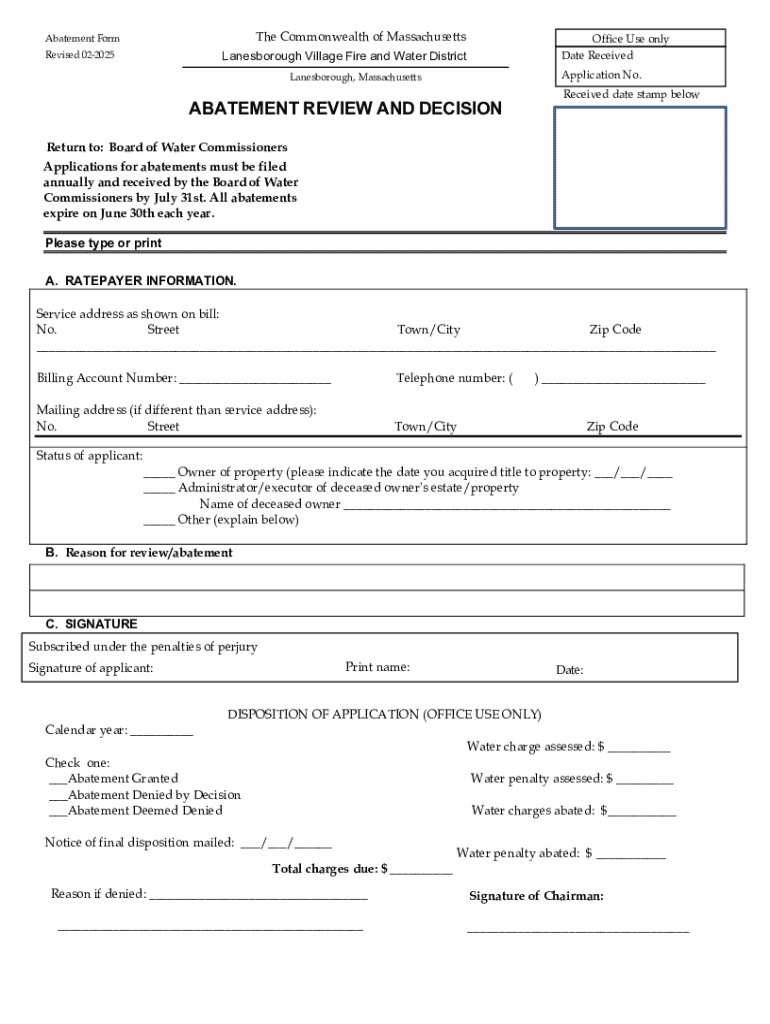

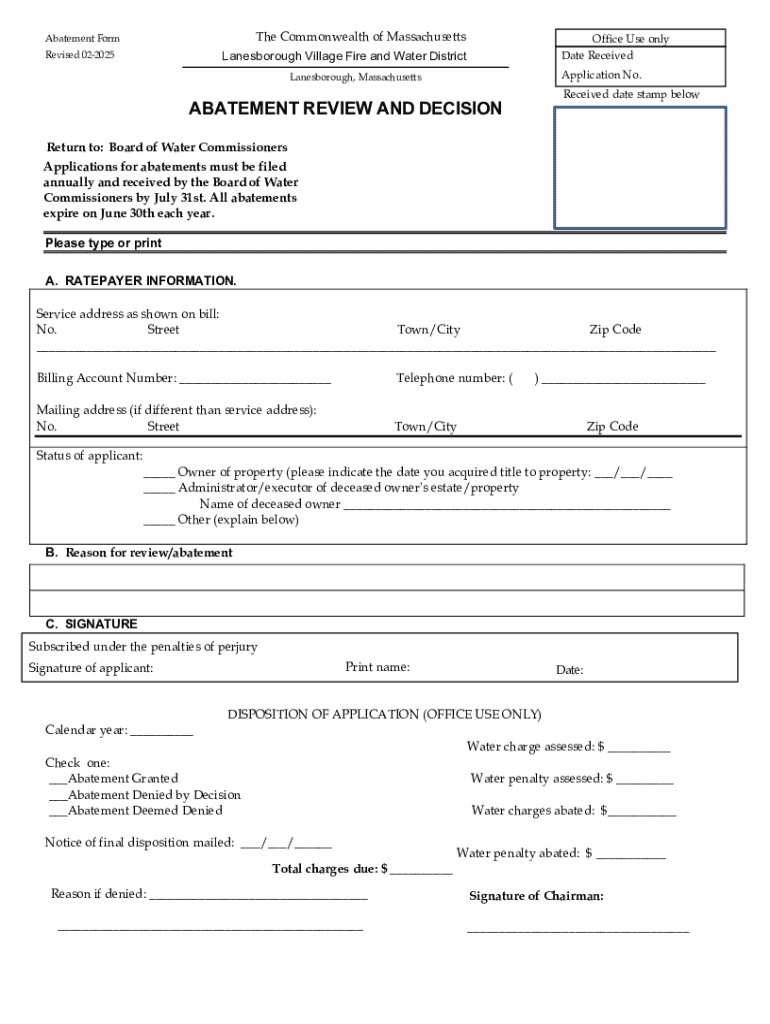

Get the free ABATEMENT REVIEW AND DECISION

Get, Create, Make and Sign abatement review and decision

Editing abatement review and decision online

Uncompromising security for your PDF editing and eSignature needs

How to fill out abatement review and decision

How to fill out abatement review and decision

Who needs abatement review and decision?

Abatement Review and Decision Form: A Comprehensive Guide

Understanding the abatement review and decision form

The abatement review and decision form is a crucial document for obtaining relief from tax penalties imposed by the IRS or state agencies. This form provides individuals and businesses the opportunity to request a reduction or cancellation of these penalties by demonstrating valid circumstances surrounding their situation. The importance of this form cannot be overstated, especially for those who may face financial strain due to unexpected life events which led them to miss crucial tax deadlines.

The relevance of this form lies in its capability to save taxpayers from unnecessary financial burdens. Individuals experiencing extenuating circumstances such as medical emergencies or natural disasters can leverage this form for potential relief. Eligibility criteria generally include being compliant with tax filings and payments and presenting a reasonable cause for the missed deadlines.

Types of abatement reviewed

There are various types of penalty relief that can be pursued through the abatement review and decision form. Understanding each type helps in determining the most viable option for your specific situation.

First-time penalty abatement (FTA)

The First-Time Penalty Abatement (FTA) is available for taxpayers who have been compliant with tax filings and payments in the past. To qualify for FTA, an individual must not have previously incurred a penalty for three years and must also have filed all required tax returns for the previous years.

Reasonable cause relief

Reasonable cause relief allows taxpayers to request abatement for penalties incurred due to unforeseen circumstances. To successfully appeal for reasonable cause, taxpayers must provide thorough documentation that supports their claims.

Statutory exception waiver

Statutory exception waivers are meant for circumstances defined by law where penalties should be removed. Situations like erroneous advice from tax authorities or significant disruptions due to natural disasters qualify for this waiver. Documenting the specifics of these exceptions is critical.

How to complete the abatement review and decision form

Completing the abatement review and decision form effectively requires careful attention to detail. Follow these step-by-step instructions for submitting a thorough application.

Step-by-step instructions

Common mistakes include omitting required information such as tax identification numbers, providing insufficient documentation, or failing to sign the form. Double-checking all entries can prevent unnecessary delays.

Submitting your abatement review and decision form

Understanding the methods of submission is essential for a smooth process. There are several options available for submitting your abatement review and decision form.

Tracking the status of your submission is vital. Many agencies offer online tracking capabilities, providing reassurance during the waiting period.

What to expect after submission

Once you've submitted your abatement review and decision form, it's crucial to know what happens next. The review process generally involves a thorough examination by tax authority personnel.

When and how to appeal a decision

If your request for abatement is denied, it’s important to understand your options for appeal. Grounds for appealing a decision typically revolve around procedural errors or lack of consideration of new evidence.

Interactive tools and resources

pdfFiller offers a range of tools to assist you with document management and completing the abatement review and decision form. Utilizing these resources simplifies the process and enhances your chances of success.

FAQs about the abatement review and decision form

The abatement review and decision form evokes many common inquiries among users. Addressing these questions assists in demystifying the process and encouraging users to take appropriate action.

Best practices for managing tax penalties

Managing tax penalties requires a proactive approach to compliance and maintaining appropriate records. Long-term strategies include setting reminders for tax deadlines and consulting with tax professionals.

Conclusion: Empowering your tax management with pdfFiller

Utilizing the abatement review and decision form effectively empowers users to take control of their tax situations. pdfFiller streamlines document creation and management, allowing users to focus on what truly matters — their financial well-being.

By increasing your understanding of the abatement process and leveraging innovative tools available, you can minimize penalties and enhance your overall tax management strategy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit abatement review and decision in Chrome?

Can I sign the abatement review and decision electronically in Chrome?

How do I edit abatement review and decision on an Android device?

What is abatement review and decision?

Who is required to file abatement review and decision?

How to fill out abatement review and decision?

What is the purpose of abatement review and decision?

What information must be reported on abatement review and decision?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.