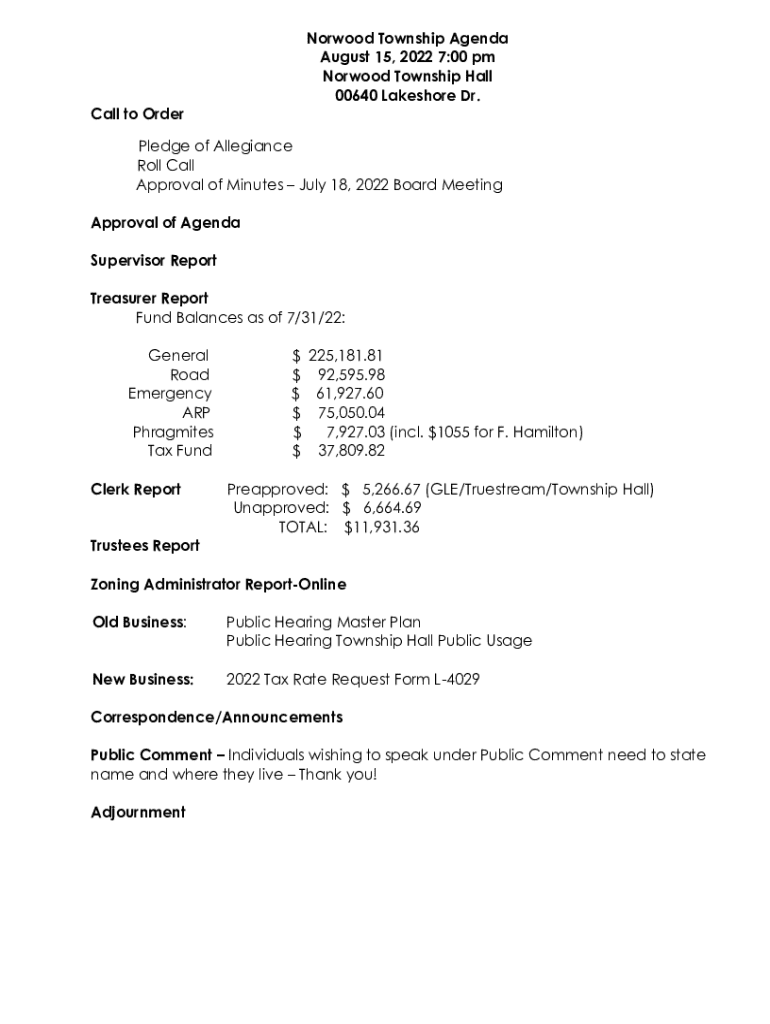

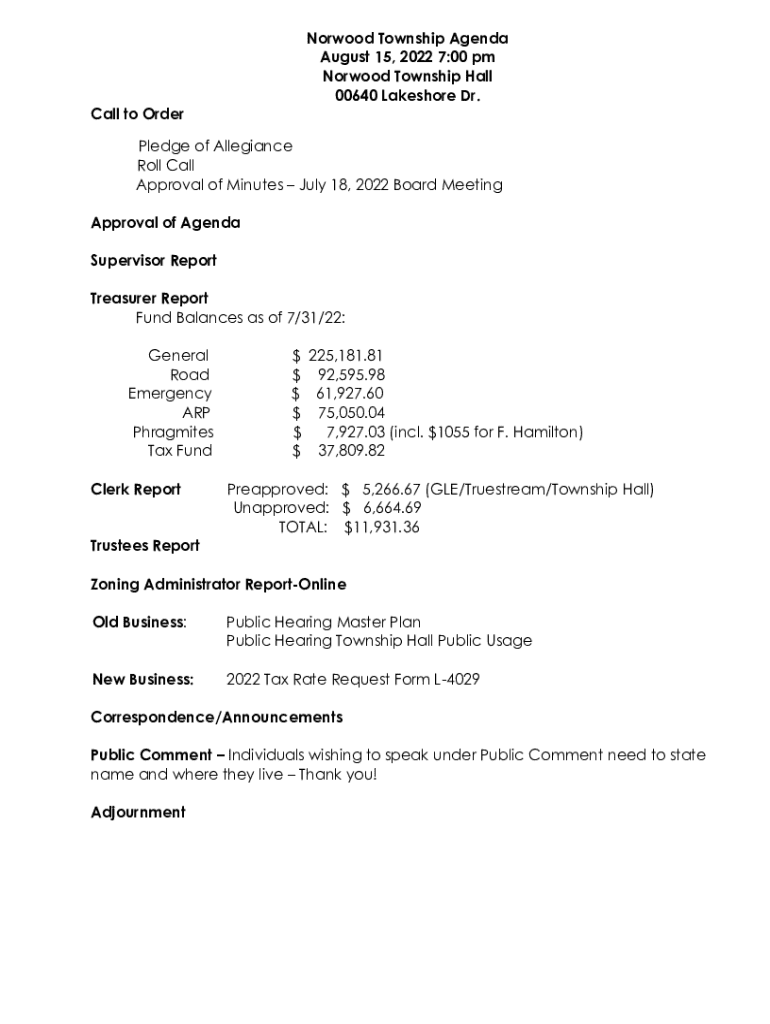

Get the free Fund Balances as of 7/31/22:

Get, Create, Make and Sign fund balances as of

Editing fund balances as of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out fund balances as of

How to fill out fund balances as of

Who needs fund balances as of?

Understanding Fund Balances as of Form: A Comprehensive Guide

Understanding fund balances

Fund balances represent the net position of a fund at a specific point in time, reflecting the difference between inflows and outflows. They are vital components of financial statements, providing insights into the financial position of an organization. Properly recorded and classified fund balances help stakeholders understand the availability of resources for future expenditures.

What are fund balances?

Fund balances are essentially the equity of governmental funds, consisting of the accumulated resources available for spending or obligating in the future. Understanding their classification and significance allows decision-makers to assess fiscal health and allocate resources effectively.

Types of fund balances

Fund balances can be categorized into four primary classifications: restricted, unrestricted, committed, and assigned. Each classification indicates a different level of constraint regarding how these funds can be used:

Role of fund balances in financial reporting

The role of fund balances in financial reporting is crucial for presenting an accurate picture of an entity’s financial health. They not only reflect the resources available for future expenditures but also impact management's decisions on budgeting and spending. Proper classification of these balances aids in effective financial planning and accountability.

Importance of proper fund balance reporting

Accurate reporting of fund balances is essential because it ensures transparency and accountability within an organization. Stakeholders, including taxpayers and investors, rely on this information to make informed decisions regarding resource allocation and fiscal viability.

Why accurate reporting matters

When financial statements are accurate and reflect true fund balances, it builds trust among stakeholders. Conversely, misclassifications can lead to misunderstandings about an organization’s fiscal health, potentially influencing funding and investments negatively.

Common pitfalls in fund balance reporting

Common pitfalls include misclassifying restricted and unrestricted balances, which can obscure the financial reality of the organization. Additionally, overlooking fiscal responsibilities related to committed and assigned funds can lead to misallocation of resources, ultimately affecting the net position.

Navigating the fund balances form

The fund balances form encapsulates the essential information required for accurately representing a fund’s financial position. Its primary purpose is to summarize the financial standing as of a specific date, ensuring that the recorded balances align with the classifications expected in financial reporting.

Overview of the fund balances form

Understanding how to fill out the fund balances form is crucial for achieving accurate reporting. Key sections often include areas to input restricted fund balances, unrestricted balances, and a classification framework for committed and assigned balances. Each section corresponds to a specific category, offering clarity in reporting.

Step-by-step guide to completing the form

Completing the fund balances form properly involves several steps. Before diving in, ensure you have all necessary financial data at hand. Here’s a structured approach to completing the document effectively:

Editing and managing fund balance data

Once the fund balances form is completed, maintaining accurate and dynamic fund balance data is essential. pdfFiller offers robust tools that facilitate easy editing and management of this data, promoting accuracy and collaboration among team members.

Using pdfFiller for editing and collaboration

With pdfFiller, users can effortlessly upload the fund balances form and utilize various editing tools. This capability allows teams to adjust and refine entries as necessary, ensuring correctness. The platform's collaboration features further streamline this process, enabling real-time feedback among team members.

Collaborative features for team input

One remarkable aspect of pdfFiller is the ability to invite colleagues to provide input on the form. This real-time collaboration fosters an environment of shared responsibility and accountability, leading to more accurate fund balance reporting. Commenting features facilitate discussions about each entry, ensuring clarity and cohesion.

eSigning and approving fund balances

Getting the necessary signatures on the fund balance forms is essential for compliance and approval. The eSigning process through pdfFiller is straightforward and secure, allowing users to obtain digital signatures quickly, thus improving the workflow significantly.

Tracking signatures and document flow

Keeping track of who has signed the document and any modifications made is crucial for maintaining the integrity of the information reported. pdfFiller’s tracking features ensure that all changes and approvals are documented, providing a clear audit trail that can be invaluable during financial reviews.

Frequently asked questions about fund balances

As with any area of financial reporting, questions often arise concerning the management of fund balances. Addressing these can significantly enhance understanding and compliance within organizations.

Common questions answered

Common queries often involve topics such as handling errors discovered after submission or modifying fund balances once reported. Understanding the procedures for rectifying such issues can alleviate concerns and prevent lapses in compliance.

Best practices for fund balance management

To promote optimal fund balance management, organizations should consider the following best practices:

Advanced insights on fund balances

Analyzing trends in fund balances over time can reveal valuable insights about financial management and forecasting. Understanding these trends can empower organizations to make strategic decisions about future funding and expenditures.

Analyzing fund balance trends over time

Interpreting changes in fund balances can help organizations identify patterns in financial inflows and outflows, guiding future planning. This data-driven approach facilitates informed decision-making, ensuring that strategies align with both short-term needs and long-term financial stability.

Tools for fund balance analysis

pdfFiller offers interactive functionalities that enhance the analysis of fund balances. By utilizing the available tools, users can delve deeper into the data, conducting thorough assessments that support sound financial strategies.

Case studies and real-world applications

Examining case studies of successful fund balance management provides practical insights for organizations striving to enhance their financial reporting practices.

Examples of successful fund balance management

Organizations that have effectively managed their fund balances often attribute their success to clear strategies, robust documentation, and regular reviews of their fund status. Learning from these case studies can reveal actionable lessons and best practices that improve accountability and performance.

Keeping up with regulatory changes

Financial regulations frequently evolve, impacting how fund balances are reported. Staying informed about these updates is crucial to maintaining compliance and accountability.

Understanding regulatory updates related to fund balances

New accounting standards can alter how fund balances are classified, which may require organizations to adjust their reporting processes. Being proactive in understanding these changes helps organizations remain compliant and support transparent financial practices.

Ensuring compliance with the latest guidelines

Resources, including webinars and consulting services, can guide organizations in navigating new regulations effectively. Leveraging tools like pdfFiller can assist in maintaining compliance while adapting to ongoing changes in financial reporting.

Conclusion and next steps

Understanding and accurately reporting fund balances is pivotal for any organization’s financial strategy. Leveraging resources like pdfFiller not only simplifies form management but enhances collaboration and compliance.

Encouragement to leverage pdfFiller features

The multitude of capabilities offered by pdfFiller can empower users to streamline their fund balance processes and improve accuracy in reporting. Exploring additional document management tools within pdfFiller could further enhance your organization’s efficiency in navigating financial forms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify fund balances as of without leaving Google Drive?

Can I sign the fund balances as of electronically in Chrome?

How do I fill out the fund balances as of form on my smartphone?

What is fund balances as of?

Who is required to file fund balances as of?

How to fill out fund balances as of?

What is the purpose of fund balances as of?

What information must be reported on fund balances as of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.