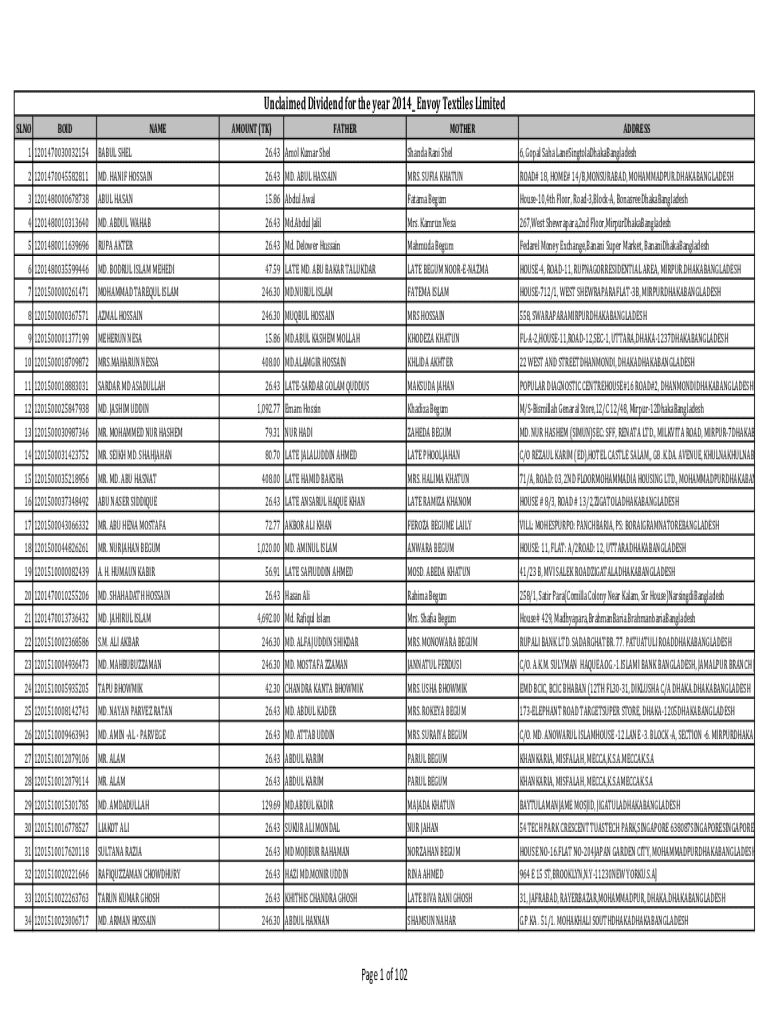

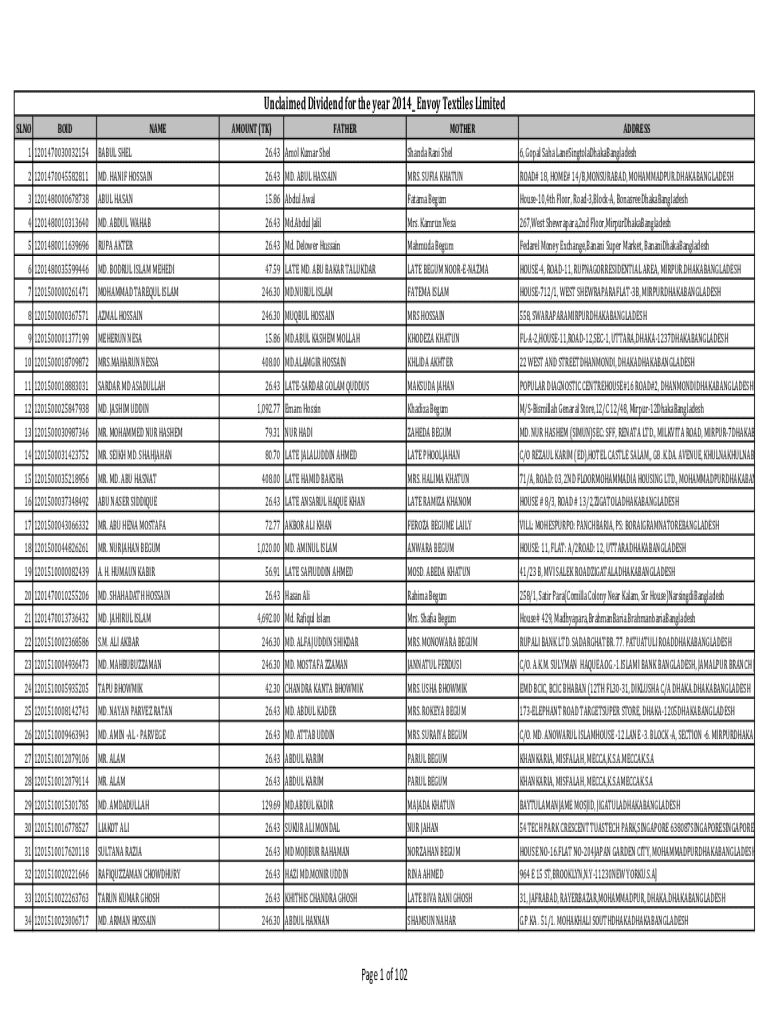

Get the free Unclaimed Dividend for the year 2014 Envoy Textiles Limited

Get, Create, Make and Sign unclaimed dividend for form

Editing unclaimed dividend for form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out unclaimed dividend for form

How to fill out unclaimed dividend for form

Who needs unclaimed dividend for form?

Unclaimed Dividend for Form: A Comprehensive Guide to Recovering Your Dividends

Understanding unclaimed dividends

Unclaimed dividends refer to profits from shares owned by investors that have not been cashed or deposited. Such dividends may go unclaimed for various reasons, including the failure of the shareholder to update their address, the passing of the shareholder without a clear beneficiary, or simply forgetting to cash the check. It's essential to claim your dividends as they can contribute significantly to personal wealth and financial stability.

Unclaimed dividends are often handled by companies in compliance with state regulations. Each state has laws concerning unclaimed property, including dividends, which stipulate how long companies can wait before considering them as unclaimed and transferring them to the state as part of an escheatment process. Being proactive in claiming your dividends can help you avoid potential loss of your monetary rights.

Checking for unclaimed dividends

To discover if you have unclaimed dividends, follow these steps to search effectively. Start by identifying the entities, such as corporations or mutual funds, that might owe you dividends. Gathering specific information related to your past investments is crucial. This includes records of your investments, old addresses, and names that may have changed.

Be cautious of common pitfalls during your search process. Misinformation about your identity can affect your results, so ensure that all details are correct. Additionally, unclaimed dividends can accumulate over time, meaning it's wise to check frequently. Financial institutions or pooling entities may not easily inform you of unclaimed dividends, and a proactive search is often necessary.

The unclaimed dividend application process

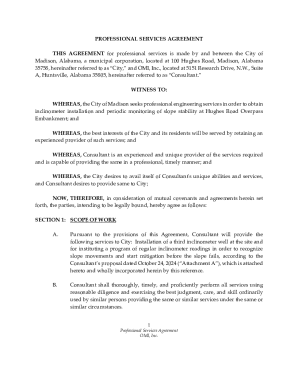

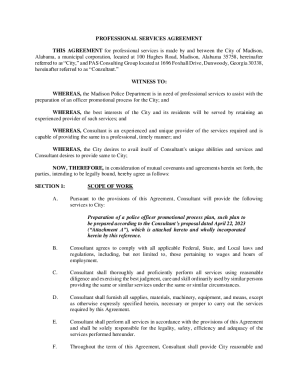

Filing a claim for unclaimed dividends involves preparing specific documents to support your application. The needed documentation typically includes proof of identity, such as a driver’s license or passport, along with documentation proving ownership of the dividend, which can be in the form of stock certificates or dividend statements.

Once you have your documents in order, you can proceed with filing the application for payment of unclaimed dividends. To do so, download the appropriate claim form from the respective state’s unclaimed property office website. Follow the provided instructions carefully when completing each section of the form. This includes ensuring that all information matches your official identification and that any required signatures are in place.

Be aware of common mistakes, such as omitting important details or providing inaccurate information. Such errors can delay the processing of your claim and complicate matters further.

Utilizing pdfFiller for your unclaimed dividend forms

To manage your unclaimed dividend claims efficiently, consider using pdfFiller. The platform provides seamless document management by allowing users to easily edit, sign, and collaborate on forms. You can access templates for unclaimed dividend applications directly from pdfFiller, which simplifies the process of filling out forms without having to start from scratch.

Interactive tools on pdfFiller enhance collaboration, enabling you to work alongside financial advisors or family members. These tools aid in ensuring that you complete the necessary forms accurately and comprehensively.

Post-application: What to expect

After submitting your claim for unclaimed dividends, it’s important to understand the expected processing time. While timelines vary by state and individual claims, many states aim to process applications within a few weeks to several months depending on their workload and the accuracy of the provided information.

Once you’ve filed your claim, it’s wise to follow up. Keeping track of your claim’s status can help expedite the process. Many states offer online tracking options, while others allow inquiries via phone or email. Know when to check in to ensure there are no issues and to clarify any potential questions the processing office may have.

Managing and storing your financial documents

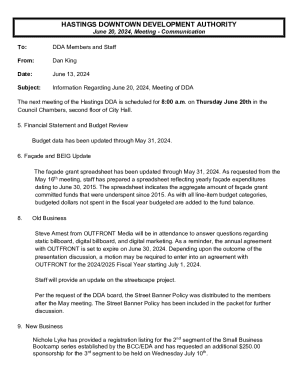

After claiming your unclaimed dividends, managing and storing your financial documents becomes essential. Keeping track of claims and dividends helps you stay organized and be prepared for future financial needs. Best practices include maintaining digital and physical copies of important documents, ensuring their security, and regularly updating your file.

pdfFiller aids in ongoing document management by providing continuous access to your documents anywhere, anytime. The platform’s features make it easy to revisit past claims and prepare for future ones, enhancing your ability to stay on top of your financial situation.

Related questions and troubleshooting

Finding your unclaimed dividends may pose challenges, but knowing what to do when difficulties arise is crucial. If you can’t find what you’re looking for, ensure all your information is correct and up-to-date. Factors such as misspellings or outdated addresses can complicate your search.

For inquiries, you can reach out to your state's unclaimed property division through their website, ensuring you take note of their contact information—typically provided as a phone number, email address, or online form for queries. Additional frequently asked questions often pertain to eligibility and common claims issues, and reaching out for expert recommendations can also be beneficial.

Conclusion: Take control of your finances

Empowering yourself with knowledge and understanding the steps to manage unclaimed dividends can significantly impact your financial health. By being proactive in searching and applying for unclaimed dividends, you ensure that you are not missing out on potential income. Utilizing tools like pdfFiller can further streamline your processes for better financial oversight and organization.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the unclaimed dividend for form electronically in Chrome?

How can I edit unclaimed dividend for form on a smartphone?

How do I complete unclaimed dividend for form on an iOS device?

What is unclaimed dividend for form?

Who is required to file unclaimed dividend for form?

How to fill out unclaimed dividend for form?

What is the purpose of unclaimed dividend for form?

What information must be reported on unclaimed dividend for form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.