Get the free Pay Personal Property Taxes - Lunenburg County E-Services

Get, Create, Make and Sign pay personal property taxes

How to edit pay personal property taxes online

Uncompromising security for your PDF editing and eSignature needs

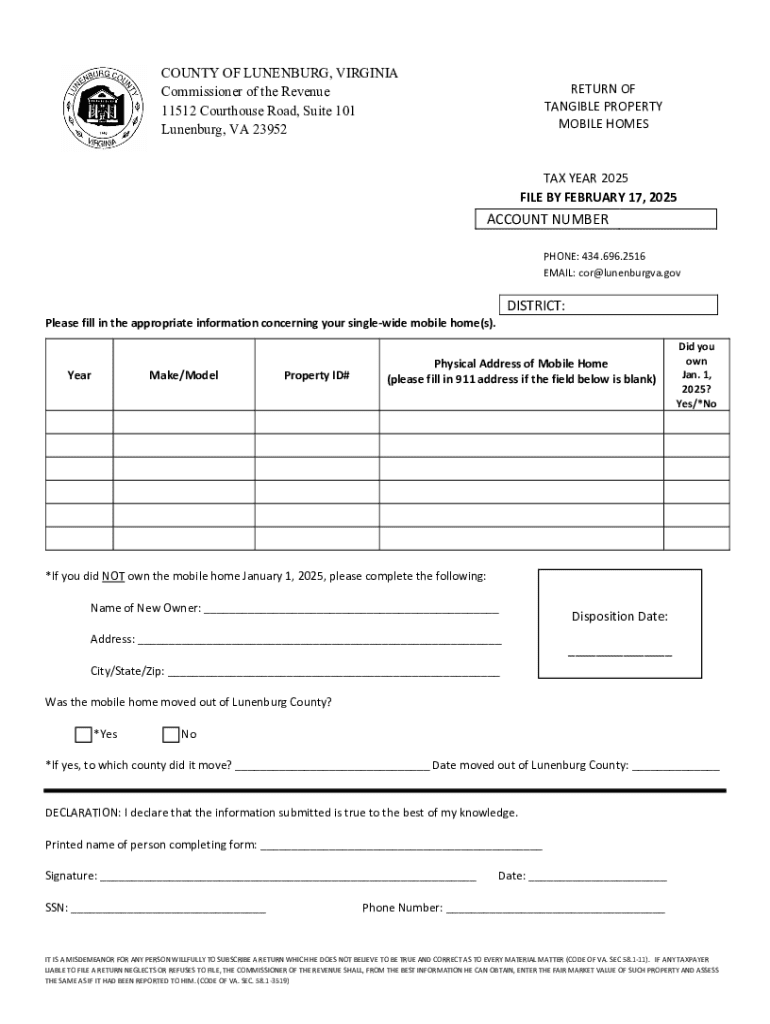

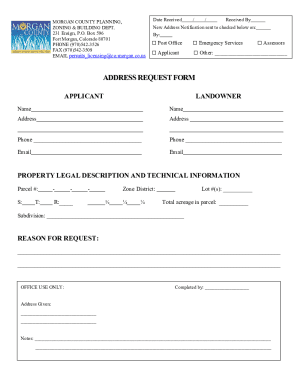

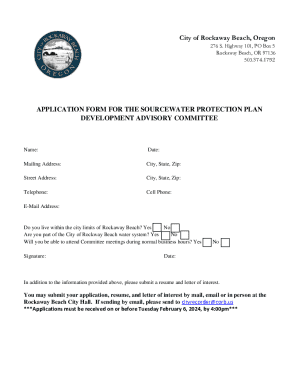

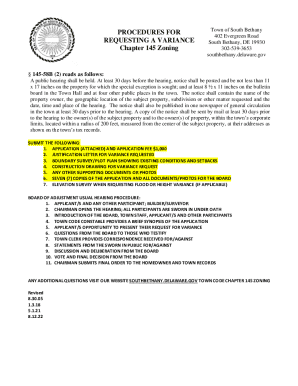

How to fill out pay personal property taxes

How to fill out pay personal property taxes

Who needs pay personal property taxes?

How to Pay Personal Property Taxes - Detailed Guide

Understanding personal property taxes

Personal property taxes are levies imposed on movable assets owned by individuals and businesses. Unlike real property taxes assessed on land and buildings, personal property taxes focus on items that aren't fixed to the ground, such as vehicles, boats, and machinery. These taxes are crucial in supporting local infrastructures, such as schools and public safety, making timely payment not just a legal responsibility but also a civic duty.

Northeast Mecklenburg County, NC, exemplifies the importance of these taxes as they directly impact funding for essential community services. It's important to understand what items qualify as personal property. Common assets that fall under this category include motor vehicles, recreational vehicles, and business equipment, all of which are subject to varying tax rates.

Overview of the payment process

Paying your personal property taxes involves adhering to specific timelines and choosing the right method that suits your needs. Tax assessment notices are generally sent out at least a month before the payment due date, allowing you time to prepare. Key deadlines depend on your local tax authority, such as the Mecklenburg County Tax Collector's office, which typically implements a spring tax payment schedule.

Preparing to pay your personal property taxes

Preparation is key when it comes to paying your personal property taxes. Gathering all necessary documentation will streamline the process significantly. The primary document you will require is your tax assessment notice, which provides crucial details about your tax liability and assessed property value. Additionally, having identification documents on hand can simplify verification requirements.

Understanding your tax bill is equally important. Typically, your tax bill will detail not only the total amount due but also provide a breakdown of charges. This could include various tax rates based on property type, local service charges, and any applicable exemptions you may qualify for, which can significantly affect the amount owed.

Step-by-step guide to paying personal property taxes

Now that you have the necessary documentation and understand your tax bill, you can proceed with the payment. Here’s a detailed guide to ensure an efficient process.

Utilizing pdfFiller for efficient tax management

pdfFiller offers a robust platform that simplifies tax document management. Once you've paid your personal property taxes, you might need to update or edit the associated documents. With pdfFiller, you can easily edit your documents to reflect your current tax status, ensuring you maintain up-to-date records throughout the year.

Moreover, if you require confirmation of payment, e-signing your tax payment confirmation is straightforward. The platform provides a user-friendly interface where you can electronically sign documents, making it simple to create a legally binding document without the hassle of printing or scanning.

Troubleshooting payment issues

Encountering issues while trying to pay your personal property taxes can be frustrating, but knowing common problems can help you address them effectively. One frequent issue is not receiving payment confirmation after transaction completion. If this occurs, check your email’s spam folder or confirm you provided the correct email address during the transaction.

If you face difficulties logging into the payment portal, ensure you’re using the correct credentials or reset your password if needed. For further assistance, contacting pdfFiller's customer support can provide you with the help required to resolve any technical issues. The support team is available via email and often responds promptly, making it easy to navigate any roadblocks.

Exploring additional tax resources

For a thorough understanding of your personal property taxes, it’s essential to use additional resources. The Mecklenburg County Tax Office website provides information tailored to state-specific laws and regulations regarding personal property taxes. Furthermore, understanding tax deductions related to personal property can save you money. Researching deductions on equipment used for business can significantly reduce your tax liability.

Numerous educational resources on tax management are available online. Websites offering tax management tips can help demystify complex tax issues, ensuring you stay informed and compliant with local tax laws.

Staying informed on tax updates

Tax regulations and deadlines can change, making it crucial to stay informed. Subscribing to tax newsletters from reliable sources or agencies ensures you receive timely updates regarding tax laws that may affect your personal property taxes. These updates could inform you of new exemptions or changes in assessment methods, helping you to prepare accordingly.

You can utilize pdfFiller as a long-term solution for ongoing document management. The ease of updates through the platform allows you to maintain accurate records related to your personal property taxes, ensuring that you’re always compliant and informed.

Interactive tools offered by pdfFiller

pdfFiller not only provides a platform for managing your personal property tax documents but also offers interactive tools that make tax filing a breeze. A live demo demonstrating document tools can showcase how to fill out tax forms and utilize features seamlessly.

The FAQ section on the pdfFiller website addresses common queries regarding personal property taxes. This section is particularly useful for quick answers to questions about tax rates, filing procedures, and document submission methods, providing a comprehensive source of information.

Streamlining future tax payments

Planning ahead for your personal property taxes can alleviate stress when the payment deadline approaches. Utilizing pdfFiller to set up reminders and notifications ensures you won’t miss essential deadlines each year. You can configure alerts that notify you when tax assessments are sent out and when payments are due.

Additionally, the platform allows for yearly updates and forms to be stored and easily accessed when needed. This streamlining of the filing process ensures you remain organized and ready each tax season, ultimately simplifying your personal property tax management experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit pay personal property taxes on a smartphone?

How do I edit pay personal property taxes on an iOS device?

How do I complete pay personal property taxes on an iOS device?

What is pay personal property taxes?

Who is required to file pay personal property taxes?

How to fill out pay personal property taxes?

What is the purpose of pay personal property taxes?

What information must be reported on pay personal property taxes?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.