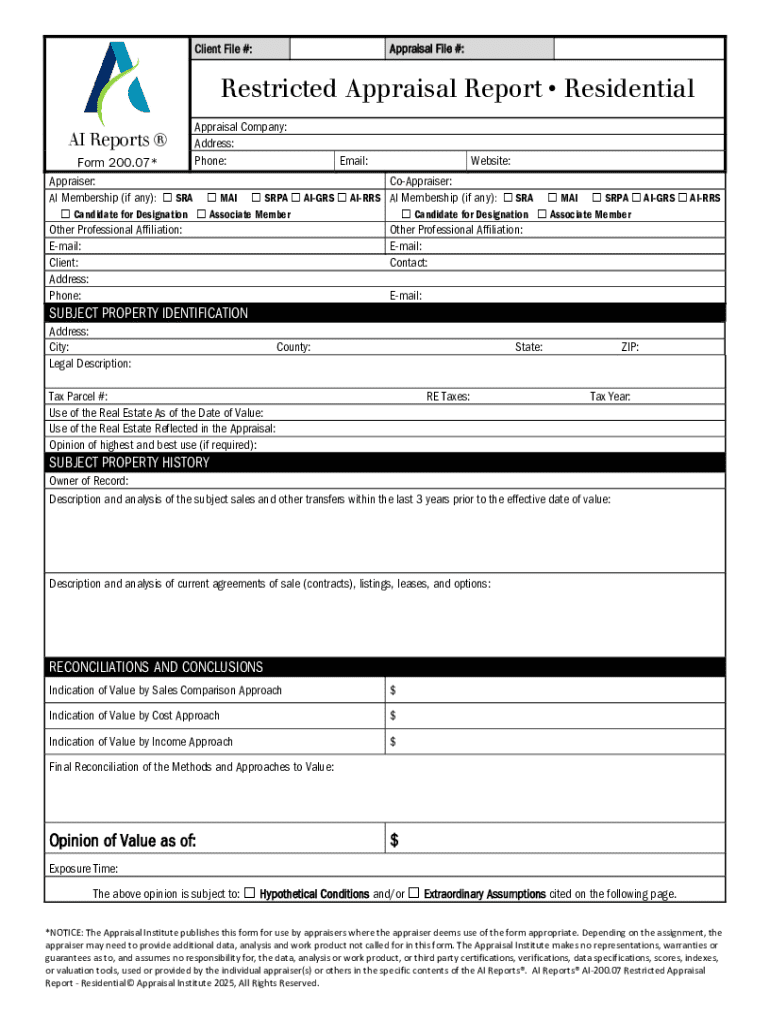

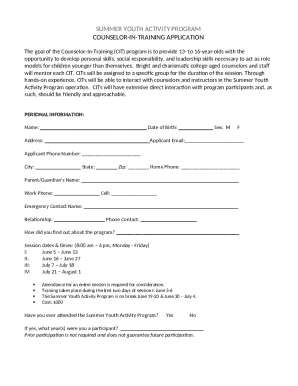

Get the free Restricted Appraisal ReportResidential

Get, Create, Make and Sign restricted appraisal reportresidential

Editing restricted appraisal reportresidential online

Uncompromising security for your PDF editing and eSignature needs

How to fill out restricted appraisal reportresidential

How to fill out restricted appraisal reportresidential

Who needs restricted appraisal reportresidential?

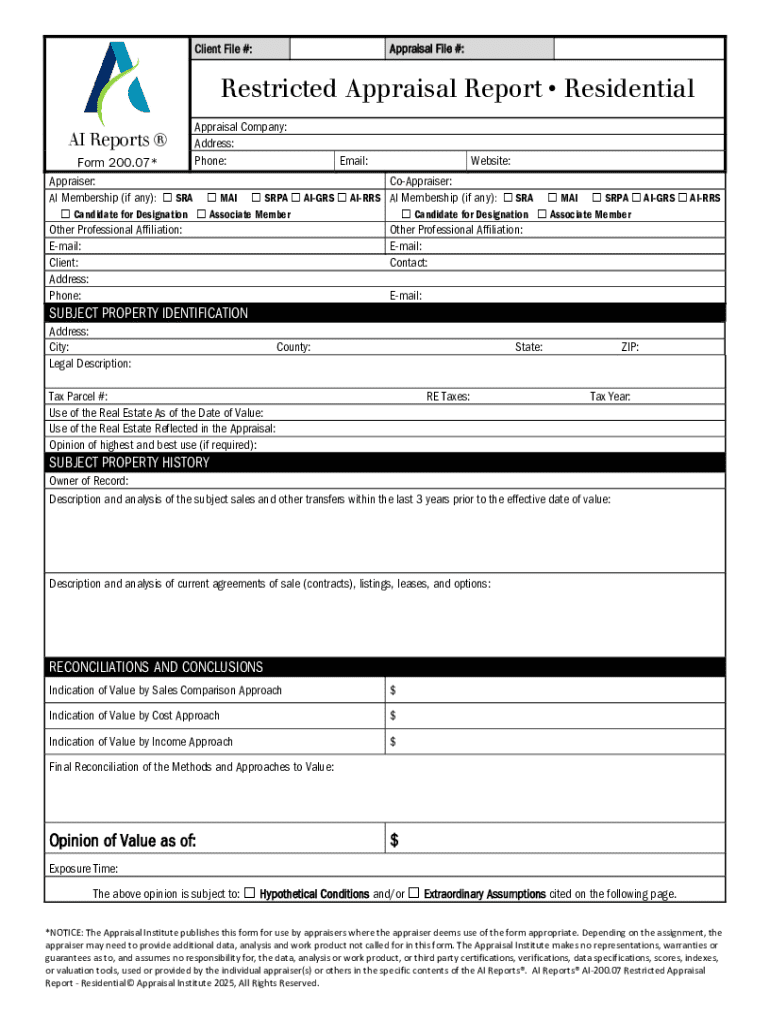

Understanding the Restricted Appraisal Report Residential Form

Understanding the restricted appraisal report

A restricted appraisal report is a specific form used in real estate transactions where the appraisal is limited to a particular audience and purpose. Unlike standard appraisal reports that provide comprehensive analysis and detailed documentation, restricted appraisal reports focus solely on a single client, typically a lender or the property owner. This type of report is designed to meet specific needs in situations where a full appraisal may not be necessary or where the audience's understanding of the property is limited.

The primary distinction between restricted and standard appraisal reports lies in their intended use and audience. While standard reports are often shared among multiple parties, including buyers, sellers, and appraisers, restricted reports are tailored solely for the client who commissioned it. This can lead to simpler content but must still maintain compliance with appraisal standards set by governing bodies such as the Appraisal Institute.

Importance in residential transactions

Restricted appraisal reports play a crucial role in various residential transactions, particularly in instances where time constraints or financial considerations make a full appraisal impractical. Investors, homebuyers, and even lenders often seek restricted reports during refinancing or when assessing the value of distressed properties. By utilizing a restricted appraisal, clients can receive a concise valuation without the extensive, often costly, detail that a full appraisal entails.

The benefits of using a restricted report extend to all parties involved in a transaction. Buyers may enjoy a quicker turnaround time in receiving property evaluations, while sellers can expedite sales by demonstrating an immediate understanding of market value. For lenders, restricted appraisal reports can simplify the underwriting process—providing necessary insights, quickly validating property values, and ensuring compliance with internal policies while minimizing risk.

When to use a restricted appraisal report

Certain scenarios warrant the use of a restricted appraisal report, particularly in real estate transactions. Common situations include refinancing existing loans, evaluating property for investment purposes, and determining the value of properties in estate planning or divestment situations. In these contexts, a restricted appraisal is generally favored for its efficiency and cost-effectiveness.

Additionally, understanding lender requirements is essential when considering a restricted appraisal report. Many lenders have become accustomed to this format, recognizing its efficiency in presenting essential information without unnecessary details. Familiarity with restricted reports can expedite the approval process for lenders, as they often prefer associated risk assessments tied directly to specific clients rather than more generalized documentation.

Key components of the restricted appraisal report

The restricted appraisal report comprises several essential elements that ensure all necessary details are conveyed effectively. Generally, a typical restricted report will include specific data on the property in question, a brief market analysis, and a conclusion regarding the property's value. The format must be clear and structured to facilitate easy comprehension for the intended audience.

Each of these components must be curated with precision, fortifying the credibility and reliability of the valuation provided. Proper inclusion of these specifics not only augments the value of the report but also ensures compliance with standard industry practices.

Step-by-step guide to completing a restricted appraisal report

Completing a restricted appraisal report is a systematic process that involves various procedural steps. Initially, accurate information must be gathered concerning the property—this includes basic details such as year built, location, and unique features. Research on comparable properties in the vicinity can provide deeper insights into current market conditions. This step is vital, as a discrepancy in data can result in flawed valuations.

Conducting the appraisal itself should be approached methodically. This includes utilizing appropriate valuation methods—such as the sales comparison approach or income approach depending on the property type. After the appraisal is completed, it's necessary to structure the report in a clear and concise manner, ensuring logical transitions between sections and reinforcing the findings with adequate supportive data.

Filling out the residential form

To access the restricted appraisal report form, start by logging on to pdfFiller, where these forms can be found readily available. Users can search for the specific form required. Once you have the form, careful attention is needed when filling it out. Each section of the form must be completed with accuracy, ensuring that all descriptions, values, and market data correlate correctly.

Common mistakes to avoid include overlooking sections, providing inaccurate data, or failing to support conclusions with relevant analysis. Errors may undermine not only the credibility of the appraisal but also the financial decisions based upon it.

Editing and signing your restricted appraisal report

Once the restricted appraisal report has been filled out, utilizing pdfFiller’s editing tools allows for seamless modification and finalization. Users can make real-time adjustments and ensure that each detail aligns correctly with the intended data before sending the document for approval. This platform provides templates and editing capabilities that streamline the process from start to finish, making document management far more efficient.

eSigning the document effectively is another crucial step that pdfFiller facilitates. Secure e-signature options that comply with legal standards allow stakeholders to sign the document directly within the application, reducing the time and hassles associated with printed signatures. After signing, the document can be quickly distributed to all relevant parties, ensuring that everyone involved is promptly updated.

Managing your completed reports

Once the restricted appraisal report is finalized, it's imperative to manage the document efficiently. Utilizing cloud storage services available within pdfFiller ensures that your reports are safely stored, easily accessible, and well-organized for future reference. Establishing a structured filing system, such as categorizing reports by date or property type, may streamline retrieval as needed.

Moreover, sharing the report with stakeholders can be handled efficiently through pdfFiller’s collaborative features. The platform enables users to send documents directly to relevant parties and allows for online collaboration if required. This not only speeds up the overall process but ensures that every participant remains in the loop regarding the property valuation.

Common FAQs about restricted appraisal reports

Several misconceptions surround the use of restricted appraisal reports. One common concern is the belief that restricted reports are significantly less credible than full appraisals. In reality, as long as restricted reports are properly executed, they can be trustworthy, serving specific purposes efficiently. It’s vital for users to recognize that the intended audience dictates the report's integrity, not the inherent nature of the document.

To maximize the effectiveness of a restricted appraisal report, careful attention must be paid to detail, communication regarding the report’s limitations, and thorough understanding of the specific requirements laid out by users and their intended recipients.

Case studies and examples

Examining real-life applications of restricted appraisal reports provides tangible insight into their practicality. For instance, a homeowner looking to refinance may require a restricted appraisal to quickly gauge their equity. A well-executed restricted report can lead to a faster loan approval process as lenders often feel reassured when they have a straightforward valuation in hand, directly impacting the overall transaction speed.

Lessons learned from case studies highlight the importance of proper documentation and following state regulations to avoid pitfalls. One notable case involved a real estate investor leveraging a restricted report to close on a distressed property quickly. The timely action allowed the investor to capture market opportunities, demonstrating the type of strategic advantage restricted appraisals can confer when properly utilized.

Conclusion remarks on best practices

Navigating the process of creating an accurate and reliable restricted appraisal report requires diligence and attentiveness to detail. Practicing best strategies—like double-checking information, adhering to standard appraisal protocols, and leveraging tools provided by pdfFiller—can significantly enhance the quality of reports and the efficiency of transactions. The significance of these reports in real estate cannot be understated; they empower individuals and teams to find clarity amid complexity.

Choosing to utilize the tools available on pdfFiller not only streamlines the document creation process but also ensures compliance and effective communication among stakeholders. By leveraging advanced digital solutions, users can effectively manage their appraisal report needs — reinforcing the role of technology in enhancing the real estate landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send restricted appraisal reportresidential to be eSigned by others?

How do I complete restricted appraisal reportresidential on an iOS device?

How do I fill out restricted appraisal reportresidential on an Android device?

What is restricted appraisal report residential?

Who is required to file restricted appraisal report residential?

How to fill out restricted appraisal report residential?

What is the purpose of restricted appraisal report residential?

What information must be reported on restricted appraisal report residential?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.