Get the free Form MO-PTC - 2025 Property Tax Credit Claim - dor mo

Get, Create, Make and Sign form mo-ptc - 2025

How to edit form mo-ptc - 2025 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form mo-ptc - 2025

How to fill out form mo-ptc - 2025

Who needs form mo-ptc - 2025?

How to Complete the Form MO-PTC - 2025 Form: A Comprehensive Guide

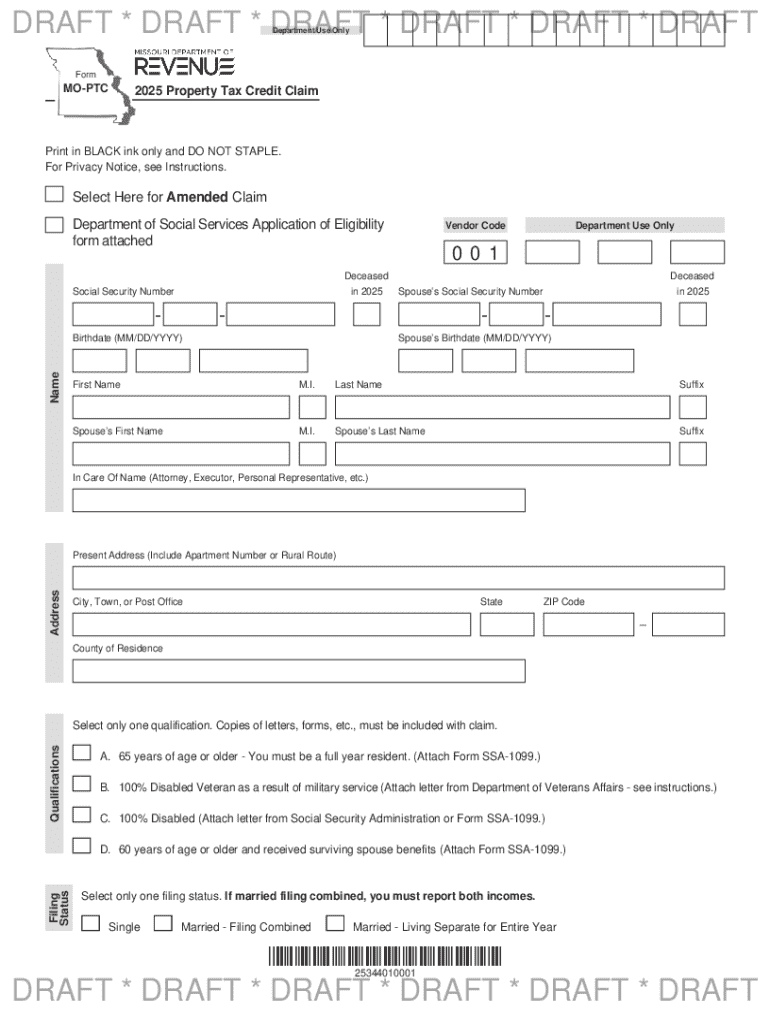

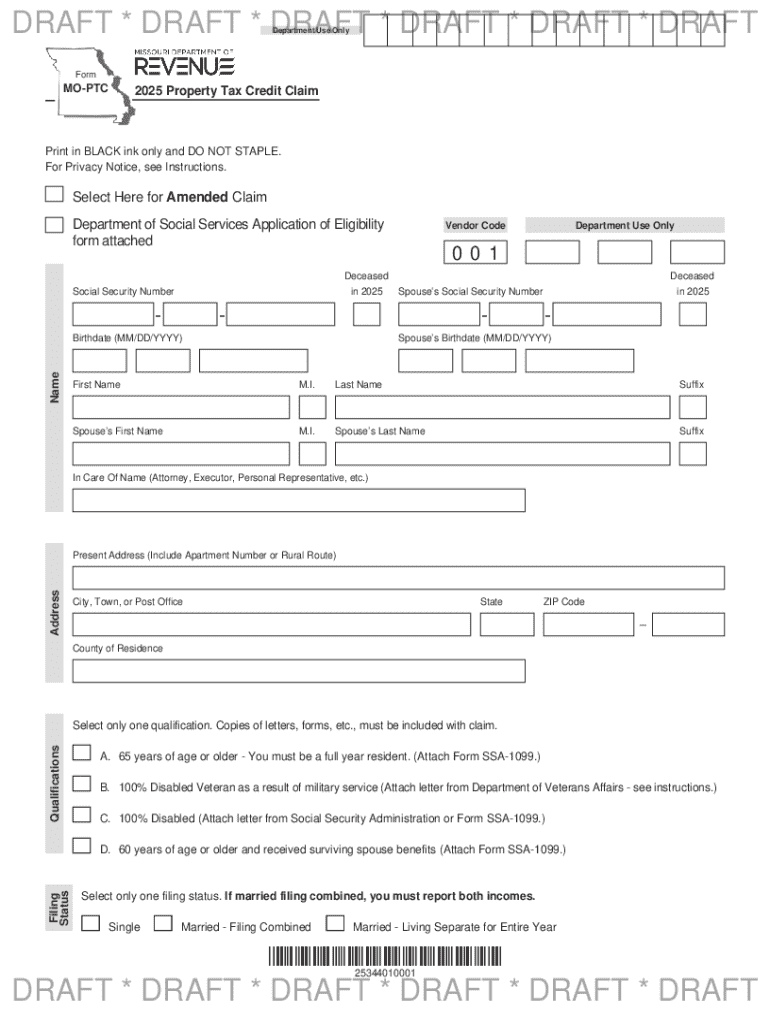

Overview of the Form MO-PTC - 2025

The Form MO-PTC - 2025 is an essential document for Missouri taxpayers seeking to claim various tax credits. This form allows applicants to apply for crucial financial reliefs that can significantly lower their tax burden. Understanding this form's nuances ensures that eligible taxpayers can maximize their benefits.

Purpose of the Form

The primary purpose of the Form MO-PTC - 2025 is to facilitate the application process for the Property Tax Credit program in Missouri. This initiative is especially beneficial for elderly residents, those with disabilities, and low-to-moderate income individuals who meet specified eligibility criteria.

Benefits of Using the MO-PTC - 2025 Form

Utilizing the Form MO-PTC - 2025 can offer substantial financial benefits. This form enables applicants to access various tax credits, providing direct assistance to those who qualify. For many, these credits play a critical role in covering housing costs and affording essential services.

Understanding the Components of Form MO-PTC - 2025

To effectively complete the Form MO-PTC - 2025, it's essential to familiarize yourself with each component. This ensures that no essential information is overlooked, which could delay processing or alter credit amounts.

Detailed breakdown of each section

Important Notes on Each Component

Avoiding common pitfalls when filling out the Form MO-PTC - 2025 is crucial. For instance, omitting income sources can affect eligibility for credits, while inaccuracies in personal information can delay processing time. Always double-check your entries.

Step-by-step instructions for filling out Form MO-PTC - 2025

Filling out the Form MO-PTC - 2025 can be straightforward if you follow a systematic approach. Begin by gathering all necessary documentation to ensure a seamless process.

Preparing Your Documents: What You Need

Filling out the Form

Each section of the form should be carefully completed, ensuring accuracy in both personal and financial details. Focus on completing one section at a time to minimize errors. If you encounter a question you’re not sure about, seek clarification before proceeding.

eSigning Your Form

eSigning allows for a quick and secure way to sign the Form MO-PTC - 2025 electronically. This method is both efficient and environmentally friendly, eliminating the need for physical paperwork.

Editing and managing the Form MO-PTC - 2025

Editing your Form MO-PTC - 2025 using pdfFiller is not only possible; it's simple and efficient. Interactive tools allow you to easily make adjustments on the fly.

Using interactive tools on pdfFiller

Saving and storing your form

Effective document management is vital. It’s recommended to save your Form MO-PTC - 2025 in a dedicated folder on your cloud storage for easy access and reference. Using pdfFiller’s intuitive find-your-form features can help locate your document quickly whenever needed.

Submitting the MO-PTC - 2025 Form

Submitting the completed Form MO-PTC - 2025 requires attention to detail to ensure it reaches the proper channels without delay.

Electronic Submission: How It Works

pdfFiller provides a seamless platform for electronic submissions, which is efficient and time-saving. When your form is ready, simply select the electronic submission option.

Alternative Submission Methods

If electronic submission is not preferable, alternative methods such as mailing in your form are available. Ensure to use the correct address specified for the Form MO-PTC - 2025, and consider using certified mail for tracking purposes.

Common questions and troubleshooting

Navigating tax forms can lead to numerous questions. Having a resource for the Form MO-PTC - 2025 can provide clarity for frequently asked queries.

FAQs About the Form MO-PTC - 2025

Common inquiries focus on eligibility requirements, submission deadlines, and updates to the form. Understanding these aspects is crucial for a smooth application process.

Troubleshooting tips for common issues

Conclusion

Successfully completing the Form MO-PTC - 2025 hinges on understanding its components, meticulously filling it out, and utilizing available digital tools effectively. Taking advantage of pdfFiller’s robust platform will enhance both the accuracy and efficiency of your submission process.

In summary, this guide provides essential insights into the Form MO-PTC - 2025, ensuring taxpayers can navigate their filing obligations with confidence and clarity. By embracing the digital features offered by pdfFiller, users can manage their documents seamlessly and enhance their overall experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify form mo-ptc - 2025 without leaving Google Drive?

How do I edit form mo-ptc - 2025 straight from my smartphone?

How do I fill out form mo-ptc - 2025 using my mobile device?

What is form mo-ptc - 2025?

Who is required to file form mo-ptc - 2025?

How to fill out form mo-ptc - 2025?

What is the purpose of form mo-ptc - 2025?

What information must be reported on form mo-ptc - 2025?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.