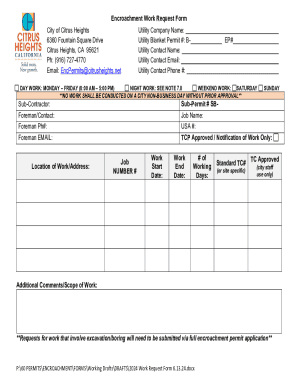

Get the free Assessor Valuation of Livestock and Personal Property ...

Get, Create, Make and Sign assessor valuation of livestock

How to edit assessor valuation of livestock online

Uncompromising security for your PDF editing and eSignature needs

How to fill out assessor valuation of livestock

How to fill out assessor valuation of livestock

Who needs assessor valuation of livestock?

Assessor Valuation of Livestock Form: A Comprehensive How-To Guide

Understanding the assessor valuation of livestock form

The Assessor Valuation of Livestock Form is a crucial document for livestock owners that facilitates the accurate assessment of property taxes based on the value of their livestock. This valuation not only aids counties in determining tax obligations but also ensures that livestock owners are taxed fairly, reflecting the true market value of their animals. The form typically includes various types of livestock—from cattle and sheep to poultry—each of which can present unique valuation challenges.

Accurate livestock valuation is essential for property taxes, as it directly impacts revenue for local governments that fund services vital to the community, such as schools and infrastructure. Understanding the types of livestock included in assessments helps owners prepare accurate records and prevents discrepancies during reviews.

Preparing to complete the livestock valuation form

Before diving into the details of the Assessor Valuation of Livestock Form, preparation is key. Owners should gather all necessary information that will support their valuations. This includes a thorough herd inventory, which involves accurately counting and categorizing animals by type—cattle, goats, sheep, horses, chickens, and so forth. Additionally, health and productivity records will provide insight into the animals' worth, as healthy, high-producing animals often carry a higher market value.

Financial data further underpins valuation credibility, offering tangible proof of costs and potential revenue from livestock. Effective document management can streamline this process—using tools like pdfFiller not only simplifies editing forms but also allows for easy collaboration with family members or farm advisors, ensuring everyone is on the same page during form preparation.

Step-by-step instructions for completing the form

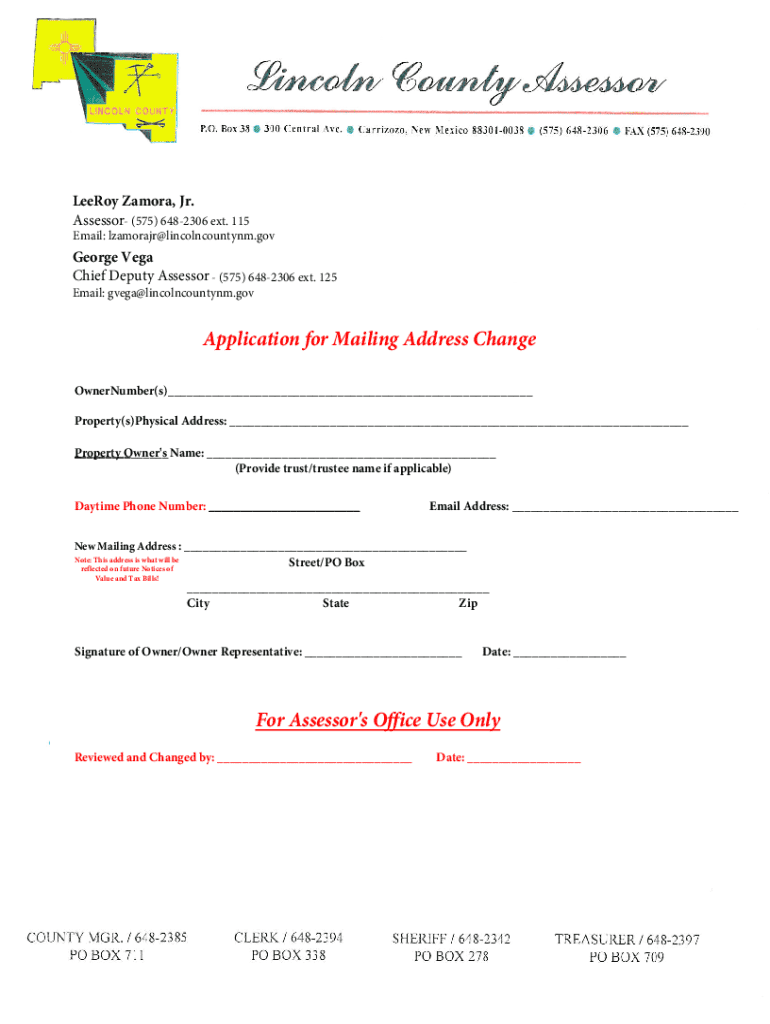

Filling out the Assessor Valuation of Livestock Form is systematic. The first section, 'Owner Information,' requires entrants to provide identifying details. Here, it’s important to ensure that all personal information is accurate, understanding that submissions remain confidential and are only used for assessment purposes.

Next comes the 'Description of Livestock' section. Each type of livestock should be detailed clearly—indicate how many of each kind you own, along with any specific characteristics that might affect valuation, such as breed and age. Precision in this section can prevent future disputes regarding assessed values.

The third section focuses on 'Value Assessment.' Here, assist your valuation by determining the fair market value of your livestock through research on market trends and considering local data, which can often be obtained from cooperative extension offices or local agricultural departments. Supporting documentation can further validate your claims.

Finally, there may be an 'Additional Information' section available for reporting any unique circumstances that may impact your livestock’s value, such as specialty breeding or unique feed programs. Including this information can fortify your submission.

Editing and customizing your form

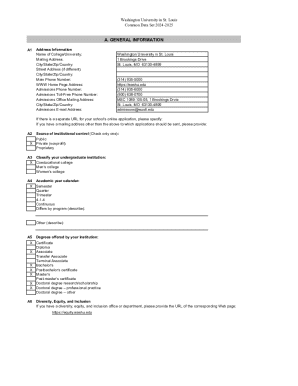

Once you have completed the form, using pdfFiller opens up a range of customization and editing options. Accessing your form through a cloud-based platform allows you to make necessary updates easily and efficiently. If any changes are needed after completing the form, pdfFiller's tools enable swift adjustments without the hassle of redrafting.

Collaborative features are particularly beneficial—invite advisors, family members, or colleagues to review your completed form. Utilizing comments and suggestion tools fosters an environment for better submissions, leading to fewer errors and enhancing overall clarity.

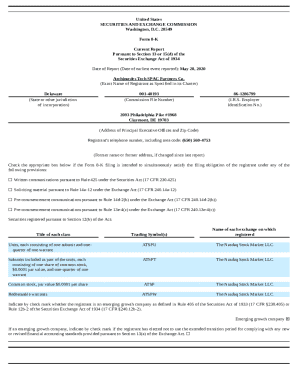

Signing and finalizing the livestock valuation form

Applying electronic signatures to your completed Assessor Valuation of Livestock Form is a straightforward process. The legality of eSignatures for official documents means you can finalize your submission with ease. Steps within pdfFiller allow for smooth eSigning, significantly reducing the time spent on administrative duties.

Before hitting 'submit,' conduct a thorough review. Create a checklist of essential elements such as owner information, livestock descriptions, and supporting documents. This proactive step can help catch common mistakes, including inaccuracies in numbers or livestock types, that could lead to an incorrect valuation.

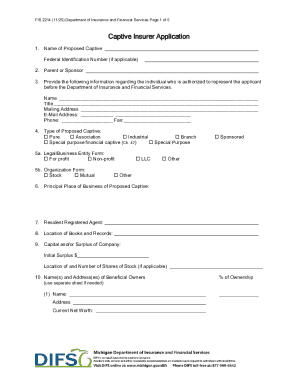

Submitting your valuation form

Once the form is complete and signed, consider your submission method. Online submission often proves more efficient than physical mailing, allowing for real-time tracking of your submission status through county assessor websites. This capability can provide peace of mind as you await assessment results.

Following submission, expect a timeline for processing your valuation. Familiarize yourself with what to anticipate regarding notification, which may take anywhere from a few weeks to several months, depending on your county’s workload. Understanding follow-up procedures is also essential, as you may need to clarify details or provide additional documentation if required.

Navigating assessments and appeals

Understanding your valuation results is critical. Livestock valuations take multiple factors into account—including market trends, animal health, and historical data—to arrive at a fair value. Familiarize yourself with how local laws and regulations impact these assessments, as they can vary significantly from one county to another.

If you find yourself disagreeing with your assessment, it's essential to know how to initiate an appeal. Contact your local county assessor's office to learn about the specific appeal process and ensure that you compile all necessary documentation to support your case. Effective documentation is key to a successful appeal, especially if you believe the assessment undervalued your livestock.

Frequently asked questions (FAQs)

Some common inquiries regarding the Assessor Valuation of Livestock Form might include: Can I amend my livestock valuation after submission? Generally, yes, but it depends on your county's regulations. It’s advisable to reach out to the assessor’s office for specific guidelines on amendments.

Maximizing efficiency with document management platforms

Using pdfFiller goes beyond simply handling the Assessor Valuation of Livestock Form; it can revolutionize how you manage all agricultural documents. The ability to organize various documents—from invoices to contracts—within a single platform increases efficiency and reduces administrative time.

Consider some successful case studies of utilizing pdfFiller. Farmers who faced challenges in document organization reported decreased mailing times and improved accessibility to important documents. They noted that the ease of access benefits not only monthly management but also during seasonal audits and assessments, making document retrieval seamless and stress-free.

Key takeaways for livestock owners

Completing the Assessor Valuation of Livestock Form is a critical task for livestock owners, as it directly affects property taxation and overall financial health. Key elements to recall include the necessity for accurate herd inventory, understanding of market values, and utilizing tools like pdfFiller for effective document management and submission.

Emphasizing the importance of collaboration, accurate information, and utilizing technology, livestock owners can navigate the complexities of assessments with confidence, directly impacting their operational success and financial well-being.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send assessor valuation of livestock to be eSigned by others?

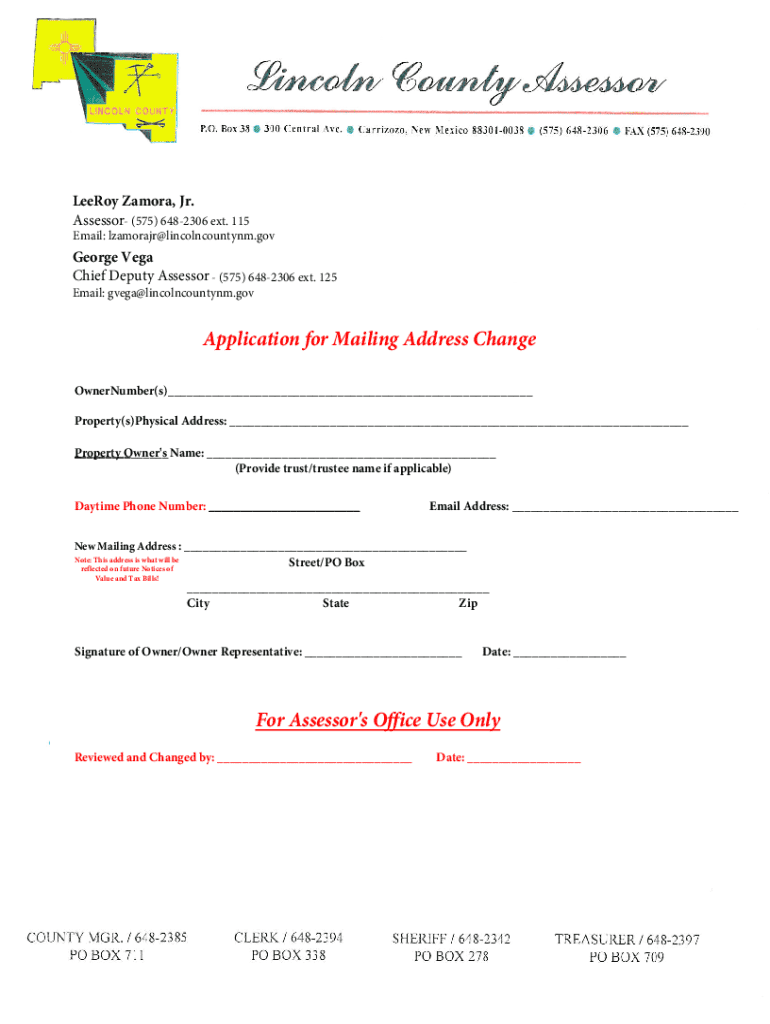

Where do I find assessor valuation of livestock?

How do I edit assessor valuation of livestock straight from my smartphone?

What is assessor valuation of livestock?

Who is required to file assessor valuation of livestock?

How to fill out assessor valuation of livestock?

What is the purpose of assessor valuation of livestock?

What information must be reported on assessor valuation of livestock?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.