Get the free transient accommodations tax

Get, Create, Make and Sign transient accommodations tax form

How to edit transient accommodations tax form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out transient accommodations tax form

How to fill out instructions for form ta-2

Who needs instructions for form ta-2?

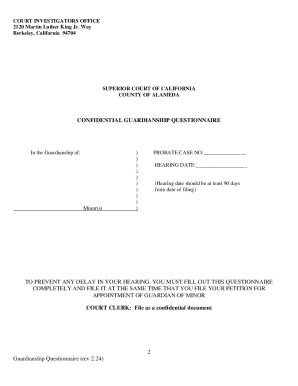

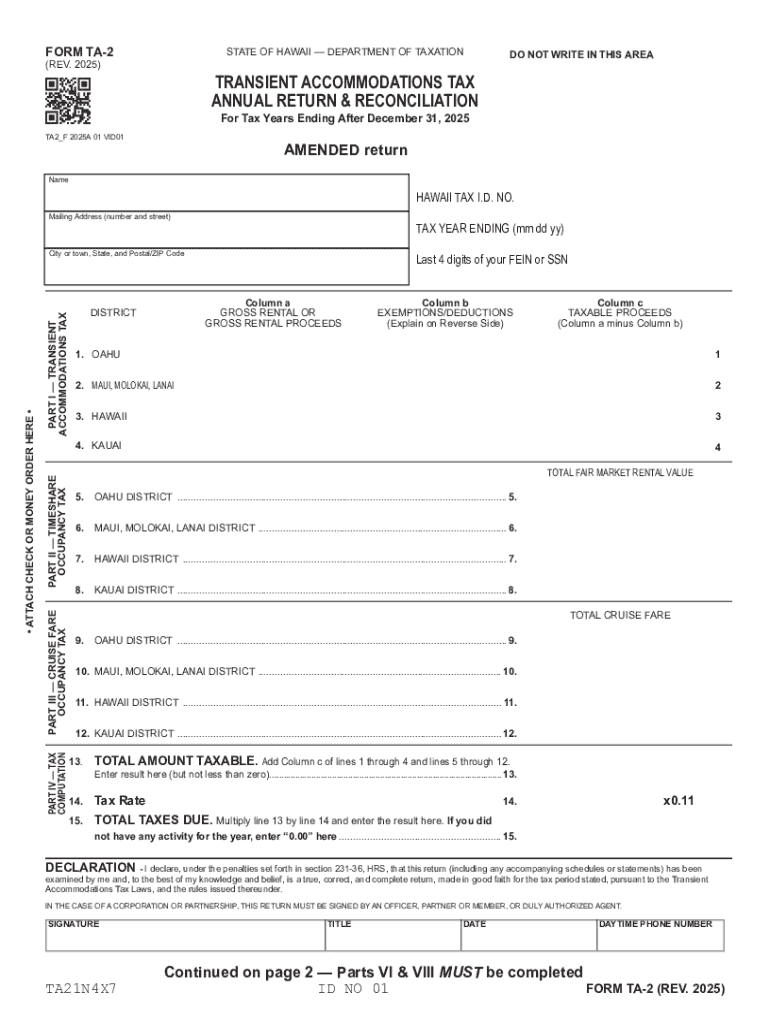

Instructions for Form TA-2 Form

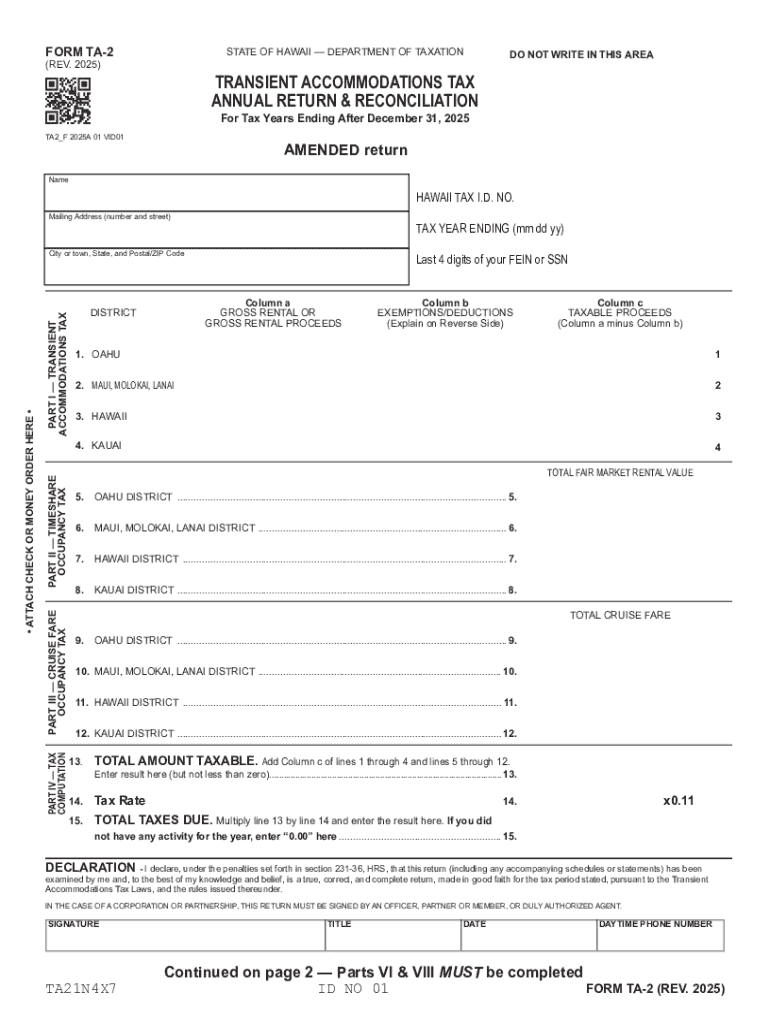

Overview of Form TA-2

Form TA-2 is a critical document used for various reporting and compliance needs. Designed primarily to facilitate accurate information submission, its purpose extends beyond simple documentation; it acts as a means of maintaining transparency and accountability within organizations. This form is particularly important for individuals and teams managing significant documentation tasks as it ensures that all required data is systematically organized and submitted correctly. By using pdfFiller, individuals can streamline the entire process, making it easier to fill out, edit, electronically sign, and securely store the TA-2 form.

Understanding who must file Form TA-2

Filing the Form TA-2 is mandatory for specified individuals or entities based on certain criteria. Typically, this encompasses any organization or individual involved in business operations subject to regulatory oversight or operational permits. Delineating the specifics of who must file can prevent compliance issues, as failure to do so may lead to penalties or setbacks. Nonetheless, there are exceptions to consider; for example, certain small businesses or individuals may bypass this requirement if their activities fall under specific thresholds.

Key components of Form TA-2

Understanding the structure of Form TA-2 is essential for accurate completion. Each section is designed to gather specific information pertinent to the filing party and the purpose of the form. Typically, the form includes basic identification details such as name, address, and contact information, as well as financial disclosures relevant to the entity's operations. Additionally, signatory requirements must be adhered to, ensuring that an authorized individual is validating the information presented within the form.

Navigating the filing requirements

Staying on top of filing requirements for Form TA-2 is crucial for compliance. Important deadlines typically accompany the submission of this form, which varies by jurisdiction. Organizations must understand these timelines to avoid late submissions that could incur fees or regulatory scrutiny. Moreover, determining whether the form is a one-time submission or requires recurring submissions can streamline operational planning.

Step-by-step instructions for filling out Form TA-2

Filling out Form TA-2 can be a straightforward process when approached step-by-step. The first step is to gather all necessary information. Essential documents to collect include previous financial statements, identification documents, and any other regulatory requirements pertinent to your filing. pdfFiller offers an efficient way to collect and consolidate this data, making the entire form-filling process smoother.

Once you've accessed Form TA-2 through pdfFiller, begin filling out each section carefully. Pay particular attention to accuracy in your entries; small mistakes can lead to significant issues later. pdfFiller provides editing tools to help correct errors on the fly. Review the completed form for any mistakes before submission. Utilizing pdfFiller's review features allows multiple team members to collaborate efficiently, ensuring the form is accurate and complete.

eSigning and finalizing your Form TA-2

After completing your Form TA-2, electronically signing the document is a crucial final step. pdfFiller streamlines this process by offering a straightforward eSignature solution. Following the prompts within the platform, you can easily add your signature and any additional signatories required. This feature not only saves time but also enhances the security of your submission, as electronic signatures are legally recognized.

Managing your Form TA-2 submissions

Post submission, it's essential to keep track of the status of your Form TA-2. pdfFiller provides tools to monitor your submission, ensuring you are notified of any required follow-up. In some cases, additional information may be required by the agency receiving your filing; knowing how to respond timely is crucial. If amendments are necessary, pdfFiller simplifies the resubmission process, allowing you to make changes swiftly and securely.

Common pitfalls and FAQs about Form TA-2

Many individuals and organizations face challenges when filing Form TA-2, leading to common pitfalls. Frequently asked questions include items related to missing deadlines, inaccurate information entry, and incorrect signatories. By being aware of these challenges, users can proactively avoid them. pdfFiller offers resources that guide users through common filing processes, making compliance manageable.

Utilizing pdfFiller for ongoing document management

Using pdfFiller for managing Form TA-2 and similar documents provides a host of benefits. The platform's comprehensive features for document creation, e-signing, and storage offer an all-in-one solution for teams and individuals managing multiple documentation tasks. Users report increased efficiency and reduced stress levels when utilizing such a robust tool to manage their essential filings.

Conclusion

Navigating the complexities of Form TA-2 can be simplified through using pdfFiller. The platform not only provides tools for filling out the form accurately but also enhances collaboration and document management long after the filing is complete. Users are encouraged to leverage pdfFiller to streamline all their documentation needs, ensuring efficiency and compliance in various regulatory environments.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send transient accommodations tax form for eSignature?

How can I get transient accommodations tax form?

How do I edit transient accommodations tax form online?

What is instructions for form ta-2?

Who is required to file instructions for form ta-2?

How to fill out instructions for form ta-2?

What is the purpose of instructions for form ta-2?

What information must be reported on instructions for form ta-2?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.