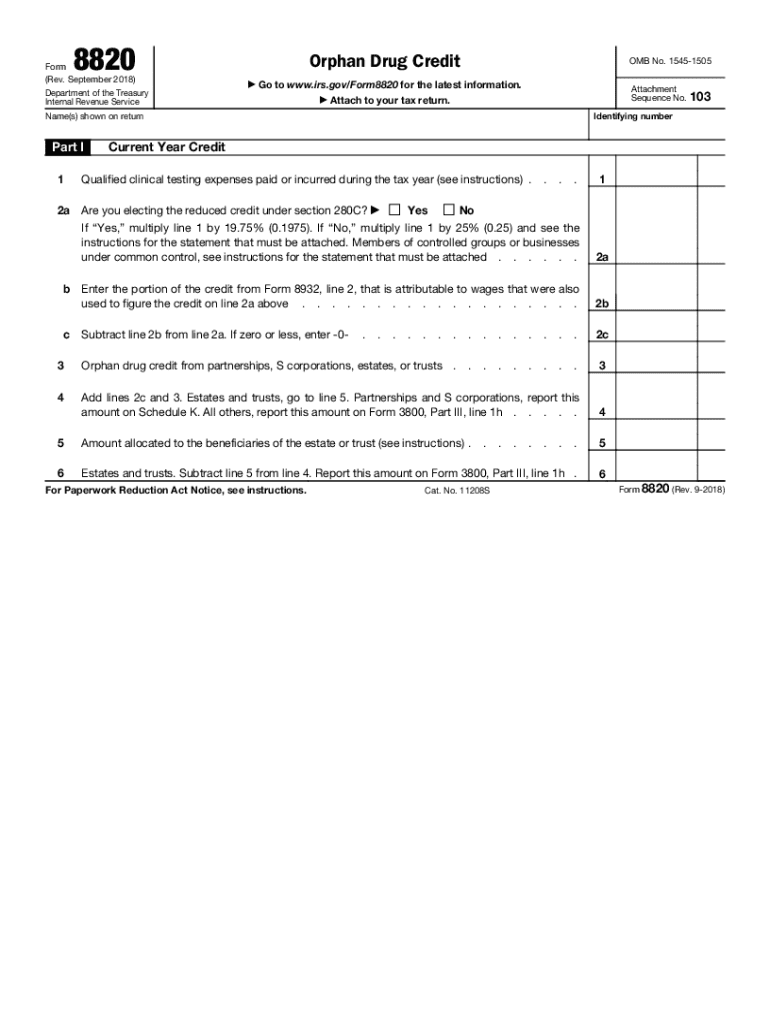

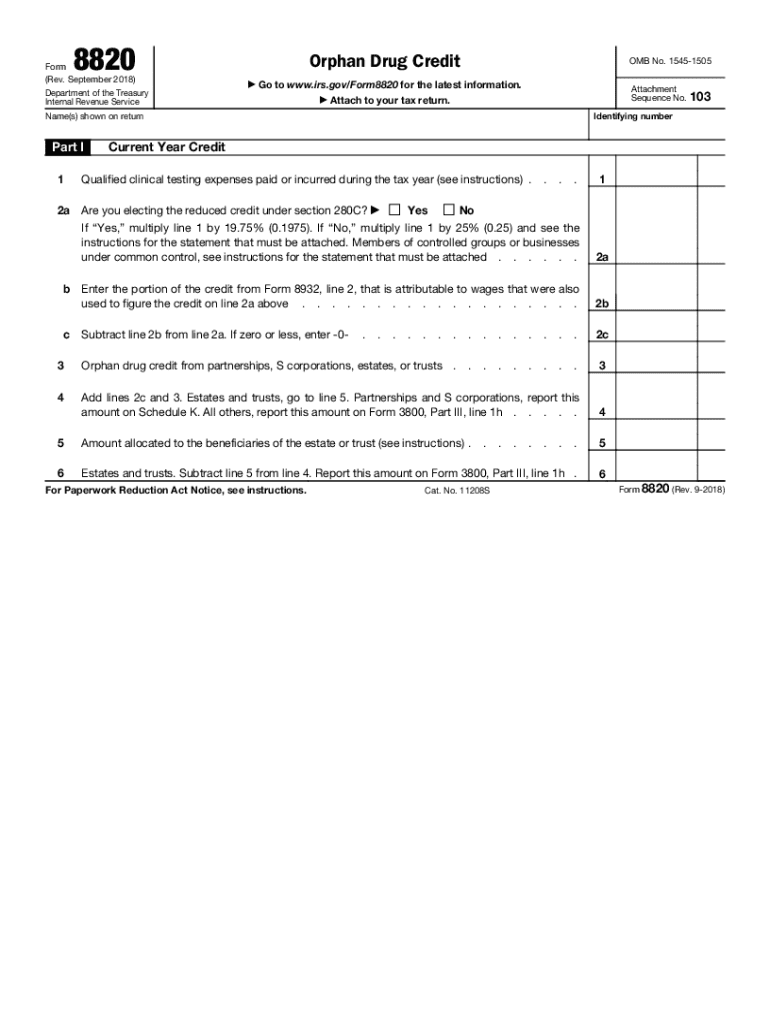

IRS 8820 2018-2026 free printable template

Get, Create, Make and Sign IRS 8820

Editing IRS 8820 online

Uncompromising security for your PDF editing and eSignature needs

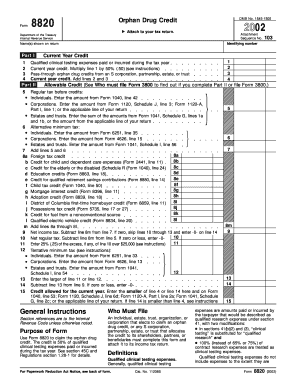

IRS 8820 Form Versions

How to fill out IRS 8820

How to fill out form 8820 rev september

Who needs form 8820 rev september?

Understanding Form 8820 Rev September

Overview of Form 8820 Rev September

Form 8820, also known as the 'Special Allowance for Second Loss on a Passive Activity,' is crucial for taxpayers claiming a qualifying special loss deduction. This form ensures compliance with IRS regulations, allowing eligible individuals to maximize their tax benefits. As of its September revision, important updates have been made to enhance clarity and usability.

The September revision of Form 8820 includes changes that could affect how users complete the form and the supporting documentation required. Understanding these updates can prevent common mistakes and streamline the filing process. Primarily, this form is intended for individuals or businesses engaged in passive activities, such as rental real estate, where losses may not fully offset other income.

Taxpayers should use Form 8820 if they have experienced a second loss on a passive activity and wish to claim the applicable deductions. Those who hold investments in activities that create a passive loss are particularly advised to familiarize themselves with the stipulations of this form.

Detailed breakdown of form elements

To effectively navigate Form 8820, it’s essential to understand its primary sections and their requirements.

Section 1: General Information

In the first section, users provide essential information such as their name, address, and taxpayer identification number (TIN). It’s important to ensure that this information is accurate, as any discrepancies may lead to delays in processing or potential audits. The purpose of this section is to identify the taxpayer and inform the IRS about the specific circumstances regarding the special allowance claimed.

Section 2: Filling out the form

Completing Form 8820 may seem daunting, but following a step-by-step guide can simplify this task significantly. First, one should read all instructions carefully—this reduces errors and ensures that every section is filled out correctly.

Some common mistakes include not double-checking figures, omitting required signatures, or failing to attach necessary schedules that substantiate passive income. To avoid these pitfalls, always use current forms from the IRS website or trusted platforms like pdfFiller.

Supporting documentation

Accompanying Form 8820 with the correct supporting documentation is critical. Taxpayers must submit relevant records that justify the claimed second loss.

Gathering accurate information will enhance the credibility of your submission and ensure timely processing of your form.

Editing and customizing form 8820

pdfFiller provides an efficient platform for editing your PDF forms, including Form 8820. Users can upload their completed forms and utilize a suite of editing tools.

The platform also allows users to add text fields and checkboxes, making the form completion process more intuitive and comprehensive.

eSigning and collaboration features

With pdfFiller, electronic signatures simplify the process of validating Form 8820. Users can sign the document electronically, a feature recognized by the IRS among many states.

Collaboration features allow multiple parties to review the form, making it an ideal solution for teams managing tax documentation.

Common FAQs related to Form 8820

Navigating the complexities of Form 8820 can raise many questions. Here are some commonly raised queries.

Accessing your form anytime, anywhere

Cloud-based solutions like pdfFiller enhance document management capabilities, allowing users to access Form 8820 and related documents from any device. This flexibility is particularly advantageous for individuals working on the go.

Having the ability to access these files from mobile devices enhances productivity and keeps users organized.

Tips for managing form submissions

Successful submission of Form 8820 often includes careful planning and organization. Here are strategies for effective management.

By establishing a structured approach to submissions, users can minimize stress and avoid last-minute complications.

Why choose pdfFiller for your document needs?

pdfFiller stands out as a comprehensive solution for editing, eSigning, and managing documents—particularly Form 8820. With seamless integration of features, users can complete every task within a single platform.

While tax forms can be intimidating, services like pdfFiller enable users to navigate the process more effectively.

People Also Ask about

What is a 8820 tax form?

What is the 8820 form for orphan drug credit?

What is form 8820 for?

What is the tax form for orphan drugs?

Is form 8821 a power of attorney?

What is a Schedule 8821 form?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the IRS 8820 electronically in Chrome?

Can I create an eSignature for the IRS 8820 in Gmail?

Can I edit IRS 8820 on an Android device?

What is form 8820 rev september?

Who is required to file form 8820 rev september?

How to fill out form 8820 rev september?

What is the purpose of form 8820 rev september?

What information must be reported on form 8820 rev september?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.