Get the free Bountiful Investment Management Form CRS

Get, Create, Make and Sign bountiful investment management form

Editing bountiful investment management form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out bountiful investment management form

How to fill out bountiful investment management form

Who needs bountiful investment management form?

Bountiful Investment Management Form: A Comprehensive Guide

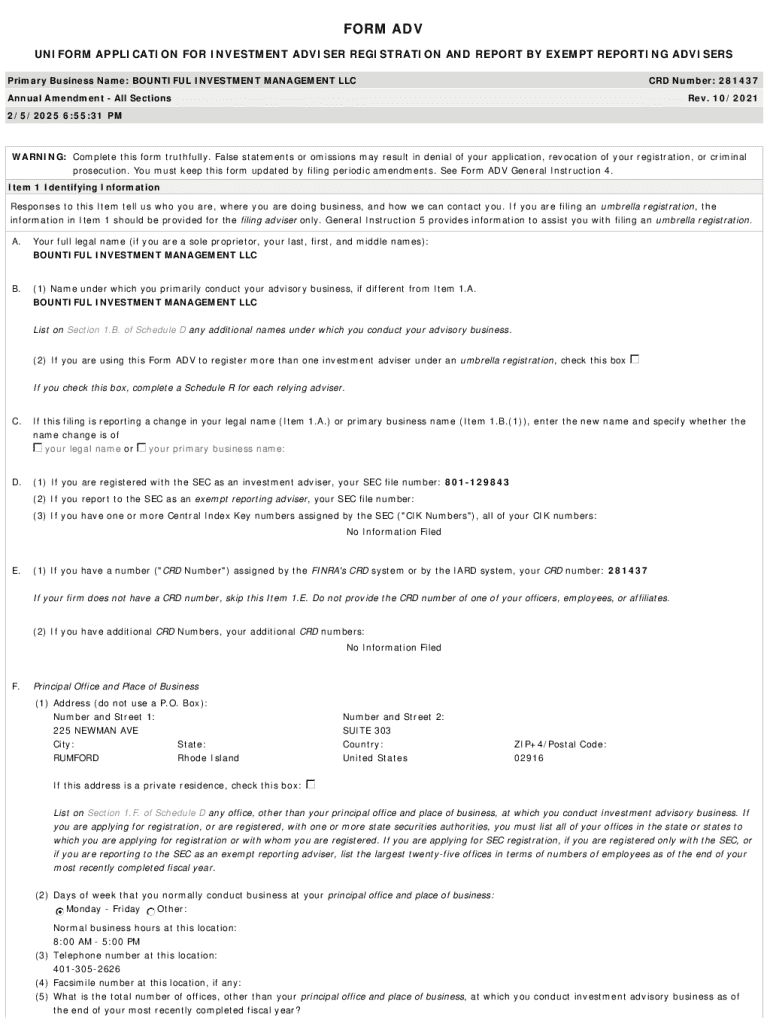

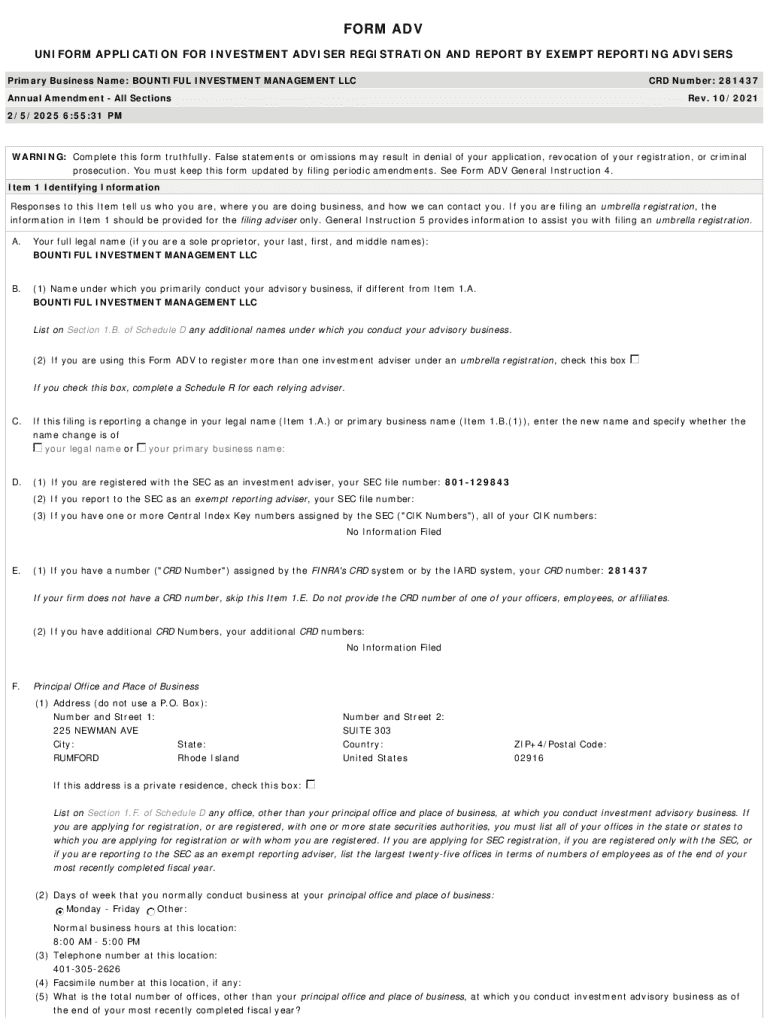

Understanding the Bountiful Investment Management Form

The Bountiful Investment Management Form serves as an essential tool for both individual investors and investment advisors. It is a structured document that captures vital information on investment goals, preferences, and risk assessments. This form aids in streamlining the process of managing investments, ensuring all aspects are covered efficiently.

The importance of the Bountiful Investment Management Form lies in its ability to guide conversations between clients and investment advisers. By clearly defining objectives and risk tolerance, the form fosters a mutual understanding of the investor's journey. Furthermore, its systematic approach helps both parties stay aligned throughout the investment process.

Navigating the pdfFiller platform

pdfFiller provides a user-friendly platform with a multitude of features that enhance document management. From editing capabilities to eSigning and collaboration tools, users can handle their investment-related documentation effortlessly. Whether you're filling out the Bountiful Investment Management Form or modifying an existing document, pdfFiller's suite of services simplifies the process.

Accessing the Bountiful Investment Management Form is straightforward. Users can search for the form within the pdfFiller library, which is continually updated with the latest templates. Once accessed, individuals can utilize interactive tools to enhance their forms — uploading documents, adding notes, and customizing layout options are all at your fingertips.

Step-by-step guide to filling out the form

Preparation is crucial when filling out the Bountiful Investment Management Form. Before you begin, ensure that you have all necessary documents on hand, such as identification proof, current financial statements, previous investment records, and any other relevant information. This ensures smoother completion and reduces the chances of errors.

Filling out the form itself can be broken down into several sections. The Personal Information section requires basic details like name, address, and contact information. Following that, you’ll define your Investment Preferences and Goals, which is crucial for aligning with your adviser. The Risk Assessment section helps to ascertain your comfort level with various investment types, ultimately guiding your investment strategy.

Utilizing interactive tools within pdfFiller can significantly enhance your experience. Features like text editing, reordering sections, and digital signatures allow you to personalize the form to fit your unique needs.

Editing and customizing the Bountiful Investment Management Form

Customizing your Bountiful Investment Management Form can make a significant difference. Use the editing features available on pdfFiller to tailor the document to your specific circumstances. Adding fields, annotations, and even notes can provide clarity for your investment adviser and improve communication.

In addition, pdfFiller enables eSignature integration directly within the form. This feature allows you to sign off on the document electronically, ensuring that the formalities of approval are met without the need for printing or scanning. Collaboration is also simple: you can share the form with team members or advisors for joint completion or review.

eSigning your Bountiful Investment Management Form

Integrating your electronic signature into the Bountiful Investment Management Form is a straightforward process. Within pdfFiller, there are options to add your signature by either typing it, drawing it, or uploading an image. This flexibility ensures that your signature genuinely reflects your identity.

It’s critical to understand the validity of eSignatures. In many jurisdictions, electronic signatures are legally binding, provided they meet specific requirements. Ensure that any form filled and signed through pdfFiller complies with these legal requirements to maintain the integrity of your investment documents.

Managing your investment documents within pdfFiller

pdfFiller also excels in helping users manage their investment documents. Once your Bountiful Investment Management Form is completed and signed, you can securely store it in the cloud. Comprehensive organizational tools allow you to categorize documents for easy retrieval.

Sharing options are abundant; you can send your completed form to stakeholders directly through the platform. By tracking the status of documents where necessary, users are immediately informed of submissions, approvals, and any necessary follow-up actions, ensuring that you and your investment adviser are always on the same page.

Common issues and troubleshooting

As with any online documentation process, users may encounter a few common issues when managing the Bountiful Investment Management Form. Frequently asked questions include inquiries regarding form accessibility, submission errors, and eSignature integrations. Quality support is crucial in resolving these issues quickly.

If you face any obstacles, pdfFiller provides extensive troubleshooting resources. Many common problems have straightforward solutions outlined in their help section. Furthermore, dedicated support teams are accessible, offering personalized assistance for any unique challenges.

Testimonials and user experiences

User experiences with the Bountiful Investment Management Form highlight its effectiveness in enhancing investment management processes. Clients have reported significant improvements in how they document investment goals and track their progress. Teams utilizing pdfFiller noted that collaboration became seamless, allowing for clearer conversations and more strategic planning.

Success stories demonstrate how the integration of this form into routine investment advisory services has streamlined workflows. By digitizing documentation, clients and investment adviser representatives can focus more on developing relationships and strategic discussions rather than getting caught up in bureaucratic processes.

Continuous improvement in investment management

Investment management is an ongoing journey, requiring periodic review and updates to your investment documents, including the Bountiful Investment Management Form. Regular assessments of your goals and risk assessment help ensure alignment with the current market conditions and personal circumstances, which are crucial for long-term success.

Staying informed about market trends and investment insights is equally vital. pdfFiller offers resources to help you keep abreast of any changes that could impact your investment decisions, enabling proactive strategy adjustments. Utilizing pdfFiller fosters continued success, making future investment documentation and management easy as you adapt to the evolving financial landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit bountiful investment management form in Chrome?

How do I complete bountiful investment management form on an iOS device?

How do I edit bountiful investment management form on an Android device?

What is bountiful investment management form?

Who is required to file bountiful investment management form?

How to fill out bountiful investment management form?

What is the purpose of bountiful investment management form?

What information must be reported on bountiful investment management form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.