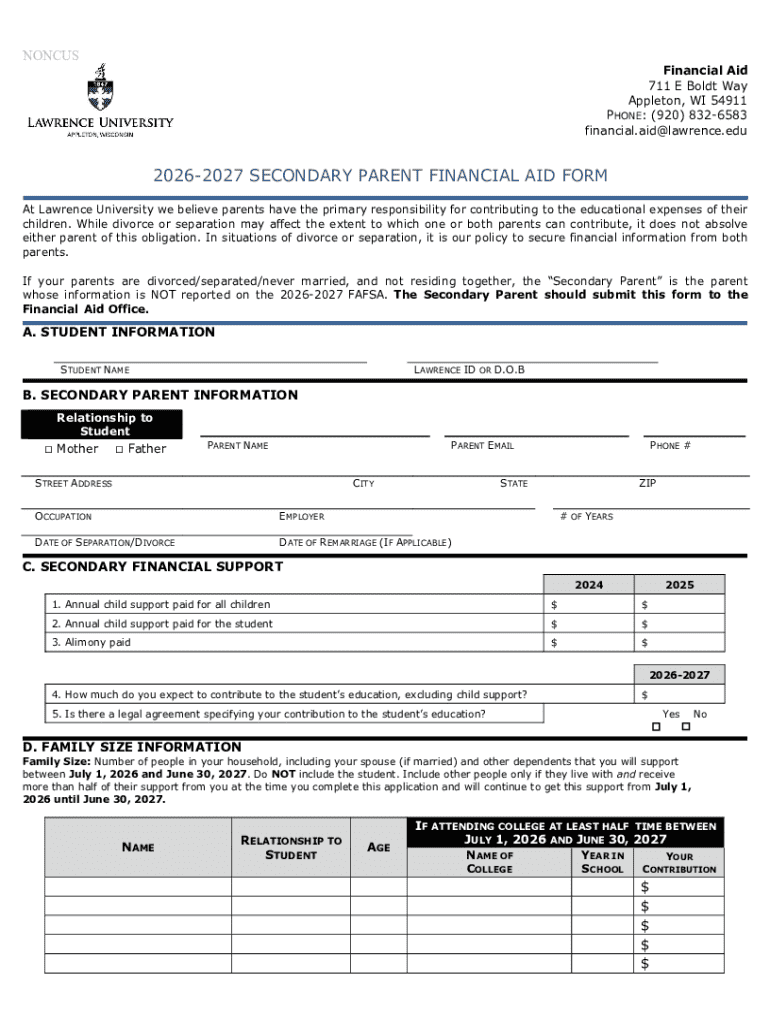

Get the free 2026-2027 Secondary Parent Financial Aid FormLawrence ...

Get, Create, Make and Sign 2026-2027 secondary parent financial

How to edit 2026-2027 secondary parent financial online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2026-2027 secondary parent financial

How to fill out 2026-2027 secondary parent financial

Who needs 2026-2027 secondary parent financial?

2 Secondary Parent Financial Form: A Comprehensive Guide

Understanding the 2 secondary parent financial form

The 2 secondary parent financial form is a crucial document in the financial aid process that allows educational institutions to evaluate a family's financial situation. This form is specifically designed to collect detailed information regarding the financial circumstances of secondary parents or guardians who are contributing to a student's education expenses. Accurate completion of this form can significantly impact the amount of financial aid a student receives.

Providing precise information in the financial form ensures that students can access optimal financial aid benefits. Each detail matters, as discrepancies or omissions can lead to delays or downsized financial assistance. Thus, understanding its key components is essential.

Familiarizing oneself with the terminology used in the form helps in providing a clearer and more accurate depiction of financial status. Understanding terms like custodial parent, noncustodial parent, and family size is vital for completing the form correctly.

Who must complete the form?

Eligibility to complete the 2 secondary parent financial form primarily hinges on the role and relationship of the parent or guardian to the student. Typically, secondary parents or guardians who have legal or financial responsibility for the student must fill out this form. This applies in scenarios where natural parents are not the primary financial supporters.

It's essential to differentiate between biological parents and other guardians. Non-traditional family structures, such as step-parents, aunts, uncles, and other legal guardians, must understand their obligations regarding this form. Each situation might come with unique requirements or considerations that need to be accounted for during form completion.

Preparing to fill out the form

Before diving into the 2 secondary parent financial form, it’s necessary to gather all required documentation. Having the right documents on hand can significantly streamline the process, ensuring everything is filled out accurately and thoroughly. Key documents typically include the most recent tax returns, W-2 forms, bank statements, and any additional financial records that detail income and assets.

An organized approach to data collection is crucial. Start by arranging financial details such as income first, followed by expenses and assets, ensuring a logical flow of information. It’s also important to verify each figure for accuracy. Small errors can lead to larger complications down the line, affecting the overall financial aid eligibility.

Step-by-step guide to completing the 2 secondary parent financial form

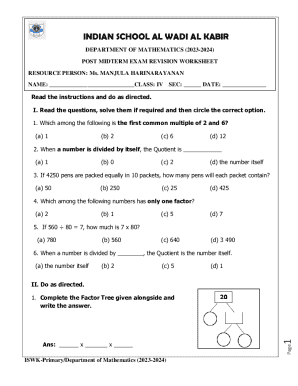

Completing the 2 secondary parent financial form involves several clear sections, each requiring specific types of information. Attention to detail at this stage can prevent delays in financial aid. The sections include Personal Information, Financial Information, and Household Information.

Let’s break down each section for greater clarity:

Common pitfalls during completion include misunderstanding specific financial terms or inaccurately reporting income. To avoid these mistakes, it's prudent to review the form thoroughly or consult a financial aid counselor if necessary.

Editing and updating your information

Financial situations can change frequently, which may necessitate updating the 2 secondary parent financial form. Situations such as a job loss, significant changes in income, or family circumstances should trigger an immediate review and revision of the submitted form to reflect current conditions accurately.

Editing the form is straightforward, particularly using tools such as those partnered with pdfFiller. Users can utilize online tools or PDF editors to amend information seamlessly. It's also crucial to keep records of any revisions made, as these may need to be referenced in future communications.

Electronic signing and submission

Once the 2 secondary parent financial form is completed, the next step is electronic signing. The eSigning process streamlines the submission, allowing for quick and legal acknowledgment of the information provided. Understanding the electronic signing process is vital since it carries legal implications.

After signing, various submission options are available, including online submissions or traditional mail. Each educational institution may set specific deadlines for submissions, so it’s critical to check these thoroughly to ensure compliance and avoid missing out on financial aid opportunities.

After submission: what’s next?

Once the 2 secondary parent financial form is submitted, it’s crucial to confirm its receipt. Students should check with the financial aid office or use online portals if available to ensure that all forms have been successfully received and are being processed.

Following submission, financial aid offices may request additional information. Understanding how to respond to these requests promptly and accurately is essential. Missing or incomplete responses can jeopardize financial aid eligibility.

Managing your financial data with pdfFiller

pdfFiller offers a range of interactive tools designed to enhance your experience with the 2 secondary parent financial form. Features such as editing capabilities, eSignatures, and collaboration tools make the form-filling process more efficient and user-friendly.

Storing and accessing the completed form securely is another benefit. With pdfFiller’s cloud storage, users can easily access their forms from anywhere, ensuring that important documents are always within reach. Additional functionalities allow parents to track the status of their submissions and maintain seamless communication with schools regarding their financial information.

Frequently asked questions about the 2 secondary parent financial form

Many individuals have common concerns when it comes to filling out the 2 secondary parent financial form. Questions often arise around eligibility, documentation requirements, and the implications of provided information.

Furthermore, there are misconceptions about who is required to submit the form. Understanding these aspects is critical to ensure a smooth application process. Resources are available through financial aid offices or online platforms to clarify any doubts regarding the completion process or subsequent steps.

Additional tips for navigating financial aid

Maximizing financial aid opportunities involves understanding the broader financial aid landscape. Students and their families should stay informed about scholarship opportunities, grants, loans, and other forms of aid that may complement the financial assistance offered by institutions.

Staying updated on changes to financial aid policies is also vital. Educational institutions often adjust their policies, impacting eligibility or benefits. Subscribing to financial aid newsletters or monitoring educational websites can ensure that families remain informed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 2026-2027 secondary parent financial without leaving Google Drive?

How do I complete 2026-2027 secondary parent financial online?

How do I complete 2026-2027 secondary parent financial on an Android device?

What is 2026-2027 secondary parent financial?

Who is required to file 2026-2027 secondary parent financial?

How to fill out 2026-2027 secondary parent financial?

What is the purpose of 2026-2027 secondary parent financial?

What information must be reported on 2026-2027 secondary parent financial?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.