Get the free non filer tax form

Get, Create, Make and Sign non filer tax form

Editing non filer tax form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out non filer tax form

How to fill out 20252026 student non-filing tax

Who needs 20252026 student non-filing tax?

20252026 Student Non-Filing Tax Form: A Comprehensive Guide

Overview of the 20252026 non-filing tax form

The 20252026 student non-filing tax form serves as an essential document for students who do not earn sufficient income to require the submission of a standard tax return. This form indicates to financial aid offices and other entities that the student has reported their income status appropriately. Ensuring compliance can affect eligibility for various financial aids and programs, making it vital for students to understand their non-filing options.

Filing taxes, or in this case, claiming non-filing status, can impact students financially. It’s crucial for students to grasp the importance of this form, not just to avoid complications with the IRS but also to streamline their financial aid applications. The 20252026 form helps to maintain accurate records, making it easier for students to manage their finances while pursuing their education.

Understanding eligibility for non-filing status

Eligibility for non-filing status for the 20252026 tax year hinges on several criteria, primarily focusing on the student's income level. To qualify as a non-filer, students must meet certain income thresholds set by the IRS, which generally consider gross income from all sources, including wages, scholarships, and other earnings. For 20252026, this threshold remains relatively low, ensuring that most full-time students fall within this category.

In addition, students who are dependent or living away from home while in school may have different considerations. Full-time students typically have lower earnings compared to part-time students, making it essential to understand how residency and financial support impact filing status. Documenting this information accurately helps clarify a student's financial situation for educational funding purposes.

Key features of the 20252026 student non-filing tax form

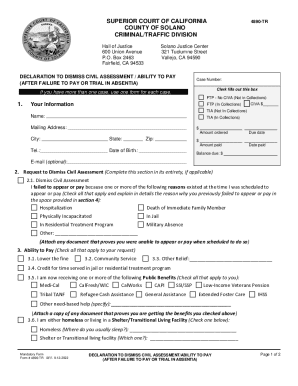

The 20252026 student non-filing tax form comprises several key sections that require careful attention. The primary components include personal identification details such as the student’s name, Social Security number, and residential address. Following that, the financial details section prompts users to report any income and their financial aid status. It's vital for accuracy in this section to maintain eligibility for future financial aid.

Students should note the distinctions in reporting requirements compared to regular tax filers. Generally, they may report zero income on the non-filing form, which can simplify the process. There have been recent changes for the 20252026 tax year, primarily aimed at improving clarity and user-friendliness on the form. Understanding these changes can help students navigate the non-filing process more effectively.

Step-by-step instructions for completing the non-filing tax form

Filling out the 20252026 student non-filing tax form can be straightforward if students approach it methodically. Here’s a step-by-step guide to ensure proper completion:

Common mistakes to avoid include entering incorrect social security numbers, forgetting to sign the form, and neglecting to include supporting documentation for claims. Paying attention to these details is crucial for smooth processing.

Interactive tools for form management

pdfFiller provides an ideal platform for managing the 20252026 student non-filing tax form, offering features that enhance user experience significantly. Whether students need to edit, sign, or collaborate on the document, pdfFiller simplifies these tasks with its cloud-based structure.

With pdfFiller, users can enjoy benefits like:

These interactive tools not only streamline the management of tax forms but also reduce errors and enhance the overall filing experience.

Navigating the submission process

Once the 20252026 student non-filing tax form is completed, understanding how to submit it correctly is the next critical step. Students have options for submission: they can electronically file online using the IRS’s e-form capabilities or choose to mail in a hard copy of the form. Each method has different processing times and requirements.

Regardless of submission mode, adhering to deadlines is paramount. For the 20252026 tax year, keep an eye on key dates to ensure compliance and avoid penalties. Ensure that forms are submitted in a timely manner, especially around critical financial aid deadlines.

Special scenarios and considerations

While most students may find filling out the 20252026 student non-filing tax form straightforward, certain scenarios require careful consideration. A significant question involves when to actually file a tax return instead of claiming non-filing status. Students who earn income above the threshold or those whose situations change throughout the year should reassess their filing requirements.

Furthermore, students juggling part-time work may need to account for mixed income situations, where they must evaluate how their part-time earnings impact filing status. Unique situations, such as those involving international students or students on gap years, may also necessitate different approaches to tax-related documentation. Understanding these complexities can save students from unexpected tax liabilities.

Policies and procedures related to non-filing

Understanding the overarching policies surrounding the 20252026 non-filing tax form is equally vital. Students may inadvertently misrepresent their income or non-filing status, leading to complications with financial aid applications. It’s essential to approach the form with the clarity required for financial aid purposes, as incomplete or inaccurate forms can delay disbursement.

Verification processes often accompany aid applications, which may require documentation of income status. Students should prepare to provide any necessary income information upon request to avoid disruption in funding. This proactive approach can ease the stress of dealing with financial aid adjustments.

FAQs regarding the 20252026 non-filing tax form

Here are some commonly asked questions concerning the 20252026 student non-filing tax form:

Students often have misconceptions surrounding this tax form, including its relevance to financial aid and the implications of non-filing versus actual tax filing. Addressing these inquiries effectively ensures students make informed decisions about their financial obligations.

Conclusion: empowering students with knowledge and tools

Understanding the 20252026 student non-filing tax form is crucial for all students, especially those looking to optimize their financial situation during their educational journeys. Recognizing the significance of this form helps to clarify the non-filing process, highlighting how it can ensure eligibility for financial aid and reduce complications.

By utilizing tools offered by pdfFiller, students can manage their tax documentation tasks efficiently, ensuring forms are filled correctly, signed, and submitted on time. The empowerment that comes from being informed and agile in managing necessary documents, coupled with the interactive management of resources, enables students to focus more on their studies and less on financial stress.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find non filer tax form?

How do I make changes in non filer tax form?

Can I edit non filer tax form on an Android device?

What is 20252026 student non-filing tax?

Who is required to file 20252026 student non-filing tax?

How to fill out 20252026 student non-filing tax?

What is the purpose of 20252026 student non-filing tax?

What information must be reported on 20252026 student non-filing tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.