Get the free Business VISA Credit Cards

Get, Create, Make and Sign business visa credit cards

Editing business visa credit cards online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business visa credit cards

How to fill out business visa credit cards

Who needs business visa credit cards?

Understanding the Business Visa Credit Cards Form

1. Understanding Business Visa Credit Cards

A business Visa credit card is specifically designed for business expenses, providing various features that are distinct from personal credit cards. These cards can help manage cash flow, track business spending, and streamline expense reporting. Unlike personal credit cards, business Visa cards often come with higher credit limits, tailored rewards for business purchases, and expense management tools to help businesses keep track of their spending patterns.

The major difference lies in the varying reporting systems; personal credit cards typically focus on individual credit scores, while business credit cards contribute to building a business credit history. This addition can significantly impact the ability of a business to secure loans or further credit lines in the future.

1.2 Benefits of Using Business Visa Credit Cards

2. The Importance of the Business Visa Credit Cards Form

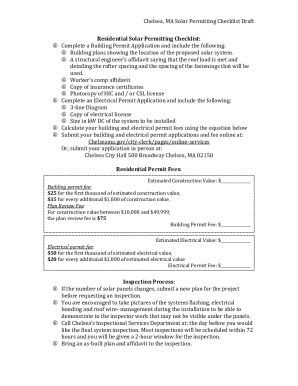

Properly filling out the business Visa credit cards form is essential for successfully applying and receiving your card. This form serves as the official documentation needed to process your application, ensuring that all necessary information is submitted accurately. Missing or incorrect details can lead to delays or rejection of your application.

Accuracy is crucial; even minor errors can result in complications during the verification process, making it imperative to review the form thoroughly before submission.

2.2 Common requirements and eligibility criteria

When applying for a business Visa credit card, you'll typically need to provide documentation such as a business license, tax ID number, and proof of income. Eligibility is often contingent upon the business's credit history and financial situation, with many card issuers requiring a minimum annual revenue or a certain number of years in operation.

This verification process ensures that only qualifying businesses receive the credit they seek, thereby reducing the risk for issuers.

3. How to Fill Out the Business Visa Credit Cards Form

Filling out the business Visa credit cards form can initially seem daunting, but following a step-by-step guide can simplify the process. Start by thoroughly reading the instructions provided by the card issuer to ensure compliance with all requirements.

3.1 Step-by-step guide to completing the form

The form typically includes sections for basic business information, financial details, and applicant information. You should be prepared to provide:

3.3 Avoiding common mistakes on the form

Common errors include misplacing decimal points in revenue figures, incorrect business names, and failing to provide required supporting documentation. To avoid these mistakes, take the time to double-check all entered information and ensure all required fields are correctly filled out before submission.

4. Editing and Managing Your Form

Once you have filled out the business Visa credit cards form, utilizing tools like pdfFiller can help you edit and manage your document comprehensively. pdfFiller offers interactive features that facilitate easy adjustments to the form, such as filling in blank sections, adding signatures, or correcting any errors found.

4.1 Utilizing pdfFiller for form editing

With pdfFiller, users can customize the template, merge documents, and fill any fields needed without hassle. This ensures that the final submission is polished and meets all requirements set forth by the credit card issuer.

4.2 Saving and sharing your form

After editing, it’s vital to save your progress. pdfFiller allows you to save drafts and share them with team members or advisors for collaborative input, ensuring accuracy before final submission.

5. Signing the Business Visa Credit Cards Form

eSigning the business Visa credit cards form is a convenient option that offers numerous advantages over traditional methods. Electronic signatures are recognized legally in many jurisdictions, simplifying the signing process and allowing for faster submission.

By using PDF tools like pdfFiller to create an eSignature, you can sign the document securely, ensuring your information remains protected while expediting the approval process.

5.2 How to eSign your form using pdfFiller

To eSign your form in pdfFiller, you just need to click on the 'eSign' option available in the editing menu. Follow the prompts to create your signature digitally, place it on the form, and save it. This method is efficient, secure, and greatly enhances the turnaround time for processing your credit card application.

6. Submitting the Business Visa Credit Cards Form

Once your form is complete and signed, it’s time to submit the business Visa credit cards form. Most issuers allow for online submissions via their website, but alternative methods such as mailing or faxing may also be available.

6.1 Where to submit your completed form

For online submissions, navigate to the respective credit card issuer's website where you will find the upload option for your completed form. It's important to follow the specific submission guidelines provided in the application, ensuring all protocols are adhered to.

6.2 Tracking your application status

After submission, monitoring your application status is important for staying informed. Most issuers provide a reference number upon submission, allowing you to check your application status online or by contacting customer service.

7. Frequently Asked Questions (FAQs)

Here are some common inquiries related to business Visa credit cards that may assist you in your journey:

7.2 Specific inquiries about the application process

Clarifying doubts beforehand can streamline the application experience. It's prudent to directly consult the issuing bank or credit card provider for tailored answers to specific questions regarding documentation or eligibility.

8. Related Tools and Resources on pdfFiller

Besides the business Visa credit cards form, pdfFiller offers a plethora of other templates that may cater to your business needs. These include forms for expense reports, loan applications, and employee onboarding.

8.2 Additional resources for business credit management

Many articles and guides are available on pdfFiller that can help you understand how to manage your business credit effectively. These resources will assist you in making informed choices about credit usage and long-term financial strategies.

9. Beyond the Form: Managing Your Business Credit

Successfully managing a business Visa credit card goes beyond filling out the form; it involves implementing best practices for financial management. Establish a budget based on projected income and expenses to ensure you make the most of rewards offered while avoiding unnecessary debt.

9.1 Best practices for using your business Visa credit card

Within your financial management strategy, consider the following tips:

9.2 Leveraging your business credit for growth

Smart use of your business credit can facilitate expansion opportunities. Whether investing in new equipment, marketing initiatives, or enhancing inventory, using a business Visa credit card responsibly can provide you with the flexibility needed to thrive. Make informed repayment decisions to maintain a healthy business credit profile as you grow.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send business visa credit cards for eSignature?

Where do I find business visa credit cards?

Can I create an eSignature for the business visa credit cards in Gmail?

What is business visa credit cards?

Who is required to file business visa credit cards?

How to fill out business visa credit cards?

What is the purpose of business visa credit cards?

What information must be reported on business visa credit cards?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.