Get the free 2025 Form 5500 Series Informational Copies Released

Get, Create, Make and Sign 2025 form 5500 series

How to edit 2025 form 5500 series online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 form 5500 series

How to fill out 2025 form 5500 series

Who needs 2025 form 5500 series?

2025 Form 5500 Series Form: A Comprehensive How-to Guide

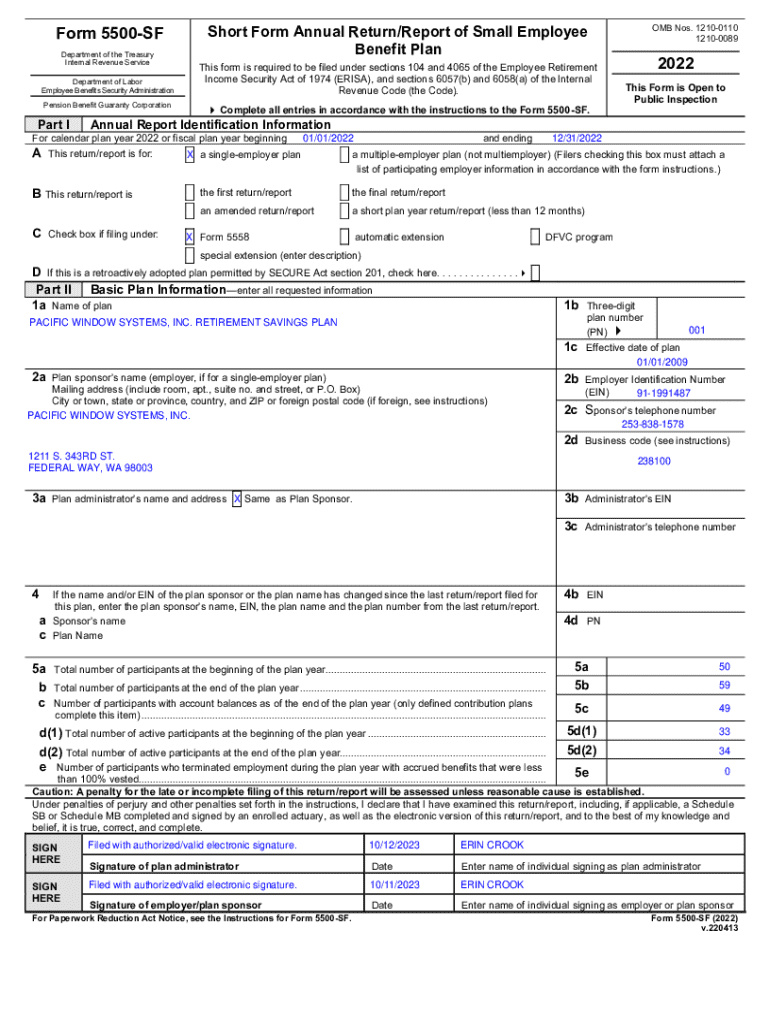

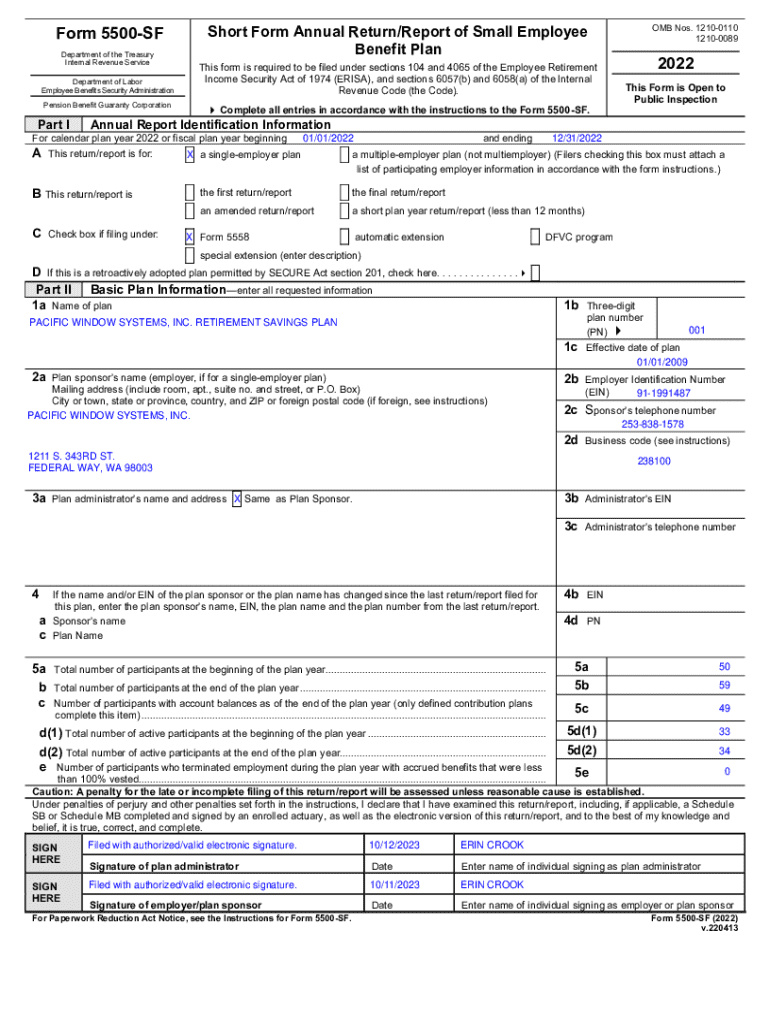

Understanding the Form 5500 series

The Form 5500 series serves as a cornerstone for compliance with the Employee Retirement Income Security Act (ERISA). Designed to provide the government, plan participants, and the public with crucial information about employee benefit plans, it ensures accountability and transparency within the retirement and health plans sector.

Key stakeholders include employers, who are responsible for accurate reporting; plan participants, who rely on this information to understand their rights and benefits; and government regulators, who use the data to monitor compliance with federal regulations. The insight provided through these forms allows for better consumer protection and regulatory oversight.

Significant changes are evident in the 2025 Form 5500 series compared to previous years, with new requirements emphasizing transparency and adherence to changing regulations. Understanding these changes will help stakeholders navigate their reporting responsibilities effectively.

Quick links for navigating the Form 5500 series

Accessing the 2025 Form 5500 series online is crucial for ease of filing. The forms and supporting documents are available on the official website, streamlining the process for users. Direct links allow for quick downloads and reference to related filing resources.

Frequently asked questions about the filing process can provide clarity, particularly regarding the differences between electronic and paper submissions. Understanding these aspects can simplify the workload and enhance accuracy.

Electronic filing requirements

For the 2025 reporting period, electronic filing is not just a modern convenience; it is a requirement for many plan sponsors. Eligible entities for electronic submission include those with 100 or more participants in their plans. This policy is set to enhance efficiency, reduce errors, and streamline government processing.

The benefits of choosing electronic filing include faster processing times, immediate confirmation of filing, and automated error-checking. Thus, it’s critical for eligible employers to comply with these requirements.

When preparing to file electronically, specific software and tools are required. To facilitate the process, plan sponsors need to engage with the specified electronic filing system provided by the government. Here’s a basic guide to electronic filing steps:

Filling out the 2025 forms

The complexity of the 2025 Form 5500 series requires careful attention to detail. Each section demands specific information that collectively shapes the entire filing. Understanding the layout can significantly ease the filing process.

Part I requires basic information about the plan, such as the name, type, and identifying numbers. This section sets the foundation for the rest of the form.

Part II focuses on financial information, including balance sheets and income statements. This section identifies the financial health of the plans and enables regulators to assess risks adequately.

Part III involves plan characteristics, addressing the demographics of the participants and the specific benefits offered. Ensuring accuracy in this section is vital for compliance.

Forms and filing instructions

Filing the 2025 Form 5500 involves working with several related forms, from Schedule A to Schedule R, each fulfilling different filing requirements. Understanding the differences between these forms is essential for complete compliance.

For instance, Schedule A deals with insurance information, while Schedule C requires reporting on service providers. Each schedule must be accurately filled out and attached to the main form to ensure compliance with ERISA regulations.

Here’s how to fill out each of the related forms accurately:

ERISA reporting forms

Understanding ERISA reporting obligations is crucial for all plan sponsors. Those required to report include employers with defined benefit plans, defined contribution plans, and welfare benefit plans. The timeline for reporting is generally within seven months after the end of the plan year.

Plans that meet certain criteria might qualify for an extension, but awareness of all reporting obligations remains essential to avoid penalties.

For clarity, consider a scenario where a company with a defined benefit plan is closing down its operations. They must file Form 5500 to inform the Department of Labor and protect participant rights concerning their benefits. Understanding such reporting responsibilities in various situations will lead to greater compliance and risk management.

Model notices and forms

Model notices serve a vital role in ensuring compliance with ERISA. They provide standard formats for communicating plan-related information to participants effectively. These notices cover aspects such as Summary Plan Descriptions (SPDs) and Qualified Default Investment Alternatives (QDIAs).

Customizing these model notices to fit specific plans is essential. Start with the template and adjust the content according to your plan’s features while ensuring compliance with all regulatory mandates.

Filing searches made easy

Conducting a filing search is essential for validating past submissions and understanding compliance history. The Department of Labor’s searchable database allows users to access filings efficiently, ensuring that necessary documents are readily available for review.

To perform a search effectively, follow these steps:

Need help finding something?

If any issues arise during the filing process, various support options are available. For immediate assistance, contact government agencies or utilize help lines provided on their websites. Access to user forums and communities can also provide valuable insights from peers navigating similar challenges.

pdfFiller offers document management solutions that simplify the filing process. With tools to fill, edit, sign, and manage the 2025 Form 5500, pdfFiller supports users every step of the way, enhancing the compliance experience seamlessly.

Utilizing pdfFiller for your document needs

Choosing pdfFiller for managing the 2025 Form 5500 is a strategic advantage. With seamless editing and eSigning features, users can personalize their documents effortlessly. The platform allows for collaborative efforts among teams, ensuring that all necessary stakeholders can contribute to the filing process.

The cloud-based solution provides accessibility from anywhere, enabling users to complete their forms without being tied to a specific location. This flexibility is beneficial not only for teams but also for individuals who need to file documents promptly and accurately.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 2025 form 5500 series to be eSigned by others?

Can I create an eSignature for the 2025 form 5500 series in Gmail?

How do I fill out 2025 form 5500 series on an Android device?

What is 2025 form 5500 series?

Who is required to file 2025 form 5500 series?

How to fill out 2025 form 5500 series?

What is the purpose of 2025 form 5500 series?

What information must be reported on 2025 form 5500 series?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.