Get the free Student/Spouse 2023 Federal Tax Return Transcript Request

Get, Create, Make and Sign studentspouse 2023 federal tax

How to edit studentspouse 2023 federal tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out studentspouse 2023 federal tax

How to fill out studentspouse 2023 federal tax

Who needs studentspouse 2023 federal tax?

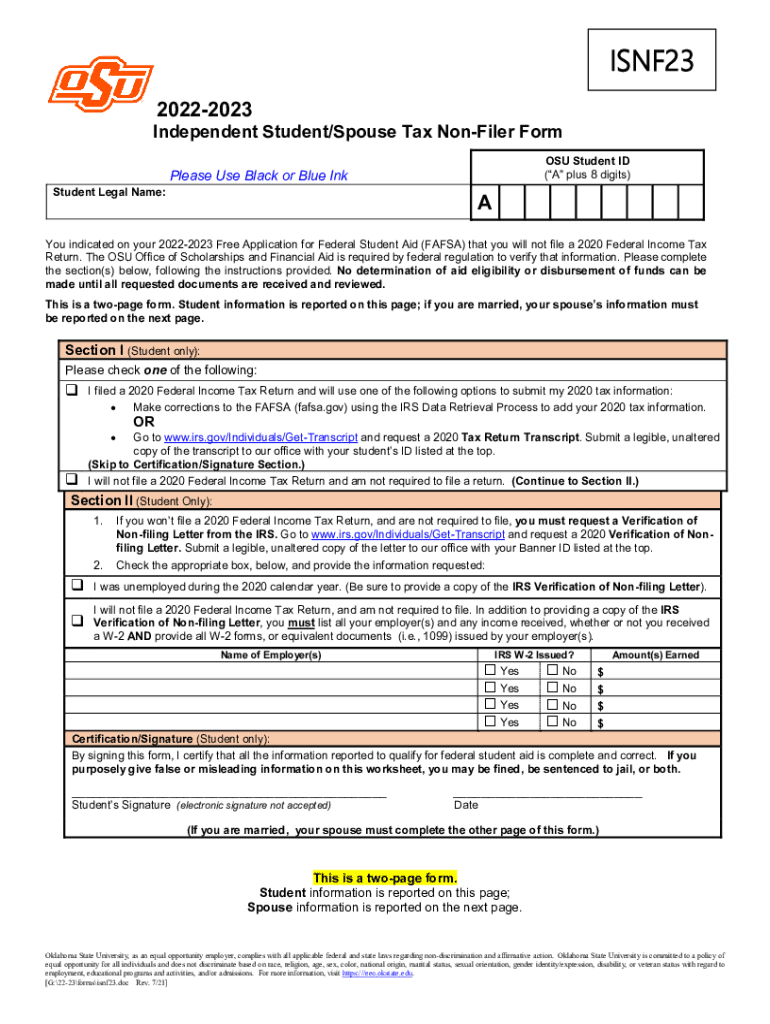

Studentspouse 2023 federal tax form: A comprehensive guide for students and their spouses

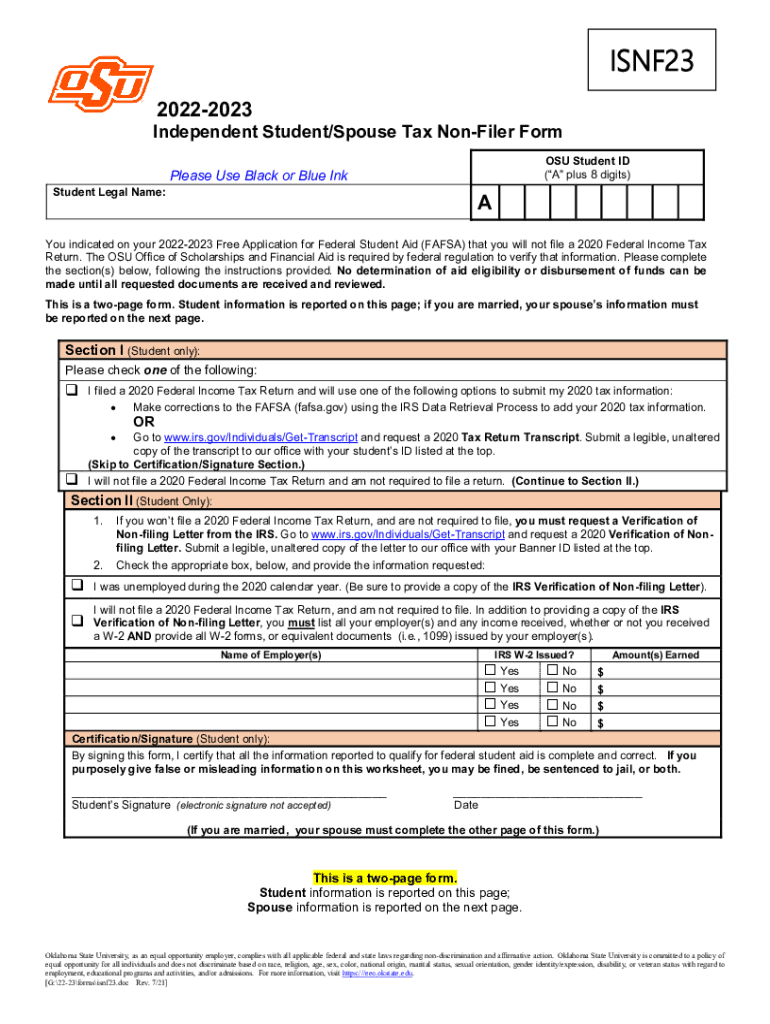

Overview of the 2023 federal tax form for students and spouses

Navigating the 2023 federal tax form can be particularly challenging for students and their spouses. Understanding qualifications as a student or spouse for tax purposes is crucial. Generally, a student is defined as someone enrolled in an eligible educational institution, while a spouse covers a legally married partner. Filing the federal tax form correctly is important not only for compliance but also for potential refunds or credits that can alleviate some of the financial burdens associated with education.

Key components of the form

The primary vehicle for individual tax filing in the U.S. is the IRS Form 1040, which is essential for students and their spouses. Appropriately grasping its components can streamline the process. Students should also be aware of various schedules associated with the form, including Schedule A for itemizing deductions or Schedule C if self-employed. Moreover, understanding the distinction between dependent and independent statuses can significantly impact tax liabilities and available credits.

Collecting necessary documentation

Proper documentation is critical for efficient tax filing. Students and their spouses should gather the following essential documents: W-2 forms from employers that provide proof of earnings; 1098-E statements, which detail student loan interest paid; and 1098-T forms that show tuition and fees. Additionally, any relevant income documents, like 1099 forms for freelance work, should also be incorporated into your tax filing preparation.

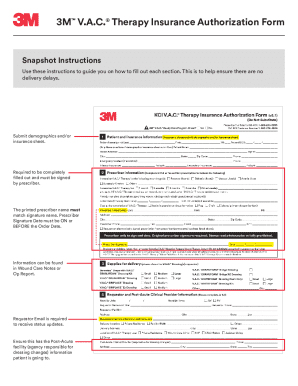

Step-by-step guide to filling out the form

Filling out the federal tax form can seem daunting, but breaking it down step-by-step can simplify the process. The first step involves entering personal information — both yours and your spouse's — as well as detailing income sources such as wages, scholarships, and grants. Next, you need to decide on claiming dependents. Properly defining dependents and understanding eligibility criteria are vital. After this, you’ll report education expenses, which may include educational credits and deductions. These aspects are crucial for accurately reporting tax liabilities and maximizing potential credits.

Managing common issues

Common issues can arise during the filing process. One frequent problem involves mistakes in dependent claims, which could lead to delays or audits. To avoid complications, ensure income is reported accurately; this can help minimize audit risks. Additionally, if you miss the filing deadline, you still have options such as applying for an extension or filing late to avoid penalties. Knowing how to navigate these challenges ahead of time can save you considerable stress.

Interactive tools for enhanced filing experience

Utilizing interactive tools can make the tax form process much more manageable. Platforms like pdfFiller enable users to edit PDFs and fill forms electronically, reducing the hassle of handling paper documents. The eSigning capabilities expedite submission, and collaboration features allow easy sharing of tax documents with advisors or co-filers, ensuring that everything is aligned and accurate before submission.

Frequently asked questions

As tax filing time approaches, many questions arise regarding student tax filing and spouse considerations. A common query is whether students can file their taxes independently. The answer generally hinges on dependency status and income levels. Questions also arise about whether both spouses can be students and how to handle education expenses for spouses who do not attend school. Understanding these distinctions can help ensure smooth filing when multiple individuals are involved.

Support and resources for students and spouses

Comprehensive resources are available to guide students and their spouses through the tax filing process. The IRS website is an excellent starting point, offering detailed instructions and updates. For real-time assistance, pdfFiller’s dedicated customer support can walk users through any issues they encounter when completing their tax forms. Being equipped with information and support can alleviate concerns and enhance understanding, paving the way for a successful filing experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit studentspouse 2023 federal tax from Google Drive?

How do I edit studentspouse 2023 federal tax straight from my smartphone?

How do I complete studentspouse 2023 federal tax on an Android device?

What is studentspouse 2023 federal tax?

Who is required to file studentspouse 2023 federal tax?

How to fill out studentspouse 2023 federal tax?

What is the purpose of studentspouse 2023 federal tax?

What information must be reported on studentspouse 2023 federal tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.