Get the free retirement application

Get, Create, Make and Sign retirement application form

Editing retirement application form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out retirement application form

How to fill out retirement application forms

Who needs retirement application forms?

A comprehensive guide to retirement application forms

Understanding retirement application forms

Retirement application forms serve as a crucial gateway for individuals transitioning from their careers to retirement. These forms collect vital information to determine eligibility and calculate retirement benefits, making them an essential part of the retirement planning process. Completing the retirement application accurately is fundamental for ensuring that retirees receive their entitled benefits without unnecessary delays.

Understanding the different types of retirement application forms is also key. They can vary by jurisdiction and the specifics of an individual's employment. Those retired from federal employment will encounter federal retirement application forms. State-specific forms may differ based on individual state rules, while private sector retirees will often have their own unique application forms dictated by employer policies.

Familiarity with key terminology is essential when navigating retirement application forms. Terms like 'vesting,' 'pension plan,' 'benefit calculations,' and 'eligibility' can determine how benefits are calculated and paid out. Proper understanding helps reduce errors in the application process and ultimately impacts the retirement experience.

Preparing to fill out your retirement application form

Candidly assessing your eligibility for retirement is the first step towards a successful application. Eligibility can depend on several factors including your age, years of service, and any additional criteria set by your employer or state law. Age requirements might vary, for example, early retirement options often arise at age 55, while full retirement might not occur until age 67.

Years of service, typically calculable through your employment records, play a significant role. For example, many federal pensions require a minimum of five years of service to be eligible. Understanding these aspects before filling out your retirement application forms can help avoid unnecessary setbacks.

Gathering necessary documentation is the next vital step before diving into the actual completion of your retirement application form. Personal identification information, employment history records, and financial documents provide the essential data required for your application.

To ensure the most successful application process, consider these tips: double-check all forms for accuracy, review specific submission instructions, and keep copies of all submitted documents. A well-prepared application can smooth the transition into retirement.

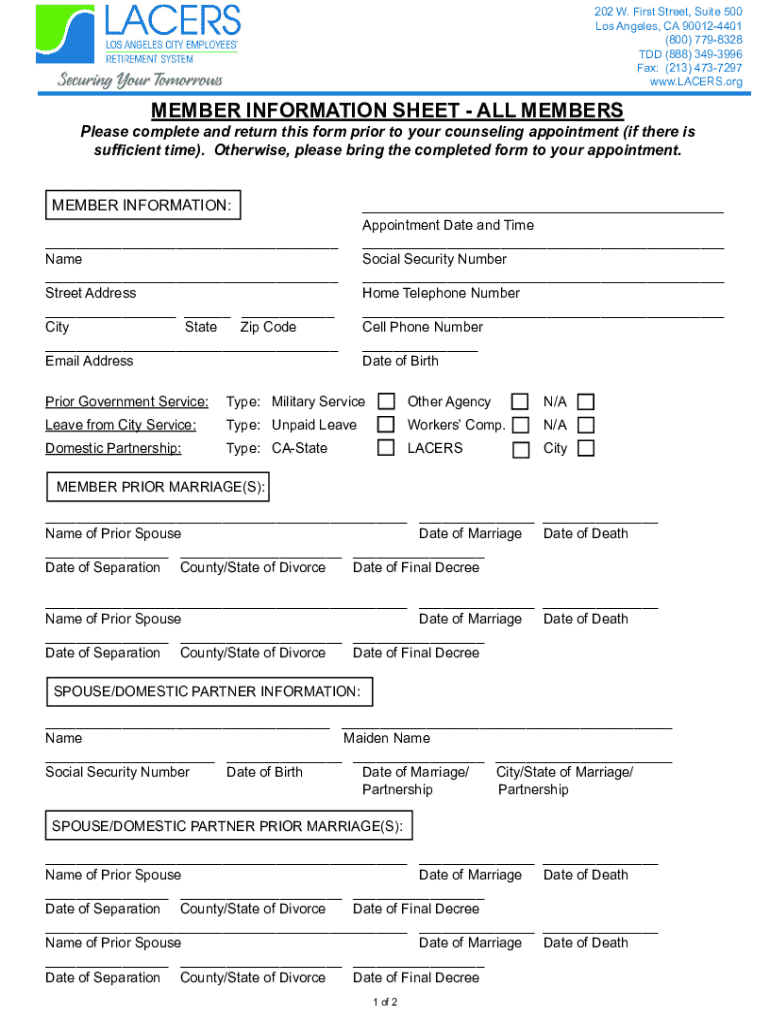

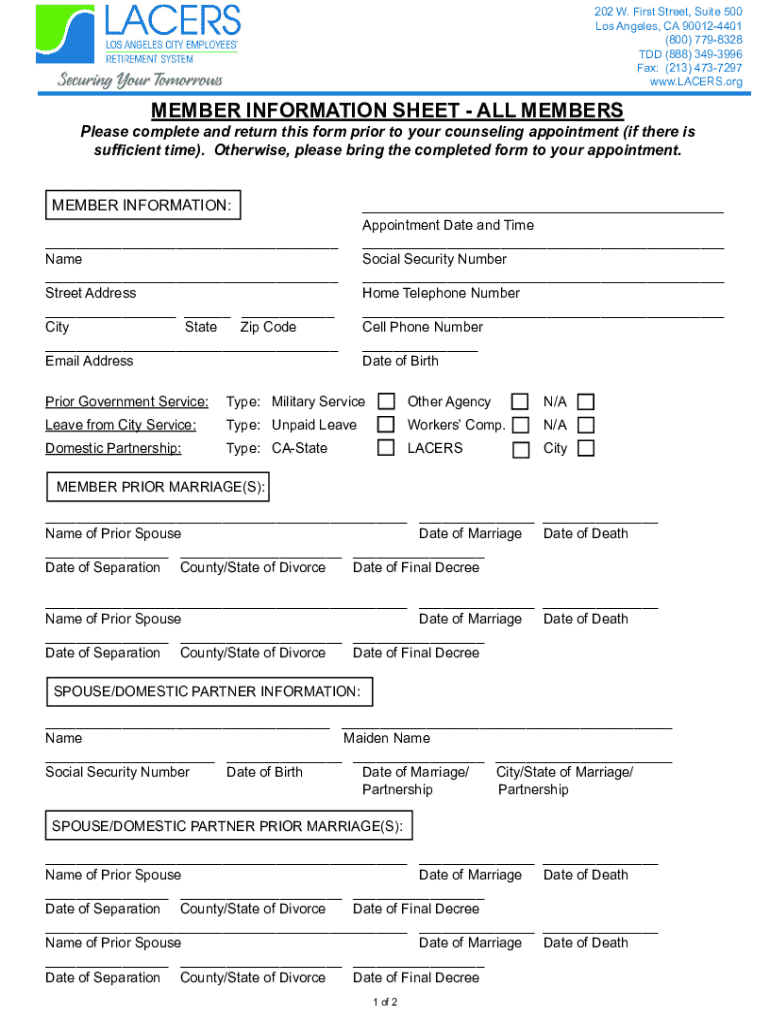

Detailed guide to completing retirement application forms

When you begin filling out your retirement application forms, start with the personal information section. This section usually requires your full name, contact information, and social security number. Errors here can lead to processing delays so be vigilant when inputting your details.

Moving on to the employment history section, this encompasses details about your employment as it relates to the retirement plan. Specify your job titles, departments, and the duration of your employment. Detailing breaks in service or varied roles assists in accurately calculating your benefits.

Common mistakes to avoid include failing to sign the application, providing incomplete information, or overlooking submission deadlines. Carefully reading through the form and accompanying instructions before submission can significantly reduce these risks.

Frequently asked questions around form-specific challenges often arise. For instance, how to amend details post-submission or address form denials can alleviate stress as you progress through the retirement process.

Digital tools for retirement application forms

In this digital era, leveraging tools like pdfFiller simplifies the management of retirement application forms. This versatile platform allows users to edit and customize forms easily before use. By enabling direct input into PDF formats, the software eliminates the need for extensive printing and scanning.

One standout feature of pdfFiller is eSigning, providing a legally binding way to sign documents digitally. This eliminates the hassle of physical signatures and allows users to submit applications quickly without visiting an office.

Moreover, the interactive features offered by pdfFiller include cloud storage benefits. Using the cloud allows users to access their forms from anywhere, creating convenience for those constantly on the go. The platform is designed to be accessible across devices, ensuring you can manage your retirement application forms form from your laptop, tablet, or smartphone.

After submission: managing your retirement application

Once your retirement application forms are submitted, managing the follow-up becomes crucial. Tracking the status of your application can save time and mitigate any potential frustration. Typically, you can check online or directly contact the retirement office to get updates on your application.

Understanding response times helps set your expectations. Depending on the entity reviewing your application, processing might take several weeks to months. Patience is essential, but remaining proactive by checking in can help ensure you’re on track.

Additional forms related to retirement

In addition to your primary retirement application forms, various other documents may be necessary to finalize your retirement process. Beneficiary designation forms are crucial for determining who will receive benefits after your passing. It’s vital to keep these updated to reflect your current wishes.

Tax implications can also play a significant role in your retirement planning. The W-4P form, which indicates how much tax should be withheld from your pension payments, is essential to avoid surprises during tax season. Completing it correctly can lead to consistent cash flow during retirement.

Support and resources for navigating retirement applications

Navigating the retirement application process doesn’t have to be a solitary endeavor. Reaching out to HR departments for assistance can provide personalized guidance tailored to your unique situation. HR can clarify confusing sections and help ensure your applications are submitted correctly.

Additionally, connecting with retiree support groups and networks often yields valuable insights from individuals who have recently gone through the retirement process. Online resources and forums dedicated to retirees can also be beneficial, offering shared experiences and advice on completing retirement application forms.

The future of retirement applications

The landscape of retirement planning and applications is evolving. More organizations are adopting technology to streamline processes, leading to a more user-centric approach in the completion of retirement application forms. Improvements in online forms may soon include features like auto-fill capabilities and instant feedback mechanisms to further enhance the user experience.

Moreover, anticipated changes in retirement legislation could directly impact the details within retirement applications. Awareness and adaptation will be critical as regulations shift, ensuring retirees don’t misstep during their transitions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my retirement application form directly from Gmail?

How can I send retirement application form for eSignature?

How do I execute retirement application form online?

What is retirement application forms?

Who is required to file retirement application forms?

How to fill out retirement application forms?

What is the purpose of retirement application forms?

What information must be reported on retirement application forms?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.