Get the free Financial Aid Independent Non-Filer Form 2026-2027

Get, Create, Make and Sign financial aid independent non-filer

How to edit financial aid independent non-filer online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial aid independent non-filer

How to fill out financial aid independent non-filer

Who needs financial aid independent non-filer?

A comprehensive guide to the financial aid independent non-filer form

Understanding the financial aid independent non-filer form

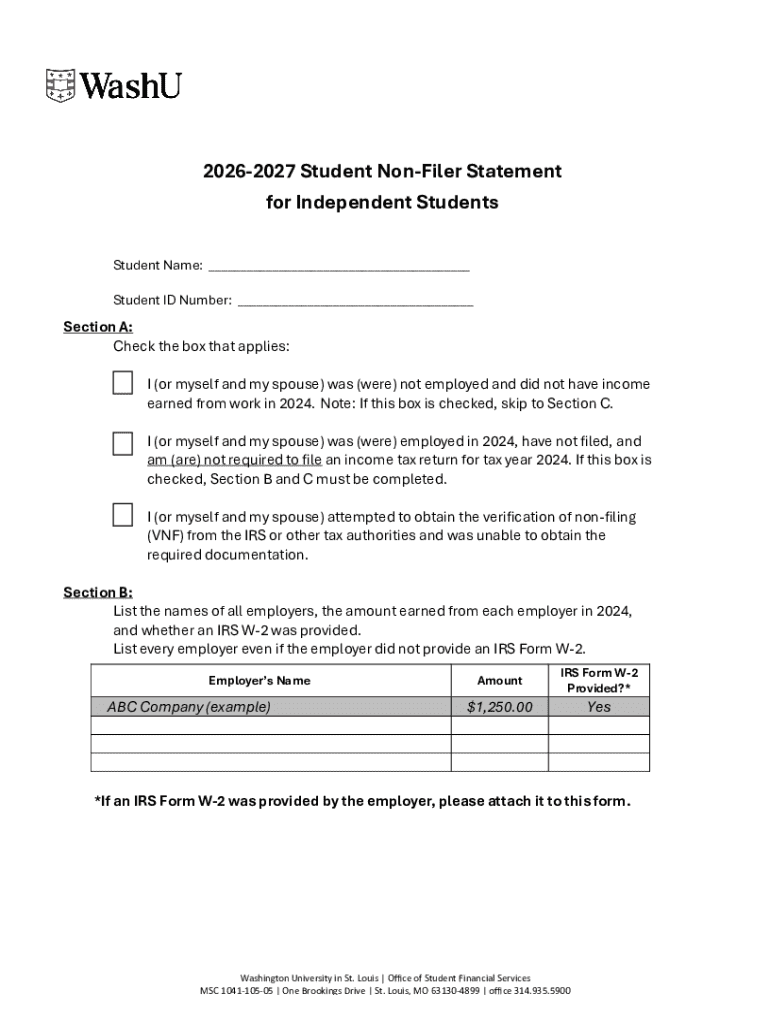

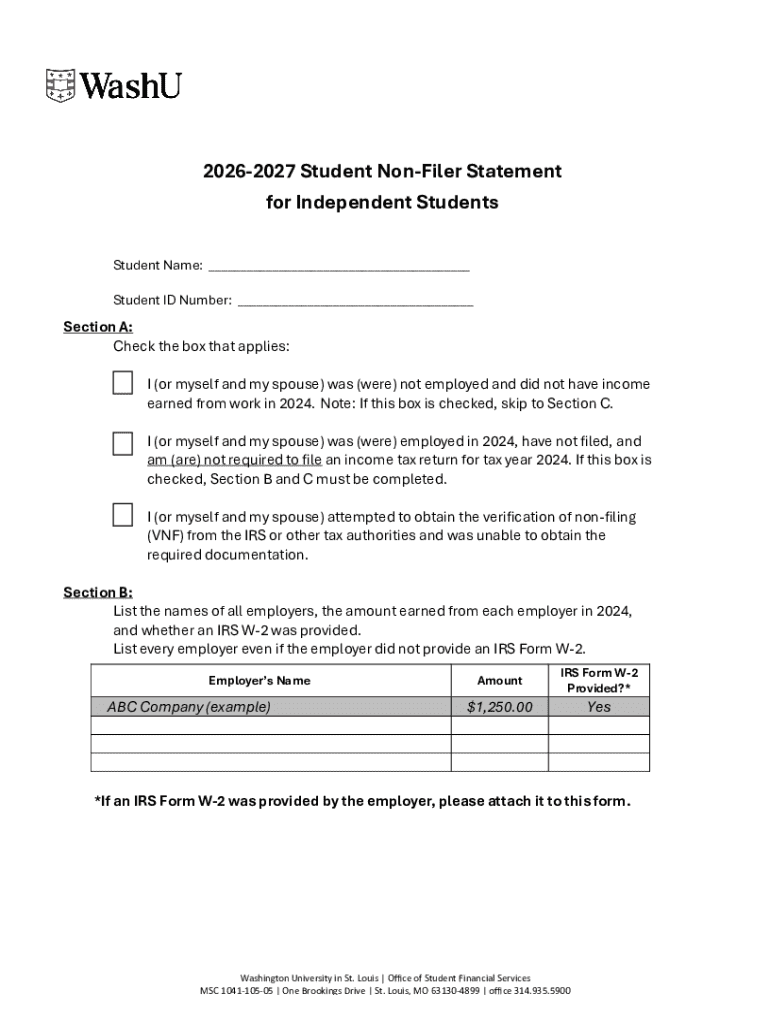

The financial aid independent non-filer form is a crucial document for students seeking financial assistance for their higher education when they do not meet the traditional tax-filing requirements. This form plays a vital role in determining eligibility for various federal and state financial aid programs, especially for individuals who have not filed a federal tax return. It allows these students to provide necessary financial information to aid offices without the standard tax return documentation.

Understanding who qualifies as an independent non-filer is essential for proper completion. Generally, independent students are those who are 24 years of age or older, married, graduate students, or those who have been orphaned or are veterans of the U.S. Armed Forces. These classifications are crucial as they dictate the type of financial aid available and the forms required for application.

Preparing to fill out the financial aid independent non-filer form

Before filling out the financial aid independent non-filer form, it’s imperative to gather all necessary documentation and information. Typically, applicants need to provide income statements, proof of non-filing, and perhaps other financial documents such as bank statements and records of untaxed income. Ensuring the accuracy of this information is paramount; discrepancies can lead to delays or denials in financial aid.

Key terms and definitions are also significant when navigating this form. Knowing the difference between 'independent' and 'dependent' status can greatly affect your expected family contribution (EFC). Independent students are assessed based on their own financial situations, while dependent students must include their parents' financial details, which can complicate many applications.

Step-by-step guide to completing the form

Completing the financial aid independent non-filer form involves several sections, each requiring specific information. Start with 'Section 1: Personal Information,' where you’ll include your name, contact details, and social security number. Always double-check to ensure you don’t omit any personal identifiers.

Next, 'Section 2: Income Information for Non-Filers' is critical. Here, you must accurately report your income without traditional tax returns. Alternative documentation such as pay stubs or benefit letters is often required to verify your financial situation in this without tax forms, making thoroughness essential.

Moving on to 'Section 3: Additional Required Information,' you’ll disclose any assets and liabilities. This includes savings accounts, valued properties, and any debts you owe. Moreover, you'll need to report any financial assistance you receive, such as government aid or scholarships, to give the aid office a complete picture of your finances.

Lastly, 'Section 4: Certification and Signature' ensures that you certify the truthfulness of your provided information. Sign digitally if using online services, as eSigning not only facilitates a more efficient process but can also expedite your application.

Common mistakes to avoid when filling out the form

While filling out the financial aid independent non-filer form, several common mistakes can hinder your application. One major issue is providing incomplete information, which can lead to delays in processing. Make sure to cross-verify each question to confirm that your responses are thorough and precise.

Another frequent error involves misreporting income or assets. A lack of comprehensive documentation can easily lead to misunderstandings regarding your true financial status. Always ensure that your reported financial figures are supported by accurate records to avoid complications down the line.

Finally, neglecting to sign or date the form is a critical error. Without a signature, your application cannot proceed, ultimately delaying your financial aid process. Always review the entire document before submission to confirm it meets all requirements.

Submitting your financial aid independent non-filer form

Once completed, the financial aid independent non-filer form must be submitted correctly to ensure efficient processing. Online submissions can be made easily through platforms like pdfFiller, which can handle PDF edits and submissions seamlessly. Uploading your form directly through such a platform can often help streamline the process, minimizing the chance of errors.

For those unable to use online submissions, mail or in-person options are usually available. Make sure to inquire about your school's specific requirements for mailed documents, as they might include address specifics and additional items to include. Be mindful of deadlines, as completing submissions late can result in loss of financial aid opportunities.

Adhering to submission timelines is crucial. Most financial aid offices outlay very strict deadlines, especially for the 2 academic year, aligning submissions to coincide with specific program deadlines.

After submission: what to expect

After submitting your financial aid independent non-filer form, you will typically receive a confirmation of submission, which may come via email or an online portal. It's essential to keep this for your records. Following up on the status of your form is recommended, particularly if you do not hear back within a few weeks.

Be aware that if any changes to your information occur after submission, they may impact your application. Promptly notifying the financial aid office of any alterations ensures that your data remains accurate and considered during the financial aid determination process.

Frequently asked questions (FAQs)

One common question arises about correcting mistakes after submission. If you realize that you’ve made an error, contact your financial aid office immediately for their specific guidance on how to amend any submissions. Whether a new form needs to be submitted or a minor correction is adequate can vary between institutions.

Another frequent concern is what happens if you miss the deadline. Generally, financial aid offices may have strict policies regarding late submissions. However, it’s often worth reaching out to inquire if there are any options available to still be considered for aid.

Understanding how independent non-filer status impacts financial aid eligibility can also be perplexing for many. Since independent students are assessed uniquely, they may qualify for different types of aid than dependent students, affecting the overall financial assistance available.

Useful resources for financial aid applicants

For those seeking to streamline their process, pdfFiller offers tools designed for easy document editing and signing. Their cloud-based platform allows for efficient access to necessary forms while ensuring data security and compliance with regulations surrounding financial documentation.

Additionally, it is advisable to have direct contact with financial aid offices at your educational institution. They can provide tailored guidance and answer any specific questions about local or institutional regulations that may influence your financial aid parameters.

State-specific financial aid resources are also essential for applicants. Familiarize yourself with your state’s regulations, deadlines, and available aid programs to maximize your financial aid opportunities.

Expert tips for maximizing financial aid opportunities

Leveraging your independent non-filer status wisely can significantly enhance your chances of receiving adequate financial aid. For example, understanding your financial position and knowing what aid packages you are eligible for will allow you to make informed decisions when submitting applications. Accurately completing the financial aid independent non-filer form is your first step towards maximizing these opportunities.

Consider additional forms and documents that may complement your primary application. Some schools may require the CSS Profile or state-specific aid applications that can further enhance your financial aid profile. Being proactive about all necessary documentation can streamline your application process and improve financial aid outcomes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my financial aid independent non-filer in Gmail?

Can I create an electronic signature for the financial aid independent non-filer in Chrome?

How do I complete financial aid independent non-filer on an Android device?

What is financial aid independent non-filer?

Who is required to file financial aid independent non-filer?

How to fill out financial aid independent non-filer?

What is the purpose of financial aid independent non-filer?

What information must be reported on financial aid independent non-filer?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.