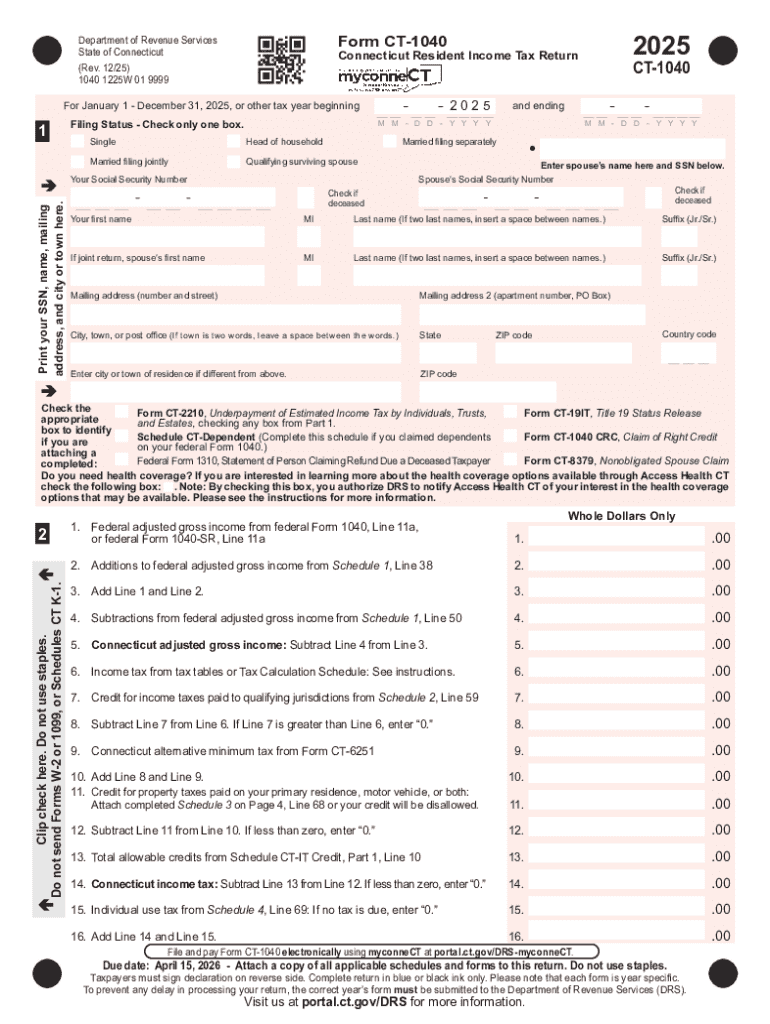

Get the free Connecticut resident income tax return and instructions. Form ...

Get, Create, Make and Sign connecticut resident income tax

How to edit connecticut resident income tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out connecticut resident income tax

How to fill out connecticut resident income tax

Who needs connecticut resident income tax?

Complete Guide to Filing Your Connecticut Resident Income Tax Form

Overview of Connecticut resident income tax

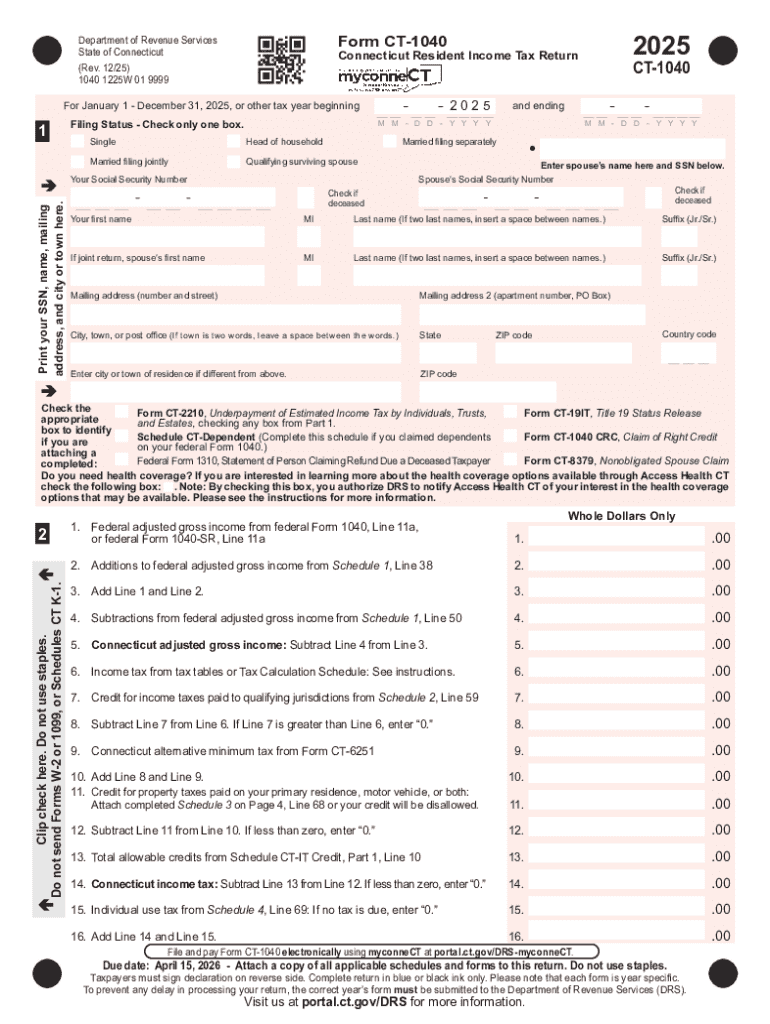

Filing your Connecticut resident income tax form is crucial for compliance with state tax laws. Every year, residents must report their income to the Connecticut Department of Revenue Services (DRS), which plays a significant role in funding state services including education and infrastructure. By filing accurately, taxpayers not only fulfill their legal obligations but also unlock various benefits, such as potential refunds and tax credits.

Connecticut has a progressive income tax rate that scales with income levels, which means that higher earners will pay a larger percentage of their income in taxes. For the 2023 tax year, rates range from 3% to 6.99%, depending on the income bracket. It's essential to keep track of the filing deadlines; generally, state income tax returns are due on April 15, aligning with federal tax deadlines.

Who needs to file a Connecticut resident income tax form?

Most Connecticut residents must file a state income tax return if they are employed or have other sources of income exceeding a certain threshold. For the 2023 tax year, individuals with income over $12,000, or couples with a combined income over $24,000, are required to file. Additionally, residency status is crucial: you must be a permanent resident or a domiciled taxpayer.

Exceptions exist for certain categories, including individuals who are dependents or who earn below the income thresholds. Furthermore, special rules apply to married couples. Filing jointly typically results in lower overall taxes, but couples may also opt to file separately based on their unique financial circumstances.

Determining your filing status

Your filing status in Connecticut directly influences your income tax rate and liabilities. The form provides four options: Single, Married Filing Jointly, Married Filing Separately, and Head of Household. Each category has specific qualifications and tax implications.

For instance, single filers often enjoy the highest tax brackets, while married couples filing jointly might benefit from lower overall rates due to combined income limits. Single parents can qualify for Head of Household status, significantly lowering their taxable income. Understanding these classifications is vital for maximizing deductions and minimizing tax burdens.

Preparing to file your Connecticut tax return

Before embarking on your tax filing journey, gathering the necessary documentation is paramount. Essential items include W-2 forms from employers, 1099s for any freelance work, and receipts for possible deductions, such as medical expenses or charitable donations. It is also advisable to have your prior year tax return on hand to ensure consistency and accuracy.

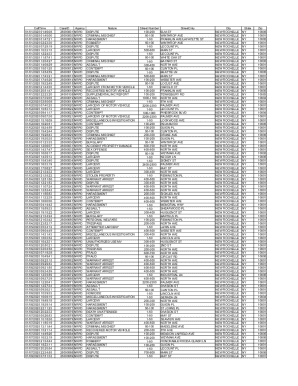

Calculating your taxable income accurately is crucial, as this figure dictates the amount subject to tax. Connecticut residents may claim a variety of deductions and credits, such as the personal exemption and property tax credit, which can significantly reduce the overall tax liability.

Completing the Connecticut resident income tax form

When filling out the Connecticut resident income tax form, attention to detail is vital. Start by gathering necessary personal information, your sources of income, and any deductions you intend to claim. The form is broken down into various sections, guiding you through income reporting, deductions, and credit applications.

Be aware of common pitfalls, such as entering incorrect Social Security numbers or miscalculating totals. To streamline the process, tools like pdfFiller offer editing features that make it easier to correct errors. You can even eSign your tax return through the platform, increasing efficiency in your filing process.

Filing your Connecticut resident income tax return

Once you have completed the Connecticut resident income tax form, it’s time to submit it. There are two main options for filing: online or via paper. Online filing is generally quicker and allows for faster processing times, while paper forms can take longer to be processed through the mail.

If you choose to eFile through pdfFiller, the streamlined interface makes it easy to submit your return and track its status. Remember to file before the April 15 deadline to avoid potential penalties. Once submitted, you can check the status of your return through the Connecticut DRS website.

Frequently asked questions about Connecticut resident income tax filing

A common concern among taxpayers is addressing any inability to pay taxes owed. If you find yourself in this scenario, it’s essential to contact DRS to discuss potential payment plans to avoid penalties. Additionally, if you've made an error after filing, you can amend your tax return to correct mistakes.

Tax refunds in Connecticut can be directly deposited into your bank account, expediting the process. For localized assistance, many communities offer resources such as free tax assistance programs during the filing season. Online resources, including the DRS website, provide comprehensive information on these topics.

Managing and storing your tax documents

Keeping copies of your tax returns is crucial for future reference, substantiating next year's filings, or any future audits. It's good practice to maintain organized records of all documents that substantiate your income and deductions for at least three years.

Digital storage solutions, like those offered by pdfFiller, allow for efficient document management. With cloud-based storage, you can access your tax-related documents from anywhere, which enhances both safety and convenience. Take advantage of features that help you organize, retrieve, and manage your documents with ease.

Filing taxes with other states

For Connecticut residents working or earning income from multiple states, it’s essential to understand your tax obligations. Each state may impose its own set of tax rules, requiring you to file returns in both Connecticut and any additional states.

Fortunately, many states offer tax credits for taxes paid to other states, which can alleviate the burden of double taxation. Ensure you are informed about proper filing procedures to avoid complications. Maintaining consistent records across different states will also make the process smoother.

Interactive tools and resources

To ease the tax filing process, utilize tools like pdfFiller’s interactive tax filing checklist, which guides you through necessary steps and documents. Customizable templates are available to help prepare your tax documents, enhancing ease-of-use and efficiency.

Additionally, reliable links to state revenue services can provide further information and updates on tax regulations. Staying informed and organized will significantly enhance your overall tax filing experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get connecticut resident income tax?

How do I execute connecticut resident income tax online?

How do I complete connecticut resident income tax on an Android device?

What is connecticut resident income tax?

Who is required to file connecticut resident income tax?

How to fill out connecticut resident income tax?

What is the purpose of connecticut resident income tax?

What information must be reported on connecticut resident income tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.