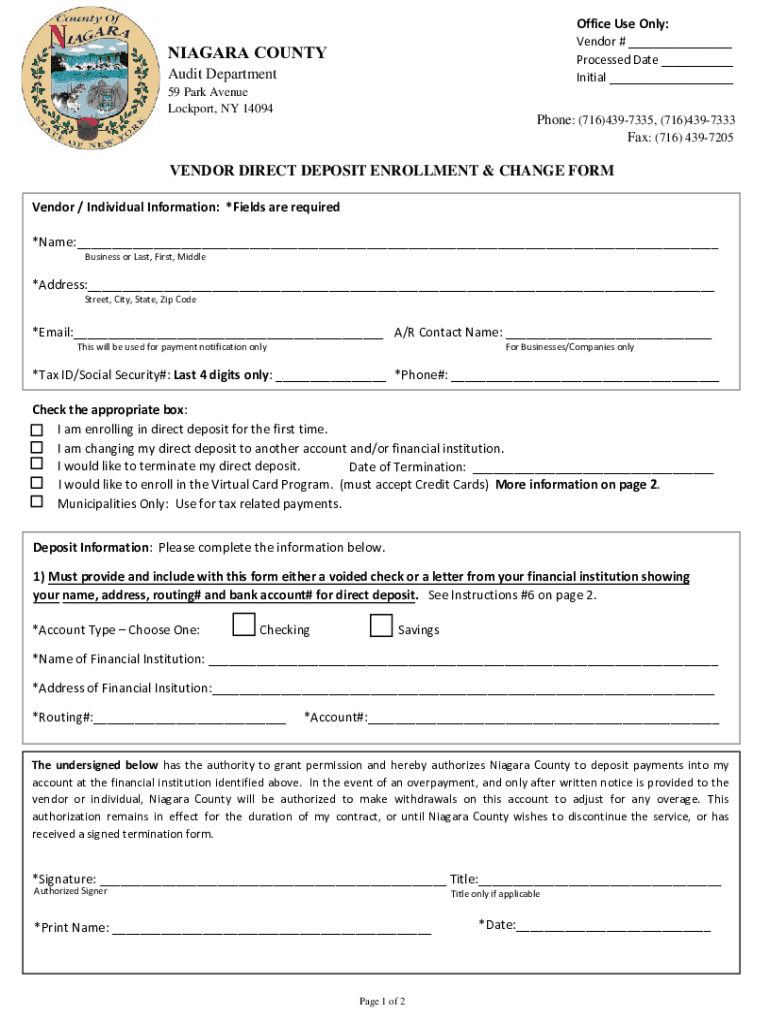

Get the free Vendor Direct Deposit Enrollment & Change Form

Get, Create, Make and Sign vendor direct deposit enrollment

How to edit vendor direct deposit enrollment online

Uncompromising security for your PDF editing and eSignature needs

How to fill out vendor direct deposit enrollment

How to fill out vendor direct deposit enrollment

Who needs vendor direct deposit enrollment?

Vendor Direct Deposit Enrollment Form – How-to Guide Long-read

Understanding Direct Deposit Enrollment

Direct deposit is a payment method that allows funds to be electronically transferred directly into a bank account. Instead of receiving a physical check, vendors receive payments straight into their designated financial institutions. This process streamlines transactions, making it an increasingly popular choice for businesses and their vendors.

Vendors in the state of Oregon, for instance, benefit significantly from this payment method, especially when it comes to travel reimbursements and prompt payment for services rendered. Understanding the enrollment process is crucial for ensuring timely payments without any hitches.

Benefits of direct deposit

The advantages of opting for direct deposit over traditional payment methods are multifaceted:

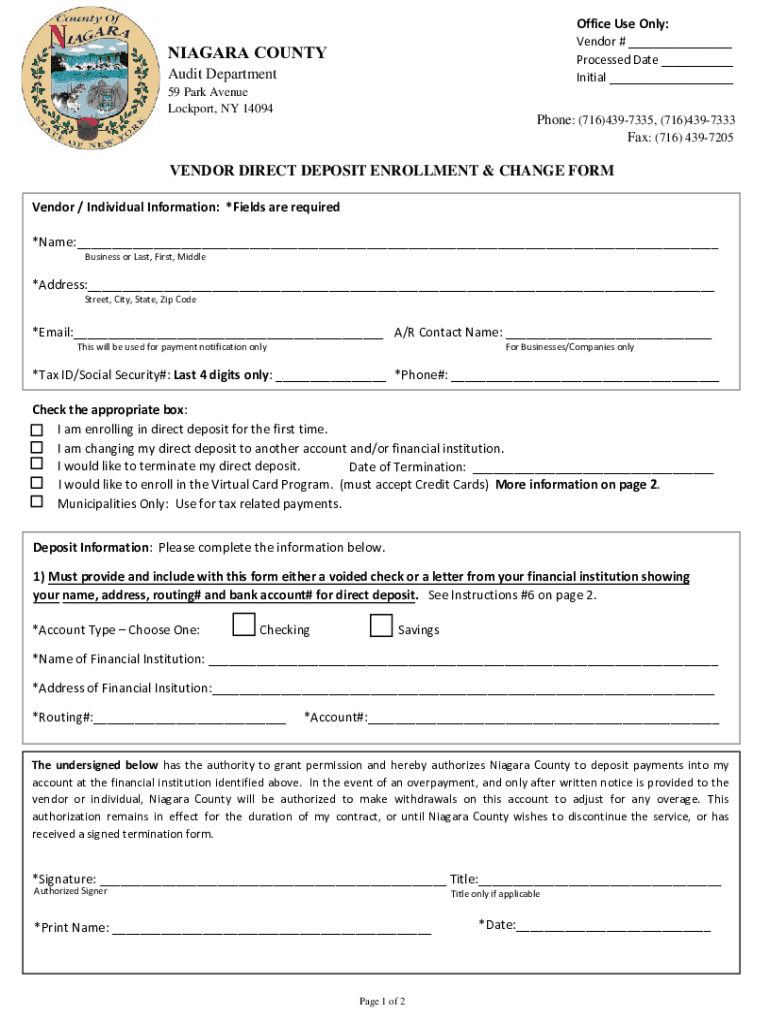

Overview of the vendor direct deposit enrollment form

To initiate direct deposit, vendors must complete a vendor direct deposit enrollment form. This document serves as a formal request to their organization and it gathers essential banking details to facilitate the smooth transfer of funds.

Purpose of the enrollment form

Completing the enrollment form is critical for vendors as it establishes a direct line for payments. Without this form, organizations cannot process funds directly to a vendor's account, leading to potential delays in payment and increased administrative overhead.

Key components of the form

Some essential components required on the form include:

It's vital for vendors to ensure accuracy in these details to avoid payment issues.

Explaining the process of completing the vendor direct deposit enrollment form

Filling out the vendor direct deposit enrollment form doesn't have to be complex. Follow these steps for a smooth enrollment.

Step-by-step instructions

**Step 1:** Gathering Required Information

Before starting, gather essential documents such as your business identification number, bank statements, and identification documents, which will ensure you have all necessary information.

**Step 2:** Filling Out the Form

As you fill out the form, pay close attention to the instructions for each section. Here are crucial tips to avoid common mistakes:

**Step 3:** Submission of the Form

Once completed, submit the form through the preferred channels specified by your organization. Options typically include online submission via a secure portal or mailing a physical copy. For any inquiries, vendors are encouraged to email questions directly to the finance department for clarity.

Monitoring your submission

After submission, keeping track of your application status is prudent. Organizations often provide confirmation timelines, typically ranging from a few days to a couple of weeks, depending on their processing capabilities. It's advisable to follow up if confirmation isn't received within those timelines.

Frequently asked questions (FAQs)

What happens if make a mistake on my form?

If an error is noticed after submission, promptly contact your finance department to rectify it. Depending on the nature of the mistake, they may require you to fill out a corrected form. Accuracy is essential, especially concerning bank details.

How long does it take to set up direct deposit?

While some applications can be processed within a week, others may take longer depending on the submission volume and specific organizational procedures. It's always beneficial to inquire during your submission about expected processing times.

Can change my bank account once enrolled?

Yes, vendors can update their banking details. This typically involves submitting a new vendor direct deposit enrollment form with the updated information. Be aware that changes may temporarily disrupt payments, so plan accordingly.

Security considerations

How secure is the vendor direct deposit process?

Security is paramount when it comes to electronic payments. The vendor direct deposit process incorporates various security measures to protect sensitive information including encryption. Vendors should ensure they utilize secure platforms, like pdfFiller, which are designed to keep their data safe.

Protecting your financial information

To safeguard your personal and banking data, consider the following tips:

Alternative payment methods

What are other payment options?

While direct deposit is a frontrunner, other payment methods include traditional checks and ACH payments. Each method has its pros and cons that vendors should consider:

Vendors might prefer alternatives based on their specific circumstances, such as cash flow needs or personal preferences.

When to consider switching payment methods

Indicators that direct deposit may not be suitable include experiences of frequent payment errors or dissatisfaction with processing times. Pay attention to your financial stability and consider alternative methods that might better align with your business operations.

Utilizing pdfFiller for smooth enrollment

How pdfFiller simplifies the process

pdfFiller enhances the direct deposit enrollment experience by providing a user-friendly, cloud-based platform. Users can access the vendor direct deposit enrollment form from anywhere, making it easy to work on documents as needed. The platform supports editing, signing, and sharing, streamlining the process, and reduces errors.

Navigating the pdfFiller platform

Getting the most out of pdfFiller is simple. Users can make use of its interactive tools to fill out forms correctly, add electronic signatures, and manage submitted documents efficiently. Additionally, orgs can save completed forms in an organized manner and access them whenever required.

Final thoughts on vendor direct deposit

The future of payments for vendors

As technology advances, it is evident that direct deposit will continue to dominate the payment landscape for vendors. The sheer convenience, security, and speed are compelling reasons to adopt this payment method over traditional alternatives. Embracing developments such as these will enable vendors to stay competitive and efficient.

Encouragement to embrace digital solutions

By leveraging tools such as pdfFiller, organizations can enhance their document management processes significantly. Vendors should not only invest time in learning about the vendor direct deposit enrollment form but also use these digital solutions for optimizing their payment processes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in vendor direct deposit enrollment?

How do I make edits in vendor direct deposit enrollment without leaving Chrome?

How can I edit vendor direct deposit enrollment on a smartphone?

What is vendor direct deposit enrollment?

Who is required to file vendor direct deposit enrollment?

How to fill out vendor direct deposit enrollment?

What is the purpose of vendor direct deposit enrollment?

What information must be reported on vendor direct deposit enrollment?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.