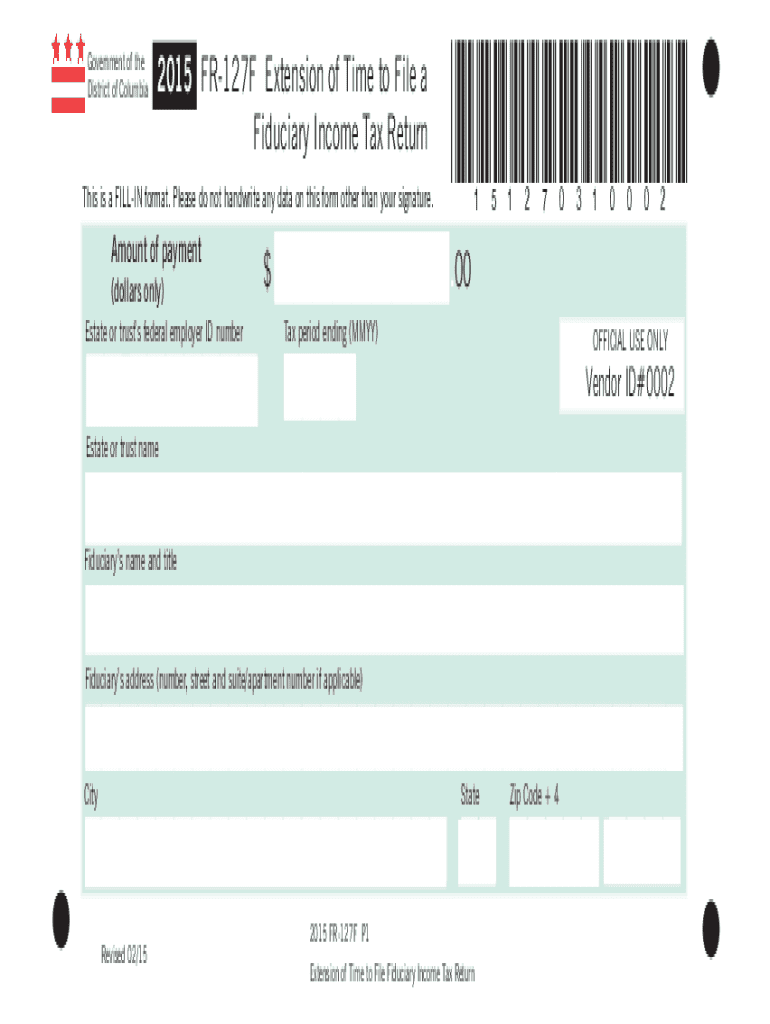

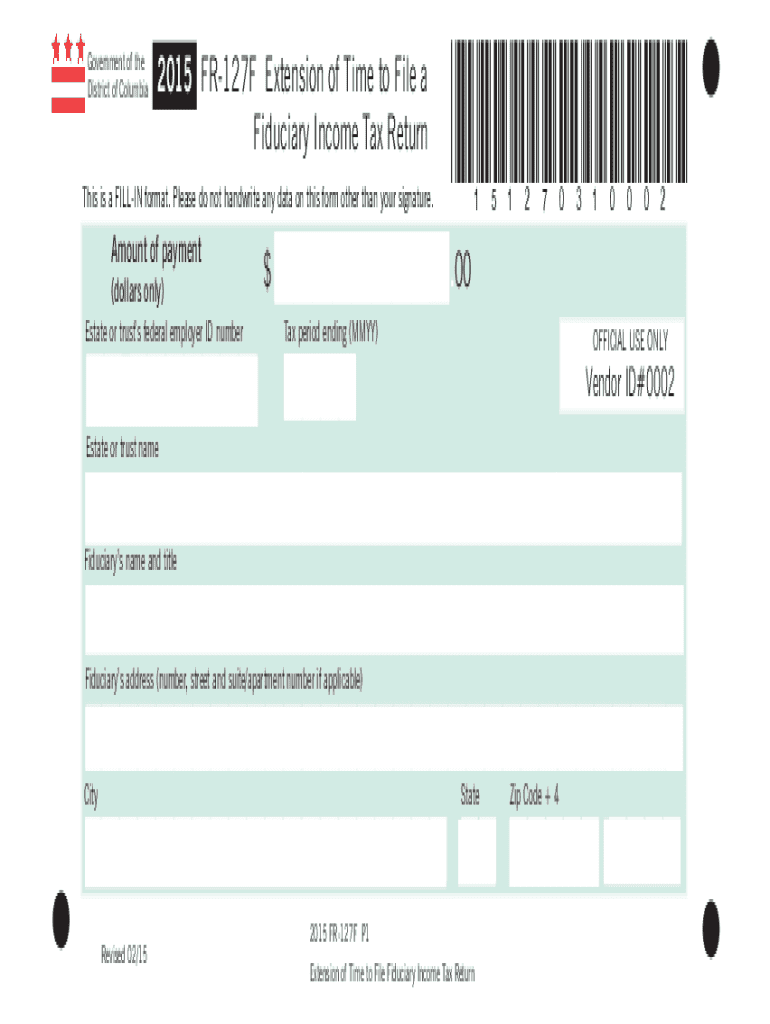

Get the free FR-127F. 2015 Extension of Time to File Fiduciary Return

Get, Create, Make and Sign fr-127f 2015 extension of

Editing fr-127f 2015 extension of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out fr-127f 2015 extension of

How to fill out fr-127f 2015 extension of

Who needs fr-127f 2015 extension of?

Comprehensive Guide to FR-127F 2015 Extension of Form

Understanding the FR-127F 2015 extension of form

The FR-127F is a tax form used in various contexts, primarily as an extension request for individual taxpayers and organizations. Released in 2015, this particular extension of form streamlines the process of filing taxes, allowing taxpayers extra time to prepare their documents without facing penalties.

The purpose of the 2015 extension is to provide relief to taxpayers who may not be able to meet their tax obligations by the original due date. This allows individuals and businesses better flexibility in managing their finances, especially for those who may experience unforeseen circumstances affecting their ability to file on time.

Eligibility criteria

Who can use the FR-127F? This form is designed for a diverse array of users, including both individual taxpayers and registered businesses or organizations. It accommodates those who require an extension due to various circumstances, from personal to financial. Specifically, if an individual or organization anticipates challenges in meeting the filing deadlines, they can opt for this extension.

Prior to filing, certain prerequisites must be fulfilled. Taxpayers should gather relevant documentation and essential information, including prior year tax returns and estimates of current income. This preparation is vital for a successful extension application.

Detailed instructions for completing the FR-127F

Completing the FR-127F form involves a systematic approach. First, gather all necessary information, paying particular attention to your personal identification data and relevant financial information. This step is critical to avoid delays and ensure formatting accuracy.

Next, while filling out the form, pay close attention to each section. Start by entering your taxpayer information in Section A, followed by income declarations in Section B. Finally, Section C focuses on deductions and credits where you can reduce taxable income. Thoroughly review each part to minimize errors that could lead to rejections.

Editing and signing the FR-127F

Editing the PDF form can efficiently be accomplished using pdfFiller's tools. The platform allows users to easily make changes to their FR-127F by uploading the document and utilizing pdfFiller’s editing features. This process enhances accuracy and removes the potential errors that could arise from hand-filled forms.

Once the form is filled out, signing it is the next vital step. Adding electronic signatures is not just convenient but also holds legal validity across many jurisdictions. Users can follow a straightforward process through pdfFiller, ensuring their signature appears correctly.

Submitting the FR-127F

After completing your FR-127F, submitting it requires understanding the available options. Users can choose between online submission through e-filing platforms or traditional mail-in options. Choosing the online method can expedite the process, ensuring timely filing results.

It is vital to adhere to submission deadlines. Missing these deadlines could result in penalties or denial of the extension request. After submission, tracking progress is a best practice that allows you to stay informed about the processing status.

Managing your FR-127F submission

Keeping your submission organized is crucial for both individual taxpayers and teams. pdfFiller facilitates this by allowing users to categorize and label their forms within the platform. This capability helps retrieve past submissions easily, ensuring all relevant documents are accessible.

Additionally, collaboration features in pdfFiller allow teams to work seamlessly together on the filing process. This means that team members can edit, comment, and finalize documents, thus enhancing cooperation and improving overall workflow.

Troubleshooting and common issues

Despite the best efforts, issues may arise when filing the FR-127F. If your form faces rejection, the first step you should take is to review the provided feedback meticulously. Often, rejections stem from minor errors in forms that can be easily corrected.

In cases where you require additional assistance, contacting customer support is essential. pdfFiller offers robust support channels, ensuring you have access to help when needed. Engaging with available resources can also provide clarity on complex issues related to the FR-127F.

Additional tools and resources

pdfFiller extends its value by offering a suite of interactive tools specifically designed for document management. These tools not only simplify the process of filling out forms like FR-127F but also support improved collaboration and efficiency in managing all tax-related documentation.

How-to videos provided on the platform give users visual guidance on form completion, making the process easier to understand. The FAQs section covers common questions and clarifications related to the FR-127F and is an invaluable resource during filling.

Conclusion on maximizing the use of pdfFiller for the FR-127F

Utilizing a cloud-based solution such as pdfFiller for the FR-127F 2015 extension of form delivers numerous benefits, including ease of use, accessibility, and reliability. This platform simplifies the often arduous task of tax document preparation, allowing users to focus on the accuracy of their filings instead of the potential pitfalls associated with manual submissions.

Moreover, pdfFiller enhances overall efficiency through collaboration features that streamline teamwork during the filing process. As a result, users can confidently navigate the complexities of tax forms while ensuring a smooth submission experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit fr-127f 2015 extension of from Google Drive?

How do I edit fr-127f 2015 extension of in Chrome?

How do I complete fr-127f 2015 extension of on an iOS device?

What is fr-127f 2015 extension of?

Who is required to file fr-127f 2015 extension of?

How to fill out fr-127f 2015 extension of?

What is the purpose of fr-127f 2015 extension of?

What information must be reported on fr-127f 2015 extension of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.