Get the free Form CRS (Client Relationship Summary), February 4, ...

Get, Create, Make and Sign form crs client relationship

How to edit form crs client relationship online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form crs client relationship

How to fill out form crs client relationship

Who needs form crs client relationship?

How-to Guide: Completing the Client Relationship Form (CRS)

Understanding the Client Relationship Form (CRS)

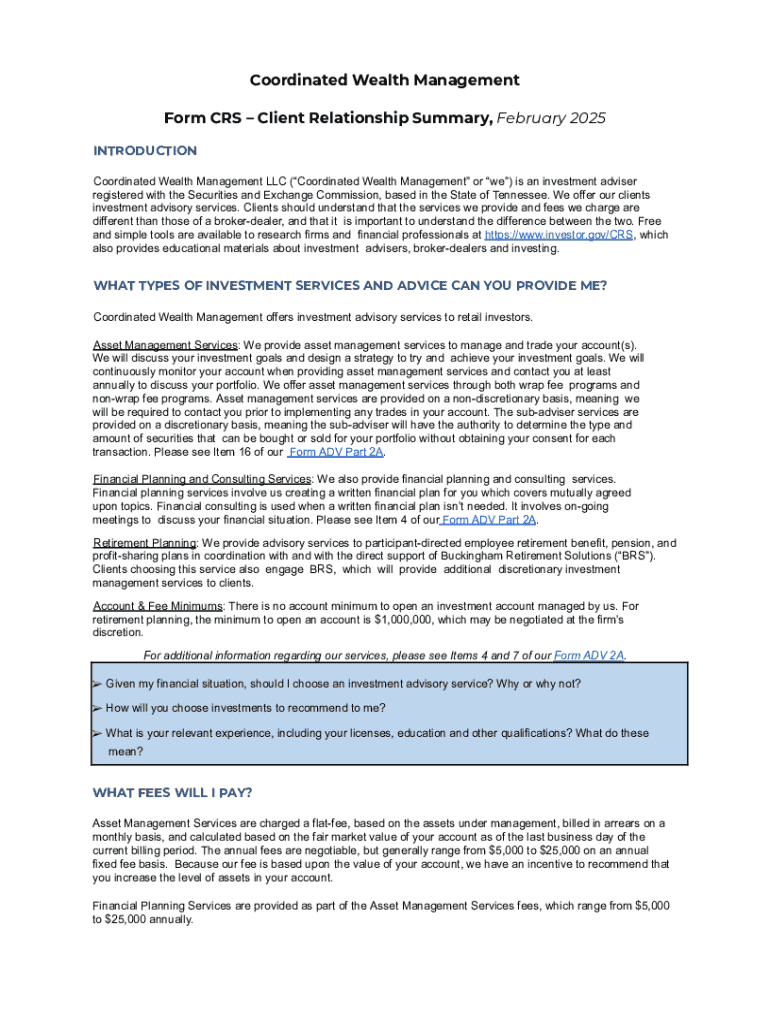

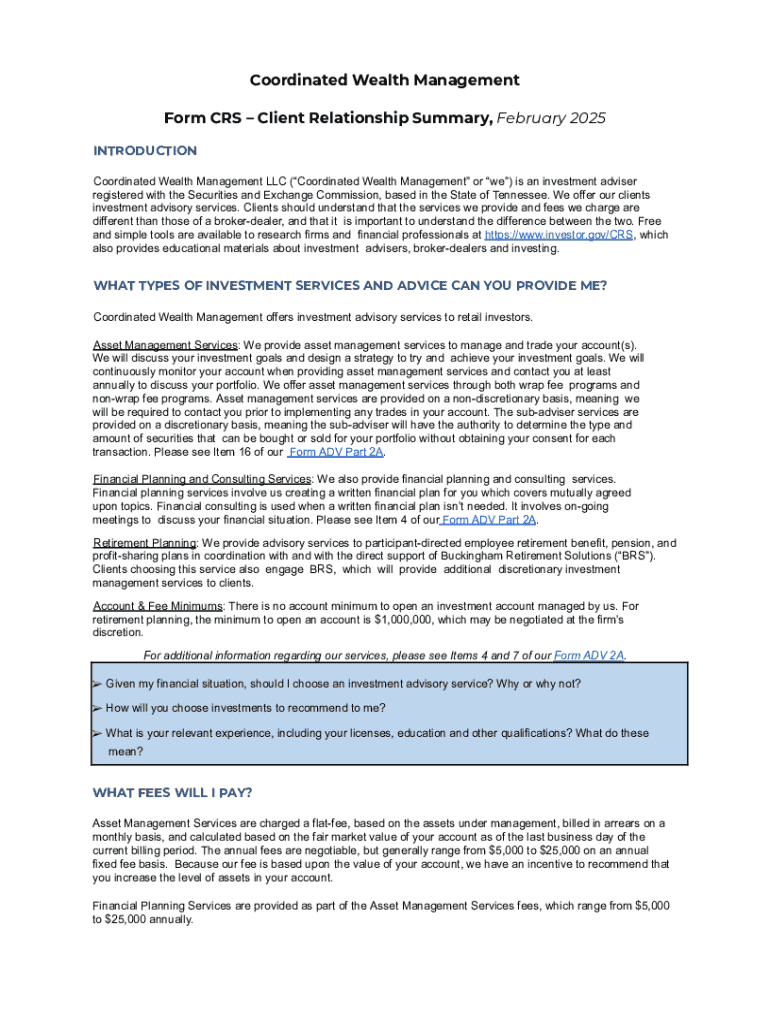

The Client Relationship Form (CRS) serves as a foundational document in the financial services industry, designed to foster clear and transparent interactions between financial advisory firms and their clients. Its primary purpose is to outline the relationship parameters, investment objectives, risk tolerance, and fee structures, ensuring that both parties have a mutual understanding of expectations.

Streamlining the CRS process can enhance client relationships significantly. Not only does it promote clarity in client interactions, but it also plays a critical role in regulatory compliance. By maintaining accurate records of client preferences and requirements, firms can mitigate risks associated with misunderstandings and fiduciary duties.

Getting started with the CRS

Before diving into the CRS, it’s essential to know how to access the template efficiently. You can find the CRS template on pdfFiller, a robust online platform that provides a multitude of document management tools designed specifically to streamline your workflow.

To access the CRS template on pdfFiller, follow these simple steps: Login to your pdfFiller account, navigate to the 'Templates' section, and use the search bar to locate ‘Client Relationship Form’. This platform allows you to edit documents directly in your browser without the need for downloading additional software.

PdfFiller provides multiple editing tools to complete your CRS effectively. From adding text fields to insertions for signatures, these interactive tools ensure a seamless document management process.

Step-by-step instructions for filling out the CRS

Preparing to fill out the CRS involves gathering necessary information about your client. Be ready to provide detailed data such as personal information, investment aspirations, and financial history. It's advisable to collect any prior assessment documents or reports that could assist in this process, ensuring comprehensive accuracy.

Carefully reviewing the form's sections is vital when completing the CRS. Below, we outline each segment to facilitate precise reporting.

Common mistakes arise during the completion of the CRS. It's crucial to avoid generalizations in client data reporting. Ensure your notes are accurate and up-to-date to comply fully with regulations, enhancing credibility and servicing performance.

Editing and customizing the CRS on pdfFiller

Once you complete the CRS, pdfFiller’s editing features become essential for fine-tuning your form. You can annotate, add or remove fields, and adjust any entries as your client's needs evolve. This flexibility ensures your CRS remains relevant and up-to-date over time.

Enhancing collaboration among team members is another key benefit of pdfFiller. Utilizing shared access allows relevant staff to review and provide input on the CRS simultaneously, contributing to a more cohesive understanding of the client’s profile.

Managing and storing the completed CRS

After finalizing the CRS, organization is crucial. PdfFiller offers powerful storage solutions, where you can categorize your forms appropriately. Creating folders based on client names or investment types can streamline your retrieval processes and enhance operational efficiency.

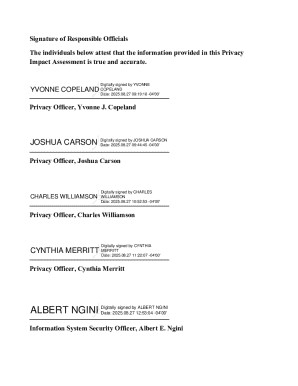

Ensuring compliance and security for sensitive data is paramount. PdfFiller employs advanced encryption and access controls to safeguard your client information, maintaining confidentiality while ensuring you meet regulatory guidelines effectively.

Integrating the CRS into your workflow

To maximize the benefits of the CRS, establish best practices for regular use. Set clear protocols for completion and updates, ensuring that the form is revisited in response to any significant changes in a client's financial situation or regulatory guidelines.

Tracking client feedback related to the CRS can also offer invaluable insights. Utilizing these comments helps you refine client profiles further, adapting to their evolving needs. Regularly reassess the risk tolerance and investment objectives to maintain relevance in this ever-changing financial landscape.

FAQs about the Client Relationship Form (CRS)

Clients often have questions about the CRS. Clarifying the necessity of this form and its implications for their investments can be crucial. Some common queries include: 'Why do I need to fill out the CRS?' or 'What happens if my investment goals change?' Addressing these concerns directly can build trust and transparency.

Moreover, understanding the regulatory requirements surrounding the CRS is essential for compliance. Make sure to provide clear answers about data reporting obligations and rectifying any errors that occur during completion.

Conclusion

Successfully completing the Client Relationship Form (CRS) can significantly enhance your engagement with clients, ensuring that their needs and preferences are accurately documented. Keep your records current and conduct regular analyses of client feedback to foster dependable relationships.

By adhering to well-structured protocols and utilizing innovative platforms like pdfFiller, you can streamline the CRS process, maintain transparency, and navigate regulatory landscapes with confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit form crs client relationship on an iOS device?

How can I fill out form crs client relationship on an iOS device?

How do I fill out form crs client relationship on an Android device?

What is form crs client relationship?

Who is required to file form crs client relationship?

How to fill out form crs client relationship?

What is the purpose of form crs client relationship?

What information must be reported on form crs client relationship?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.