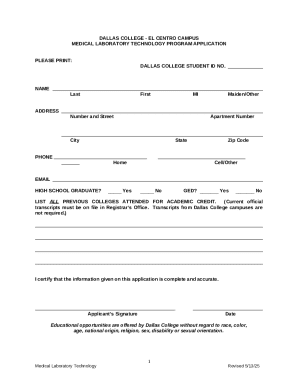

Get the free ( )Compliance Officer ()MLRO

Get, Create, Make and Sign compliance officer mlro

Editing compliance officer mlro online

Uncompromising security for your PDF editing and eSignature needs

How to fill out compliance officer mlro

How to fill out compliance officer mlro

Who needs compliance officer mlro?

A comprehensive guide to the compliance officer MLRO form

Understanding the role of a compliance officer and MLRO

The compliance officer is integral to ensuring that an organization adheres to legal and regulatory requirements. This role encompasses various responsibilities, including monitoring adherence to rules, conducting risk assessments, and developing compliance strategies that align with organizational policies. Compliance officers proactively ensure that the organization meets its obligations, significantly reducing the risk of legal penalties and maintaining reputation.

In particular, the Money Laundering Reporting Officer (MLRO) has distinct legal obligations, primarily focused on identifying and reporting suspicious activities related to money laundering. MLROs must operate within a structured compliance framework while ensuring staff are trained and informed about how to recognize and respond to potential money laundering activities. This role not only helps protect the organization but also contributes to the broader effort to combat financial crime.

Overview of the compliance officer MLRO form

The compliance officer MLRO form serves a critical purpose in streamlining the reporting process for compliance officers and MLROs. This form assists organizations in maintaining accurate records of compliance activities, which are imperative for regulatory reviews and audits. Accurate form submission not only fulfills legal obligations but also enhances internal governance.

Key components of the compliance officer MLRO form include several essential sections that help gather critical information. These sections encompass personal information, organizational details, compliance history, incident reporting, and a signature section. Each part of the form plays a vital role in the overarching compliance effort, making complete and precise completion crucial.

Step-by-step guide to completing the compliance officer MLRO form

Completing the compliance officer MLRO form requires meticulous attention to detail. Gathering necessary information before starting is crucial, including organizational documentation, personal credential verification, and any previous compliance-related incidents. Having these documents ready can significantly expedite the form completion process.

In completing each section, start with personal information. This includes your name, position, and contact details. Then, move to organizational details, ensuring you provide accurate organizational identifiers such as the registration number. In compliance history, clearly explain any prior incidents, even if resolved, since full disclosure is necessary to support transparent compliance efforts. For incident reporting, be thorough in documenting any suspicious events, providing as much detail as possible underlined by evidence, if available.

Once the form is filled, reviewing it for accuracy is vital. A thorough checklist can help ensure all sections are complete, correct, and accurately represent the compliance state of your organization before submission.

Common mistakes to avoid when filing the compliance officer MLRO form

Submitting incomplete forms is a common error that can lead to significant delays. Ensure all sections of the compliance officer MLRO form are filled out before submission. Another frequent issue is providing inaccurate information. Double-check facts and figures provided in the form to avoid discrepancies and potential compliance complications.

Missing deadlines can have serious implications, so stay aware of submission timelines. Additionally, ensure proper signatory procedures are followed. An incorrect signature can render the form invalid, leading to further complications down the line.

Interactive tools for form management

Using tools like pdfFiller improves the efficiency of completing and managing the compliance officer MLRO form. pdfFiller allows users to edit, sign, and collaborate on documents seamlessly, elevating the overall compliance experience. Its intuitive features streamline the entire process, making it easy to complete forms without needing extensive technical knowledge.

Collaboration tools in pdfFiller facilitate teamwork by enabling multiple individuals to work on a single document concurrently. This approach increases efficiency and ensures all team members can contribute to ensuring the accuracy and completeness of the form. Additionally, pdfFiller's cloud-based access enhances security features and offers access controls for team members, ensuring document integrity and confidentiality.

Tips for efficient document management post-submission

After submitting the compliance officer MLRO form, keeping track of the submission status is critical. Utilize digital tracking tools to monitor whether the form was received and processed. Establishing a method of communication with relevant authorities or departments can expedite follow-up procedures if necessary.

Managing document records is equally important. Best practices include implementing version control strategies to ensure everyone is aware of which version of the form is the most current. Additionally, archiving completed forms for future reference is vital; this allows for easy retrieval and value in monitoring past compliance efforts.

Best practices for compliance officers and MLROs

Ongoing training and education are paramount for compliance officers and MLROs. They must stay updated with the latest regulatory changes and industry best practices. Regular training sessions can foster an informed team that is critical to the compliance culture of an organization.

Developing a culture of compliance throughout an organization ensures that compliance is prioritized in every business operation. Encourage team engagement in compliance matters, fostering an environment where everyone feels responsible for adhering to regulatory requirements.

Leveraging technology is pivotal in enhancing compliance. Utilize tools and resources available to aid in compliance duties, easing report generation, data analysis, and regulatory monitoring.

Success stories from compliant organizations

Numerous organizations have successfully navigated the complexities of compliance through diligent efforts in managing their MLRO responsibilities. Case studies highlighting best practices demonstrate how a proactive approach to compliance can lead to enhanced reputational standing and operational efficiency.

Lessons learned from these successful organizations often include the importance of fostering open communication around compliance issues and investing in training resources to enhance overall awareness and cultural integration of compliance practices across all departments.

Future trends in compliance and MLRO practices

Looking ahead, organizations must prepare for evolving regulatory frameworks and expectations in compliance practices. As financial crimes become more sophisticated, regulatory bodies are likely to enhance their scrutiny over compliance measures. Staying informed about upcoming changes, especially in money laundering laws, is vital for compliance officers and MLROs.

Technology will play a crucial role in shaping the future of compliance frameworks. AI and machine learning tools are expected to enhance the ability to detect and report suspicious activities, automating many processes to support compliance officers and MLROs as they navigate their demanding roles in ensuring organizational integrity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send compliance officer mlro for eSignature?

How do I execute compliance officer mlro online?

How do I complete compliance officer mlro on an Android device?

What is compliance officer mlro?

Who is required to file compliance officer mlro?

How to fill out compliance officer mlro?

What is the purpose of compliance officer mlro?

What information must be reported on compliance officer mlro?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.