Get the free Tax Assessor's Office

Get, Create, Make and Sign tax assessor039s office

Editing tax assessor039s office online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax assessor039s office

How to fill out tax assessor039s office

Who needs tax assessor039s office?

A Comprehensive Guide to Tax Assessor's Office Forms

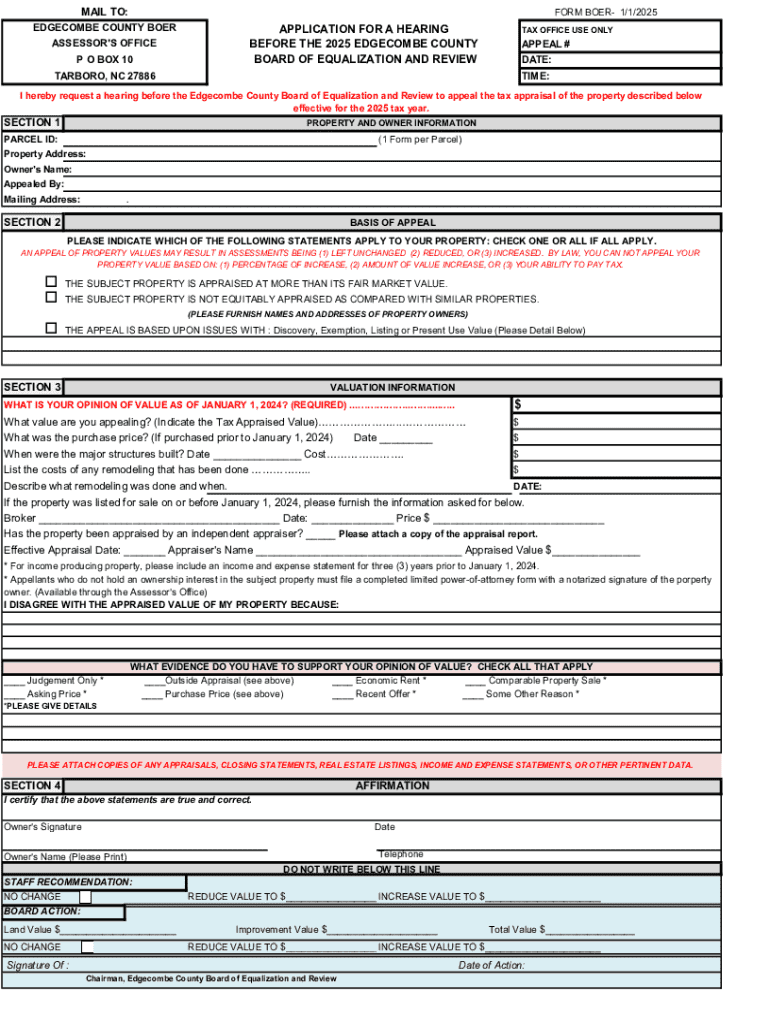

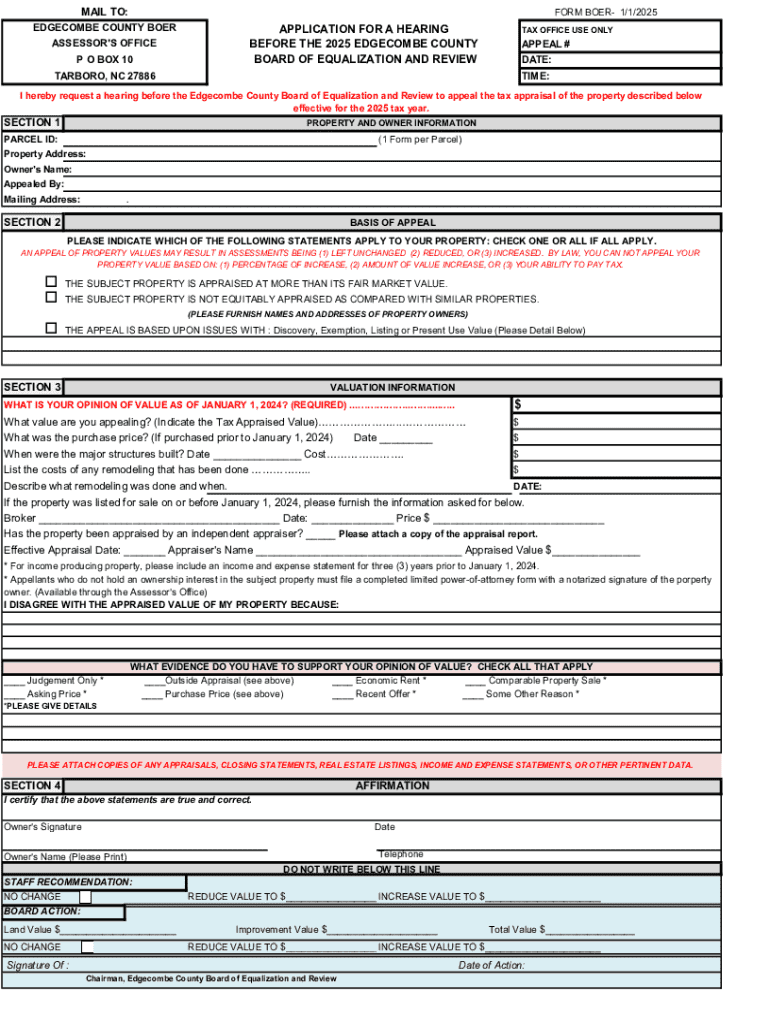

Understanding the Tax Assessor's Office form

The tax assessor's office plays a critical role in determining property values for taxation purposes. This office ensures that properties are accurately assessed for tax liabilities, which provides essential funding for public services such as education, public safety, and infrastructure. Accurate documentation is vital, as incorrect assessments can lead to financial discrepancies that affect municipalities and taxpayers alike.

To navigate the processes associated with property taxes, understanding key terminology is crucial. Terms like 'tax assessment', 'market value', and 'tax relief' are fundamental in context with the tax assessor's office form. Knowing these terms helps individuals complete forms properly and communicate effectively with tax professionals.

Types of Tax Assessor's Office forms

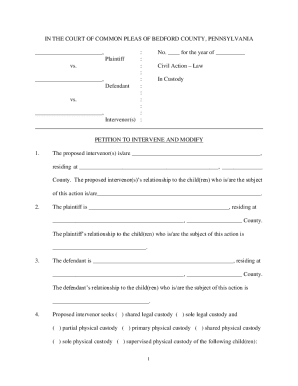

Different forms issued by the tax assessor's office serve various needs in property tax assessment. Commonly used forms include assessment appeals, which allow property owners to contest their property's assessed value, and exemption applications that let eligible homeowners apply for property tax relief. Understanding the right form to use can streamline the process and help avoid unnecessary delays.

Specific forms vary by jurisdiction, such as those used in Tulare County. Each form has its own criteria and submission guidelines, making it critical to choose the correct one based on individual circumstances.

Step-by-step guide to completing the form

Before you start filling out the tax assessor's office form, gather all necessary documents. These may include property deeds, prior tax assessments, and any supporting documents related to exemptions or appeals. Being organized will ease the process and minimize errors.

When you're ready, break down each section of the form. Start by providing your personal information, such as your name, address, and contact details. This information is crucial for the assessor to reach you without delay.

Next, move to the property details section. Here, provide an accurate valuation of your property based on recent assessments or market comparisons. Lastly, for the financial information section, accurately report any income or deductions relevant to the property for tax liabilities.

Editing and submitting the form

With pdfFiller, you can easily edit your forms digitally. First, upload your completed form to the platform, where you can utilize a suite of tools to make necessary changes and add signatures. Digital editing saves time and minimizes the likelihood of losing important documents.

Once you're satisfied with the form, you can sign it electronically and promptly submit it through various channels. Many tax assessor offices now accept online submissions, but if you prefer, you can submit in person. Be sure to check the specific submission method required in your jurisdiction, which can differ significantly.

After submission: What to expect

After you've submitted your form to the tax assessor's office, it typically takes a few weeks to process. During this period, the office will review your information and may reach out if further clarification or supporting documents are needed. Staying responsive can expedite the review, ensuring a smoother assessment process.

Depending on the outcome, you may receive approval for your appeal or exemption. If denied, the letter will often outline the rationale behind the decision and will inform you of any next steps, such as an opportunity for further appeal.

Resources for further assistance

Should you need extra support, you can reach out to your local tax assessor's office directly. They can offer guidance specific to your situation, available services, and details on how to fill forms correctly. Familiarizing yourself with their contact information ensures you can get help promptly.

Additionally, a FAQ section on many tax assessor websites can clarify common doubts related to forms and submission processes. These resources can be especially useful if you're new to the property tax system or are submitting a form for the first time.

Leveraging pdfFiller for document management

Using pdfFiller for tax forms provides an array of benefits. The platform allows users to edit PDFs efficiently, use eSignatures, and collaborate with others seamlessly. This can be particularly advantageous in team situations where multiple stakeholders need to review or sign tax-related documentation.

By automating and streamlining the form management process, individuals and teams can increase overall productivity. Testimonials from users indicate significant time savings and reduction in errors when utilizing pdfFiller for their property tax forms.

Interactive tools available on pdfFiller

pdfFiller also offers various interactive tools designed to assist users in calculating taxes and assessing forms. These tools simplify complex calculations and provide step-by-step templates tailored specifically for property taxes. Utilizing these unique resources can enhance your understanding and efficiency when preparing and submitting your forms.

Staying informed about any recent updates or changes in tax assessment laws is crucial for accurately filling out forms. Changes can affect deduction limits, assessment criteria, or eligibility for specific programs. Regularly check reliable platforms and your tax assessor's office for the latest information.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my tax assessor039s office directly from Gmail?

How do I execute tax assessor039s office online?

Can I sign the tax assessor039s office electronically in Chrome?

What is tax assessor039s office?

Who is required to file tax assessor039s office?

How to fill out tax assessor039s office?

What is the purpose of tax assessor039s office?

What information must be reported on tax assessor039s office?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.